OpenStack Service Market Size, Share, Trends and Forecast by Component Type, Organization Size, Platform, Application, and Region, 2025-2033

OpenStack Service Market Size and Share:

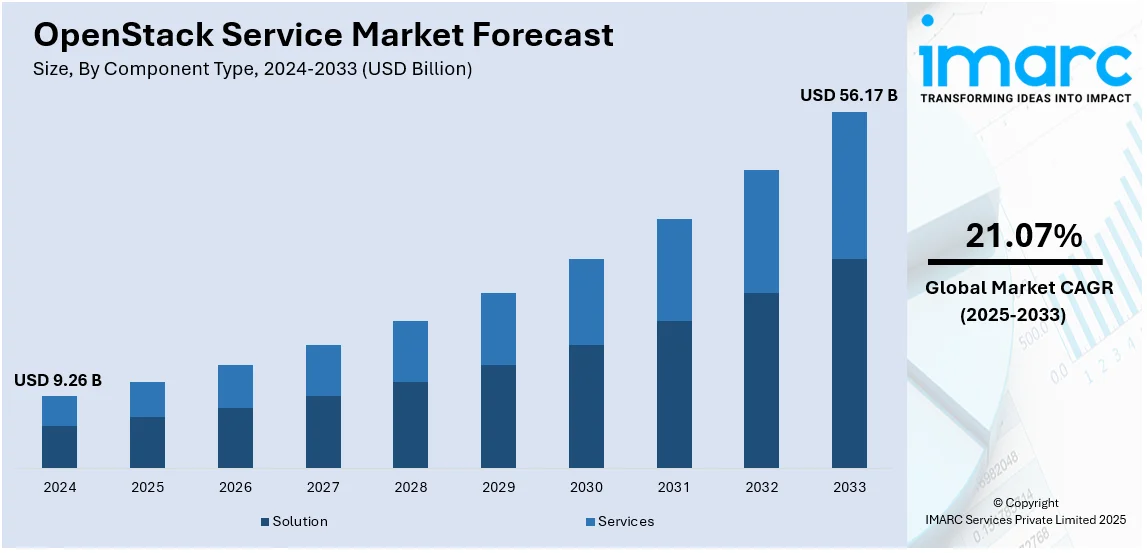

The global OpenStack service market size was valued at USD 9.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 56.17 Billion by 2033, exhibiting a CAGR of 21.07% from 2025-2033. North America currently dominates the market, holding a market share of over 37.2% in 2024. The OpenStack service market share in the region is growing because of strong cloud infrastructure, high enterprise adoption, technological advancements, and a robust information technology (IT) ecosystem. The presence of key industry players and increasing demand for scalable, cost-effective cloud solutions further supports the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.26 Billion |

|

Market Forecast in 2033

|

USD 56.17 Billion |

| Market Growth Rate 2025-2033 | 21.07% |

Businesses in various sectors are embracing cloud infrastructure to increase scalability, lower capital costs, and boost operational agility. OpenStack offers a versatile, open-source option to proprietary cloud platforms, enabling companies to set up and oversee cloud environments effectively. Moreover, the absence of licensing costs associated with OpenStack makes it an appealing choice for businesses looking for budget-friendly cloud solutions. The open-source aspect ensures vendor neutrality, allowing businesses higher control over their cloud environments and reducing reliance on one provider. In addition to this, the growing employment of big data analytics and artificial intelligence (AI) requires scalable cloud infrastructure. OpenStack's modular design allows companies to handle substantial data volumes effectively while smoothly incorporating AI-driven tasks.

The United States is a crucial segment in the market, driven by increasing investment in AI infrastructure. For example, in 2025, the Stargate Project was launched, with major tech firms like SoftBank, OpenAI, and Oracle, among others, intending to invest $500 billion in the next four years to build AI infrastructure in the US. The initiative will encompass as many as 20 data center projects, intended to enhance AI development and ensure US dominance in AI. Major technology companies are making significant investments in AI-powered data centers, necessitating adaptable and scalable cloud solutions. The open-source characteristic of OpenStack, its cost-effectiveness, and its capability to handle high-performance workloads make it a perfect option for AI applications.

