Optical Sensor Market Report by Type (Intrinsic Optical Sensors, Extrinsic Optical Sensors), Operation (Through-Beam, Retro-Reflective, Diffuse Reflection), Sensor Type (Fiber Optic Sensor, Image Sensor, Photoelectric Sensor, Ambient Light and Proximity Sensor, and Others), Application (Pressure and Strain Sensing, Temperature Sensing, Geological Survey, Biometric, and Others), Industry Vertical (Consumer Electronics, Industrial, Aerospace and Defense, Oil and Gas, Automotive, Healthcare, and Others), and Region 2025-2033

Optical Sensor Market Size:

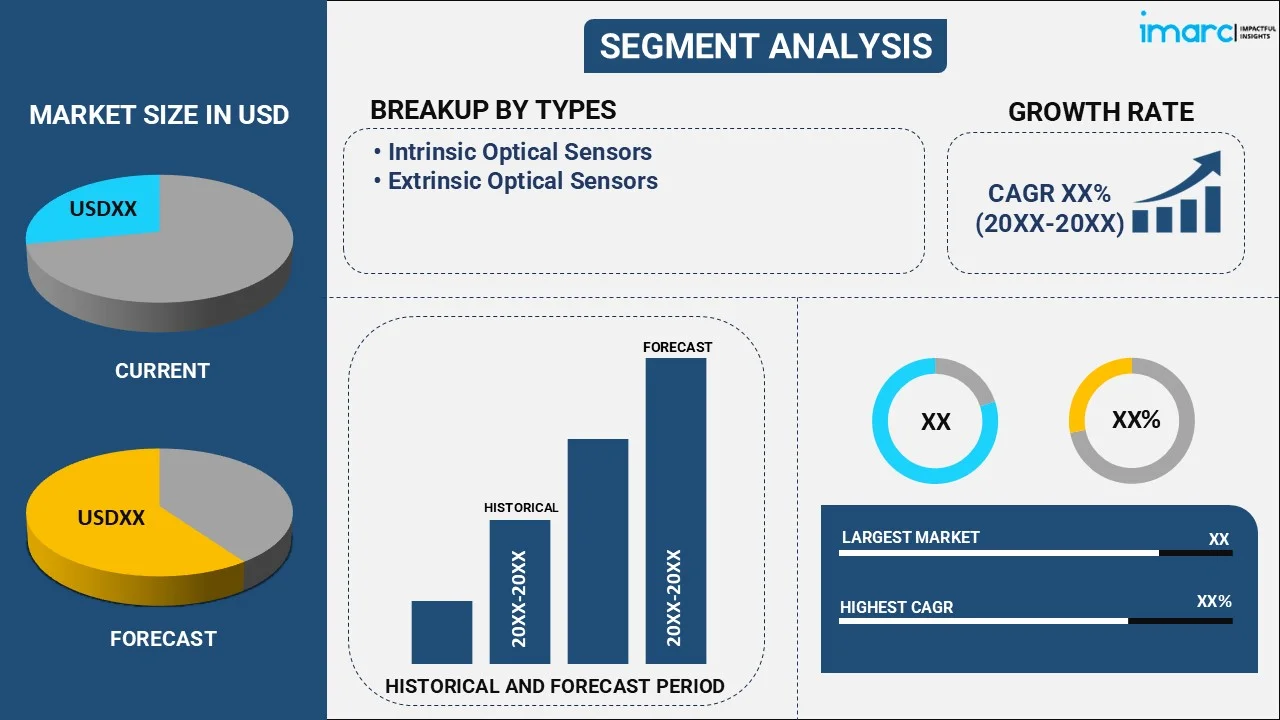

The global optical sensor market size reached USD 26.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 55.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033. Increasing demand for automation in industries such as automotive and electronics, expanding applications in gesture recognition and ambient light sensing, emphasis on energy efficiency, integration with IoT devices, adoption in healthcare, and government regulations for safety systems are propelling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.2 Billion |

| Market Forecast in 2033 | USD 55.1 Billion |

| Market Growth Rate 2025-2033 | 8.6% |

Optical Sensor Market Analysis:

- Major Market Drivers: According to the optical sensor market report, primary drivers in the optical sensor market are increasing technological advancements, developments in non-invasive diagnostics and monitoring in healthcare, and the rise in industry automation, including the automotive, and manufacturing sectors.

- Key Market Trends: Key trends in the optical sensor market include miniaturization and integration of sensors with mobile devices, enabling new portable diagnostic systems, and improved consumer electronics. The growth of IoT and smart home industries drive market innovation through implementing optical sensors in home automation, energy management systems, and more.

