Online Food Delivery Market Report by Platform Type (Mobile Applications, Website), Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System), Payment Method (Online Payment, Cash on Delivery), and Region 2025-2033

Global Online Food Delivery Market Size:

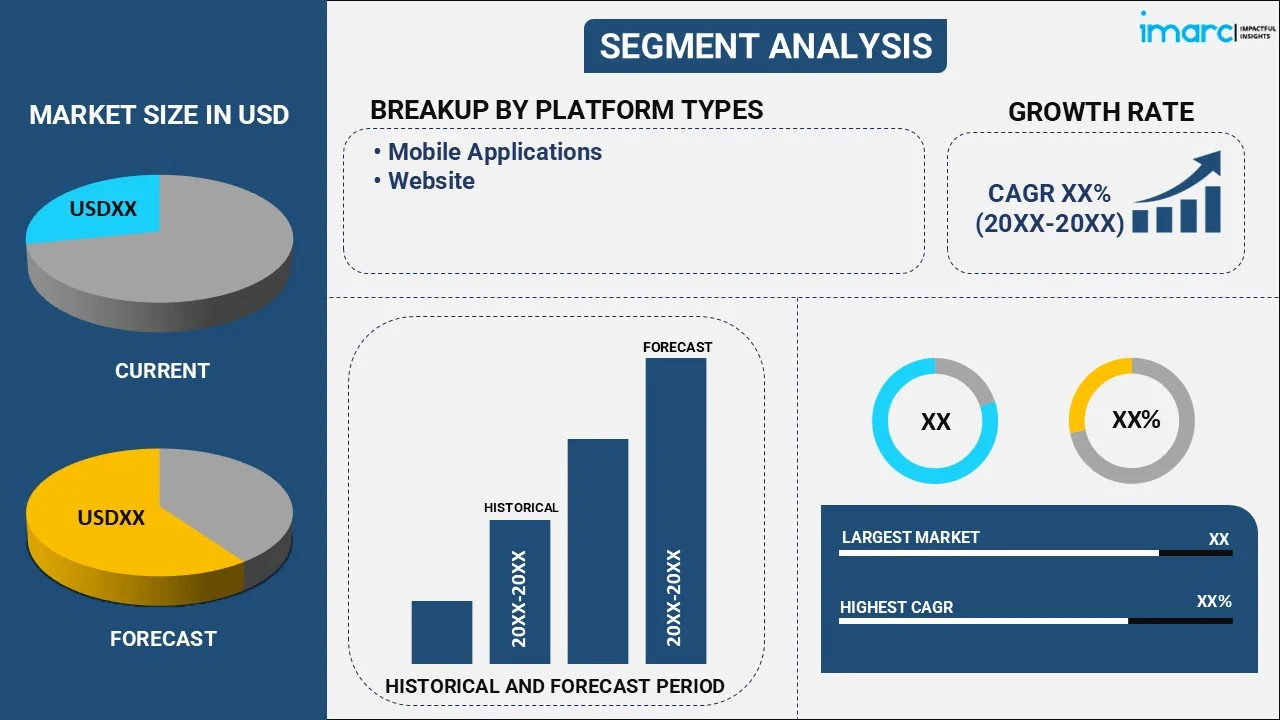

The global online food delivery market size reached USD 147.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 329.4 Billion by 2033, exhibiting a growth rate (CAGR) of 9.3% during 2025-2033. The growing emphasis on consumer convenience, increasing smartphone usage and internet accessibility, rapid urbanization across the globe, rising number of dual-income households, integration of advanced features, and introduction of offers, discounts, and loyalty programs are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 147.9 Billion |

| Market Forecast in 2033 | USD 329.4 Billion |

| Market Growth Rate (2025-2033) | 9.3% |

Online Food Delivery Market Analysis:

- Major Market Drivers: The rising demand for online food delivery owing to the increasing number of dual-income households that are unable to cook regularly coupled with the integration of advanced features such as global positioning system (GPS) tracking and secure payment gateways that make the service user-friendly and build trust among consumers is boosting the market growth.

