Oral Hygiene Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033

Oral Hygiene Market Size:

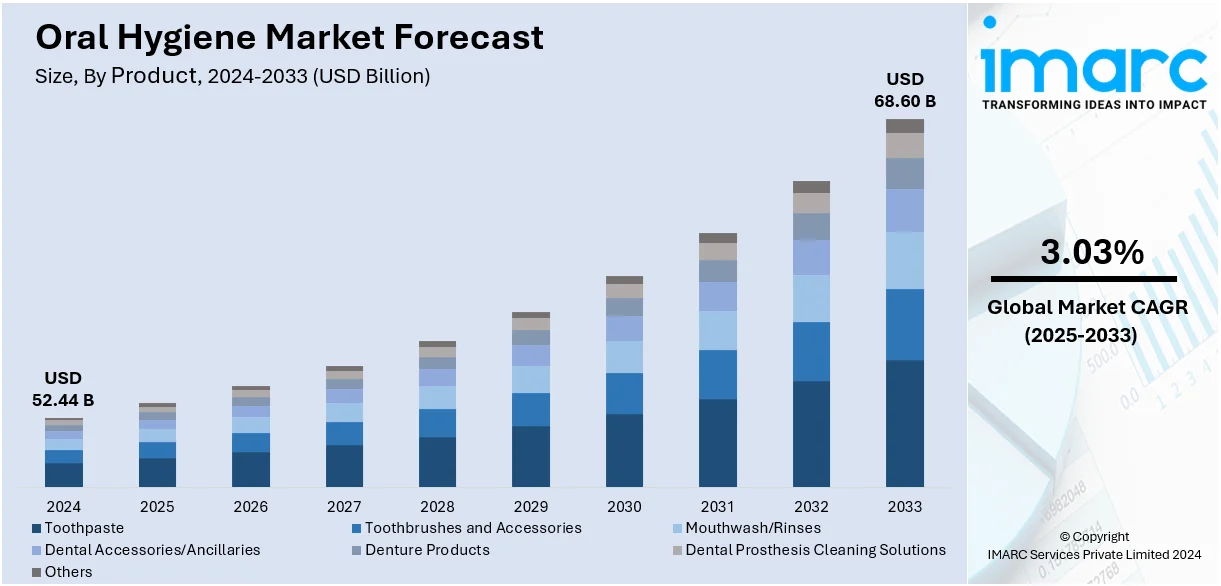

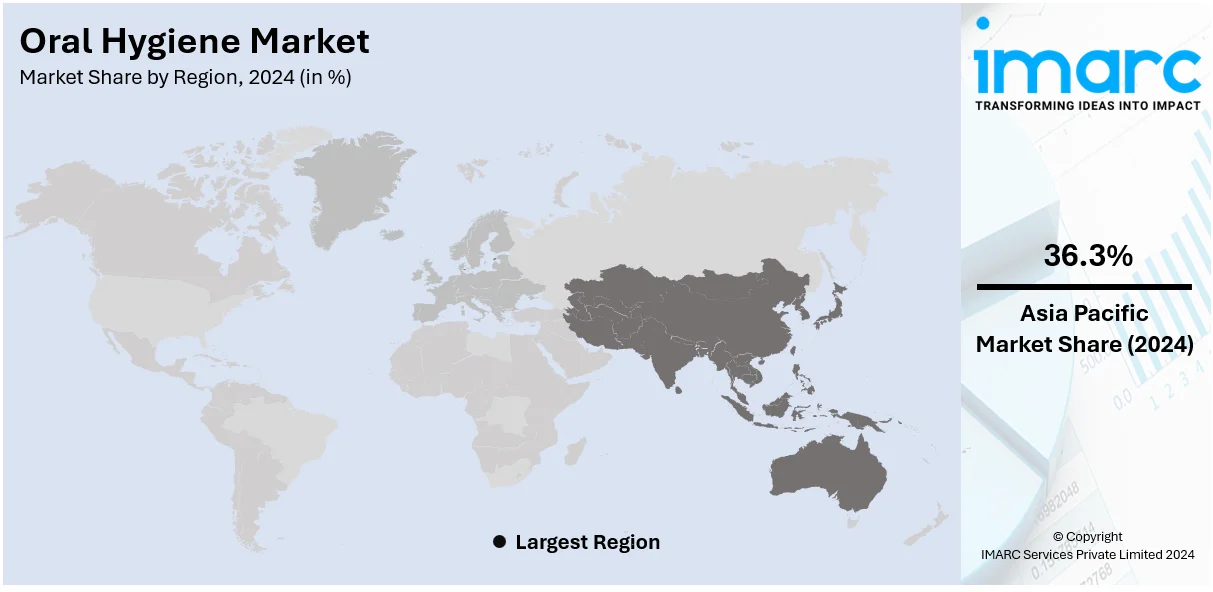

The global oral hygiene market size was valued at USD 52.44 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 68.60 Billion by 2033, exhibiting a CAGR of 3.03% from 2025-2033. Asia Pacific is currently dominating the market with a share of 36.3%. The market is rapidly driven by increasing public awareness of oral health, recent technological advancements in oral hygiene products, rising prevalence of oral