OpenStack Service Market Trends:

Rising Demand for Cloud-Based and Internet-Enabled Services

The market for OpenStack services is growing, fueled by the increasing demand for cloud-centric and online services. Businesses in various sectors are emphasizing the importance of adaptable, scalable, and cost-effective cloud infrastructure to facilitate digital transformation. OpenStack, being an open-source platform, provides interoperability, vendor neutrality, and tailor-made solutions, positioning it as a favored option for organizations aiming for enhanced control over their cloud settings. The rising funding in cloud and AI infrastructure is further boosting the market growth. For instance, Microsoft’s USD 3 billion investment in India's cloud and AI ecosystem in 2025 highlights the growing emphasis on enhancing cloud infrastructure to satisfy escalating demand. Moreover, progress in edge computing, Internet of Things (IoT), and AI-based applications are steering organizations towards OpenStack's modular structure, facilitating smooth integration with new technologies. Hybrid and multi-cloud approaches are becoming more popular, as companies utilize OpenStack to enhance workloads in both public and private cloud settings. The growth of data-centric applications, heightened dependence on cloud-native technologies, and a significant movement towards open-source options over proprietary cloud solutions also drives market expansion. As businesses keep improving their digital skills, OpenStack services are poised to be instrumental in influencing the future of cloud computing.

Growing Adoption Among Telecom and Small and Medium-Sized Enterprises (SMEs)

Businesses, especially small and medium-sized enterprises (SMEs) and telecom operators, are adopting OpenStack to optimize their cloud infrastructure without high licensing costs. With approximately 33,185,550 small businesses in the United States in 2023, the demand for scalable and open-source cloud solutions is rising. OpenStack’s modular architecture enables SMEs to deploy customized cloud environments, reducing dependence on proprietary vendors while enhancing agility and operational efficiency. Additionally, the growing integration of big data analytics in the telecom sector is accelerating OpenStack adoption. Telecom companies rely on OpenStack’s scalability to manage vast volumes of network data, improve service delivery, and support 5G deployments. The ability to deploy cloud environments seamlessly, coupled with enhanced support for virtualization and containerized workloads, makes OpenStack an attractive solution for enterprises seeking cost-efficient alternatives. As businesses focus on digital transformation, the demand for open-source cloud platforms continues to rise, positioning OpenStack as a critical component in driving cloud adoption across diverse industries. This trend is expected to fuel sustained market growth in the coming years.

OpenStack Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global OpenStack service market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component type, organization size, platform, and application.

Analysis by Component Type:

- Solution

- Services

Solution holds the biggest market share because of its extensive cloud management features, scalability, and cost effectiveness. Organizations are progressively embracing OpenStack-driven private and hybrid cloud solutions to improve infrastructure, boost security, and effectively manage workloads. The need for cloud automation, orchestration, and virtualization boosts the implementation of OpenStack solutions. Businesses depend on these solutions for smooth integration with AI, big data analysis, and DevOps processes, facilitating flexible and scalable operations. Furthermore, OpenStack’s modular design enables companies to tailor cloud environments, guaranteeing adaptability across different sectors. The increasing requirement for hybrid and multi-cloud setups are catalyzing the demand for OpenStack solutions, which provide compatibility among various cloud platforms. As cloud computing continues to evolve and more enterprises embrace it, OpenStack solutions continue to be the leading element in the market.

Analysis by Organization Size:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Large enterprises extensively deploy OpenStack services to manage vast IT infrastructures, ensuring scalability, flexibility, and cost efficiency. These organizations benefit from OpenStack’s open-source nature, avoiding vendor lock-in while optimizing multi-cloud and hybrid-cloud strategies. High computing power, automation, and security features drive adoption, particularly in industries like banking, healthcare, and telecom that require robust cloud infrastructure.

Medium enterprises adopt OpenStack for cost-effective cloud solutions, balancing operational efficiency with affordability. They leverage OpenStack to scale workloads dynamically, manage containerized applications, and enhance data security. The flexibility to integrate OpenStack with existing infrastructure makes it appealing, particularly for growing technology firms, SaaS providers, and companies needing private cloud capabilities without large upfront investments.

Small enterprises utilize OpenStack primarily for affordable cloud infrastructure, enabling efficient virtualization and container management. With minimal IT resources, these businesses benefit from OpenStack’s automation and open-source support communities. Adoption is common among startups, software developers, and small IT firms seeking scalable solutions that support DevOps practices, CI/CD pipelines, and on-premise cloud deployment.

Analysis by Platform:

- Public Cloud

- Private Cloud

- Hybrid

Public cloud offers businesses scalable, economical infrastructure overseen by external providers. These solutions serve businesses that require on-demand resources without having to invest in hardware. Sectors such as e-commerce, SaaS, and media streaming utilize public cloud OpenStack for its flexibility, quick deployment, and effortless integrations, enhancing worldwide accessibility while minimizing IT management challenges and operational expenses.

Private cloud provides superior security, control, and customization for businesses handling sensitive information and compliance needs. Sectors such as finance, healthcare, and governmental organizations implement private cloud solutions to guarantee data sovereignty and adherence to regulations. OpenStack allows these organizations to operate on-premise or dedicated cloud infrastructure with scalable computing resources, enhancing workload management and operational efficiency.

