Optical Wavelength Services Market Size, Share, Trends and Forecast by Bandwidth, Interface, Organization Size, Application, and Region, 2025-2033

Optical Wavelength Services Market Size and Share:

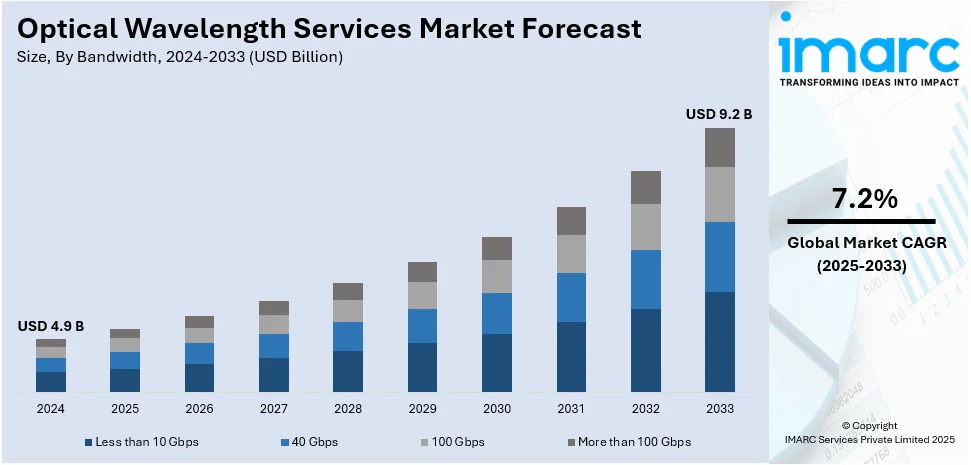

The global optical wavelength services market size was valued at USD 4.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.2 Billion by 2033, exhibiting a CAGR of 7.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35% in 2024. This dominance can be attributed to extensive fiber-optic infrastructure, high adoption of cloud computing, rapid 5G deployment, and strong demand from hyperscale data centers. Government initiatives and significant investments in network modernization further strengthen the region’s market leadership.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.9 Billion |

|

Market Forecast in 2033

|

USD 9.2 Billion |

| Market Growth Rate (2025-2033) | 7.2% |

The increasing demand for high-speed data transmission is a key driver for the optical wavelength services market, driven by the expansion of cloud computing, data centers, and content delivery networks. For instance, industry reports indicate that IP-data transmission reached approximately 149 zettabytes in 2024, requiring innovative solutions to enhance efficiency. The adoption of 5G networks further accelerates the need for reliable, low-latency optical fiber connections. Enterprises are increasingly investing in dedicated wavelength services to ensure secure, high-capacity connectivity for critical applications. Additionally, the surge in video streaming, IoT devices, and AI-driven workloads requires scalable network infrastructure, boosting market growth. Technological advancements in wavelength-division multiplexing (WDM) enhance bandwidth efficiency, supporting long-distance transmission. Regulatory support for fiber infrastructure development and investments in submarine and terrestrial fiber networks further stimulate market expansion.

To get more information on this market, Request Sample

The U.S. optical wavelength services market is driven by the rapid expansion of hyperscale data centers and enterprise cloud adoption. For instance, as per recent industrial data, hyperscale capacity in key U.S. markets grew by 10% (515 MW) during the first half of 2024 and 24% (1,100.5 MW) year-over-year, highlighting substantial expansion in available infrastructure. The proliferation of smart cities and digital transformation initiatives across industries increases demand for high-speed, high-capacity fiber-optic networks. Rising investments in fiber backbone infrastructure and metro wavelength networks enhance connectivity for enterprises, government agencies, and service providers. The growing necessity for low-latency communication, especially in financial services and healthcare, strengthens demand. Additionally, increasing 5G deployment requires robust fiber connectivity to support network backhaul and small cell densification. Government initiatives promoting broadband expansion and network modernization further encourage investment in optical wavelength services across urban and rural regions.

