Optical Switches Market Size, Share, Trends and Forecast by Type, Enterprise Size, Application, Industry Vertical, and Region, 2025-2033

Optical Switches Market Size and Share:

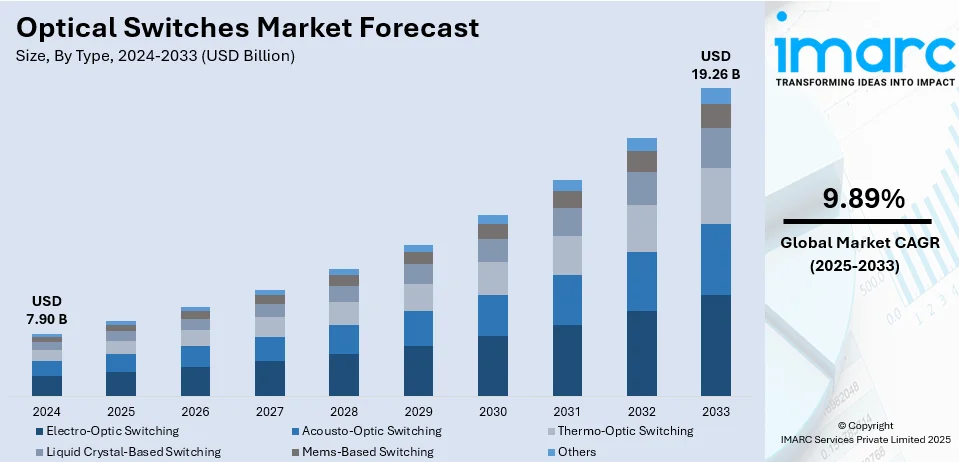

The global optical switches market size was valued at USD 7.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.26 Billion by 2033, exhibiting a CAGR of 9.89% from 2025-2033. North America currently dominates the market, holding a market share of over 36.9% in 2024. The market driven by rapid 5G expansion, increasing data center investments, growing cloud adoption, and strong government support for digital infrastructure. Rising internet penetration, surging demand for high-speed networks, and advancements in photonic technology further accelerate market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.90 Billion |

|

Market Forecast in 2033

|

USD 19.26 Billion |

| Market Growth Rate (2025-2033) | 9.89% |

The increasing volume of data traffic, driven by cloud computing, artificial intelligence (AI) driven applications, video streaming, and Internet of Things (IoT) expansion, is a major driver for the optical switches market growth. Optical switches provide the necessary speed and efficiency for modern network infrastructures as businesses and consumers demand faster, low-latency connectivity. Hyperscale data centers, 5G networks, and telecom providers rely on optical switching technology to handle the exponential rise in data transmission. For example, in March 2024, Broadcom launched Bailly, the industry’s first 51.2-Tbps co-packaged optics Ethernet switch, delivering 70% lower optical interconnect power consumption, enhancing AI cluster efficiency, and addressing bandwidth and latency challenges in hyperscale networks. Furthermore, there is an emerging interest in energy-efficient optical switching solutions as concerns about sustainability are growing, as well as reduced operating costs. Investment in PICs and WSSs grows, expanding the market. Additionally, fiber-optic networks and high-capacity data transmission solutions in these countries strengthen the demand. Continuous and rapid technological and infrastructure upgrades as digital transformation intensifies across industries, including IT, telecom, finance, and healthcare, thus making optical switches an integral tool for seamless communication of data within these industries, driving the market growth.

The U.S. optical switches market share is mainly driven by rapid data center expansion and increasing AI-driven networking solutions adoption. It currently holds a total share of 85.90%. Major cloud service providers continue to heavily invest in hyperscale data centers in the support of cloud computing, big data analytics, and AI workloads. Optical switches assume an important role in such high-performance environments, facilitating efficient and low-latency transmission of data. It's further stimulating the need for high-speed optical networks in a scenario of high AI model training and inference requiring massive data movement. For instance, in October 2024, Cisco launched the Nexus 9000 Series Switches powered by Silicon One G200, enabling 800G AI-ready network fabrics for cloud, HPC, and AI/ML workloads with dynamic load balancing, congestion control, and automated operations to enhance scalability, security, and performance in next-generation data centers. Moreover, focus of the U.S. government on digital infrastructure, 5G deployment, and cybersecurity will only strengthen the requirement for advanced optical switching solutions. Optical networking will highly become more important to enhance data security and performance among financial services, healthcare, and defense enterprises. Encouragement toward ecofriendly data centers and energy-efficient networking further accelerates adoption, making optical switches a key component of next-generation U.S. network infrastructure.

