Online Video Platform Market Size, Share, Trends and Forecast by Model Type, Application, Product Type, and Region, 2025-2033

Online Video Platform Market Size and Share:

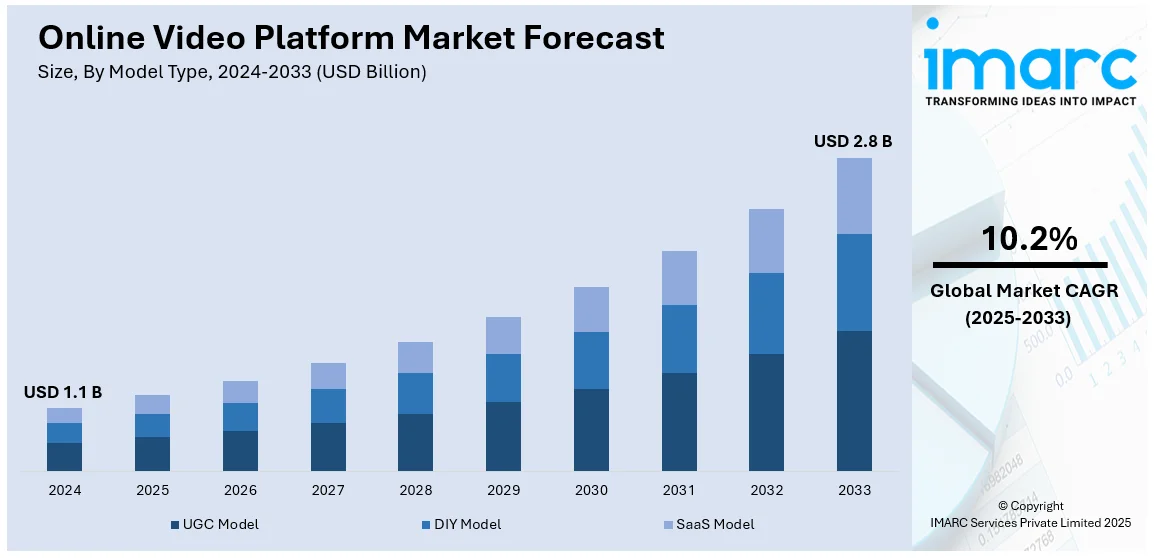

The global online video platform market size was valued at USD 1.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.8 Billion by 2033, exhibiting a CAGR of 10.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.9% in 2024, driven by the rising utilization of video content as a highly effective tool for engaging with the target audience, proliferation of smartphones and affordable data plans, and increasing need to connect face-to-face.

Key Market Trends & Insights:

- In terms of region, North America currently dominates the market, holding a significant market share of over 37.9% in 2024.

- SaaS model stands as the largest model type in 2024.

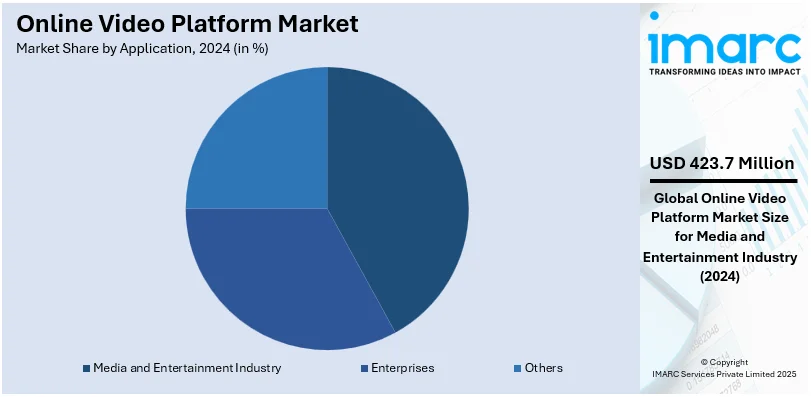

- The media and entertainment industry leads the market with around 37.8% of market share in 2024.

- Software holds a dominant market share of around 62.0% in 2024.

- In 2204, the United States accounted for 87.00% of the market share in North America.