Hybrid merges public and private cloud settings, enabling companies to achieve a balance between flexibility and security. Businesses utilize hybrid approaches to enhance workload allocation, boost disaster recovery, and scale operations effectively. This strategy aids sectors such as manufacturing, logistics, and IT services by allowing effortless data transfer, multi-cloud administration, and cost efficiency while maintaining compliance and performance.

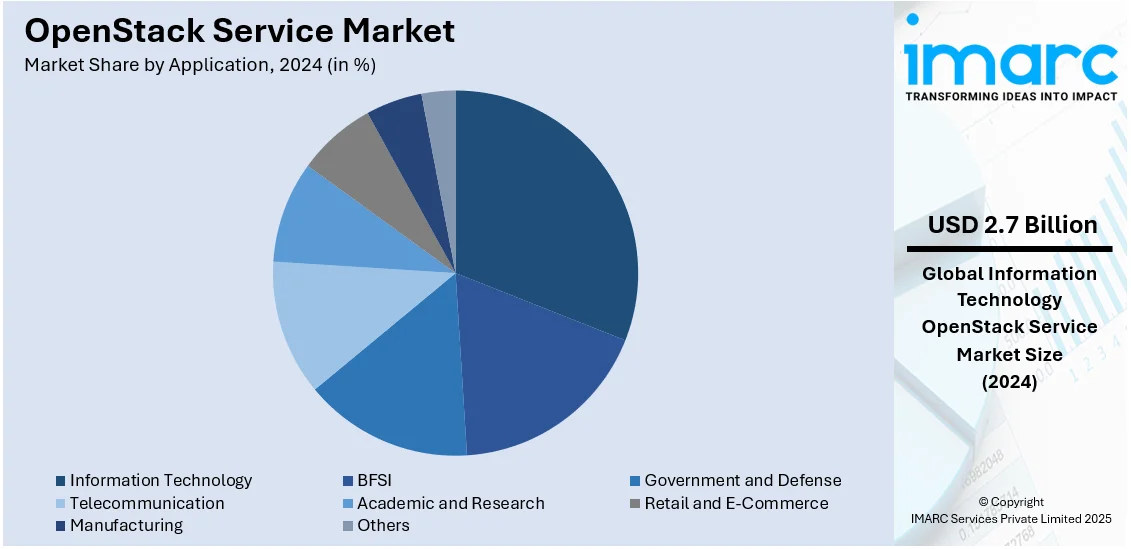

Analysis by Application:

- BFSI

- Government and Defense

- Information Technology

- Telecommunication

- Academic and Research

- Retail and E-Commerce

- Manufacturing

- Others

Information technology (IT) represents the largest segment because of its strong demand for scalable, adaptable, and economical cloud solutions. IT firms need a strong cloud infrastructure to effectively handle extensive data processing, software development, and enterprise applications. The open-source characteristic of OpenStack enables IT companies to tailor cloud environments, enhance workloads, and lessen dependence on proprietary technologies. The growing use of DevOps, containerization, and microservices in software development speeds up OpenStack deployment. Moreover, IT firms are combining OpenStack with AI, ML, and big data analytics, improving computing power and efficiency. Hybrid and multi-cloud approaches are increasingly popular, allowing IT companies to manage cost, security, and performance across various settings. As digital transformation efforts expand and the demand for secure, flexible cloud infrastructure rises, the IT industry persists in promoting OpenStack’s use, solidifying its status as the leading segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market, holding a share of 37.2%, because of its sophisticated cloud infrastructure, robust enterprise uptake, and ongoing technological progress. The region hosts leading cloud service providers, tech companies, and OpenStack contributors, promoting extensive adoption throughout various sectors. Local businesses focus on affordable, scalable cloud solutions, which makes OpenStack's open-source aspect an appealing option. The swift growth of AI, big data, and edge computing is driving the need for adaptable cloud platforms. Businesses are incorporating OpenStack into hybrid and multi-cloud plans, enhancing performance and security. The telecom industry's investment in 5G and network virtualization is also strengthening the market growth. In 2024, the Canadian federal government announced a $45 million investment in a $66 million project led by the Centre of Excellence in Next Generation Networks (CENGN). This initiative aimed to establish a 5G testbed and living lab program to develop advanced network technologies, including AI solutions. Investments by governments and enterprises in cloud modernization, combined with stringent data security and compliance needs, are contributing to the growing adoption of OpenStack.

