Operating Room Equipment Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Operating Room Equipment Market Size and Share:

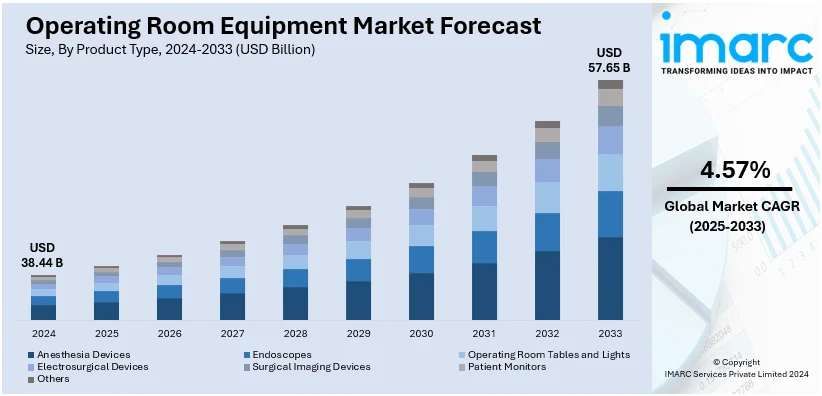

The global operating room equipment market size was valued at USD 38.44 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 57.65 Billion by 2033, exhibiting a CAGR of 4.57% from 2025-2033. North America currently dominates the market, holding a market share of over 35.6% in 2024. The market is driven by trends such as the integration of artificial intelligence (AI) for enhanced surgical precision, the rise of minimally invasive (MI) and robotic-assisted surgeries for quicker recoveries, and the growing adoption of hybrid operating rooms that combine advanced imaging technologies, improving surgical outcomes and operational efficiency in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 38.44 Billion |

|

Market Forecast in 2033

|

USD 57.65 Billion |

| Market Growth Rate (2025-2033) | 4.57% |

One major driver in the operating room equipment market is the increasing demand for minimally invasive surgeries (MIS). These procedures require advanced surgical instruments and equipment that enable precise operations with smaller incisions, leading to quicker recovery times, reduced risks, and lower healthcare costs. As the preference for MI techniques grows, there is a rising need for sophisticated operating room tools, such as robotic surgical systems, advanced imaging devices, and ergonomic tables, all of which enhance surgical precision and patient outcomes. This trend is pushing healthcare providers to invest in state-of-the-art operating room technologies.

To get more information on this market, Request Sample

In the U.S., holds a significant market share of 93.4% driving the operating room equipment market. In line with this, the global market for robotic-assisted surgery is projected to reach $14 billion by 2026. However, challenges related to clinical validation, affordability, and reimbursement structures must be addressed. With advancements in robotic technology, surgeries have become more precise, minimally invasive, and efficient, leading to lesser hospital stays and faster recovery times. The increasing demand for these advanced systems is fueled by the rising number of surgical procedures, as well as healthcare providers' focus on improving patient outcomes and reducing costs. The U.S. healthcare system's emphasis on adopting innovative technologies to enhance surgical performance is driving investments in robotic systems, imaging devices, and other cutting-edge operating room equipment.

Operating Room Equipment Market Trends:

The integration of AI and ML in equipment for operating rooms

The integration of artificial intelligence (AI) and machine learning (ML) into the operating room equipment is transforming surgical procedures. AI systems can assist surgeons by analyzing real-time medical images, detecting patterns, and suggesting the best surgical approaches. These technologies improve precision and reduce the risk of human error. Moreover, machine learning algorithms continuously improve with time, thereby providing better predictions and diagnostics, which may lead to better patient outcomes. Robotic-assisted surgery development has also been propelled by integration with AI. AI allows for the intuitive and adaptive guiding of robotic systems toward complexity in surgical environments. Therefore, this is becoming increasingly emphasized in the development and uptake of next-generation operating room technologies.

Increase in the adoption of minimally invasive and robotic surgery

The trend of MIS is what has been propelling the operating room equipment market. Such surgeries are smaller incisions, reduced blood loss, and faster recovery time. Highly specialized instruments are required for these surgeries, including endoscopes, robotic systems, and advanced imaging technologies. Robotic surgery, in particular, is fast gaining momentum and enabling surgeons to carry out highly precise operations with more flexibility. With the aid of robotic arms and 3D imaging, these systems provide far better control and visualization so that complications are fewer as well as outcomes are favorable. As healthcare providers reach out to meet the expectation of patients for faster recoveries and reduced risks, the shift towards minimally invasive techniques is a dominant trend across operating rooms.

