Organ Preservation Market Size, Share, Trends and Forecast by Preservation Solution, Organ Donation Type, Technique, Organ Type, End-User, and Region, 2025-2033

Organ Preservation Market Size and Share:

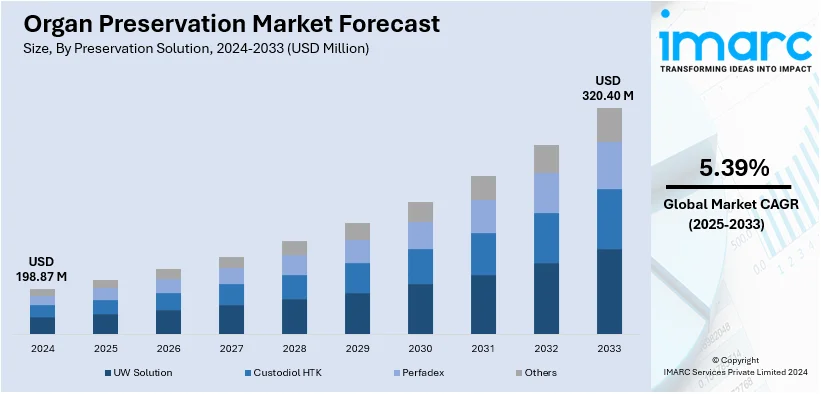

The global organ preservation market size was valued at USD 198.87 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 320.40 Million by 2033, exhibiting a CAGR of 5.39% from 2025-2033. North America currently dominates the market, holding a market share of over 45.9% in 2024. The growth of the North American region is driven by advanced healthcare infrastructure, rising organ transplants, technological advancements, and supportive government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 198.87 Million |

|

Market Forecast in 2033

|

USD 320.40 Million |

| Market Growth Rate (2025-2033) | 5.39% |

The increasing prevalence of chronic diseases, such as kidney failure, liver cirrhosis, cardiovascular diseases, and respiratory conditions, are catalyzing the demand for organ transplants. Organ failures resulting from traumatic injuries, alcohol or drug abuse, and ischemia are further contributing to the need for advanced organ preservation methods. Furthermore, innovations in organ preservation techniques, including hypothermic and normothermic machine perfusion, are enhancing organ viability, extending storage times, and improving transplant success rates. The development of specialized preservation solutions, such as the University of Wisconsin (UW) solution, is also playing a crucial role in improving organ quality during transportation. Additionally, the growing number of awareness campaigns, educational programs, and initiatives by governments, non-profit organizations (NPOs), and healthcare institutions are encouraging organ donation. These efforts are addressing misconceptions about organ donation and promoting its life-saving benefits, thus increasing the number of donors worldwide.

The United States plays a crucial role in the market, driven by its well-established transplant infrastructure with a growing number of procedures being performed each year. Rising organ donation rates, particularly from deceased donors, are further driving the demand for advanced preservation methods. Besides this, strategic partnerships between organ preservation technology providers and logistics organizations are enhancing the efficiency and accessibility of organ transport. By integrating advanced preservation devices with optimized transportation networks, these collaborations reduce delivery times, lower costs, and ensure organs reach recipients in optimal condition. In 2024, Paragonix Technologies joined forces with the Nationwide Organ Recovery Transport Alliance (NORA) to enhance fair organ delivery throughout the US. This collaboration integrates Paragonix's advanced organ preservation devices with commercial flights, reducing costs and environmental impact. The initiative aligns with the FAA Reauthorization Act's call for donor organ transport standards.

Organ Preservation Market Trends:

Rising Prevalence of Organ Failure

The increasing prevalence of organ failures due to chronic disorders, such as liver disease, kidney issues, inflammatory bowel disease, asthma, and chronic obstructive pulmonary disease (COPD), is driving the organ preservation demand globally. Organ failure can also result from traumatic injuries, alcohol or drug abuse, ischemia, and infections, further increasing the need for organ transplants. Changing lifestyles, sedentary habits, and poor dietary patterns are exacerbating these conditions, contributing to rising cases of chronic illnesses. According to the Journal of the American Medical Association (JAMA) Network, global COPD cases are expected to reach 592 million by 2050, emphasizing the urgent need for viable treatments, including organ transplants. Advances in organ preservation techniques are crucial for maintaining organ quality and extending storage times, improving transplant success rates. This rising burden of chronic diseases is creating a positive organ preservation market outlook, driving innovation and adoption worldwide.

