Optic Neuropathy Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

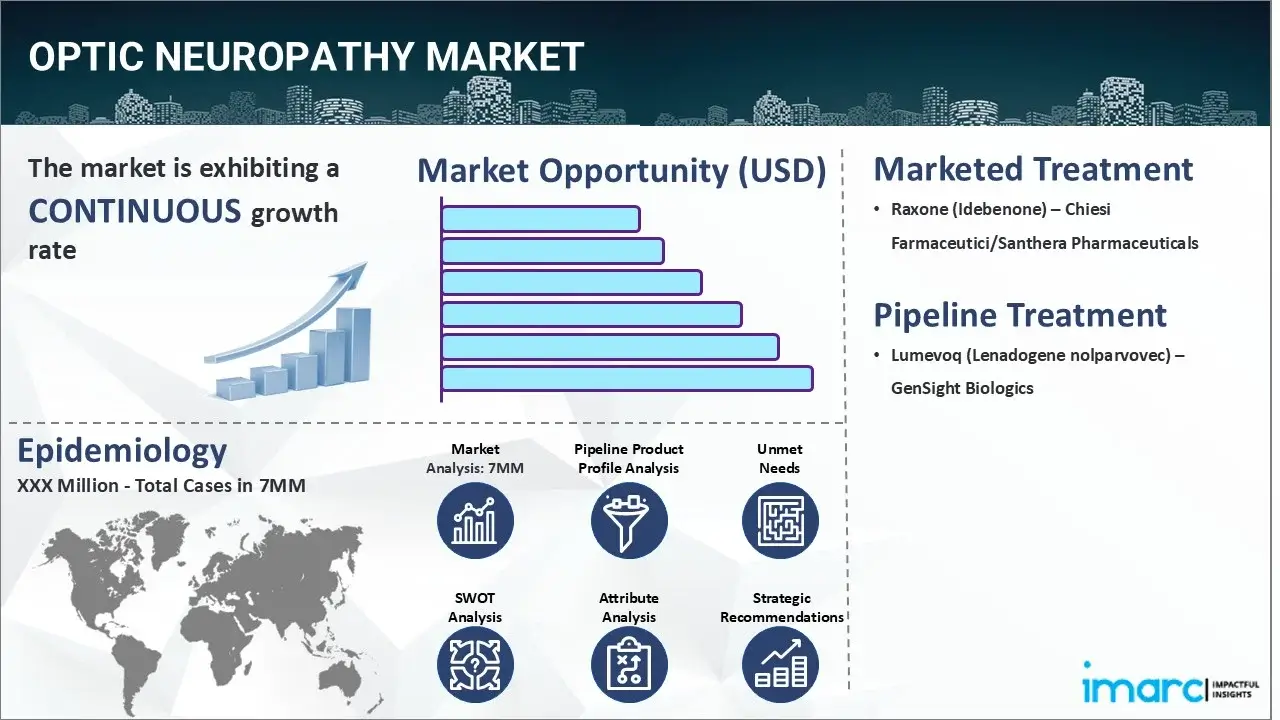

The optic neuropathy market reached a value of USD 3.1 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 4.7 Billion by 2035, exhibiting a growth rate (CAGR) of 3.79% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 3.1 Billion |

|

Market Forecast in 2035

|

USD 4.7 Billion |

|

Market Growth Rate (2025-2035)

|

3.79% |

The optic neuropathy market has been comprehensively analyzed in IMARC's new report titled "Optic Neuropathy Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Optic neuropathy refers to a medical condition characterized by damage or dysfunction of the optic nerve, which can result in vision loss or impairment. Some of the common symptoms associated with the ailment include gradual or sudden vision loss, blurred or distorted vision, reduced color vision, blank spots, loss of peripheral vision, pain or discomfort around the eye, visual disturbances like flashing lights, etc. The diagnosis of optic neuropathy typically involves a comprehensive evaluation by an eye care specialist, such as an ophthalmologist or neuro-ophthalmologist. The diagnostic process often consists of a thorough medical history review and a detailed examination of visual acuity, pupillary responses, color vision, visual field, and optic nerve appearance using specialized instruments. Various additional procedures may be conducted, including optical coherence tomography (OCT) to assess the structure of the optic nerve, visual evoked potentials (VEP) to measure electrical responses in the visual pathway, numerous imaging studies like MRI or CT scans to identify any underlying causes, etc. Besides this, blood tests may also be performed to check for systemic conditions associated with optic neuropathy.

To get more information on this market, Request Sample

The increasing cases of direct trauma to the head or eye due to motor vehicle accidents, falls, sports-related injuries, etc., which can result in optic nerve damage, are primarily driving the optic neuropathy market. Furthermore, the rising prevalence of several associated risk factors, such as advancing age, genetic mutations, underlying systemic conditions like diabetes, structural abnormalities in the optic nerve head, etc., is creating a positive outlook for the market. In addition to this, the widespread adoption of neuroprotective agents, including brimonidine and memantine, which work by preventing cell death and promoting nerve regeneration, is also bolstering the market growth. Moreover, numerous key players are making extensive investments in R&D activities to investigate gene therapies for targeting specific genetic mutations that contribute to optic nerve damage. This, in turn, is further acting as another significant growth-inducing factor. Additionally, the escalating utilization of optic nerve regeneration techniques, including the use of growth factors, tissue engineering, biomaterial scaffolds, etc., to promote axonal regrowth and repair the optic nerve, is expected to drive the optic neuropathy market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the optic neuropathy market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report the United States has the largest patient pool for optic neuropathy and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the optic neuropathy market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the optic neuropathy market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the optic neuropathy market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current optic neuropathy marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Raxone (Idebenone) | Chiesi Farmaceutici/Santhera Pharmaceuticals |

| Lumevoq (Lenadogene nolparvovec) | GenSight Biologics |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the optic neuropathy market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the optic neuropathy across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the optic neuropathy across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of optic neuropathy across the seven major markets?

- What is the number of prevalent cases (2019-2035) of optic neuropathy by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of optic neuropathy by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of optic neuropathy by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with optic neuropathy across the seven major markets?

- What is the size of the optic neuropathy patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend optic neuropathy of?

- What will be the growth rate of patients across the seven major markets?

Optic Neuropathy: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for optic neuropathy drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the optic neuropathy market?

- What are the key regulatory events related to the optic neuropathy market?

- What is the structure of clinical trial landscape by status related to the optic neuropathy market?

- What is the structure of clinical trial landscape by phase related to the optic neuropathy market?

- What is the structure of clinical trial landscape by route of administration related to the optic neuropathy market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)