Key Regional Takeaways:

United States OpenStack Service Market Analysis

United States is witnessing a surge in OpenStack service adoption, accounting for a share of 88.10%, due to the growing demand for cloud-based and internet-enabled services. According to 2020 survey, 71% of people in the US use a cloud storage service. 40% use Google Drive, 33% use iCloud, and 20% use OneDrive Organizations across various industries are modernizing their IT infrastructure to enhance agility, scalability, and cost efficiency. The shift toward hybrid and multi-cloud strategies is further driving enterprises to integrate OpenStack solutions for seamless cloud management. As cloud computing continues to reshape business operations, companies are prioritizing OpenStack for its flexibility and interoperability. The rise of digital transformation initiatives is increasing investments in open-source cloud platforms, ensuring seamless workload distribution and improved operational efficiencies. Internet-enabled services are becoming a cornerstone for businesses, accelerating OpenStack deployments to support diverse applications and workloads. The rising need for data sovereignty and security compliance is prompting businesses to leverage OpenStack’s private and hybrid cloud capabilities. The demand for OpenStack service is expected to continue growing as businesses focus on optimizing IT infrastructure while meeting regulatory and security requirements.

Europe OpenStack Service Market Analysis

Europe is witnessing strong OpenStack service adoption due to growing packaging demand driven by expanding BFSI facilities. According to reports, there were 784 foreign bank branches in the EU in 2021, of which 619 were from other EU Member States and 165 from third countries. The financial sector requires robust and scalable cloud infrastructure to manage vast volumes of transactions and data. OpenStack’s flexibility is enabling BFSI institutions to deploy secure and cost-effective private and hybrid cloud environments, ensuring regulatory compliance and data security. As financial organizations expand their digital services, cloud-based solutions are becoming integral to supporting secure online transactions and customer interactions. The growing need for efficient data storage and analytics in BFSI facilities is further driving the adoption of OpenStack. Packaging solutions for banking applications, fintech platforms, and digital payment systems rely on scalable infrastructure, making OpenStack a preferred choice. The increasing emphasis on cybersecurity and workload orchestration in BFSI is boosting demand for cloud-based solutions.

Asia Pacific OpenStack Service Market Analysis

Asia-Pacific is experiencing increased OpenStack service adoption due to the growing SMEs seeking cost-effective and scalable cloud solutions. According to the India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. Small and medium-sized enterprises are prioritizing digital transformation to enhance operational efficiency and market competitiveness. OpenStack’s open-source nature provides SMEs with an affordable alternative to proprietary cloud platforms, enabling flexibility in resource management. The increasing reliance on cloud infrastructure to support business expansion is further driving adoption, as companies seek agility and reduced infrastructure costs. As digital payments, online services, and remote work become more prevalent, SMEs are leveraging OpenStack to optimize IT operations and scale their digital presence. The demand for managed OpenStack solutions is rising as SMEs look for simplified deployment and maintenance. The evolving startup ecosystem is pushing for increased investment in cloud technologies, with OpenStack playing a crucial role in supporting business growth.

Latin America OpenStack Service Market Analysis

Latin America is experiencing rising OpenStack service adoption due to the growing retail and e-commerce sectors fueled by increasing disposable income. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Businesses are leveraging OpenStack’s capabilities to enhance scalability, cost-efficiency, and IT infrastructure management. With the expansion of digital payment systems and online shopping platforms, cloud-based solutions are becoming essential for managing inventory, customer data, and transaction processing. The demand for flexible and secure cloud infrastructure is pushing enterprises to integrate OpenStack into their operations. As businesses scale their online presence, OpenStack adoption is growing to support seamless data processing, website performance, and application deployment. The rise in disposable income is increasing consumer spending, leading to a higher demand for cloud-based retail solutions.

Middle East and Africa OpenStack Service Market Analysis

Middle East and Africa is witnessing increased OpenStack service adoption due to growing investment in IT and telecommunication. For instance, overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) will top USD 238 Billion this year, an increase of 4.5% over 2023. Enterprises are focusing on modernizing their IT infrastructure to support digital transformation initiatives and improve service delivery. The expansion of telecom networks is driving demand for cloud-based solutions that enable efficient data management and scalable operations. OpenStack’s flexibility and cost-effectiveness make it an attractive choice for businesses seeking to enhance network capabilities and streamline IT processes. As companies invest in cloud infrastructure, OpenStack adoption is increasing to support virtualized network functions and advanced communication services.