Optical Wavelength Services Market Trends:

Rising Demand for High-Capacity Connectivity

The increased demand for optical wavelength services continues where enterprises, data centers, and telecom operators seek to increase their digital infrastructure. The demand for expandable, low-latency, high-speed connectivity has amplified due to cloud computing, video streaming, and 5G networks pushing intensive data applications. As per an industry report, the worldwide 5G services market is projected to leap from USD 82.7 Billion in 2022 to an astonishing USD 919.4 Billion by 2031, demonstrating an impressive CAGR of 82.7% throughout the forecast period. This surge is attributed to the widespread adoption of data-intensive applications such as cloud computing, video streaming, and the Internet of Things (IoT), which require scalable and low-latency connectivity solutions. Also, the ever-increasing hype of software-defined networking (SDN) and network function virtualization (NFV) is compelling enterprises to embrace wavelength services in a flexible and economical way towards data transport solutions. Equipment upgrades to optical transport networks through improved wavelength division multiplexing (WDM) technologies are among those adopted by service providers to advance their optical wavelength portfolios- offering highly dedicated, high-speed connectivity solutions to enterprises in efforts to maximize network efficiency as well as business continuity.

Growing Adoption of 400G and Beyond

The changeover from 100G to 400G and beyond is rapid, as enterprises and service providers want faster data transmission to meet other needs caused by bandwidth-hungry applications. For instance, as of March 2023, Lumen Technologies declared new architecture in Europe, where the company announced a 400 Gbps wavelength networking system catering to both governmental and enterprise consumers, thus enabling them to inter-connect significant data centers with public clouds. The broad uptake of AI, machine learning, cloud computing, and big data necessitates ultra-high-speed networks. Among other things, telecom operators and cloud provider s heavily invest in next-generation optical transport networks employing coherent optics and flexible-grid WDM in order to enhance spectral efficiency and reduce cost per bit. This would transform the optical networking infrastructure, allowing them to provide service beyond the reach of today's networks. And the expected shift towards 800G and then terabit-capable networks will only further optimize the long-haul and metro networks to enable emerging applications including edge computing and IoT-driven connectivity.

Expansion of Fiber Infrastructure and Edge Data Centers

The speedy growth of fiber-optic networks and edge data centers is driving the development of optical wavelength services. For instance, in February 2023, Fujitsu introduced a unique sophisticated optical system known as the 1FINITY Ultra Optical System. This system can deliver speeds of up to 1.2Tbps in a single wavelength to cut back on the power consumption and CO2 emissions through networks. With the deployment of cloud-based applications and latency-sensitive workloads by businesses, high-speed, dedicated wavelength services are becoming essential for uninterrupted data transfer. Industry estimates put investments in metro and long-haul fiber connectivity on the rise to enable digital transformation, smart city projects, and 5G backhaul. Edge computing is also fueling demand, as organizations need localized processing of data to boost performance and avoid network congestion. Optical wavelength services are taking center stage in connecting edge data centers with core networks, providing low-latency and high-bandwidth connectivity. As government and private investments in fiber deployment continue to rise, the market is experiencing tremendous growth opportunities, especially in underserved and emerging markets.

Optical Wavelength Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global optical wavelength services market report, along with forecasts at the global, regional and country levels from 2025-2033. The market has been categorized based on bandwidth, interface, organization size, and application.

Analysis by Bandwidth:

- Less than 10 Gbps

- 40 Gbps

- 100 Gbps

- More than 100 Gbps

Less than 10 Gbps leads the market with around 48.2% of market share in 2024. The less than 10 Gbps segment dominates the market due to its widespread adoption across enterprises, telecom providers, and data centers requiring cost-effective, high-speed connectivity. Many small and medium-sized businesses rely on these services for secure, dedicated bandwidth without the expense of higher-capacity solutions. Additionally, applications such as cloud computing, VoIP, and video conferencing efficiently operate within this range, driving demand. The segment also benefits from broad network compatibility, supporting legacy systems and modern infrastructure. With increasing digital transformation initiatives, scalable, low-latency connectivity at affordable rates keeps this segment at the forefront of market adoption.

Analysis by Interface:

- OTN

- Sonet

- Ethernet

Ethernet leads the market with around 41.2% of market share in 2024. Ethernet dominates the optical wavelength services market due to its scalability, cost-effectiveness, and widespread adoption across enterprises and service providers. Its ability to support high-bandwidth applications, including cloud computing, data center interconnects, and 5G backhaul, makes it a preferred choice. Ethernet-based wavelength services offer flexible bandwidth provisioning, enabling businesses to scale connectivity as needed. Additionally, advancements in Ethernet technology, such as 400G and 800G speeds, enhance network performance while ensuring compatibility with existing infrastructure. Its standardized protocols, low latency, and interoperability with diverse network architectures further strengthen its market position, driving widespread deployment in telecom, finance, and hyperscale cloud networks.