- Key Market Trends: The introduction of offers, discounts, and loyalty programs to attract more users and increase customer acquisition rates along with the easy availability of a wider range of cuisines that cater to varied customer demands are expected to stimulate the industry growth.

- Competitive Landscape: Some of the prominent online food delivery companies in the market include Deliveroo, Delivery Hero SE, Domino's, DoorDash, Inc., Eternal Ltd, Grab, Grubhub Inc., Just Eat Takeaway.com, McDonald's Corporation, Papa John's International, Inc., Pizza Hut, LLC, Swiggy Limited, Uber Technologies Inc., and Waiter.com, Inc., among many others.

- Geographical Trends: According to the online food delivery market insights, China currently dominates the overall market. China has one of the largest populations of internet users globally, with widespread smartphone adoption and high mobile internet penetration rates. This has facilitated the growth of online food delivery platforms, as consumers can easily access these services through mobile apps.

- Challenges and Opportunities: High competition among key players, logistics complexity, and regulatory compliances are hampering the market growth. However, advancements in technology, such as AI-powered recommendation systems, real-time tracking, and route optimization algorithms, present opportunities to enhance the user experience, improve operational efficiency, and differentiate from competitors, thereby driving the market growth.

Online Food Delivery Market Trends:

Rising Preference for Convenient Food Delivery Options

The rising number of people preferring online delivery is one of the significant factors driving the market growth. For instance, according to an article published by Mad Mobile in March 2022, nearly 60% of users were expected to order online in 2022. Moreover, the number of individuals in the U.S. who use apps to order food and groceries was predicted to increase to 30.4 million in 2022. Online food delivery offers unparalleled convenience to consumers. With just a few taps on their smartphones or clicks on their computers, they can access a wide range of cuisines and have their favorite meals delivered to their doorstep. For instance, according to a survey conducted by Real Research Media in 2021, 42.95% prefer food delivery apps because they allow them to choose from a choice of cuisines. While nearly 30% stated they use it for convenience because they no longer need to physically travel to a restaurant. Besides this, online food delivery platforms often offer promotions, discounts, and loyalty programs to attract and retain customers. These incentives encourage repeat orders and drive customer loyalty, contributing to the growth of the market. For instance, in December 2023, Swiggy, a food delivery platform, launched Pockethero, an affordable food offering aimed to make online food ordering more accessible and economical. Pockethero offers free delivery and up to 60% discounts to ensure customer savings. These factors are further shaping the online food delivery market outlook.

Emergence of Cloud Kitchens

The rising number of cloud kitchens is significantly driving the market growth. For instance, according to IMARC, the India cloud kitchen market size reached US$ 969.5 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 2,948 Million by 2032, exhibiting a growth rate (CAGR) of 13.2% during 2024-2032. Cloud kitchens enable a diverse array of food options to be available for online delivery. Moreover, consumers expect quick delivery when ordering food online. Cloud kitchens, with their focus on delivery and takeaway, are ideally positioned to meet these expectations. By leveraging efficient processes and logistics, cloud kitchens can ensure that orders are prepared and delivered to customers promptly, enhancing the overall customer experience. For instance, in January 2022, Nando's, the South African restaurant company, launched its first cloud kitchen in Bengaluru, India, following its success in London. Customers could order, takeout, and receive home delivery. The brand's goal was to satisfy customers' palates with super-fast meal delivery. Apart from this, cloud kitchens leverage technology to optimize delivery operations and improve efficiency. Advanced routing algorithms, real-time tracking systems, and predictive analytics enable cloud kitchen operators to optimize delivery routes, reduce delivery times, and allocate resources effectively. These factors are further escalating the online food delivery industry demand.