Market Size & Forecast:

- 2024 Market Size: USD 1.1 Billion

- 2033 Projected Market Size: USD 2.8 Billion

- CAGR (2025-2033): 10.2%

- North America: Largest market in 2024

The global online video platform market is driven by several key factors, including the rapid growth of internet penetration and mobile device usage, which facilitate easier access to video content. The increasing demand for video streaming services across various industries, such as entertainment, education, and e-commerce, also contributes to market expansion. Technological advancements in cloud infrastructure, AI-driven content recommendations, and enhanced video quality further support the market's growth. Additionally, the rise of social media platforms, along with changing consumer behavior favoring on-demand content, significantly boosts the online video platform market demand globally.

To get more information on this market, Request Sample

The United States is a pivotal region in the global online video platform industry, mainly impacted by an exceptionally developed digital infrastructure and comprehensive internet availability. The nation hosts a substantial customer base for video streaming services, with amplifying requirement from crucial sectors, typically encompassing e-commerce, entertainment, and education. Leading tech firms and streaming companies, for instance, Amazon Prime, Netflix, and YouTube, are originally based in the United States, steering the landscape for content creation as well as innovation. For instance, as per industry reports, in Q2 2024, YouTube stood with a revenue of USD 8.66 billion, up 13% from USD 7.66 billion in the same time period last year. This growth highlights the growing demand for video streaming globally. Besides, the nation’s robust focus on investing in pioneering technologies such as 5G networks, AI, and cloud computing, further advanced the expansion prospect of online video platforms in the country.

Online Video Platform Market Trends:

Growing Demand for Video Marketing

The increasing demand for video marketing is significantly boosting the online video platform (OVP) industry. A survey revealed that 91% of businesses use video as a marketing tool. Video marketing offers businesses an engaging and visually captivating method to promote their brand, deliver messages, and endorse products. The rise of social video platform and video hosting platforms is expanding the reach of video content. Additionally, video processing platform and other tools enable firms to track and analyze the effectiveness of their video marketing efforts. As businesses continue to recognize the impact of video content, the market is positioned to play a critical role in leveraging video as a marketing tool, fueling market growth through 2033.

Expanding Global Internet Access

With global internet access expanding, the live streaming video platform market is witnessing substantial growth. As of 2024, there are 5.52 billion internet users, with an increasing number gaining access to high-speed connections, particularly in emerging markets. The growth of mobile video platforms and affordable data plans is accelerating video content consumption on mobile devices. As internet infrastructure improves, especially in Asia-Pacific, Africa, and Latin America, the audience for videoing platforms expands, thereby propelling market growth. Online video platforms are optimizing for mobile access to ensure a seamless experience for users, which is vital in sustaining the rise in video as a service adoption.

Rise in Remote Work and Virtual Events

The shift to remote work and virtual events is driving increased demand for video hosting platforms. Platforms are essential for conducting virtual meetings, webinars, and training sessions, as they offer features such as video conferencing and screen sharing. In addition, live streaming video platforms are enabling virtual events like trade shows, conferences, and entertainment content, providing new audiences for businesses. As remote work becomes an integral part of the modern workforce, online video trends indicate that the demand for OVP market solutions for virtual collaboration and event hosting will continue to rise, enhancing productivity and facilitating communication in a digital-first world.

Emphasis on Interactive and Personalized Experiences

The online video platform (OVP) market is seeing a shift towards delivering more interactive and personalized user experiences. By leveraging advanced data analytics, platforms can offer tailored content based on user preferences, increasing engagement. Features like live streaming and content customization are enhancing user satisfaction, making videoing platforms more attractive to consumers. As businesses intensify efforts to retain users and drive growth, these personalized experiences are becoming central to platform strategies. This emphasis on engagement and customization is expected to play a significant role in the OVP market’s expansion in the coming years, especially as competition grows.

Shift Towards Cloud-Based Platforms

Cloud-based video processing platforms are gaining popularity, offering scalability, flexibility, and reduced operational costs compared to traditional infrastructure. The shift to cloud platforms enables businesses to store and stream content across multiple devices, enhancing user accessibility. As demand for video as a service continues to rise, OVP market players are adopting cloud solutions to offer real-time analytics, improve security, and optimize content delivery. This trend is further accelerating as businesses require platforms capable of delivering high-quality content with minimal latency, driving the adoption of cloud-based video streaming and content management solutions.