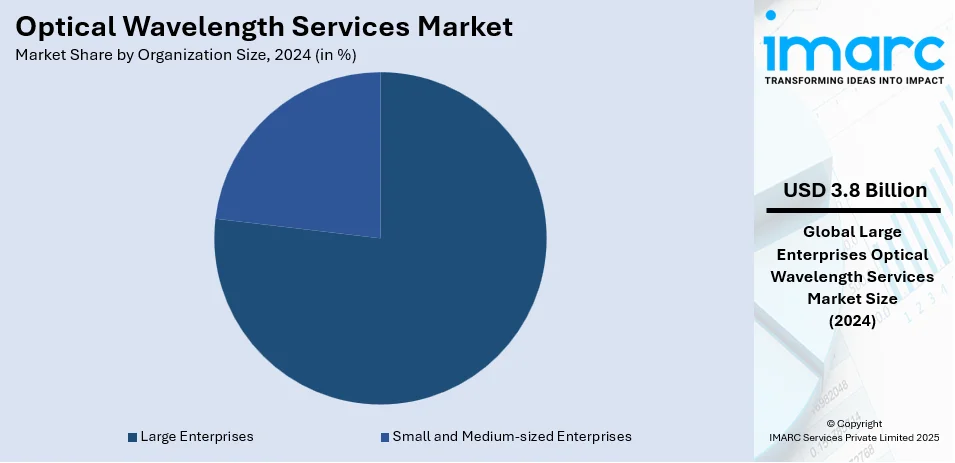

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises leads the market with around 76.5% of market share in 2024. Large enterprises dominate the market due to their extensive data transmission needs, reliance on high-capacity networks, and demand for secure, low-latency connectivity. These organizations operate global data centers, use cloud-based applications, and require dedicated, scalable bandwidth to support business-critical operations. Sectors such as banking, healthcare, and IT heavily invest in optical wavelength services to ensure seamless communication, disaster recovery, and real-time data processing. Moreover, large enterprises prioritize network reliability and redundancy, making them key adopters of wavelength-division multiplexing (WDM) technology. Their ability to invest in customized, high-performance network infrastructure further strengthens their leadership in this market.

Analysis by Application:

- Short Haul

- Metro

- Long Haul

Short haul leads the market with around 41.4% of market share in 2024. Short-haul optical wavelength services dominate the market due to the rising demand for high-speed, low-latency connectivity across metro networks, enterprise data centers, and cloud infrastructure. Increasing adoption of 5G networks, IoT applications, and edge computing necessitates robust short-haul fiber links for seamless data transmission. Enterprises and hyperscale cloud providers require reliable, high-bandwidth connections for real-time processing, driving demand for metro and regional wavelength services. Additionally, rapid urbanization and digital transformation initiatives fuel investments in short-haul fiber networks to support business continuity and operational efficiency. Cost-effectiveness, scalability, and lower latency make short-haul services preferable for mission-critical applications and high-speed interconnectivity.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35%. North America leads the optical wavelength services market due to its advanced telecommunications infrastructure, high broadband penetration, and extensive fiber-optic network deployments. The region is home to major cloud service providers, data centers, and content delivery networks, driving high-capacity connectivity demands. The rapid adoption of 5G, IoT, and AI-powered applications further accelerates network investments. For instance, industry reports state that the U.S. is at the forefront of 5G investment. By 2030, the 5G economy is expected to generate between USD 1.4 trillion and USD 1.7 trillion, creating up to 4.6 million jobs. Additionally, increasing enterprise reliance on cloud computing and digital transformation fuels demand for dedicated wavelength services. Strong government support for broadband expansion, alongside private sector investments in metro and long-haul fiber networks, enhances market growth. North America's competitive landscape fosters continuous innovation, ensuring market leadership.

