One-Way Valve Market Size, Share, Trends and Forecast by Material Type, Application, Sales Type, and Region, 2025-2033

One-Way Valve Market Size and Share:

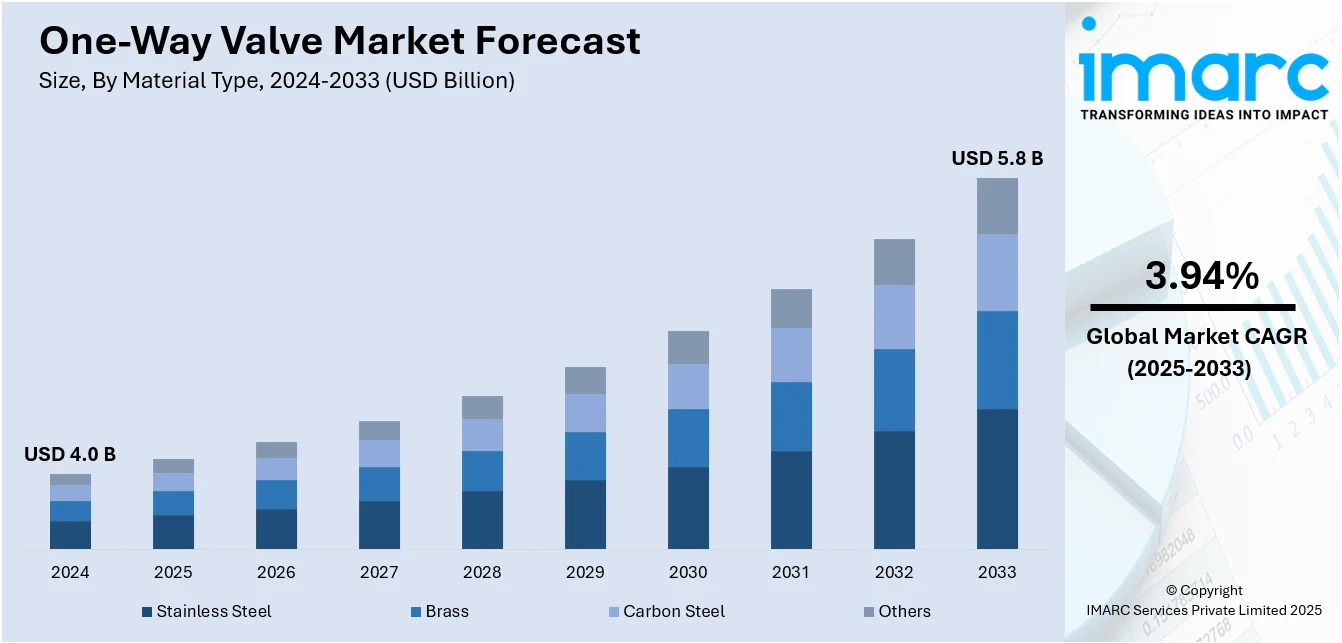

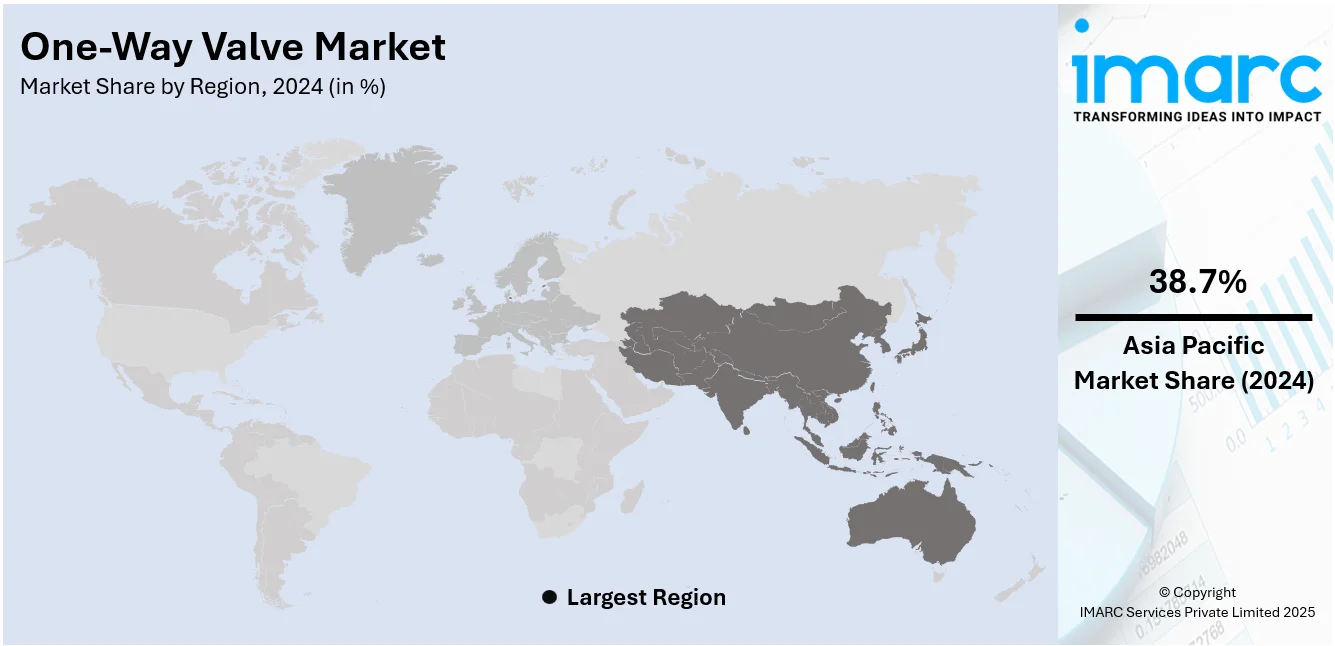

The global one-way valve market size was valued at USD 4.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.8 Billion by 2033, exhibiting a CAGR of 3.94% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 38.7% in 2024, driven by rapid industrialization, technological advancements, and growing demand from key sectors like healthcare and automotive.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 5.8 Billion |

| Market Growth Rate 2025-2033 | 3.94% |

One major driver of the one-way valve market is the growing demand for fluid control systems across various industries, such as healthcare, automotive, and manufacturing. One-way valves are critical components in maintaining the unidirectional flow of liquids and gases, ensuring system efficiency and safety. To exemplify, in healthcare, they are used in medical devices like respirators and infusion pumps, where precise flow control is essential. For instance, in 2024, Fluid Metering, Inc. introduced the FENYX variable dispense pump, utilizing CeramPump® technology for precise microliter control. Its compact design and accuracy enhance fluidic solutions in diagnostics, biotechnology, and medical devices. As industries continue to prioritize automation and efficiency in their operations, the adoption of advanced fluid control solutions, including one-way valves, is expected to increase, driving market growth.

To get more information on this market, Request Sample

The United States plays a pivotal role in serving the one-way valve market by acting as a hub for both manufacturing and technological innovation. Numerous companies in the U.S. are involved in the production of high-quality one-way valves, catering to sectors such as healthcare, automotive, and industrial automation. For instance, in 2025, Emerson introduced the Anderson Greenwood Type 84 Pressure Relief Valve for hydrogen and