Increasing demand for hybrid operating rooms

Hybrid operating rooms combine the traditional operating room functions with advanced imaging and diagnostic technologies. They are being increasingly used in the health sector because they allow the simultaneous use of surgical equipment and advanced imaging systems such as computed tomography scan, Magnetic resonance imaging, and fluoroscopy, providing real-time visualization of critical areas during surgery. Hybrid operating rooms provide great flexibility and efficiency in allowing several specialties, such as cardiology, neurology, and orthopedics, in one room. Therefore, as the demand for such complex, multidisciplinary procedures grows, hybrid operating rooms become necessary for improving surgical precision, minimizing patient risk, and reducing the number of interventions, thus propelling the adoption of hybrid operating rooms across hospitals.

Operating Room Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global operating room equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Anesthesia Devices

- Endoscopes

- Operating Room Tables and Lights

- Electrosurgical Devices

- Surgical Imaging Devices

- Patient Monitors

- Others

Anesthesia devices stands as the largest component in 2024, holding around 29.7% of the market. This dominance is driven by the increasing number of surgeries globally, particularly in the fields of orthopedics, cardiology, and general surgery, where anesthesia is critical for patient safety and comfort. The growing preference for minimally invasive procedures, which often require advanced anesthesia delivery systems, also contributes to the demand. Moreover, advancements in anesthesia technologies, such as enhanced precision in drug delivery and real-time monitoring of vital signs, are improving patient outcomes and safety. The continuous evolution of anesthesia devices to support complex surgeries, coupled with rising healthcare spending, positions them as a key component in the operating room equipment market.

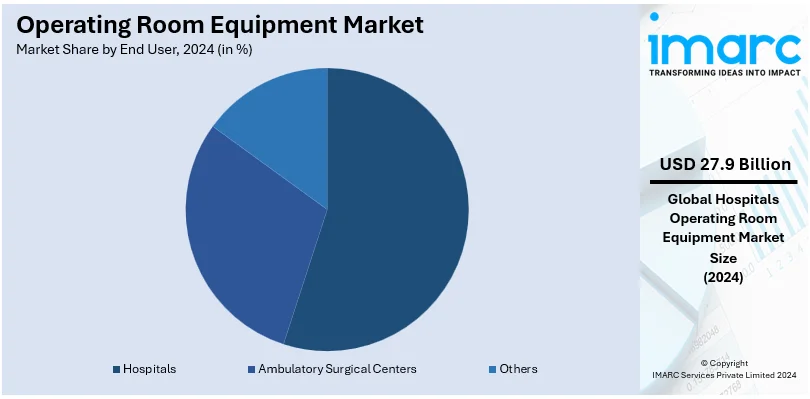

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals leads the market with around 72.7% of market share in 2024. Such a significant share is boosted by hospitals' high volumes of surgical procedures and advanced equipment to meet the current increase in demand for the performance of complex surgeries. These are the reasons why hospitals invest so much, mainly because of upgrading facilities with the best equipment available, especially when, for instance, the services provided require robotic-assisted surgical systems, high-end anesthesia machines, or other expensive sterilizers. Besides the increasing healthcare spending and the demand for quality health care, this further forces the hospitals to adopt newer technologies. Increasing prevalence of chronic diseases and the aging population only increase the demand for surgical interventions, with the importance of hospitals as a most significant market segment for operating room equipment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.6% in the operating room equipment market. This dominant share is primarily driven by the region’s advanced healthcare infrastructure, high healthcare expenditure, and widespread adoption of cutting-edge medical technologies. The U.S., as the largest contributor in the region, continues to lead in the development and deployment of innovative surgical tools and systems, such as robotic-assisted surgery and minimally invasive equipment. Additionally, the aging population and rising incidence of chronic diseases are increasing the demand for surgeries. Government initiatives, healthcare reforms, and high investments in healthcare technology are further boosting the market. Strong research and development in North America also promote continuous innovation, thus enhancing the region's leadership position in the market.