Optical Switches Market Trends:

Increasing Automation and High-Speed Network Demand

The major growth drivers for the optical switches market is the growing automation across various industries as enterprises require high-speed, reliable networking solutions, and optical switches play a key role in the management of network traffic by ensuring efficient data flow with minimal latency. External modulators, network monitors, OXCs, OADM, and fiber optic component testing are some of the applications of optical switches. The rising deployment of cloud computing, AI, and IoT-driven applications is fueling the demand for scalable, high-capacity networking infrastructure. Moreover, the global fiber optics market that stood at USD 14.35 billion in 2024 is boosting because of escalated reliance on fiber-based communication. Optical switches encompass fiber management and restoration and wavelength routing, which are to be present in all massive data transmission ways across various industries.

Rising Demand for Fiber Broadband and Switching Protection

The demand for optical switches is rising as more and more fibre broadband switching is increasingly in demand as consumers and enterprises are looking for faster and better internet connectivity. Research shows that 63% of U.S. consumers, including 54% of cable users, now prefer fiber for its superior speed and performance. Optical switches enable seamless signal rerouting in case of fiber failures with continuous network operation and enhancement in switching protection. Their ability to maintain stable, high-performance communication networks makes them critical for telecom providers, data centers, and enterprise networks. As fiber deployment is expanding globally, optical switches are becoming an integral part of next-generation network infrastructure. The growing adoption of 5G, cloud computing, and AI-driven applications further fuels the need for robust optical switching solutions that improve network resilience and efficiency.

Advancements in Reconfigurable Optical Networks

With the rapid progress of optical networking hardware, there are now highly scalable and reconfigurable optical switches with fast response times. Optical switches come in two varieties: slow and fast, both performing different types of operations. Slow optical switches are utilized for alternate routing and fault bypassing to maintain the continuity of the network even when disruptions occur. Fast optical switches, on the other hand, are used to execute logic operations in high-speed networks for real-time data transfer. Recent development in ROADM and photonic integrated circuit is enhancing optical switching technology, making it much stronger. A world of focus toward digital transformation, cloud computing, and AI-driven automation for any enterprise leads the demand toward agile, high-performance optical switches to be supported with these adaptable systems. They support bandwidth optimization and efficient networking that allows applications based on dynamics with high amounts of data transfer within industries.

Optical Switches Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global optical switches market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, enterprise size, application, and industry vertical.

Analysis by Type:

- Electro-Optic Switching

- Acousto-Optic Switching

- Thermo-Optic Switching

- Liquid Crystal-Based Switching

- Mems-Based Switching

- Others

Electro-optic switching leads the market in 2024, due to its performance in high-speed, low-power consumption, and ultra-fast data transmission support. These switches take advantage of the electro-optic materials that modify refractive indices under an electric field, leading to fast signal modulation with negligible latency. Additionally, its adoption is highly driven by escalated demand for bandwidth-intensive applications, such as 5G networks, data centers, and AI-driven computing. Enterprises and telecommunications providers are widely adopting electro-optic switching, which can optimize optical routing, and thus be scalable for large networks. Moreover, advancements in photonic integrated circuits and wavelength-selective switching further amplify the efficiency. Stimulating demand from security and interference-free optical communication across defense and finance sectors is making the market robust. Next-generation optical networking is mainly prompted by improvements in R&D investments, and electro-optic switching is that key technology ensuring better seamless, high-speed data transfer across industries.

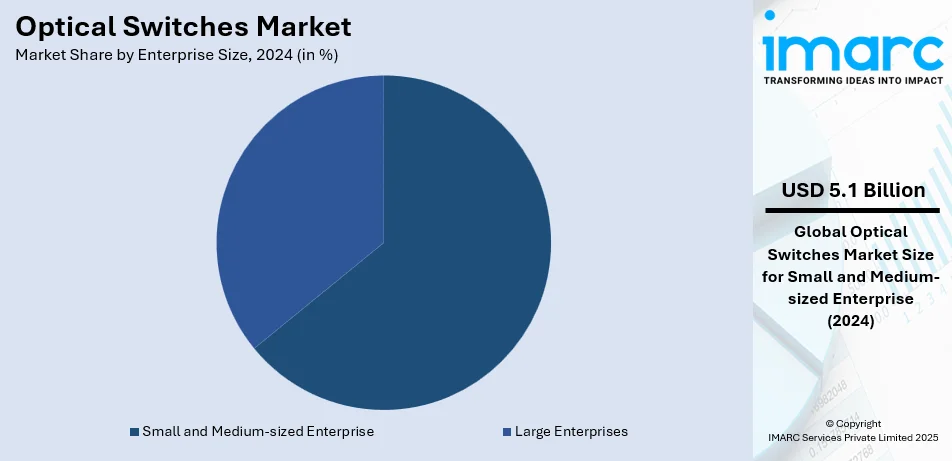

Analysis by Enterprise Size:

- Small and Medium-sized Enterprise

- Large Enterprises

Small and medium-sized enterprise (SME) are currently dominating the market with a total share of 64.3% as they are embracing optical switches to boost network efficiency, scalability, and cost-effectiveness. The demand is primarily driven by cloud-based applications, remote work infrastructure, and digital transformation initiatives. Optical switching will help SMEs improve data security and performance, reduce latency, and thus be able to support business expansion and operational continuity in competitive markets.

Analysis by Application:

- Circuit Switching

- Testing

- Multiplexing

- Cross-Connects

- Signal Monitoring

Circuit switching is the leading technology, primarily because it establishes dedicated communication paths for uninterrupted data transmission. It ensures high-speed, low-latency networking, making it a preferred choice for telecom infrastructure, financial services, and mission-critical applications. The boosting demand for reliable, high-capacity optical networks in data centers and metropolitan networks fuels its growth. The predictable nature of circuit switching makes it suitable for business applications that demand guaranteed bandwidth and low jitter. Expansion of 5G networks, IoT connectivity, and cloud-based services is going to make circuit-switched optical networks increasingly popular, while government and defense applications continue to motivate for the secure and stable communications environment the technology offers. As global data traffic continues to rise, circuit switching still remains important in supporting large-scale network architectures with minimal signal loss and enhanced transmission reliability.

Analysis by Industry Vertical:

- Government and Defense

- IT and Telecom

- BFSI

- Retail

- Manufacturing

- Others

Government and defense sectors rely on optical switches for secure, high-speed communications: encrypted data transfer and uninterrupted service. These switches are used in support of intelligence systems, surveillance networks, and critical infrastructure as part of national security and cyber defense efforts. More investment is coming in the form of fiber-optic network construction and mission-critical connectivity.

IT and telecom industries are the leaders in adopting optical switch solutions, supporting high-speed broadband, cloud computing, and 5G deployments. High data traffic, hyperscale expansion of data centers, and network virtualization drive optical switching solutions. These ensure low-latency and high-bandwidth connectivity to support seamless global communication and real-time data exchange.

BFSI institutes apply optical switches in high-speed transactions, fraud detection, and secure financial data transfer. Expanding on digital banking, algorithmic trading, and fintech services amplify the demand for reliable and low-latency networking solutions. Optical switching provides security, compliance, and operational efficiency in financial networks.

They make use of optical switches to improve omnichannel operations, inventory management, and non-interruptive payment processes. High-speed networking emerges with amplified use of e-commerce, digital payments, and AI-powered analytics. Real-time customer interactions and safe data management are all enabled by optical switches.

Manufacturing industries deploy optical switches in automation, robotics, and IoT-based smart factories. These enable monitoring in real time, predictive maintenance, and the exchange of high-speed data while improving efficiency of production in downtime-free, highly automated industrial settings.

Other industries that apply optical switches for secure, high-speed data transfer include healthcare, education, and energy. In hospitals, it is applied to telemedicine and digital records, in universities, to online learning, and by energy providers to optimize smart grids, thus enabling efficient, non-interrupted digital operations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the optical switches market with 36.9% share in 2024, driven by rapid advancement in optical networking technologies and corresponding investments in data center infrastructure. The widespread use of high-speed communication solutions, along with the presence of leading market players, leaves its mark on regional progress. In the United States, owing to an expanded 5G network, escalating demand for cloud computing applications, and increased demand for AI-driven networking solutions, regional growth gains pace. The initiatives undertaken by the government to improve broadband connectivity and fiber-optic networks are driving further expansion of the market. The increasing proliferation of hyperscale data centers and adoption of software-defined networking further enhances North America's role as a central location for innovation in optical switches. Next-generation telecom infrastructure and amplifying needs for efficient data transmission put the region on track for continued growth in the coming years.