Shortage of Donor Organs

According to the Health Resources and Services Administration (HRSA), in 2024, 89,101 patients awaited kidney transplants, 832 for pancreas transplants, and 9,862 for liver transplants, underscoring the persistent shortage of donor organs. This organ scarcity emphasizes the critical need for effective preservation techniques to extend the viability of organs during storage and transportation. Organ preservation plays a vital role in minimizing ischemic damage, ensuring organs remain functional for successful transplantation, and improving patient outcomes. Advancements in preservation methods, including static cold storage and machine perfusion systems, are addressing logistical challenges and maximizing organ utilization. Increasing investments in research and innovative preservation technologies are enhancing the quality and longevity of organs. Furthermore, the growing awareness about organ donation and its life-saving benefits is driving the demand for organ preservation solutions, helping to bridge the gap between organ availability and the rising number of patients in need.

Improving Healthcare Infrastructure

Healthcare facilities play a pivotal role in providing advanced care to individuals suffering from various diseases, including organ failure, thereby driving the demand for organ preservation. The increasing number of organ transplant procedures performed in these facilities is further bolstering the organ preservation market growth. This trend is supported by improvements in healthcare infrastructure, including the establishment of new hospitals, clinics, and specialized care centers worldwide. The growing prevalence of chronic diseases, such as kidney, liver, and heart conditions, are necessitating efficient organ transplantation services. According to the American Hospital Association (AHA), the total number of hospitals in the United States reached 65,129 in the financial year 2022, highlighting the scale of healthcare infrastructure expansion. Additionally, advancements in preservation technologies, coupled with rising investments in medical research and logistics, are enhancing organ viability and increasing the success rates of transplantation procedures, further fueling market demand.

Organ Preservation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global organ preservation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on preservation solution, organ donation type, technique, organ type, and end-user.

Analysis by Preservation Solution:

- UW Solution

- Custodiol HTK

- Perfadex

- Others

UW solution represent the largest segment with 35.8% of market share in 2024. University of Wisconsin (UW) solution provides superior preservation for kidney and other organs. The UW preservation allows longer and safer preservation of kidneys and livers, a higher rate of graft survival, and a lower rate of primary nonfunction. It is an intracellular preservation solution with low sodium and high potassium concentrations that mimic an intracellular environment. The rising adoption of UW solution for kidney preservation due to its superior properties as compared to EC solution is bolstering the growth of the market. Besides this, the increasing focus on preserving organs to fulfill the growing number of organ transplants is impelling the market growth. For example, a total 7,624 organ transplants were performed between January-February 2024 in the United States, as claimed by the Organ Procurement and Transplantation Network (OPTN).

Analysis by Organ Donation Type:

- Living Organ Donation

- Deceased Organ Donation

Deceased organ donation holds the biggest organ preservation market share owing to the rising incidence of brain death cases, increased awareness about organ donation, and advancements in preservation techniques enhancing organ viability for transplantation. Deceased organ donation involves donating an organ or part of an organ after the donor's death for transplantation, offering lifesaving opportunities to individuals suffering from organ failure. This practice remains a cornerstone of addressing critical shortages in organs required for transplants. The increasing awareness campaigns about the importance of organ donation and its role in saving lives are significantly contributing to market growth. Governments, healthcare organizations, and NGOs are actively promoting deceased organ donation through education programs and policy support. According to the Organ Procurement and Transplantation Network (OPTN), 14,903 individuals became deceased organ donors in 2022. Technological advancements in organ preservation and transplantation techniques are further enhancing the success rates of these procedures.

Analysis by Technique:

- Static Cold Storage Technique

- Hypothermic Machine Perfusion

- Normothermic Machine Perfusion

- Others

Static cold storage technique dominates the market with 45.0% of market share in 2024. Static cold storage technique is a widely utilized method for preserving organs, particularly for liver, kidney, and pancreas transplantation. This method involves flushing the organ with specialized preservation solutions and storing it at low temperatures to slow down metabolic activity and reduce cellular damage. Its simplicity and accessibility make it a preferred choice, as it does not require complex equipment, specialized training, or continuous monitoring, making it highly cost-effective. The rising adoption of static cold storage is driven by its logistical convenience and compatibility with most transplant allografts, supporting broader use across transplant centers globally. Preservation techniques like static cold storage are critical for maintaining organ quality, minimizing ischemic damage, and reducing transplant-associated mortality and morbidity.