Integration of AI and Machine Learning

The integration of Artificial Intelligence (AI) and machine learning (ML) is transforming the live streaming video platform market. AI algorithms are enhancing content recommendations, improving search functionality, and optimizing ad targeting, increasing user engagement. Moreover, ML is contributing to video quality enhancements through processes like video compression and real-time adjustments. As video hosting platforms look to improve personalization and discoverability, the incorporation of AI and ML is becoming a key component of their strategy. These technologies are expected to continue evolving, strengthening their impact on the market by improving user retention and engagement.

Growth of Short-Form Video Content

The rise of short-form video content is one of the most prominent online video trends driving growth in the market. With platforms like TikTok, YouTube Shorts, and Instagram Reels, short-form videos have gained widespread popularity due to their quick and engaging nature. As mobile device usage grows, short-form content is becoming more accessible, attracting younger audiences. This trend is prompting social video platforms to incorporate short-form video capabilities into their services, while creators capitalize on this growing demand to create shareable, bite-sized videos. As short-form content becomes a major part of video consumption, this growth is expected to fuel the OVP market over the next decade.

Focus on Quality and Reliability

Ensuring high-quality and reliable streaming is critical in the online video platform (OVP) market. As demand for HD and 4K content rises, platforms are investing in robust infrastructure to minimize interruptions and buffering. Video hosting platforms are incorporating features like adaptive bitrate streaming to ensure consistent performance even with varying internet speeds. With video as a service becoming an increasingly popular solution, OVP market players are prioritizing the reliability of their services to enhance user satisfaction. Maintaining high standards for content quality and platform reliability will be crucial for differentiation in a highly competitive market.

Online Video Platform Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global online video platform market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on model type, application, and product type.

Analysis by Model Type:

- UGC Model

- DIY Model

- SaaS Model

SaaS model stand as the largest model type in 2024. The SaaS model offers a cloud-based and subscription-driven approach to video hosting and management. It provides businesses with the flexibility to upload, store, and deliver video content securely from the cloud, reducing the need for on-premises infrastructure. With features like content management, analytics, and scalability, the SaaS-based model is gaining popularity across various industries. Furthermore, it offers ease of use, cost-effectiveness, and continuous updates that make it a preferred choice for businesses of all sizes seeking a hassle-free solution for video content delivery. Moreover, the SaaS model supports seamless integration with other cloud services, offering enhanced collaboration and improved operational efficiency. Its ability to handle increasing video content demands further strengthens its position as the preferred model in the market.

Analysis by Application:

- Media and Entertainment Industry

- Enterprises

- Others

Media and entertainment industry leads the market with around 37.8% of market share in 2024. Serving as the chief means of content distribution, content providers, streaming services, and video-on-demand platforms depend on such platforms to offer music videos, movies, TV shows, and sports events to a worldwide audience. The extensive requirement for exceptional-quality live streaming of events, video streaming, and customized content recommendations is bolstering significant expansion in this segment. In addition to this, online video platforms personalized for the media and entertainment segment provides attributes such as upgraded analytics, content monetization, and digital rights management (DRM), to significantly improve revenue generation and consumer engagement. Besides this, the rapid incorporation of uninterrupted multi-device streaming abilities and AI-based recommendations further augments the customer experience, guaranteeing steady market growth. The notable boost in global purchasing of smart TVs and mobile devices also aids the ongoing expansion in this industry.

Analysis by Product Type:

- Software

- Services

Software leads the market with around 62.0% of market share in 2024. The software segment encompasses a wide range of video management and delivery solutions, providing the essential infrastructure for uploading, storing, managing, and delivering video content over the internet. Online video software offers features such as content libraries, video analytics, content monetization options, content security, and customization capabilities. Apart from this, several enterprises and businesses across key sectors actively leverage online video software to distribute, generate, or organize video content with great effectiveness. This segment is further highlighted by cloud-based as well as on-premises services, with cloud-based software attaining rapid popularity because of its cost-efficiency and flexibility. Besides this, the notable incorporation of leading-edge AI-powered tools for content personalization and video optimization is substantially improving customer engagement. The increasing need for seamless multi-platform distribution further drives the adoption of video software, particularly in industries like media, education, and corporate training.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.9%, propelled by escalated customer need for video streaming services and innovative technological network. The region heavily profits from robust utilization of on-demand content, comprehensive internet penetration, and mobile device ownership. Dominant streaming platforms, encompassing Netflix, is headquartered in North America, bolstering market expansion and facilitating advancements in content personalization as well as delivery. For instance, as per industry reports, Netflix has approximately 80.13 million paying subscribers across the US and Canada, representing 30.79% of its global subscriber base. In addition to this, the heightening inclination towards e-commerce, digital entertainment, and education services further amplifies the market growth trajectory. The region’s elevated disposable income, combined with a competitive dynamic, incentivizes constant investment in 5G infrastructure, cloud computing, and AI, which are improving the availability and quality of online video platforms. Such factors fortify North America’s leading position in the industry.