high-pressure gas applications, featuring Arlon® 3000XT thermoplastic seating, ASME SA-479 Type S21800 stainless steel, and exceptional leak-tight performance. The country’s advanced research and development capabilities drive the creation of increasingly efficient and reliable valve technologies. Additionally, the U.S. benefits from a robust supply chain infrastructure, facilitating the global distribution of one-way valves. With its strong focus on innovation, regulatory compliance, and market demand, the U.S. continues to be a key player in the global one-way valve market.

One-Way Valve Market Trends:

Rising Demand in Water & Wastewater Management

Increased urbanization and more stringent regulations regarding water quality have driven the demand for reliable check valves to prevent backflow contamination in municipal water systems and wastewater treatment plants. The need to ensure the safety and efficiency of water distribution and treatment becomes a growing concern with cities expanding and populations increasing. India water and wastewater treatment market is predicted to reach above USD 18 billion by 2026 as per ITA, and the development of this will increase the necessity for high-class check valves as they maintain the fluid control to prevent contamination thus supporting the growth of the infrastructure of the country and the governmental compliance.

Growth in the Oil & Gas Industry

There has been a rapid increase in the development of deepwater drilling, refining, and pipeline infrastructure with the need for high-pressure, high-temperature one-way valves in critical applications to ensure safe and efficient fluid flow. These valves are going to play a crucial role as the oil and gas industry continues to grow in managing pressure, preventing backflow, and maintaining operational safety. India is projected to witness its oil demand double to reach 11 million barrels per day by 2045. In that sense, it's becoming essential for sophisticated one-way valve solutions in the rapidly developing energy infrastructure in the country, besides ensuring safe and reliable fluid handling.