Key Regional Takeaways:

United States Operating Room Equipment Market Analysis

The demand for advanced operating room equipment in the United States is driven by an increasing number of surgical procedures, largely due to an aging population and the rising prevalence of chronic diseases. The International Society of Aesthetic Plastic Surgery (ISAPS) reported that the U.S. performed over 33.7 million surgical and non-surgical aesthetic procedures in 2022, making it the leading country for such procedures worldwide. Additionally, the U.S. healthcare sector, with national health expenditure surpassing USD 4.3 trillion in 2022 and contributing approximately 17.3% to the GDP, plays a significant role in driving demand for cutting-edge operating room technologies. This growth is also supported by government initiatives aimed at reducing healthcare costs while maintaining high-quality standards. The focus on improving patient outcomes has led to increased investments in robotic-assisted surgical systems, minimally invasive devices, and real-time imaging tools. Furthermore, private hospital chains are modernizing their facilities to stay competitive, further propelling the adoption of advanced operating room solutions.

Europe Operating Room Equipment Market Analysis

Europe’s operating room equipment market is driven by the widespread adoption of innovative technologies, including hybrid operating rooms, which combine surgical and diagnostic functionalities. The rising number of surgeries in the region is a natural driver for the market, with over 1.10 Million caesarean sections performed in the EU in 2022, as reported by the IMARC, the market for operating equipment is rising. the market demand is growing due to increasing aging populations and lifestyle diseases that necessitate surgical interventions. Adopting robotic surgery has brought forward the need for developing more sophisticated integration of equipment, of which European countries are pioneers in their use. Due to tight regulations on safety towards patients, hospitals have developed the need to spend highly on sterilization systems and monitors. Research and development done through governments and private corporations leads to continuous advancements of surgical instruments. The rising trend of outpatient surgeries, supported by advanced anesthesia delivery systems, is also aiding the growth of the market. Additionally, collaborative healthcare models across the region are boosting the standardization of high-quality operating room equipment.

Asia Pacific Operating Room Equipment Market Analysis

The Asia-Pacific region is witnessing a surge in demand for operating room equipment due to expanding healthcare infrastructure and increased investments in hospital modernization, particularly in emerging economies. Rapid urbanization and growing healthcare awareness are resulting in higher surgical volumes, necessitating upgraded surgical tools and equipment. For instance, rapid urbanization in India, with an additional 416 Million people expected in urban areas by 2050, boosts the demand for advanced operating room equipment to meet expanding healthcare needs. The region’s booming medical tourism industry, supported by affordable treatment options and skilled professionals, is driving hospitals to adopt cutting-edge technologies. Government efforts to strengthen healthcare systems, coupled with increasing public and private sector funding, are contributing to the market's expansion. Local manufacturers are introducing cost-effective products tailored to regional needs, enhancing accessibility. Rising cases of trauma and orthopedic surgeries are further catalyzing the adoption of advanced operating room systems.

Latin America Operating Room Equipment Market Analysis

In Latin America, the growth of operating room equipment is fuelled by the expansion of private healthcare providers catering to a growing affluent population seeking advanced surgical services. According to ITA, Brazil, the largest healthcare market in Latin America, allocates 9.47% of its GDP (USD 161 Billion) to healthcare, with 62% of its 7,191 hospitals privately owned, supporting the growth of operating room equipment demand in a sector serving 50.7 Million Brazilians through private healthcare. The region's emphasis on training and education for medical professionals is driving the demand for state-of-the-art equipment designed for precision and usability. Additionally, the increasing focus on mobile and compact solutions suitable for diverse environments, including rural areas, is promoting innovation in the sector. Partnerships between international manufacturers and local distributors are ensuring the availability of cutting-edge equipment at competitive prices, further boosting adoption rates across the region.

Middle East and Africa Operating Room Equipment Market Analysis

The Middle East and Africa experience demand for operating room equipment due to growing medical tourism in countries like the UAE and South Africa. To attract international patients, these hospitals invest in high-quality equipment. For example, in 2023, Dubai alone attracted over 691,000 medical tourists, which contributed approximately USD 280 Million to healthcare spending, exemplifying the global leadership that the UAE boasts in terms of advanced healthcare. This influx boosts demand for cutting-edge Operating Room Equipment, benefiting from international patient growth and the UAE's world-class medical and recovery ecosystem. The emphasis on infection control measures is nudging the acceptance of integrated sterilization and disinfection technologies into surgical instruments. In addition, the greater prevalence of chronic diseases in need of surgical interventions- such as kidney and liver disorders- creates a necessity for more advanced equipment capable of addressing specific procedures. International collaborations with medical technology firms bring innovative solutions into the region, thereby bringing modern surgical tools to the patient's doorsteps.