Analysis by Organ Type:

- Kidney

- Liver

- Lung

- Heart

- Others

Kidney leads the market with around 33.9% of market share in 2024. The kidney is a vital part of the human body that benefits in removing waste products from the blood and producing urine. It regulates essential hormones in the body that help to control blood pressure, red blood cell (RBC) production, and calcium uptake from the intestine. It aids in maintaining a healthy balance of salts, water, and minerals, such as sodium, calcium, phosphorus, and potassium, in the blood of an individual. The rising prevalence of chronic kidney diseases (CKDs) is catalyzing the demand for kidney organs among individuals. The growing focus on organ preservation due to the increasing number of kidney transplant procedures is positively influencing the market. The number of patients with a functioning kidney transplant increased to 245,506 in 2021 as claimed by the U.S. Department of Health and Human Services.

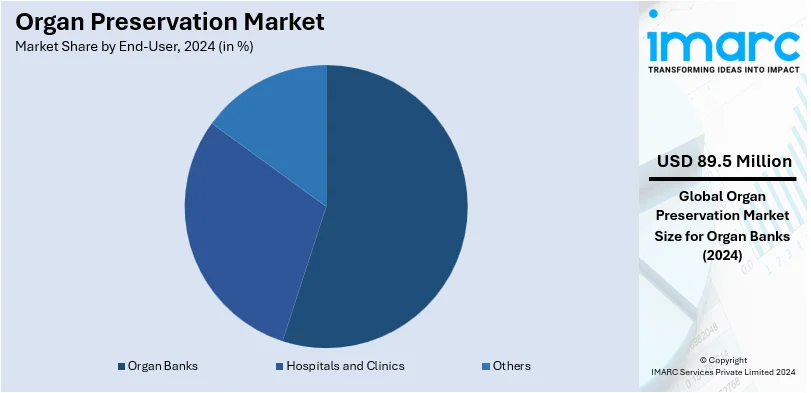

Analysis by End-User:

- Hospitals and Clinics

- Organ Banks

- Others

Organ banks lead the market with 45.0% of market share in 2024. Organ banks facilitate and manage various organs for transplant purposes, acting as intermediaries between donors, donor families, hospitals, and transplant centers. They play a crucial role in ensuring the timely and efficient retrieval, preservation, and transportation of organs from donors to recipients. By coordinating closely with medical professionals, they streamline the complex organ donation process, minimizing delays and optimizing organ viability. Organ banks are also instrumental in raising public awareness about organ donation, educating communities about its importance, and addressing misconceptions. They work on implementing advanced preservation techniques, such as hypothermic and normothermic machine perfusion, to enhance organ longevity and success rates in transplantation. Moreover, they collaborate with research institutions to improve storage protocols and develop cryopreservation technologies. Through these efforts, organ banks contribute to overcoming donor shortages, improving patient outcomes, and increasing the chances of successful organ procurement and transplantation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 45.9%. The dominance of North America is attributed to its well-established healthcare infrastructure, including specialized care facilities, advanced hospitals, clinics, and medical research institutes. The rising prevalence of organ failure cases, coupled with the increasing number of organ transplants, is creating significant need for effective preservation techniques. Additionally, the growing awareness among healthcare providers about the importance of improving patient outcomes is positively influencing the market. Favorable government initiatives and private sector investments are also contributing to advancements in organ preservation technologies. For instance, the Biostasis Research Institute (BRI) announced on April 21, 2021, the establishment and funding of two new research centers at Massachusetts General Hospital and the University of Minnesota. These centers are focusing on cryogenic storage methods to create human organ banks, improving access to preserved organs for transplantation and addressing critical donor shortages in the region.

Key Regional Takeaways:

United States Organ Preservation Market Analysis

In North America, the United States accounted for 85.40% of the total market share. The strong healthcare system, the ever-growing demand for organ transplants, and the advanced preservation methods have put the US in a very dominant position in organ preservation. In 2022, the United States had performed over 42,000 organ transplants as per the data from United Network for Organ Sharing, where liver and kidney transplants are most prevalent. However, there is a significant imbalance between supply and demand as there are more than 100,000 patients on the nation's transplant waiting list, requiring efficient organ preservation.

New technology, for instance normothermic preservation and hypothermic machine perfusion are becoming very popular as it allows for longer preservation times, and a higher chance for longer organ viability. Businesses come up with new innovations that can tackle logistical challenges for instance the portable perfusion devices. Moreover, transplant requirements are spurred by the high prevalence of chronic diseases including diabetes and hypertension, factors that cause organ failure events.

The indirect boost to the preservation market is being provided by government programs and nonprofit organizations that encourage organ donation, such as the Organ Procurement and Transplantation Network (OPTN). Furthermore, the market is boosted by the increasing use of organ-sharing networks and federal financing for transplantation research. Growing research on cryopreservation and stem cell preservation technologies is also helping the U.S. market, which is fueling industry expansion.