- Geographical Trends: According to the optical sensor market analysis, Asia-Pacific region emerges as a fast-growing market supported by expanded manufacturing and technological development in such countries as China, Japan, and South Korea. On the contrary, the North American region is still a major market for optical sensors, supported by strong R&D activities and advanced technology acquisitions by the automotive and healthcare industries.

- Competitive Landscape: Key companies are leading the optical sensor market with their advanced sensors and long-term technological development. High competition and company acquisitions and mergers are common trends. Member companies tend to attract other competitors through new product acquisitions, mergers, and partnerships.

- Challenges and Opportunities: The optical sensor market overview suggests that major obstacles to market growth are high R&D costs and increasing design complexity. Market opportunities include expanding application opportunities for biometrics and consumer electronics products.

Optical Sensor Market Trends:

Automation and smart technologies demand

The optical sensor market is witnessing significant growth due to the increase in demand for automation and smart technology across industries. Due to automation driving many of the industrial sectors, such as manufacturing, automotive, and logistics, the sensor system is becoming essential. Optical sensors specifically can detect and measure light changes, thus enabling critical automation tasks. For instance, the sensor is critical to object detection, proximity sensing, and motion tracking, as it is used in industrial robotics and machinery to reduce human intervention and improve operational efficiency. Therefore, this is creating a positive optical sensor market outlook. These sensors are also essential components of smart products, such as touchless interfaces and gesture recognition. Various industries are turning to automation to enhance productivity and streamline operations. According to a marker research report, the global industrial robotics market size reached US$ 18.0 Billion in 2023. IMARC Group expects the market to reach US$ 49.7 Billion by 2032, exhibiting a growth rate (CAGR) of 11.95% during 2024-2032. Thus, this is also positively influencing optical sensor market revenue.

Expanding application landscape

The optical sensor market is majorly driven by the increasing number of applications in various sectors. Optical sensors are widely used in classic areas of application and cover more developing spheres, such as augmented reality, virtual reality, and biometric authentication. Also, optical sensors are used for sensing ambient light to adjust a display’s brightness level and, as a result, they decrease energy used by devices such as smartphones and laptops running on batteries. Thus, this is increasing optical sensor demand. A study revealed biometrics are available on 81% of smartphones as of 2022, and in 2023, 46% of passengers have used biometrics at airports, up from 34% in 2022. Optical sensors help to sense users’ movements accurately to create a full immersion effect. Along with this, the automotive sector uses optical sensors to create adaptive luminaires and help the driver, which improves the driving experience and safety. In addition, optical sensors are used in smartwatches and fitness bracelets to monitor health metrics and movement. There is a broad spectrum of use cases that prove the relevance of optical sensors and promote optical sensor market growth.

Energy efficiency imperative

The need for energy efficiency further drives the expansion of the optical sensor market. Modern industries and society are gradually becoming prone to environmental friendliness, and the requirement for solutions to become more energy-efficient is growing. Optical sensors assist in achieving this goal by powering intelligent lighting solutions that regulate illumination based on external illumination. Such sensors are used in buildings and other public places to reduce the waste of energy for unnecessary lighting, which eventually reduces consumption and costs. Moreover, such technology is used in automotive industries to adjust the light directed by the cars based on conditions, thus ensuring better visibility and lower power consumption at the same time. They are used in smart house technology and devices to make appliances operate in accordance with real-time conditions by receiving input from the environment. As a result, the rising demand for energy-efficient solutions due to growing environmental friendliness trends increasingly embraced by society becomes another driver that enhances the application of optical sensors as one of the core elements of eco-technologies.

Optical Sensor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global optical sensor market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, operation, sensor type, application, and industry vertical.

Breakup by Type:

- Intrinsic Optical Sensors

- Extrinsic Optical Sensors

Extrinsic optical sensors dominate the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes intrinsic optical sensors and extrinsic optical sensors. According to the report, extrinsic optical sensor represented the largest segment.

The extrinsic optical sensor segment holds the largest optical sensor market share. This is mainly attributed to the rapid product uptake in industrial automation and the manufacturing process. Extrinsic sensors enable precise measurements and provide accurate feedback, which is required for quality control and yield optimization. Additionally, the demand for extrinsic optical sensors is increasing in the automotive sector due to their integration into advanced driver assistance systems and the proliferation of autonomous vehicles. Along with this, the use of the sensors enables improved object detection, lane departure prevention, and collision avoidance. In addition, the increasing applications of extrinsic optical sensors in the healthcare sector, including imaging and diagnostics, are driving the segment growth. The sensors enable the capture of high-resolution images and measurements that are essential for accurate diagnoses and treatment planning. Furthermore, the demand for extrinsic optical sensors is projected to increase due to the inclination for smart cities and infrastructure sectors such as traffic monitoring and management and pollution control.