Advancements in Industrial Automation

Demand for check valves that are durable and efficient is on the rise, because of the rising adoption of automation in process control in manufacturing, pharmaceuticals, and food processing. The "Made in China 2025" initiative is modernizing manufacturing with automation at its core, especially in the automotive, electronics, and heavy industries sectors. This smart manufacturing push demands high-performance check valves to regulate fluid flow, prevent backflow, and ensure system reliability. With the expansion of automation, the demand for advanced check valves is rapidly increasing to optimize fluid handling systems and improve operational efficiency.

One-Way Valve Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global one-way valve market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, application, and sales type.

Analysis by Material Type:

- Stainless Steel

- Brass

- Carbon Steel

- Others

Stainless steel leads the market with around 45.3% of market share in 2024. This dominance stems from stainless steel's outstanding strength, resistance to corrosion, and capability to endure high temperatures and pressures, making it highly suitable for various demanding applications such as oil and gas, healthcare, automotive, and water treatment. Its strength and longevity are crucial in maintaining the reliability and safety of fluid control systems, particularly in demanding environments. The increasing focus on automation, industrial efficiency, and safety further fuels the demand for stainless steel one-way valves. Additionally, the material's versatility and cost-effectiveness in various industrial applications contribute to its leading position in the market.

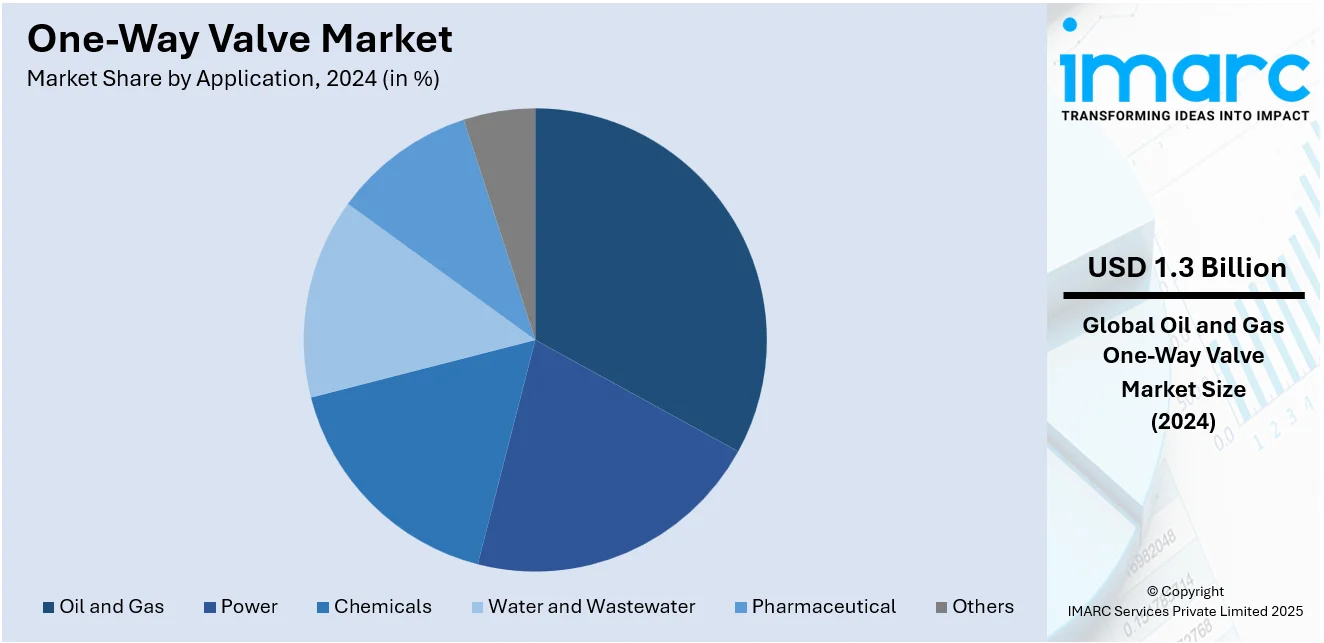

Analysis by Application:

- Oil and Gas

- Power

- Chemicals

- Water and Wastewater

- Pharmaceutical

- Others

Oil and gas leads the market with around 33.2% of market share in 2024. This domination is primarily driven by the critical role one-way valves play in the regulation of fluid and gas flow within pipelines, equipment, and storage systems. Valves are necessary elements to avoid backflow, ensure the operational safety, and maintain efficiency in oil and gas operations. The rising demand for energy and growth in infrastructure have made the sector more dependent on one-way valves, which need to be robust, durable, and of high performance. More importantly, in the oil and gas industry, strict regulations along with the necessity of safe operations contribute to an increase in market share of one-way valves.