diseases. Additionally, the growing geriatric populations and the escalating influence of cosmetic dentistry are favoring the oral hygiene market share.

Key Insights:

- In terms of region, Asia Pacific held the leading position in revenue with a share of 36.3% in 2024.

- Among products, toothpaste generated the highest revenue with a share of 41.1% in 2024.

- The supermarkets and hypermarkets segment was the leading distribution channel with a share of 44.9% in 2024.

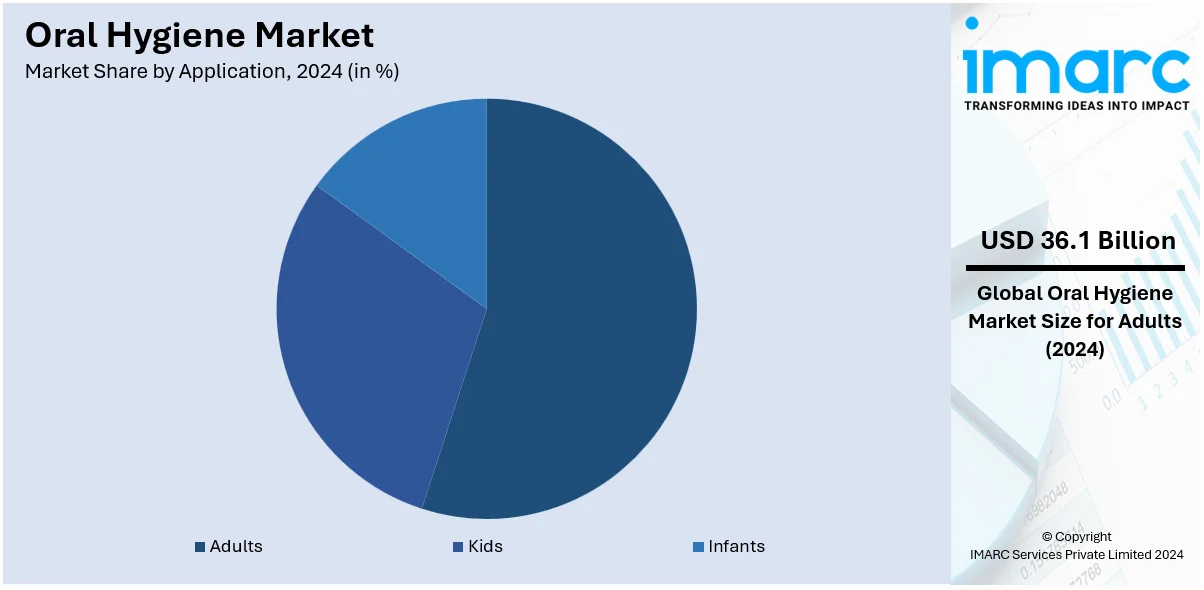

- In 2024, the adults segment led the market with a share of 68.8% among all other applications.