Key Regional Takeaways:

United States Online Video Platform Market Analysis

In 2024, United States accounted for 87.00% of the market share in North America. The growing adoption of online video platforms in the United States is fuelled by an increasing presence of social media platforms and cloud-based services. For instance, the number of social media users in the US is projected to reach 307.06 Million in 2025. By 2029, this number is set to elevate to 326.74 Million. As the popularity of social media continues to rise, people are more likely to engage with video content across platforms, creating a demand for diverse video offerings. Cloud-based services further support this trend by providing scalable and efficient infrastructure for video hosting, making it easier for content creators to deliver high-quality videos to a global audience. This shift not only enhances user experience but also creates new opportunities for advertisers, influencers, and content creators, who leverage the synergy between social media and video platforms to grow their reach and engagement. As the adoption of these platforms expands, businesses in entertainment, education, and communication sectors also stand to benefit from broader audience engagement and content distribution capabilities.

Asia Pacific Online Video Platform Market Analysis

In the Asia-Pacific region, the increasing investment in the entertainment industry is driving the adoption of online video platforms. According to India Brand Equity Foundation, 2023 recorded USD 575 Million in PE/VC investments in the media and entertainment sector of India. As the demand for streaming services grows, stakeholders are investing in new technologies to enhance the user experience, from high-definition video streaming to interactive features. This influx of capital speeds up the development of local content and original programming, attracting more viewers. Additionally, partnerships between traditional media outlets and streaming platforms are becoming more common, helping to expand the reach of online video. The industry's growth is reflected in the emergence of innovative features, including live-streaming events, sports broadcasting, and on-demand video content, which are reshaping the entertainment landscape across the region.

Europe Online Video Platform Market Analysis

The adoption of online video platforms in Europe is heavily influenced by the growing remote work culture. According to reports, the percentage of EU employees working from home rose from 5% in 2019 to 12.3% in 2020. As more businesses and employees shift to virtual working environments, the demand for communication and collaboration tools, including video conferencing and training solutions, has surged. Companies are investing in advanced video technologies to ensure smooth and efficient communication, as face-to-face meetings have been replaced by virtual alternatives. This trend is further fuelled by the need for flexible work-life balance solutions, where employees engage with training, webinars, and professional development content through video. Additionally, educational institutions and organizations have embraced video as a tool to deliver lectures, workshops, and interactive sessions, fostering a more dynamic and accessible remote work environment. This shift creates a substantial demand for high-quality video content delivery platforms, supporting continued growth in the industry.

Latin America Online Video Platform Market Analysis

In Latin America, the rapid expansion of internet access and penetration is driving the increased adoption of online video platforms. For instance, Internet penetration in Latin America jumped from 43% to 78%, even reaching 90% in Chile in 2024. As more people gain access to the internet, particularly in rural and underserved areas, the ability to stream video content becomes a central part of their daily lives. The proliferation of affordable smartphones and high-speed internet connections enables users to access a broad range of video content, from entertainment to education and beyond. As internet coverage improves, more people are discovering the benefits of streaming video, leading to higher consumption rates and an increase in the popularity of video-based platforms across the region.

Middle East and Africa Online Video Platform Market Analysis

In the Middle East and Africa, the adoption of online video platforms is growing due to the rise of influencers, tourism, and the video marketing trend. According to survey, the Middle East's influencer marketing industry is set to hit USD 1.3 Billion in 2023. Influencers play a significant role in promoting video content through social media platforms, attracting large audiences, and creating a dynamic market for video-based advertisements. Additionally, the booming tourism industry in the region is leveraging online video platforms to showcase destinations, experiences, and cultural heritage, further driving engagement. The shift toward video marketing by brands also contributes to the growth, as businesses increasingly utilize video content for targeted advertising and product promotion, resonating with local and global audiences alike.