Breakup by Operation:

- Through-Beam

- Retro-Reflective

- Diffuse Reflection

Retro-reflective holds the largest share of the market

A detailed breakup and analysis of the market based on the operation have also been provided in the report. This includes through-beam, retro-reflective, and diffuse reflection. According to the report, retro-reflective represented the largest segment.

The retro-reflective segment benefits from strong growth driven by the growing focus on road safety. Thus, the demand for retro-reflective materials in traffic signs, vehicle license plates, and road markings is increasing. Such materials have a unique ability to reflect the light to their source; hence they are utilized to enhance the visibility of the signs during low-light conditions and at night. The growth of the construction and infrastructure industry adds to the segment, as retro-reflective coatings are used as coatings on the building exterior, safety apparel, and equipment to improve visibility and prevent accidents. Also, the growing adoption of retro-reflective in the personal protective equipment sector for workers of multiple industries contributes to the segment. Enhanced focus on people’s safety in workplaces drives the integration of retro-reflective elements in clothing and gear. Moreover, the growth of the segment is also fueled by the optical sensor market recent developments. Modern retro-reflective materials are more durable, weather-resistant, and have improved optical properties.

Breakup by Sensor Type:

- Fiber Optic Sensor

- Image Sensor

- Photoelectric Sensor

- Ambient Light and Proximity Sensor

- Others

Image sensor dominate the market

The report has provided a detailed breakup and analysis of the market based on the sensor type. This includes fiber optic sensor, image sensor, photoelectric sensor, ambient light and proximity sensor, and others. According to the report, image sensor represented the largest segment.

The growth of the image sensor category is primarily driven by the increasing demand for high-quality imaging solutions offered by the growing number of industries. Specifically, the role of imaging sensors is critical for the advancements in the smartphone, automotive, surveillance, and medical devices sectors. In this regard, the accelerating expectations of the end-users in terms of high-resolution images, sensitivity, low-light performance, and quality of the visual experiences enhance the demand for such components. Moreover, the advanced technologies of artificial intelligence and the Internet of Things stimulate the integration of image sensors into products that require data acquisition and processing. For instance, the image sensors allow for the development of facial recognition systems, object detection models, and autonomous vehicles which demonstrates the scope of opportunities for the integration of these components. Along with that, the continuous advancements in imaging sensor technology, such as the introduction of back-illuminated sensors, stacked sensors, or 3D imaging capabilities promote the differentiation of the imaging sensors that can be offered to the clients. Moreover, the trend of the component miniaturization and its application in new form factors provides additional optical sensor market recent opportunities.

Breakup by Application:

- Pressure and Strain Sensing

- Temperature Sensing

- Geological Survey

- Biometric

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes pressure and strain sensing, temperature sensing, geological survey, biometric, and others.

Breakup by Industry Vertical:

- Consumer Electronics

- Industrial

- Aerospace and Defense

- Oil and Gas

- Automotive

- Healthcare

- Others

Consumer electronics hold the largest share of the market

A detailed breakup and analysis of the market based on the industry vertical has also been provided in the report. This includes consumer electronics, industrial, aerospace and defense, oil and gas, automotive, healthcare, and others. As per the report, consumer electronics represented the largest segment.

The growth of the consumer electronics segment is driven by the rapid pace of technological progress and innovation, which creates the necessity for a continually superior device regarding features and efficiency. A cycle of product development makes many goods obsolete, creating a steady demand for their upgrades. Along with this, consumer electronics become more integrated into everyday life. Smartphones, smartwatches, and smart home gadgets streamline many aspects of daily existence, provide connectivity, and improve other processes. In addition, the growing trend of the Internet of Things is another driver since this phenomenon encourages seamless integration and communication between devices. Another reason is the increase in the influence of e-commerce channels, making the availability of consumer electronics goods higher. Furthermore, higher levels of disposable income, especially in developing countries, allow people to obtain these advanced gadgets to improve their living conditions.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest optical sensor market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for optical sensor.