Market Size and Forecast:

- Market Size in 2024: USD 52.44 Billion

- Projected Market Size in 2033: USD 68.60 Billion

- CAGR (2025-2033): 3.03%

- Largest Market in 2024: Asia Pacific

Factors influencing the global oral hygiene market growth include heightening awareness of the importance of oral health and high number of people seeking solutions for common oral health issues, such as gum disease, tooth deterioration, and bad breath. People are realizing that good oral health goes together with proper overall health, demand for such products as toothpaste, mouthwash, and toothbrushes has been growing. The growing disposable income among the populations in developing countries and premiumization in oral care have led to higher spending on upgraded product offerings. For example, in March 2024, Tom's of Maine launched new natural-based toothpaste featuring glycyrrhizin from licorice root, xylitol, and organic aloe. The eco-friendly product emphasizes gentle care and sustainability. Moreover, consumers because of their increasing online social influence, and popular campaigns by public health advocacy, have started being highly responsive towards their oral health. It also leads to accelerating demand for older-age-specific product offerings, which includes denture care products. In addition to these, products, such as electronic toothbrushes and advanced types of toothpaste formula are increasingly available in the market, catering to the desires of consumers by making oral hygiene easier and better than earlier.

To get more information on this market, Request Sample

Other main reasons driving the oral care market in US with a share of 89.2% due to the standards in healthcare and full dental insurance for most of its population with preventive as well as restorative dental treatments are accessible for most people. Public health education and campaigns organized by organizations, such as ADA, to improve oral health care. The advancement in technology plays a big role, wherein the innovative incorporation of smart toothbrushes and artificial intelligence (AI) driven devices in dental care is observed by the tech-inclined to be attractive and appealing. It also speaks volumes of sustainability and wellness considering the growth popularity of natural and organic and environmental-friendly oral care products, such as biodegradable toothbrushes and fluoride-free products. Additionally, the prevalence of cosmetic dentistry and whitening products underscores the cultural focus on aesthetics and personal appearance, further fueling the market. For instance, in March 2023, Colgate-Palmolive launched Colgate Total Plaque Pro-Release toothpaste featuring stannous fluoride and Smart Foam technology for 24-hour plaque reduction, available in whitening and fresh mint across the U.S. Furthermore, the combination of these factors ensures sustained growth in the US propelling the oral hygiene market growth and shaping emerging oral care trends across various consumer groups.

Oral Hygiene Market Trends:

The Increasing Awareness of Oral Health

The surge in public awareness regarding oral health is one of the significant oral hygiene market growth drivers. The heightened consciousness is not just about basic dental care but extends to understanding the broader implications of oral health on overall well-being. According to the 2024 State of America's Oral Health and Wellness Report, 92% of U.S. adults report they believe oral health is linked with general wellness. This fact reveals a deepening recognition of oral hygiene maintenance within the scope of an all-inclusive health care plan. In line with this, the introduction of various educational initiatives led by healthcare professionals, dental associations, and public health campaigns, which emphasize the importance of regular dental check-ups and proper oral hygiene practices, is catalyzing the oral hygiene market share. Furthermore, the advent of social media and digital platforms, which has further amplified awareness messages, reaching a wider audience across various demographics, is bolstering the market growth. Moreover, the heightened awareness has led to a behavioral shift among consumers, who are now more proactive in seeking products and solutions for oral health, thus fueling the market growth.

Recent Advancements in Oral Hygiene Products

Technological advancements in oral hygiene products are significantly contributing to the market growth, with the global pharmaceutical industry investing over USD 300 billion in R&D in 2023, supporting innovation in oral care products, an industrial report stated. This, in turn, is driving the market growth as innovative products like electric toothbrushes, which provide better plaque removal, and water flossers, designed for ease of use and efficiency, are being developed. Additionally, the introduction of toothpaste with specialized formulations for sensitivity, whitening, or gum care, which addresses diverse consumer needs, is contributing to the market growth. Furthermore, extensive research and development (R&D) backed by clinical studies, which not only enhance product efficacy but also build consumer trust, is bolstering the market growth. Moreover, these constant innovations not only attract new customers but also encourage existing consumers to upgrade to newer, more advanced products.