Competitive Landscape:

The operating room equipment market exhibits a highly competitive landscape where several key global and regional players vie for market share. Leading companies dominate the market, offering a wide range of advanced surgical tools and integrated solutions. These companies emphasize innovation in technology and, of course, have placed the focus on robotic-assisted surgery, minimal invasiveness, and sterilization technology. The regional players play a great role, especially in cost-effective solutions based on local requirements. Partnerships among international manufacturers and local distributors are increasing in number. The competition in this market is extreme because firms have been putting tremendous effort into research and development for introducing new-generation equipment to provide accuracy, safety, and improved outcomes for the patients.

The report provides a comprehensive analysis of the competitive landscape in the operating room equipment market with detailed profiles of all major companies, including:

- B. Braun SE

- Baxter International Inc.

- Conmed Corporation

- Dragerwerk AG & Co. KGaA

- Getinge AB

- Inspital Medical Technology GmbH

- Mizuho OSI

- Olympus Corporation

- Skytron LLC

- Steris plc

- Stryker Corporation

Latest News and Developments:

- In February 2024, CMR Surgical launched the vLimeLite fluorescence imaging system designed to enhance surgical procedures. This advanced system allows surgeons to visually assess blood vessels and monitor blood flow in real-time. The improved visualization aids in precision during complex surgeries, reducing risks and improving patient safety. This innovation underscores CMR Surgical's commitment to advancing surgical tools and outcomes.

- In February 2024, PENTAX Medical earned the CE mark for its i20c video endoscope series, which includes the EC34-i20c colonoscope and EG27-i20c upper GI scope. These devices are tailored to support healthcare professionals in detecting, diagnosing, and treating gastrointestinal conditions. Features like enhanced imaging and an ergonomic R/L knob adaptor improve usability and diagnostic accuracy. This milestone highlights PENTAX Medical's focus on patient care and technological innovation.

- In May 2022, Zimmer Biomet introduced advanced AI capabilities for its Omni Suite intelligent operating room in May 2022. The suite enhances operational efficiency by tracking workflow milestones like door count, patient entry, and anesthesia administration. This innovation aims to streamline procedures in medical facilities. The initiative underscores Zimmer Biomet’s focus on integrating AI into healthcare solutions.

- In February 2021, Philips unveiled ClarifEye Augmented Reality Surgical Navigation, a groundbreaking innovation for minimally invasive spinal surgeries. The technology integrates AR visualization with Philips' Hybrid Suite, enhancing precision and reducing invasiveness in complex procedures. It marks a significant step in advancing hybrid operating room technologies. ClarifEye aims to improve surgical outcomes and patient recovery times while minimizing risks.

Operating Room Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Anesthesia Devices, Endoscopes, Operating Room Tables and Lights, Electrosurgical Devices, Surgical Imaging Devices, Patient Monitors, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun SE, Baxter International Inc., Conmed Corporation, Dragerwerk AG & Co. KGaA, Getinge AB, Inspital Medical Technology GmbH, Mizuho OSI, Olympus Corporation, Skytron LLC, Steris plc, Stryker Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the operating room equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global operating room equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the operating room equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Operating room equipment refers to specialized tools and devices used in surgeries to ensure precision, safety, and effective patient care. This includes surgical instruments, anesthesia machines, sterilization equipment, imaging systems, robotic surgical systems, and monitoring devices, all designed to facilitate complex medical procedures in a controlled and sterile environment.

The operating room equipment market was valued at USD 38.44 Billion in 2024.

IMARC estimates the global operating room equipment market to exhibit a CAGR of 4.57% during 2025-2033.

Key factors driving the global operating room equipment market include technological advancements such as robotic-assisted surgery, increasing surgical procedures due to aging populations, growing healthcare infrastructure investments, demand for minimally invasive surgeries, government support for healthcare modernization, and the rising prevalence of chronic diseases requiring complex surgical interventions.

In 2024, anesthesia devices represented the largest segment by product type, driven by their essential role in surgeries, ensuring patient safety and comfort.

Hospitals leads the market by end user owing to high surgical volumes, advanced technology adoption, and substantial investments in upgrading facilities to improve patient outcomes and surgical precision.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global operating room equipment market include B. Braun SE, Baxter International Inc., Conmed Corporation, Dragerwerk AG & Co. KGaA, Getinge AB, Inspital Medical Technology GmbH, Mizuho OSI, Olympus Corporation, Skytron LLC, Steris plc, Stryker Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)