Key Regional Takeaways:

United States Optical Wavelength Services Market Analysis

In 2024, the United States held 86.50% of market share in North America. In view of the increase in demand for high-speed data transmission and cloud connectivity, the U.S. optical wavelength services market is buoyant. According to the FCC, U.S. internet traffic surged more than 30% in 2023, creating a surge in demand for wavelength services. With telecom majors investing heavily in fiber-optic expansion, the market is in a healthy state, with AT&T and Verizon spending more than USD 24 billion combined on the upgrade of their network infrastructure. Data centers and hyperscale cloud providers are important catalysts; for example, Equinix is adding quite a number of facilities around the country. In the near term, the roll-out of 400G and 800G services will further increase the efficiency and capacity of networks. Initiatives such as the Broadband Equity, Access, and Deployment (BEAD) Program will support the growth of the market. Domestic players are in the lead, but the expansion of cross-border connectivity to Canada and Mexico offers prospects for additional growth.

Europe Optical Wavelength Services Market Analysis

Europe's optical wavelength services market is growing as a result of expanding fiber-optic investments and aggressive government support. Leaders are Germany and France, with extensive network development. France's electricity grid operator, RTE, signed an €1 billion (USD 1.03 billion) contract with European vendors for cable delivery to facilitate projects until 2028, consolidating the region's dedication to high-speed internet, as per reports. Germany's Deutsche Telekom keeps extending large-scale fiber rollouts, while the UK speeds up nationwide full-fiber deployment. The European Union's digital strategy is driving 800G wavelength deployments to support cloud services and AI-based applications. Top players such as Orange, Vodafone, and Deutsche Telekom are cementing alliances with hyperscale data centers to deepen bandwidth solutions. The emergence of smart cities and industrial automation also drives market growth further, with continuous investment in submarine cable networks enhancing transcontinental data transmission efficiency.

Asia Pacific Optical Wavelength Services Market Analysis

Asia Pacific's market for optical wavelength services is expanding quickly due to growing internet penetration and smart city programs. In 2023, China laid close to 4.74 million kilometers of optical fiber cable, increasing the national figure to 64.32 million kilometers, further cementing its status as a global leader in fiber-optic installation, the Ministry of Industry and Information Technology (MIIT) stated. India's 5G deployment has stepped up demand, with the government investing USD 10 billion to boost digital connectivity, as per reports. Japan and South Korea are front-runners in deploying 800G wavelengths, serving high-bandwidth applications. Higher bandwidth consumption due to increasing e-commerce and digital services fuels wavelength service adoption. Strategic collaborations between cloud service providers and telecom operators, e.g., NTT Communications with hyperscale data centers, benefit the market. Emerging economies such as Vietnam and Indonesia are investing in submarine cable networks, further increasing regional connectivity.

Latin America Optical Wavelength Services Market Analysis

The increase in internet penetration and digital transformation initiatives is contributing to the growth of the optical wavelength services market in Latin America. The largest economy of the region, Brazil, has been a major propeller of growth. A recent estimate by Mexican entrepreneur Carlos Slim in April 2024 said he had invested over BRL 40 billion (about USD 7.5 billion) in Brazil in the past five years and plans to invest another BRL 40 billion in five years' time for a large part on fiber optics and high-speed internet services. Mexico and Argentina are also ramping up fiber-optic deployment to support 5G and cloud-based applications. Connectivity infrastructure is enhanced by government-backed programs with foreign investments through submarine cable projects to improve cross-border data transmission. For instance, leading telecom operators, including Telefónica and Claro, are increasing the offerings of wavelength services to cater to the increasing need from enterprises and consumers, thus positioning Latin America to be one of the emerging players within the global optical networking market.

Middle East and Africa Optical Wavelength Services Market Analysis

Owing to increasing digitalization, infrastructure investments, and robust government initiatives, the optical wavelength services market in the MEA is on the rise. The ITU's ICT Development Index (IDI) for 2023 states that Saudi Arabia attained a 99% internet penetration rate and is thus making headway toward the development of the region. The UAE and Qatar are also ramping up fiber-optic deployments to facilitate smart city initiatives and cloud-based services. In Africa, South Africa and Kenya are investing in high-speed fiber networks to foot the digital divide. Submarine cable projects like Google’s Equiano and Meta's 2Africa enhance international bandwidth for high data transmission speeds. Telecom giants Etisalat and MTN are expanding wavelength services to meet enterprise demand and 5G rollout. So with rising connectivity demands and increasing cloud adoption, the optical networking market in the region will witness mammoth growth.