Key Regional Takeaways:

United States Optical Switches Market Analysis

The optical switches market in the United States is primarily driven by the growing demand for high-speed data transmission, spurred by advancements in cloud computing, 5G infrastructure, and the accelerating use of Internet of Things (IoT) devices. The U.S. industrial IoT market, which reached 135.6 Billion USD in 2024, is a great example of the growing demand for the efficient, low-latency communication network in support of smart factories, connected devices, and automated processes. The expansion of data centers and the shift towards fiber-optic networks in telecommunications further support the demand for optical switches, offering enhanced bandwidth and reduced latency. Moreover, the surge in high-performance computing applications, such as artificial intelligence (AI) and big data analytics, requires reliable, scalable network systems, further boosting market growth. The U.S. government’s support for infrastructure development, particularly in the context of 5G rollout and broadband expansion, continues to drive investments in optical switch technology. Additionally, heightened concerns over cybersecurity and the need for secure communication networks bolster the adoption of optical switching solutions. Together, these factors create a strong market environment for optical switches, contributing to the region’s ongoing technological advancements.

Asia Pacific Optical Switches Market Analysis

The optical switches market in the Asia-Pacific region is experiencing significant growth driven by rapid digitalization and infrastructure development, particularly in countries like China, Japan, and South Korea. A major catalyst for the growth of 5G networks has been an expansion, especially in South Korea, with over 31.3 Million 5G connections-more than 48% of mobile connections-and China has over 700 Million 5G connections, which accounts for about 41% of total connections, according to GSMA. More so, the rapid adoption of the Internet of Things and the extension of data centers continues to fuel the demand for extremely high-speed, low-latency optical switching solutions. Governments across the region are heavily investing in telecommunications and digital infrastructure, fostering a conducive environment for the growth of optical switches. The region's rising need for more efficient and secure network solutions in sectors such as manufacturing, healthcare, and smart cities also supports the growing demand for optical switches, enhancing overall market expansion.

Europe Optical Switches Market Analysis

In Europe, the optical switches market is being driven by stimulating demand for high-bandwidth networks and the growing rollout of 5G infrastructure across the region. The EU’s focus on digital transformation, including the development of smart cities and IoT networks, is fueling the need for efficient, low-latency communication solutions. Reports indicate that 29% of EU enterprises used IoT devices in 2021, mainly for security and operational efficiency improvement. This also increases the demand for optical switches to ensure reliable and fast data transmission. Furthermore, the development of fiber-optic networks is helping to meet the escalating demand for faster internet and higher capacity networks, especially in the context of cloud services and high-performance computing applications. The European Union’s investments in digital infrastructure, sustainability, and energy-efficient technologies also support the adoption of optical switching solutions, as they provide significant advantages over traditional copper networks. The rise of digital content consumption and the high need for secure, high-speed networks in industries such as media, entertainment, and finance further propel the market. With regulatory frameworks supporting technological advancements and the development of robust digital ecosystems, the optical switches market in Europe is poised for continued growth, driven by these technological and infrastructure trends.

Latin America Optical Switches Market Analysis

Latin America is home to one of the fastest-growing mobile markets globally, with significant growth in mobile internet usage. According to reports, in 2018, the region had 326 million mobile internet users, which is expected to rise to 422 million by 2025. Therefore, this rise in mobile internet service subscription will increase demand for more enhanced networking solutions, such as optical switches. The region’s expanding mobile connectivity and the rise of IoT applications further contribute to the market’s need for high-speed, reliable communication networks, supporting the growth of optical switches in Latin America.

Middle East and Africa Optical Switches Market Analysis

In the Middle East and Africa, the optical switches market is being driven by the rapid expansion of 5G networks. According to reports, Saudi Arabia has the largest market share with more than 11.2 Million 5G subscriptions at the end of 2022, accounting for over a quarter of the overall mobile sector. As 5G adoption accelerates, there is an increasing need for high-capacity, low-latency optical switching solutions that can provide fast and reliable data transmission. The region’s continued investments in digital infrastructure and the growing demand for IoT, smart cities, and cloud-based services are fueling the market for optical switches in the MEA region.

Competitive Landscape:

The competition within the optical switches market is very high, with many players competing based on innovation, product differentiation, and technological advancement. Companies invest in research and development for better switching speed, reduced latency, and energy efficiency. Strategic collaboration, mergers, and acquisitions are common since firms are keen on expanding their presence in a market area and strengthening their product line. Competition is now being seen in high-performance solutions with a shift toward photonic integrated circuits and software-defined optical networks. The market participants are also stressing cost-effective manufacturing processes to cater to the rising demand in data centers, telecom, and enterprise networks. In sectors dealing with sensitive data, regulatory compliance and cybersecurity considerations are further shaping competitive strategies. Regional expansion, especially in the Asia-Pacific and North America, is a testament to its expansion efforts for market penetration. Because data traffic keeps growing, it is competing further in providing scalable, reliable, and efficient optical switching solutions suitable for changing network architectures.