Competitive Landscape:

Top companies in the industry are concentrating on broadening their cloud services, improving platform functionalities, and bolstering alliances. For instance, in 2023, OpenStack unveiled Bobcat, its 28th release, which brought new capabilities such as Manila's resource locking framework, Horizon's TOTP authentication, and Ironic's ability to support active node servicing. Key players are also putting resources into open-source development, enhancing OpenStack’s ecosystem with better security, scalability, and automation capabilities. Numerous organizations are adopting AI, big data, and edge computing technologies to address changing business needs. Support for hybrid and multi-cloud is a key focus, as organizations enhance OpenStack for effortless interoperability among various cloud settings. Strategic partnerships with telecom companies and businesses are promoting the uptake of 5G and network virtualization. Furthermore, major players are providing managed OpenStack services, allowing companies to deploy, monitor, and manage cloud infrastructure with less complexity and operational burden.

The report provides a comprehensive analysis of the competitive landscape in the OpenStack service market with detailed profiles of all major companies, including:

- Bright Computing Inc.

- Canonical

- Cisco Systems Inc.

- Dell Technologies Inc

- Hewlett Packard Enterprise

- IBM

- Mirantis Inc.

- Oracle Corporation

- Rackspace Inc.

- Red Hat Inc.

- SUSE

- VMware Inc.

Latest News and Developments:

- January 2025: Mirantis launched Rockoon, an open-source project that simplifies OpenStack service management on Kubernetes. Rockoon meets the rising demand for cost-effective alternatives after Broadcom’s VMware acquisition. This initiative reflects Mirantis’ commitment to open-source innovation in cloud infrastructure.

- January 2025: UNICC launched UNIQCloud, a private cloud solution for the UN system, leveraging OpenStack service for transparency and flexibility. Designed for secure digital environments, it enhances data protection and vendor independence. Operating from UNICC’s data centers, it ensures robust cybersecurity and scalable cloud capabilities.

- October 2024: Rackspace Technology strengthened its commitment to the OpenStack service by joining the OpenInfra Foundation Board of Directors as a Platinum Member. This move enhanced its influence on the strategic direction of the OpenInfra community and industry.

- August 2024: Red Hat announced the general availability of Red Hat OpenStack Services on OpenShift, enhancing enterprise cloud infrastructure. This new release enabled organizations, especially telecom providers, to unify traditional and cloud-native networks seamlessly. Red Hat OpenStack Services on OpenShift simplifies virtualization strategies, improving scalability and resource management.

- August 2024: Rackspace Technology introduced Rackspace OpenStack Enterprise, a cloud solution designed for security, efficiency, and scalability in critical workloads. This move reinforced Rackspace’s commitment to OpenStack by simplifying complexity and offering fully managed services.

- July 2024: Mirantis launched MOSK 24.2, enhancing its Kubernetes-powered OpenStack service with performance and AI optimizations. The update introduced a Distributed Resource Balancer for improved load management and is based on OpenStack Caracal. These enhancements position Mirantis' OpenStack distribution as a stronger competitor to VMware vSphere.

OpenStack Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Solution, Services |

| Organization Sizes Covered | Large Enterprises, Medium Enterprises, Small Enterprises |

| Platforms Covered | Public Cloud, Private Cloud, Hybrid |

| Applications Covered | BFSI, Government and Defense, Information Technology, Telecommunication, Academic and Research, Retail and E-Commerce, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bright Computing Inc., Canonical, Cisco Systems Inc., Dell Technologies Inc, Hewlett Packard Enterprise, IBM, Mirantis Inc., Oracle Corporation, Rackspace Inc., Red Hat Inc., SUSE and VMware Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the OpenStack service market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global OpenStack service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the OpenStack service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The OpenStack service market was valued at USD 9.26 Billion in 2024.

The OpenStack service market is projected to exhibit a CAGR of 21.07% during 2025-2033, reaching a value of USD 56.17 Billion by 2033.

The OpenStack service market is expanding due to rising cloud adoption, demand for open-source infrastructure, cost efficiency, and scalability. Enterprises seek vendor neutrality, hybrid cloud integration, and security enhancements. Growing digital transformation, edge computing, and AI workloads further accelerate adoption. Industry collaborations and ongoing development of OpenStack modules strengthen its position in cloud ecosystems.

North America currently dominates the OpenStack service market, accounting for a share of 37.2%. The dominance of the region is because of strong cloud infrastructure, high enterprise adoption, technological advancements, and a robust IT ecosystem. The presence of key industry players and increasing demand for scalable, cost-effective cloud solutions further support the market growth.

Some of the major players in the OpenStack service market include Bright Computing Inc., Canonical, Cisco Systems Inc., Dell Technologies Inc, Hewlett Packard Enterprise, IBM, Mirantis Inc., Oracle Corporation, Rackspace Inc., Red Hat Inc., SUSE and VMware Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)