Integration of AI and Big Data

Integration of AI and big data in online delivery platforms are driving the market growth. AI algorithms analyze vast amounts of data, including customer preferences, ordering history, and feedback, to personalize the user experience. By understanding individual preferences, online food delivery platforms can offer tailored recommendations, promotions, and discounts, leading to higher customer satisfaction and loyalty. For instance, in July 2023, Swiggy, an online food delivery platform, integrated generative AI techniques to boost user experience. With AI-powered neural research, the company aimed to assist users in discovering food and receiving tailored recommendations. Moreover, it enables users to search using conversational and open-ended queries, which further makes it easier for consumers to find what they are looking for without having to remember specific keywords. Besides this, AI algorithms analyze transaction data and user behavior to detect and prevent fraudulent activities, such as payment fraud and account takeover. By identifying anomalies and suspicious patterns, platforms can enhance security measures, protect customer data, and maintain trust in their payment systems. For instance, in May 2024, Swiggy, an online food delivery company, collaborated with SHIELD, a device-first risk AI platform, to improve its fraud detection and prevention capabilities. Swiggy will be able to limit promotional exploitation and deter fraudulent behaviors within the delivery partner ecosystem due to SHIELD device intelligence. These factors are escalating the market growth.

Global Online Food Delivery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global online food delivery market report, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on platform type, business model, and payment method.

Breakup by Platform Type:

- Mobile Applications

- Website

Mobile applications dominate the market

The report has provided a detailed breakup and analysis of the market based on platform type. This includes mobile applications and website. According to the report, mobile applications represented the largest segment.

According to the online food delivery market outlook, mobile applications are dominating the market due to the proliferation of smartphones, which has made it incredibly convenient for consumers to order food on-the-go. Furthermore, mobile applications offer a highly user-friendly experience through intuitive interfaces, which allow users to easily browse menus, read reviews, and customize their orders. In addition, they also offer features, such as saved preferences, quick re-order options, and in-app tracking of delivery status to make the whole process seamless for the consumer. Besides this, mobile applications provide a more personalized customer experience as they leverage data analytics to offer customized recommendations, loyalty programs, and targeted promotions, thus enhancing customer engagement and encouraging repeat orders. Moreover, the integration of geolocation features in mobile apps, which help track orders in real-time and optimize delivery routes, is supporting the market growth. For instance, in May 2023, Suniel Shetty launched a new food delivery app, Waayu, in Mumbai in order to provide affordable, timely, hygienic, and quality food to the customers.

Breakup by Business Model:

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

Order focused food delivery system hold the largest share in the market

A detailed breakup and analysis of the market based on the business model has also been provided in the report. This includes order focused food delivery system, logistics-based food delivery system, and full-service food delivery system. According to the online food delivery market report, order focused food delivery system represented the largest segment.

The order-focused food delivery system is dominating the market as it allows a wide range of restaurants to participate without the need for an extensive logistics network on the part of the service provider. Furthermore, it minimizes operational complexities for food delivery platforms by reducing the need for extensive investment in delivery personnel and transportation. Additionally, an order-focused food delivery system allows restaurants to maintain greater control over their food quality and delivery service, which is crucial for brand image. Using this system, restaurants can ensure that the food is prepared, packaged, and delivered to meet their quality standards, thus increasing customer satisfaction. Moreover, it is financially less burdensome for participating restaurants, as they do not have to share a significant portion of their revenue with the platform.

Breakup by Payment Method:

- Online Payment

- Cash on Delivery

Online payments hold the largest share in the market

A detailed breakup and analysis of the market based on payment method has also been provided in the report. This includes online payment and cash on delivery. According to the report, online payments accounted for the largest market share.

Online payments are dominating the market as they offer unmatched convenience and speed up the entire ordering process, leading to higher customer satisfaction. Furthermore, they enhance operational efficiency for food delivery services. With instant payment confirmation, orders can be processed more quickly, leading to faster delivery times. Additionally, online payment systems are highly secure and reliable, as they come with features such as two-factor authentication, encryption, and secure gateways, which contribute to their widespread acceptance among consumers. Moreover, offering online payments enables businesses to implement dynamic pricing strategies more effectively. Features, such as promo codes, discounts, and loyalty points, can be easily applied during the online payment process, encouraging more orders and repeat business. Along with this, online payments simplify the accounting and money management processes for businesses. For instance, according to an article published by the National Restaurant Association in May 2024, 73% of individuals would like to pay using a digital wallet, such as Apple Pay, Samsung Pay, Google Wallet, PayPal, or Venmo.