Rising Prevalence of Oral Diseases

The increasing incidence of oral diseases, such as dental caries, periodontal diseases, and oral cancers, is a significant factor driving the oral care market. According to WHO, oral diseases affect over 3.5 billion people worldwide. These diseases are prevalent across the globe, cutting across socio-economic classes, and are often linked to lifestyle choices, dietary habits, and lack of proper oral care. In line with this, the heightened focus on preventive oral care, as consumers are becoming more inclined to invest in quality oral hygiene products as a means to avoid expensive dental treatments, is bolstering the market growth. Moreover, the introduction of several public health initiatives that focus on addressing the burden of oral diseases and providing access to quality treatment options is creating a positive oral hygiene market outlook.

Growing Geriatric Population

The growing segment of the geriatric population is a key driver in the oral care industry. According to a research article, in 2022, 771 million people were aged 65 or older, accounting for almost 10% of the world's population. The geriatric population encounters specific oral health challenges, such as gum recession, dry mouth, and increased susceptibility to oral diseases. They require specialized oral care products that cater to their unique needs. It includes products like softer toothbrushes, non-abrasive toothpaste, and oral moisturizers. Additionally, the geriatric population is generally more conscious of health maintenance, including oral health, and thus are willing to invest in products that ensure their well-being. Besides this, the growing demand for oral hygiene products from this demographic is prompting manufacturers to innovate and create items tailored for older adults.

Escalating Influence of Cosmetic Dentistry

The burgeoning field of cosmetic dentistry is playing a significant role in driving the oral care market. In line with this, the growing societal emphasis on aesthetic appearance, including a desirable smile, making cosmetic dental procedures like teeth whitening, veneers, and orthodontics increasingly popular, is driving the market growth. For instance, according to an industrial report, the global teeth whitening market is expected to grow at a CAGR of 5.18% during 2024-32. Additionally, consumers are seeking products to maintain and enhance the results of their cosmetic procedures, such as whitening toothpaste, at-home whitening kits, and products designed for sensitive teeth post-cosmetic treatments. According to the oral hygiene market forecast, the rising influence of cosmetic dentistry beyond clinical settings into daily oral care, which aligns consumer habits with the desire for an aesthetically pleasing appearance, is favoring the market growth.

Growing Shift toward Plant-Based Oral Care

Consumers are increasingly opting for oral hygiene products with natural and herbal ingredients, avoiding synthetic chemicals, artificial flavors, and harsh foaming agents. This demand is driving brands to introduce toothpastes, mouthwashes, and rinses formulated with ingredients like neem, clove, tea tree oil, and aloe vera. The appeal lies in perceived safety, minimal side effects, and alignment with broader wellness lifestyles. This trend is especially prominent among health-conscious and environmentally aware consumers seeking cleaner labels and sustainable choices. The surge in interest has encouraged both established and emerging players to expand their product lines, offering Ayurvedic or botanically inspired alternatives. The result is a growing market segment focused on purity, transparency, and ingredient traceability in oral care.

Oral Hygiene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oral hygiene market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and application.