Analysis by Sales Type:

- New Sales

- Aftermarket

Aftermarket leads the market with around 60% of market share in 2024. There exists a critical requirement for the maintenance, replacement, and repair of one-way valves in such industries as oil and gas, manufacturing, and food and beverage. After equipment and machinery become older, there will be an increase in demand for aftermarket solutions including quality valves in order to maintain efficiency and ensure safety in their operations. An increasing demand for upgrading valves for regulatory compliance, enhanced performance, and increased durability is coming from the source-aided by aftermarket services within industries. The growing emphasis on equipment longevity, coupled with the increasing preference toward predictive maintenance, also supports the one-way valve aftermarket market dominance.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 38.7%. This is due to the rapid industrialization and economic growth in this region, particularly in countries such as China, India, and Japan. Demand for automation in manufacturing, with the increasing infrastructure projects in several industries, such as automotive, oil and gas, and healthcare, has contributed to a sharp increase in the demand for fluid control systems, including one-way valves. Asia Pacific has been increasingly focusing on sustainable energy solutions and smart technologies, which has led to the adoption of advanced valve technologies. The region's expanding industrial base, coupled with technological advancements and favorable government regulations, continues to support the strong growth of the one-way valve market.

Key Regional Takeaways:

United States One-Way Valve Market Analysis

US accounts for 86.30% share of the market in North America. One of the primary factors for the one-way valve market, particularly in the healthcare sector, is the rising cases of respiratory diseases in the United States. As per the Asthma and Allergy Foundation of America, in April 2021, over 20 million adults suffered from asthma every year in the United States. Moreover, the increasing prevalence of chronic obstructive pulmonary disease and other respiratory diseases has created a greater need for inhalers, ventilators, nebulizers, and oxygen therapy equipment, all of which use one-way valve technology to control airflow and prevent contamination.

Advances in the field of one-way valves medical-grade, anti-microbial and biocompatibility-based materials used, are continuously increasing patient safety and device performance. The shift to home care respiratory therapy services, coupled with an aging population, is bolstering demand for the reliable provision of one-way valve solutions for respiratory therapy devices.

North America One-Way Valve Market Analysis

The North American one-way valve market is experiencing steady growth, driven by increasing demand across key industries such as healthcare, automotive, oil and gas, and industrial automation. The healthcare sector, in particular, requires one-way valves for precise flow control in medical devices like respirators and infusion pumps. In the oil and gas industry, valves are essential for fluid control and ensuring safety during extraction and processing. For instance, in 2024, SPX FLOW launched the CU4plus ASi-5 control unit, enabling control for up to 96 devices in a single network—36% more than previous models—while enhancing connectivity, performance, and IoT integration for sanitary valves. Additionally, North America's push for sustainable energy solutions and industrial automation is further fueling demand. The market benefits from a robust manufacturing base, technological advancements, and a strong regulatory environment. As industries increasingly prioritize efficiency, reliability, and automation, the North American one-way valve market is expected to continue expanding in the coming years.

Europe One-Way Valve Market Analysis

The growth of the automotive industry in Europe is another significant driver of demand for one-way valves, especially in fuel systems, exhaust emission control, cooling circuits, and braking systems. According to the European Automobile Manufacturers' Association (ACEA), the number of automobile assembly, engine, and battery production plants in Europe increased from 301 in 2021 to 322, reflecting the expansion of automotive manufacturing capacity.

The rapid growth currently being experienced in investments towards electric vehicles (EVs) and tough emission regulations will boost the investment further in advanced valve technologies to improve fuel efficiency and reduce environmental impact. Additionally, hydrogen and hybrid powertrains translate into greater demand for high-performance, corrosion-resistant one-way valves in cooling and energy storage systems. Technological advancements also gain strength in smart valves, which are integrated with the IoT-based vehicle diagnostics. With increased vehicle production and regulatory compliance pressures, growth in the one-way valve market in Europe is steady, especially in applications involving autos.