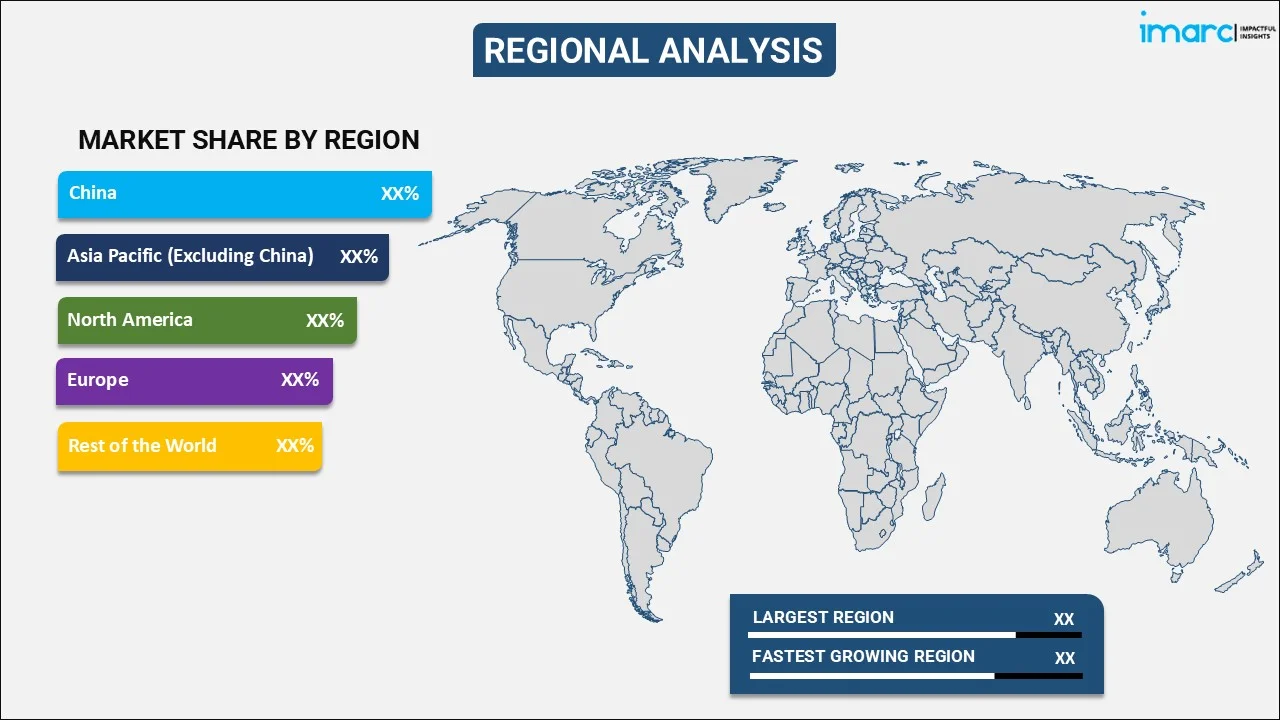

Breakup by Region:

- China

- North America

- Asia Pacific (Excluding China)

- Europe

- Rest of the World

China exhibits a clear dominance, accounting for the largest online food delivery market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, North America, Asia Pacific (excluding China), Europe, and rest of the world. According to the report, China accounted for the largest market share.

China provides a large and diverse customer base that is increasingly becoming more tech-savvy and comfortable with e-commerce. Furthermore, the rapid urbanization in China, which has led to higher population densities in cities, making it logistically more straightforward and economically viable to deliver food, is propelling the market growth. Additionally, the increasing expenditure capacity, which is enabling consumers to pay for convenient online food delivery, is contributing to the market growth. For instance, according to an article published by Statista in April 2024, China has the world's largest user base for online food delivery services, with over 540 million users. Besides this, the presence of a robust technology infrastructure in China, which enables seamless online transactions and efficient route planning for delivery personnel, is strengthening the market growth. Moreover, the competitive landscape in China, which has encouraged innovation and investment in the online food delivery industry, is positively influencing the market growth. For instance, in March 2023, Pony.ai, a self-driving company collaborated with Meituan, a Chinese tech giant in order to build autonomous vehicles for food delivery services in China.