Analysis by Product:

- Toothpaste

- Toothbrushes and Accessories

- Mouthwash/Rinses

- Dental Accessories/Ancillaries

- Denture Products

- Dental Prosthesis Cleaning Solutions

- Others

Toothpaste represents the largest segment with a share of 41.1% driven by its essential role in daily oral care routines. It caters to a variety of oral health needs, such as cavity prevention, gingivitis, tooth sensitivity, teeth whitening, and enamel protection. Furthermore, recent innovations in formulations, including natural and organic ingredients, that are attracting health-conscious consumers are positively influencing the market growth. The easy availability of toothpaste in various flavors and formulations for different age groups, such as children and the elderly, is bolstering the oral hygiene market growth revenue.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets represent the largest segment with a share of 44.9% due to the wide range of products available under one roof, competitive pricing, and the convenience of combining shopping for oral care with general groceries. Additionally, they offer products from multiple brands, including both premium and budget options, catering to a broad spectrum of consumer preferences. Furthermore, the accessibility of supermarkets and hypermarkets, especially in urban and suburban areas, makes them a primary choice for most consumers seeking oral hygiene products, supporting the market growth.

Analysis by Application:

- Adults

- Kids

- Infants

The adult segment dominates the market, with a share of 68.8% driven by a broad range of products tailored to their diverse needs and concerns, such as advanced toothbrushes, interdental cle

aning tools, toothpaste for sensitivity, gingivitis, and whitening. Furthermore, the high purchasing power of adults and their increasing awareness of oral health's impact on overall well-being is propelling the market growth. Additionally, the rise in cosmetic dentistry and the focus on maintaining a healthy, aesthetically pleasing smile are contributing to the market growth. Additionally, the growing prevalence of oral diseases among adults, which necessitates a more intensive and specialized oral care routine, is supporting the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia Pacific region represents the largest segment with a share of 36.3% in the oral hygiene market due to its vast population and rapidly growing economies. Additionally, the increasing awareness of oral health, rising disposable incomes, and the adoption of Western lifestyle habits, are contributing to the market growth. Besides this, the presence of diverse cultures and economic conditions in the region, which offer a wide market spectrum, from basic oral care products to premium and specialized items, is strengthening the market growth. Furthermore, the growing middle class in the Asia Pacific, driving the demand for innovative and advanced oral hygiene products, is supporting the market growth.

Key Regional Takeaways:

North America Oral Hygiene Market

North American oral hygiene market is propelling as oral health awareness is intensely heightening. Cavity and other oral conditions are common issues today, causing major problems if not handled properly. Intense preventive dental care among adults has also brought escalation in adopting improved oral hygiene practices in recent years, which contributes to growing markets. Technological innovations in the form of electric toothbrushes, water flossers, and enhanced toothpastes with specific formulations are gaining consumers' attention. Moreover, with the increasing natural and organic oral care products consumption, it fits into the global trend of the safer, environment-friendly alternatives being preferred. In the region, retailers are accelerating oral hygiene products offerings through online portals as well as physical stores, catering to consumers' bolstering needs. Further, a proper and well-structured healthcare with effective and continued dental care awareness campaigns sustain the region's oral hygiene market, providing continuous growth.

United States Oral Hygiene Market Analysis

The U.S. oral hygiene market is experiencing growth driven by heightened awareness of dental health and a rise in oral diseases. Industry reports indicate that over 78% of Americans have had at least one cavity by the age of 17. Approximately 80% of adults are diagnosed with any form of gum disease. Periodontal disease affects over 40-50% of adults over age 30, meaning that there is a critical requirement for effective oral care solutions. Electric toothbrushes and therapeutic mouthwashes are currently supported by innovation valued at USD 9.7 billion in 2023, but the 2021 Oral Health in America report brings to light the ongoing barriers in accessing affordable dental care; leading to that significant major brand's efforts to close these gaps with consumer-accessible quality. Federal campaigns and high consumer interest in preventive care, on the other hand, help drive market growth, while there is a wide prevalence of oral cancer and risk factors that require more advanced products in oral care.

Europe Oral Hygiene Market Analysis

The Europe oral hygiene market is marked by significant development but still lags behind. Oral health, for the last three decades, has been amazing in most places. An industry report indicates that more than 50% of the European populace could experience some kind of periodontitis, with more than 10% facing severe cases; the prevalence rises to 70-85% among individuals aged 60-65 years. Oral cancer ranks as the eighth most prevalent cancer globally. In the European Union, cancer of the lip and oral cavity ranks as the 12th most prevalent cancer among men. It is in these contexts that well-targeted public health initiatives, along with improved oral care access and increased awareness among people about prevention, can enhance equitable health results and spur expansion in the regional oral hygiene market.