Competitive Landscape:

The market is highly competitive, with key players vying for market share through content innovation, user experience enhancement, and technological advancements. Companies are focusing on regional content expansion, offering localized services to attract diverse audiences. Additionally, the rise of niche streaming platforms targeting specific genres or demographics intensifies competition. The increasing importance of personalized recommendations driven by AI, improved streaming quality, and the integration of 5G technology further shape the competitive dynamics. Furthermore, as consumer demand for on-demand content continues to grow, players must strategically invest in content creation, partnerships, and advanced technologies to maintain their competitive edge. For instance, in December 2024, Zype, a major all-in-one video distribution and management platform, announced partnership with NPAW, a prominent AI-based video analytics services provider, to provide streaming platforms an all-in-one service for upgrading content delivery and boosting customer viewer engagement.

The report provides a comprehensive analysis of the competitive landscape in the online video platform market with detailed profiles of all major companies, including:

- Dalet Digital Media Systems USA Inc.

- MediaMelon, INC.

- Akamai Technologies

- Kaltura Inc.

- Panopto

- Brightcove Inc.

- Frame.io, Inc.

- Limelight Networks Inc.

- YouTube

- Comcast Technology Solutions

Latest News and Developments:

- January 2025: Quickplay has introduced "Quickplay Shorts," a new product that creates and syndicates short-form vertical content from both live and on-demand videos. This feature integrates seamlessly into existing OTT platforms, enabling streamers to reach younger audiences and explore new monetization opportunities. The product offers a social infinite vertical scroll experience.

- November 2024: TikTok has launched its AI-powered video platform, Symphony Creative Studios, to advertisers globally. The platform, announced by ByteDance, aims to enhance TikTok's ad business by helping businesses, creators, and agencies create customized, high-quality content. Symphony was first introduced at the TikTok World Product Summit earlier this year.

- October 2024: At Adobe MAX 2024, Adobe unveiled new generative AI video tools, powered by Firefly models. The tools, available in limited beta, include Generative Extend for video editing, and Text to Video & Image to Video for content creation. These tools aim to enhance video production by seamlessly extending clips and improving timing. Adobe integrates them into Premiere Pro for more efficient video editing.

- October 2024: Meta has launched Movie Gen, an AI tool designed for video creation and editing, accessible globally online. Users can generate custom videos and soundtracks by simply entering text prompts. The tool is aimed at transforming video production, making it easier for anyone to create high-quality content. Movie Gen comes amid growing demand for video content across online platforms.

- July 2024: Phenomenal AI launched India's first text-to-video AI platform. The platform uses advanced AI and Machine Learning to generate professional-grade videos from text, including scripts. It transforms video production for marketing, education, e-commerce, social media, and personal projects. This innovation makes high-quality video creation more accessible, cost-effective, and simple.

Online Video Platform Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Model Types Covered | UGC Model, DIY Model, SaaS Model |

| Applications Covered | Media and Entertainment Industry, Enterprises, Others |

| Product Types Covered | Software, Services |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Dalet Digital Media Systems USA Inc., MediaMelon, INC., Akamai Technologies, Kaltura Inc., Panopto, Brightcove Inc., Frame.io, Inc., Limelight Networks Inc., YouTube, Comcast Technology Solutions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online video platform market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online video platform market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online video platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online video platform (OVP) market was valued at USD 1.1 Billion in 2024.

The online video platform market is projected to exhibit a CAGR of 10.2% during 2025-2033, reaching a value of USD 2.8 Billion by 2033.

The market is driven by the increasing demand for video marketing, the rise of interactive and personalized experiences, and the growing need for cloud-based platforms. Additionally, the proliferation of mobile devices, better internet infrastructure, and the shift toward AI and machine learning technologies are propelling the growth of the OVP market. The increasing consumption of video content across multiple sectors, including entertainment, education, and business, further fuels market expansion.

North America currently dominates the online video platform market, holding a significant market share of over 37.9% in 2024. The region benefits from a strong digital infrastructure, high demand for video content, and a rapidly expanding video marketing landscape.

Some of the major players in the online video platform market include Dalet Digital Media Systems USA Inc., MediaMelon, INC., Akamai Technologies, Kaltura Inc., Panopto, Brightcove Inc., Frame.io, Inc., Limelight Networks Inc., YouTube, Comcast Technology Solutions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)