Europe Organ Preservation Market Analysis

The growing organ failure rates and organized organ donation systems of Europe are driving the market for organ preservation. In organ donation rates, countries such as Croatia and Spain stand at the world's top; in 2023, Spain had 48.9 donors per million people. Spain performed 5,851 organ transplants last year, a 9% increase from 2022, as per the data from Government of Spain. Transplant accessibility is increased by the EU's Cross-Border Healthcare Directive, which makes organ sharing among its member states easier.

In Europe, cutting-edge methods such as oxygenated machine perfusion are extensively used to improve organ viability during transit, especially for high-risk organs. For example, the use of normothermic machine perfusion in liver transplantation has increased market adoption by improving organ functionality and success rates. The rising incidence of chronic liver and renal diseases drives the demand for organ transplantation and preservation techniques, as numerous thousands of Europeans receive dialysis annually. Horizon Europe-funded research projects fuel development in preservation techniques, such as cryopreservation and ex vivo organ management systems, and ensure market growth.

Asia Pacific Organ Preservation Market Analysis

Due to ever-increasing health care expenditures, chronic illness prevalence, and organ donation awareness among masses, the organ preservation market is witnessing substantial growth within the Asia-Pacific region. End-stage renal disorders are also highly prevalent in China and India; over 200,000 cases each year in India require kidney transplantation, as claimed by research papers from the National Institute of Health. Out of these many cases, only 13,642 transplants were successfully done in the year 2023.

The industry is being positively impacted by government initiatives that encourage organ donation, such as India's National Organ Transplant Program. Furthermore, as the number of transplants increases in South Korea and Japan, developments in machine perfusion and cold storage technologies are becoming more popular there. Advances in the medical tourism industry on the continent, especially across bordering nations in Thailand and Singapore, create demand in the region for high advanced organ preservation technology. Top-notch care by reasonably cost continues to attract patients from nations alongside.

Latin America Organ Preservation Market Analysis

This region is influenced by advancing care spending and organ donation, in turn boosting the organ preservation sector. Brazil, the largest market in that region, performed more than 12,000 organ transplants between January and November 2021, according to data provided by Brazil Government. A nongovernmental group like ALIANZA of Mexico is doing its bit in raising donation rates and empowering state-of-the-art preservation technology. Even though the cold storage solutions are commonplace, the cutting-edge technologies like hypothermic perfusion are gradually gaining mileage. The demand for efficient preservation solutions is being brought forth by the chronic diseases like liver cirrhosis and end-stage renal disease (ESRD), which are driving the growth of the market.

Middle East and Africa Organ Preservation Market Analysis

The need for organ preservation is increasing across the Middle East and Africa because of an increase in patients with organ failure and better healthcare facilities. The Gulf nations are now putting huge money into transplantation facilities. At the forefront are Saudi Arabia, followed by the United Arab Emirates. Since the inception of SCOT programmes, more than 549 kidney transplants have taken place in Saudi Arabia according to Saudi Centre for Organ Transplantation's data and this occurred during the course of the year 2020. Although cold preservation is still the most widely used method, newer approaches such as ex vivo perfusion are increasingly being used. The market is expanding due to government campaigns to encourage organ donation and increased medical travel, especially in the United Arab Emirates.

Competitive Landscape:

Key players in the market are getting approvals from governing authorities, which is supporting the market growth. For example, Transmedics, Inc., a medical technology company, received premarket approval (PMA) for its OCS™ Heart System to be used with DCD organs from the United States Food and Drug Administration (FDA) on April 28, 2022. Furthermore, X-Therma revealed that the US Food and Drug Administration's Center for Devices and Radiological Health (CDRH) offered TimeSeal organ transport device and XT-ViVo organ preservation solution on May 3, 2022. Besides this, strategic partnership, collaboration, and acquisition are being done to have more product offerings and geographical reach. Companies are also working to improve logistics for organ transport with minimal ischemic damage.

The report provides a comprehensive analysis of the competitive landscape in the organ preservation market with detailed profiles of all major companies, including:

- 21st Century Medicine

- Bridge to Life™ Ltd.

- Carnamedica Sp. z o.o.

- Dr. Franz Köhler Chemie GmbH

- Global Transplant Solutions

- Institut Georges Lopez (IGL) (I-CAIR group)

- Organ Recovery Systems (Lifeline Scientific, Inc.)