Asia Pacific Oral Hygiene Market Analysis

The Asia Pacific oral hygiene market is fast growing in light of increased disposable income and awareness towards dental health. This article about dental care in Beijing claims that the population of China is at approximately 20% of the world's population, adding up to 1.2 billion people. Beijing has a strong dental infrastructure; there are 1,328 dentists and oral surgeons assisted by 515 specialized dental nurses in hospital-based dental departments. An estimated 2 million new patients annually seek dental consultations. Oral implantology, still a relatively new technology, could only treat 384 people in Beijing in 1992, but hospital interest is on the rise. Challenges remain because implants imported from overseas are too expensive for most patients, which has opened up an opportunity for cheap domestic and less expensive imported versions. These factors form a basis of tremendous market scope for innovation while facilitating better access to modern dental treatments. Times of India reveals that more than 70% Indians suffer from problems related to their gums. These create demand for therapeutic oral care products. Regionally, the herbal and Ayurvedic formulates have created a following and are leading. In Japan, sonic toothbrushes with various advanced technologies form the order of the day. This promotes innovation through the collaborative ventures of local and international companies, with the rise in urbanization leading to steady growth in the market. Asia Pacific's focus on oral health awareness campaigns places it at a significant position globally.

Latin America Oral Hygiene Market Analysis

Latin America oral hygiene benefits from innovative health policies that make it accessible and increase awareness. For instance, the Prevent Brazil policy in Brazil has significantly improved the utilization of oral health care among pregnant women. According to the latest statistics, the number of pregnant women who received oral health care increased from a mere 15% recorded in 2018 to an impressive 69% in 2023. It therefore points out the efficiency of government empowerment of raising the dental importance during pregnancies, dealing with health and economic obstacles. By focusing on maternal health, Brazil has been a model for other countries in the region. Targeted health programs can thus be seen to have the potential to create growth opportunities for the industry players with the resultant demand for oral hygiene products and services, which will help expand the market. This is a success story that underlines the role of public policy in determining consumer behavior and long-term market development.

Middle East and Africa Oral Hygiene Market Analysis

The oral hygiene market in the Middle East and Africa challenges are slightly different, but especially addressing the high prevalence of oral diseases. The World Health Organization reports the following untreated caries in primary teeth affected 38.6% of children aged 1–9 in the African Region in 2019, while 28.5% of individuals over 5 years old had untreated caries in their permanent teeth. These statistics emphasize the enormous load of oral diseases, which have grown to be a major health problem in Africa. The region has seen the biggest increase in the world in oral diseases over the last three decades, mainly attributed to limited dental care access, inadequate public health infrastructure, and low awareness on oral hygiene. This will be coupled with focused investment in dental care services and educational programs aimed at prevention, giving way to greater market expansion opportunities and improved health outcomes in the region.

Competitive Landscape:

Most players are actively pursuing a number of strategic initiatives aimed at maintaining or strengthening their respective positions in the market. They continue to invest extensively in R&D in order to launch innovative products, such as high-end electric toothbrushes, multi-variant toothpaste, and sustainable oral care options. In addition to these, numerous companies are taking their online presences to higher levels by offering e-commerce options and digital marketing strategies to better reach a greater, more heterogeneous consumer base. Besides this, they are signing strategic partnerships and acquisitions to enlarge their global reach and diversify the product portfolios that they offer to consumers.

The report provides a comprehensive analysis of the competitive landscape in the oral hygiene market with detailed profiles of all major companies, including:

- Church & Dwight Co., Inc.

- 3M Company

- Colgate-Palmolive Company

- Dabur India Ltd.

- Haleon plc

- Himalaya Wellness Company

- Koninklijke Philips N.V.

- Lion Corporation

- Sunstar Suisse S.A.