The growth of Asia Pacific is attributed to the high population and rapidly growing middle-class citizens, increasing consumer electronics, automotive, and industrial goods demand. This is enhancing the optical sensors market due to the growing use of optical sensors in these industries. Besides, the high demand offered by the massive urbanization and infrastructure construction necessitates advanced sensors such as optical sensors for support in creating smart cities, managing traffic, and using energy in lighting. Along with this, the Asia Pacific is also a big manufacturer of manufacturing plants and export factories; thus, the integration of optical sensors for maintaining high quality, automation and control, and optimal production has become massive in the market. According to the optical sensor market forecast, Asia Pacific on technology developments, and investment in research and development are an accelerator in this trend.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the optical sensor industry include

- ams-OSRAM AG

- Analog Devices Inc.

- Broadcom Inc.

- Hamamatsu Photonics K.K.

- Honeywell International Inc.

- ifm electronic gmbh

- Keyence Corporation

- OMRON Corporation

- Panasonic Holdings Corporation

- Rockwell Automation Inc.

- Rohm Co. Ltd.

- STMicroelectronics

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Top companies in the market are furthering their rise through differentiation and partnership. They are investing significantly in R&D to leverage market trends and launching camera sensor products with higher resolution, more sensitive pixels, and lower energy consumption, as these features are increasingly demanded in growing sectors such as automotive, healthcare, and consumer electronics. In addition to their expansion of production facilities in cost-competitive regions, optical sensor companies are acquiring technology developers and establishing partnerships with leading technology firms to incorporate their sensors in more applications and enter adjacent markets. These strategies enable companies to take advantage of emerging opportunities in autonomous vehicles and IoT on a competitive and innovative basis.

Optical Sensor Market News:

- April 30, 2024: Quantum Machines announced the combination of Hamamatsu's fast ORCA-Quest camera and its sophisticated OPX quantum controller. The integrated approach offers cold atom and trapped-ion qubits ultra-fast camera readout capabilities.

- February 24, 2024: Analog Devices Inc. declared a strategic partnership with Japan Advanced Semiconductor Manufacturing, Inc. ("JASM"), a majority-owned subsidiary of TSMC situated in Kumamoto Prefecture, Japan, to increase its long-term wafer capacity. TSMC is the top semiconductor foundry in the world.

Optical Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Intrinsic Optical Sensors, Extrinsic Optical Sensors |

| Operations Covered | Through-Beam, Retro-Reflective, Diffuse Reflection |

| Sensor Types Covered | Fiber Optic Sensor, Image Sensor, Photoelectric Sensor, Ambient Light and Proximity Sensor, Others |

| Applications Covered | Pressure and Strain Sensing, Temperature Sensing, Geological Survey, Biometric, Others |

| Industry Verticals Covered | Consumer Electronics, Industrial, Aerospace and Defense, Oil and Gas, Automotive, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ams-OSRAM AG, Analog Devices Inc., Broadcom Inc., Hamamatsu Photonics K.K., Honeywell International Inc., ifm electronic gmbh, Keyence Corporation, OMRON Corporation, Panasonic Holdings Corporation, Rockwell Automation Inc., Rohm Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, Vishay Intertechnology Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the optical sensor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global optical sensor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the optical sensor industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global optical sensor market was valued at USD 26.2 Billion in 2024.

We expect the global optical sensor market to exhibit a CAGR of 8.6% during 2025-2033.

The rising adoption of optical sensors in several sectors, such as healthcare, automotive, consumer electronics, etc., as they are resistant to high temperatures and chemically reactive environment, is primarily driving the global optical sensor market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for optical sensors.

Based on the type, the global optical sensor market has been segmented into intrinsic optical sensors and extrinsic optical sensors. Currently, extrinsic optical sensors hold the majority of the total market share.

Based on the operation, the global optical sensor market can be divided into through-beam, retro-reflective, and diffuse reflection, where retro-reflective currently exhibits a clear dominance in the market.

Based on the sensor type, the global optical sensor market has been categorized into fiber optic sensor, image sensor, photoelectric sensor, ambient light and proximity sensor, and others. Currently, image sensor accounts for the majority of the global market share.

Based on the industry vertical, the global optical sensor market can be segregated into consumer electronics, industrial, aerospace and defence, oil and gas, automotive, healthcare, and others. Among these, the consumer electronics industry holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global optical sensor market include ams-OSRAM AG, Analog Devices Inc., Broadcom Inc., Hamamatsu Photonics K.K., Honeywell International Inc., ifm electronic gmbh, Keyence Corporation, OMRON Corporation, Panasonic Holdings Corporation, Rockwell Automation Inc., Rohm Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, and Vishay Intertechnology Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)