- OrganOx Limited

- Paragonix Technologies, Inc (Getinge)

- Preservation Solutions, Inc.

- Transmedics, Inc.

- XVIVO Perfusion AB

Latest News and Developments:

- October 2024: OrganOx announced that Health Canada approved its OrganOx metra System for liver transplantation. The system, which uses normothermic machine perfusion, extends organ preservation time and improves clinical outcomes.

- August 2024: Paragonix Technologies, an organ preservation and transportation system business, is to be acquired by Getinge, one of the world's leading medical technology companies. A global industry leader in organ transplantation, Paragonix is recognized for the advanced, FDA-approved organ transportation solutions it provides to safeguard the secure transportation of donor organs.

- July 2024: Visakhapatnam's King George Hospital launched India's first "Preserve the Uterus Centre of Excellence" to reduce unnecessary hysterectomies. The goal is to preserve uterine health and improve women's overall well-being.

- April 2024: A Swiss biotech company called VivaLyx has secured $5.4 million to further research a new organ preservation liquid that would increase the viability of organs for transplantation. The liquid is intended to prolong the period of preservation and enhance the results of organ transplantation.

- March 2024: Apollo Proton Cancer Centre launched the Apollo Rectal Cancer (ARC) Programme, India's first integrated approach for managing rectal cancer. The program uses advanced treatments like chemoradiotherapy, proton therapy, and robotic surgery to provide comprehensive care and preserve rectal function. It aims to set a global benchmark in rectal cancer treatment.

Organ Preservation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Preservation Solutions Covered | UW Solution, Custodiol HTK, Perfadex, Others |

| Organ Donation Types Covered | Living Organ Donation, Deceased Organ Donation |

| Techniques Covered | Static Cold Storage Technique, Hypothermic Machine Perfusion, Normothermic Machine Perfusion, Others |

| Organ Types Covered | Kidney, Liver, Lung, Heart, Others |

| End-Users Covered | Hospitals and Clinics, Organ Banks, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 21st Century Medicine, Bridge to Life™ Ltd., Carnamedica Sp. z o.o., Dr. Franz Köhler Chemie GmbH, Global Transplant Solutions, Institut Georges Lopez (IGL) (I-CAIR group), Organ Recovery Systems (Lifeline Scientific, Inc.), OrganOx Limited, Paragonix Technologies, Inc (Getinge), Preservation Solutions, Inc., Transmedics, Inc., XVIVO Perfusion AB, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the organ preservation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global organ preservation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the organ preservation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Organ preservation involves maintaining the viability and functionality of an organ outside the human body to ensure it remains suitable for transplantation. It prevents cellular damage caused by ischemia or lack of blood supply and extends the time between organ retrieval and transplantation.

The organ preservation market was valued at USD 198.87 Million in 2024.

IMARC estimates the global organ preservation market to exhibit a CAGR of 5.39% during 2025-2033.

The global organ preservation market is driven by the rising demand for organ transplants due to increasing organ failure cases, advancements in preservation techniques, and higher awareness about organ donation. Additionally, supportive government initiatives, improved healthcare infrastructure, and technological innovations like hypothermic and normothermic perfusion systems are enhancing organ viability.

In 2024, UW solution represented the largest segment by preservation solution, driven by its superior efficacy in reducing cellular injury, extending organ viability, and widespread adoption for liver, kidney, and pancreas transplants.

Deceased organ donation leads the market by organ donation type owing to the rising incidence of brain death cases, increased awareness about organ donation, and advancements in preservation techniques enhancing organ viability for transplantation.

Static cold storage technique is the leading segment by technique attributed to its cost-effectiveness, simplicity, and widespread use in preserving organs for shorter durations, particularly in liver, kidney, and pancreas transplants.

Kidney leads the market by organ type accredited to the increasing prevalence of chronic kidney disease, rising demand for transplants, and advancements in preservation techniques ensuring better outcomes and extended organ viability.

Organ banks are the leading segment by end-user due to their critical role in organ collection, storage, and distribution, along with rising organ transplant demand and advancements in preservation technologies ensuring organ viability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global organ preservation market include 21st Century Medicine, Bridge to Life™ Ltd., Carnamedica Sp. z o.o., Dr. Franz Köhler Chemie GmbH, Global Transplant Solutions, Institut Georges Lopez (IGL) (I-CAIR group), Organ Recovery Systems (Lifeline Scientific, Inc.), OrganOx Limited, Paragonix Technologies, Inc (Getinge), Preservation Solutions, Inc., Transmedics, Inc., XVIVO Perfusion AB, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)