- The Procter & Gamble Company (P&G)

- Unilever plc

- Young Innovations, Inc.

Latest News and Developments:

- May 2025: Delta Dental’s latest report showed strong awareness among US adults about oral health link to overall wellness, but fewer connect it to conditions like heart disease. Despite good intentions, anxiety around dental visits and inconsistent at-home care remain barriers. The findings highlight potential gaps in oral hygiene habits, especially among children, pointing to areas the market could address through education and product innovation.

- March 2025: The EFP and Dentaid launched the “Oral Health Throughout Life” campaign to promote preventive care from infancy to old age. With half of toddlers facing early tooth decay and 77% of European teens affected by caries, the campaign highlights critical intervention points. Rising gum issues in adolescence also signal growing demand for targeted oral hygiene products and education in pediatric and teen segments.

- December 2024: Dabur India entered the kids' oral care market with Dabur Herbal Kids Toothpaste. Available on e-commerce, this toothpaste includes natural ingredients, enamel protection, and fun interactive games with collectible prizes. The company claims that the amalgamation of herbal wisdom and innovation creates safe and enjoyable oral care solutions.

- December 2024: Johnson & Johnson licensed Kaken Pharmaceutical's STAT6 program, including KP-723, an oral candidate targeting atopic dermatitis and autoimmune diseases, with Phase 1 trials planned for next year.

- November 2024: Colgate-Palmolive India has launched the #ColgateOralHealthMovement in partnership with Logy.AI to use AI-powered dental screening. The initiative will democratize access to Oral Health, engaging 50,000 Indian Dental Association dentists and offering free consultations. The movement will empower millions across India with personalized Oral Care solutions through WhatsApp and multilingual tools.

- October 2024: Philips partnered with Aspen Dental to offer Sonicare products in more than 1,100 locations of Aspen Dental. This will expand access to oral care tools, including the ExpertClean toothbrush, Cordless Power Flosser, and Teeth Whitening Kits.

- January 2024: Lion Corporation will launch "OCH-TUNE," a new oral care brand that offers FAST and SLOW styles. The product line includes toothpastes, toothbrushes, and mouthwashes, which are designed according to preferences such as efficiency or thoroughness, with the aim of enriching oral care selection beyond specific ailments. This innovation supports diverse consumer habits.

Oral Hygiene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toothpaste, Toothbrushes and Accessories, Mouthwash/Rinses, Dental Accessories/Ancillaries, Denture Products, Dental Prosthesis Cleaning Solutions, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, Others |

| Applications Covered | Adults, Kids, Infants |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Church & Dwight Co., Inc., 3M Company, Colgate-Palmolive Company, Dabur India Ltd., Haleon plc, Himalaya Wellness Company, Koninklijke Philips N.V., Lion Corporation, Sunstar Suisse S.A., The Procter & Gamble Company (P&G), Unilever plc, Young Innovations, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oral hygiene market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oral hygiene market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oral hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oral hygiene market was valued at USD 52.44 Billion in 2024.

The oral hygiene market is projected to exhibit a CAGR of 3.03% during 2025-2033, reaching a value of USD 68.60 Billion by 2033.

The market is driven by an increase in oral health awareness, inflating disposable income, and demand for premium oral care products. The geriatric population and growing prevalence of dental disorders also propel the market. In addition to this, product innovations, such as electric toothbrushes and natural ingredient-based products further drive the market expansion.

Asia Pacific currently dominates the oral hygiene market, accounting for a share of 36.3% in 2024. The dominance is fueled by increasing awareness of dental health, rising disposable incomes, expanding population, and growing availability of innovative oral care products in the region.

Some of the major players in the oral hygiene market include Church & Dwight Co., Inc., 3M Company, Colgate-Palmolive Company, Dabur India Ltd., Haleon plc, Himalaya Wellness Company, Koninklijke Philips N.V., Lion Corporation, Sunstar Suisse S.A., The Procter & Gamble Company (P&G), Unilever plc, and Young Innovations, Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)