The report provides a comprehensive analysis of the competitive landscape in the optical switches market with detailed profiles of all major companies, including:

- Agiltron Inc.

- D-Link Corporation

- EMCORE Corporation

- Fujitsu Limited

- Furukawa Electric Co. Ltd.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Keysight Technologies Inc.

- Nokia Corporation

- NTT Advanced Technology Corporation (The Nippon Telegraph and Telephone Corporation)

- OMRON Corporation

- Yokogawa Electric Corporation

Latest News and Developments:

- March 2024: Coherent has launched an optical circuit switch based on its Datacenter Lightwave Cross-Connect (DLX™) technology. The OCS reduces the electrical switches and expensive OEO conversions inside AI data centers. It saves more costs and in powers now, avoiding upgradation as AI clusters morph with new requirements. With high reliability and scalability needs in AI networks, it blends well with other solutions such as its optical transceivers.

- March 2024: Broadcom launched the first 51.2 Tbps Co-Packaged Optics (CPO) Ethernet switch, called Bailly. The product integrates eight 6.4-Tbps optical engines with Broadcom's StrataXGS ^{®} Tomahawk ^{®} 5 switch chip, yielding 70% lower power consumption and 8x silicon area efficiency improvements over pluggable transceivers. It is aimed at AI clusters, addressing the need for bandwidth in GPUs while offering power- and cost-efficient optical interconnect.

- May 2024: ZTE Corporation took part in ANGA COM 2024, Cologne, Germany, demonstrating leadership in optical communications. Being the market leader in 10G PON technology, ZTE unveiled its Combo PON solution compatible with 50G PON and 10G PON and GPON, which streamlines the evolution of these technologies. It offers solutions to challenges such as high construction costs and complex fiber cabling by using a common Optical Distribution Network (ODN) platform.

- September 2023: Santec Holdings Corporation, a leading manufacturer of optical components, tunable lasers, optical test equipment, and OCT systems, has introduced the OSX-100E OEM Optical Switch. This compact switch is available in configurations of up to 80 channels, with options for single-mode, multimode, polarization maintaining, or custom core sizes.

- March 2022: Go!Foton had presented its optical switch in the OFC Conference 2024 in San Diego on March 6-10. The design of the switch was an automated optical patch panel, using a step-motor and rotating discs in order to implement efficient port switching, instead of using the power dependency and complexity of mirror manipulation.

Optical Switches Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electro-Optic Switching, Acousto-Optic Switching, Thermo-Optic Switching, Liquid Crystal-Based Switching, Mems-Based Switching, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprise, Large Enterprises |

| Applications Covered | Circuit Switching, Testing, Multiplexing, Cross-Connects, Signal Monitoring |

| Industry Verticals Covered | Government and Defense, IT and Telecom, BFSI, Retail, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agiltron Inc., D-Link Corporation, EMCORE Corporation, Fujitsu Limited, Furukawa Electric Co. Ltd., Huawei Technologies Co. Ltd., Juniper Networks Inc., Keysight Technologies Inc., Nokia Corporation, NTT Advanced Technology Corporation (The Nippon Telegraph and Telephone Corporation), OMRON Corporation and Yokogawa Electric Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the optical switches market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global optical switches market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the optical switches industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The optical switches market was valued at USD 7.90 Billion in 2024.

The optical switches market is projected to exhibit a CAGR of 9.89% during 2025-2033, reaching a value of USD 19.26 Billion by 2033.

Rising data traffic, increasing demand for high-speed networks, cloud computing expansion, and AI-driven data centers are driving the optical switches market. Growing adoption in telecom, 5G infrastructure, and hyperscale data centers, alongside advancements in photonic integration and MEMS technology, further boost growth. Cost-efficiency, energy savings, and low-latency requirements accelerate industry adoption across multiple sectors.

North America currently dominates the optical switches market, accounting for a share of 36.9%. The market driven by rapid 5G expansion, high data center investments, growing cloud adoption, and strong government support for digital infrastructure. Rising internet penetration, surging demand for high-speed networks, and advancements in photonic technology further accelerate market growth across the region.

Some of the major players in the optical switches market include Agiltron Inc., D-Link Corporation, EMCORE Corporation, Fujitsu Limited, Furukawa Electric Co. Ltd., Huawei Technologies Co. Ltd., Juniper Networks Inc., Keysight Technologies Inc., Nokia Corporation, NTT Advanced Technology Corporation (The Nippon Telegraph and Telephone Corporation), OMRON Corporation and Yokogawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)