Competitive Landscape:

Major online food delivery companies are investing in technologies, such as real-time tracking, estimated delivery times, and artificial intelligence (AI)-driven personalized recommendations, to enhance user interface and customer experience. Furthermore, they are using data to understand consumer behavior, optimize delivery routes, and tailor marketing campaigns. Additionally, leading companies are focusing on creating robust and efficient supply chains and delivery networks. In line with this, they are using advanced algorithms for route optimization and inventory management. Besides this, top players are entering into strategic partnerships with restaurants, grocery stores, and even competing delivery services to expand their customer base and offerings. Moreover, they are taking steps to reduce their carbon footprint through eco-friendly packaging, electric delivery vehicles, and food waste reduction programs.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Deliveroo

- Delivery Hero SE

- Domino's

- DoorDash, Inc.

- Eternal Ltd

- Grab

- Grubhub Inc.

- Just Eat Takeaway.com

- McDonald's Corporation

- Papa John's International, Inc.

- Pizza Hut, LLC

- Swiggy Limited

- Uber Technologies Inc.

- Waiter.com, Inc.

Online Food Delivery Market Recent Developments:

- May 2024: Zomato expanded the 'priority food delivery services' in cities such as Mumbai and Bengaluru. In priority delivery, users may get their food delivered up to 5 minutes faster as compared to traditional delivery.

- May 2024: Swiggy, an online food delivery company, collaborated with SHIELD, a device-first risk AI platform, to improve its fraud detection and prevention capabilities.

- April 2024: Zomato created a "large order fleet" to handle group orders or events. This was said to be an all-electric fleet specifically geared to serve orders for groups of up to fifty people.

Online Food Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile Applications, Website |

| Business Models Covered | Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System |

| Payment Methods Covered | Online Payment, Cash on Delivery |

| Regions Covered | China, North America, Asia Pacific (excluding China), Europe, Rest of the World |

| Companies Covered | Deliveroo, Delivery Hero SE, Domino's, DoorDash, Inc., Eternal Ltd, Grab, Grubhub Inc., Just Eat Takeaway.com, McDonald's Corporation, Papa John's International, Inc., Pizza Hut, LLC, Swiggy Limited, Uber Technologies Inc., Waiter.com, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, online food delivery market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global online food delivery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online food delivery industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global online food delivery market reached a value of USD 147.9 Billion in 2024.

According to the estimates by IMARC Group, the global online food delivery market is expected to exhibit a CAGR of 9.3% during 2025-2033.

The increasing utilization of smartphones, expanding food and beverage (F&B) industry, and the escalating demand for convenient and quick food delivery solutions, represent some of the key drivers for the global online food delivery market.

The rapid integration of online food delivery services with numerous advanced technologies, such as AI, IoT, predictive analytics, etc., represents one of the key trends in the global online food delivery market.

Sudden outbreak of the COVID-19 pandemic had led to the temporary closure of dine-in services across various eateries, thereby propelling the market for online food delivery platforms on a global level.

On the basis of the platform type, the market has been divided into websites and mobile applications. Currently, mobile applications represent the largest market segment.

On the basis of the business model, the market has been bifurcated into order focused food delivery system, logistics-based food delivery system, and full-service food delivery system. Among these, order focused food delivery system holds the majority of the total market share.

On the basis of the payment mode, the market has been divided into online payment and cash on delivery. At present, online payments represent the largest market share.

Region-wise, the market has been classified into China, North America, Asia Pacific (excluding China), Europe, and Rest of the World, where China dominates the global market.

The key companies in the global online food delivery market are Deliveroo, Delivery Hero SE, Domino's, DoorDash, Inc., Eternal Ltd, Grab, Grubhub Inc., Just Eat Takeaway.com, McDonald's Corporation, Papa John's International, Inc., Pizza Hut, LLC, Swiggy Limited, Uber Technologies Inc. and Waiter.com, Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)