Competitive Landscape:

The optical wavelength services market is highly competitive, with key players focusing on network expansion, technological advancements, and strategic partnerships to enhance service capabilities. Major companies dominate the market, leveraging their extensive fiber-optic infrastructure to provide high-speed, low-latency connectivity. Competition is driven by increasing data traffic, cloud adoption, and 5G deployment, compelling providers to invest in software-defined networking (SDN) and wavelength-division multiplexing (WDM) technologies. Additionally, regional and niche providers compete by offering customized solutions, aggressive pricing, and enhanced service-level agreements (SLAs) to differentiate themselves in a rapidly evolving landscape.

The report provides a comprehensive analysis of the competitive landscape in the optical wavelength services market with detailed profiles of all major companies, including:

- AT&T

- CarrierBid Communications

- Colt Technology Services Group Limited

- Comcast Corporation

- Crown Castle

- Deutsche Telekom AG

- Lumen Technologies

- Nokia Corporation

- Verizon

- Windstream Intellectual Property Services, LLC

- Zayo Group, LLC

Recent Developments:

- November 2024: Colt Technology Services and Ciena successfully completed the first-ever 1.2 Tb/s wavelength transmission across the Atlantic using Ciena’s WaveLogic 6 Extreme technology. The trial doubled wavelength capacity while cutting power consumption by 50%, enhancing spectral efficiency and supporting sustainable, high-performance digital infrastructure.

- October 2024: Nokia, Windstream Wholesale, and Colt Technology Services completed the world’s first 800GbE optical service trial over an 8,500km transatlantic route. Using Nokia’s PSE-6s coherent optics, the trial showcased ultra-high capacity, low latency, and power-efficient networking for AI, content delivery, and financial data applications.

- September 2024: Nokia and AT&T signed a multi-year deal to enhance AT&T’s fiber network, which covered 27.8 million locations as of Q2 2024. Nokia will provide fiber solutions to expand and upgrade AT&T’s network, improving broadband access and enabling advanced digital services.

- August 2024: Nokia has been chosen by TM to enhance its international optical Dense Wavelength Division Multiplexing (DWDM) network, improving hyperscaler connectivity across Malaysia, Thailand, and Singapore. Powered by Nokia’s PSE-Vs technology, the network will optimize capacity, reduce latency, and support AI-driven automation for enhanced performance and scalability.

- April 2024: T-Mobile and EQT announced a joint venture to acquire Lumos, leveraging its fiber network for broadband expansion. Lumos’ 7,500-mile fiber footprint will transition to a wholesale model, with T-Mobile as the anchor tenant to enhance optical wavelength services and attract new subscribers.

Optical Wavelength Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bandwidths Covered | Less than 10 Gbps, 40 Gbps, 100 Gbps, More than 100 Gbps |

| Interfaces Covered | OTN, Sonet, Ethernet |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Short Haul, Metro, Long Haul |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T, CarrierBid Communications, Colt Technology Services Group Limited, Comcast Corporation, Crown Castle, Deutsche Telekom AG, Lumen Technologies, Nokia Corporation, Verizon, Windstream Intellectual Property Services, LLC, Zayo Group, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the optical wavelength services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global optical wavelength services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the optical wavelength services industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The optical wavelength services market was valued at USD 4.9 Billion in 2024.

IMARC estimates the optical wavelength services market to reach USD 9.2 Billion by 2033, exhibiting a CAGR of 7.2% during 2025-2033.

The market is driven by increasing demand for high-speed data transmission, rising cloud adoption, 5G network expansion, growing internet traffic, enhanced network security needs, and advancements in DWDM technology. Additionally, increasing enterprise digital transformation and data center interconnectivity are fueling market growth.

On a regional level, North America leads the market, holding a significant share of 35% in the market. The region’s leadership in the market can be attributed to its advanced telecom infrastructure, high broadband penetration, and strong demand for high-speed connectivity. Major investments in 5G, cloud computing, and data centers drive market expansion. Additionally, the presence of key industry players and rapid adoption of wavelength-division multiplexing (WDM) technology further strengthen the region’s dominance.

Some of the major players in the global optical wavelength services market include AT&T, CarrierBid Communications, Colt Technology Services Group Limited, Comcast Corporation, Crown Castle, Deutsche Telekom AG, Lumen Technologies, Nokia Corporation, Verizon, Windstream Intellectual Property Services, LLC, Zayo Group, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)