Asia Pacific One-Way Valve Market Analysis

This rapidly growing pharmaceutical market in Asia-Pacific is the significant growth driver in the one-way valve market in drug manufacturing, sterile fluid handling, and applications in medical devices. The industry reports estimate the Asia-Pacific pharmaceutical market to have a CAGR of 4.2% from 2022 to 2027 and that China and Japan will head the region. The factors leading to this are increasing healthcare costs, increasing demands for generic medicine, and research in biotechnology.

The use of one-way valves in pharmaceutical manufacturing and packaging provides precise control of fluids, protection against contamination, and conformity with strict standards in regulatory bodies like GMP, ISO, and FDA. Recent advances in biopharmaceutical research, production of vaccines, and development of injectable formulations have raised the demand for one-way valves that can ensure sterile processing. Investments in automated pharmaceutical manufacturing and bioprocessing technologies are also growing the adoption of specialized one-way valves, placing Asia-Pacific at the forefront as a growth market for the industry.

Latin America One-Way Valve Market Analysis

The one-way valve market in the region is fueled by the rapidly growing automotive industry in Latin America. Industry reports indicate that in 2023, the Latin American automotive market sold 4.8 million units and was expected to rise by 8.2% in 2024, reflecting a strong upward trend. The growth in the electric vehicle market in this region is highly driven by an increase in the demand for fuel-efficient vehicles, emission reduction technologies, and increasing electric vehicle production.

Automotive fuel systems, exhaust emission control, braking systems, and cooling circuits cannot function optimally without one-way valves. The growing market of hybrid and electric vehicles increases the demand for sophisticated one-way valves in cooling and energy storage applications. High automotive production rates, especially in countries such as Brazil and Mexico, will continue to drive demand for high-performance, durable one-way valves, leading to growth in the Latin American market.

Middle East and Africa One-Way Valve Market Analysis

The Middle East and Africa region represents a vital source of growth for the one-way valve market in the oil & gas sector. The five leading oil producers of the world exist in the region, which are Saudi Arabia, Iraq, UAE, Iran, and Kuwait, and strong demand for one-way valves is registered in these aspects: extraction, pipeline infrastructure, and energy storage systems. In a report issued by the International Energy Agency, energy investment in the Middle East will be at USD 175 Billion by 2024, of which about 15% is set for clean energy initiatives.

Substantial investments in hydrocarbon exploration, refining, and new energy infrastructure, along with transition projects in clean energy, such as solar and hydrogen, are driving this growth. Critical applications in pressure control systems and environmental safety measures will increasingly demand high-performance, corrosion-resistant one-way valves. These developments make the Middle East and Africa a key region for the expansion of the one-way valve market.

Competitive Landscape:

The competitive landscape of the one-way valve market is marked by the presence of several key players globally, ranging from established industrial valve manufacturers to specialized companies focusing on niche applications. Major players focus on innovation, offering advanced valve designs with enhanced performance, durability, and cost-efficiency. For instance, in 2025, Emerson partnered with Laramie Energy to help comply with emissions regulations using ASCOTM zero-emissions electric dump valves, reducing power usage by 98.75%, and eliminating vented and fugitive emissions in oil and gas processes. Companies are investing in research and development to create valves that meet stringent industry standards, particularly in healthcare, automotive, and oil and gas sectors. Strategic mergers, acquisitions, and partnerships are also common, enabling market expansion and improved product portfolios. As the market evolves, competition intensifies, driven by the demand for more efficient, customizable, and reliable valve solutions.

The report provides a comprehensive analysis of the competitive landscape in the one-way valve market with detailed profiles of all major companies, including:

- AVK UK Ltd

- CIRCOR International, Inc.

- DHV Industries Inc.

- Emerson Electric Co.

- Flowserve Corporation

- Lance Valves Inc.

- PetrolValves S.p.A.

- SLB

- SPX FLOW Inc.

- The Weir Group PLC

- Valvitalia SpA

- Velan

Latest News and Developments:

- August 2024:Gilmore manufactured the PR2 20k Check Valve which operates at up to a maximum allowable working pressure of 20,000 PSI and in an operating temperature from 0° F to 250° F.

- June 2024: The Public Works Director of St. Pete Beach created a new tide check valve that stops tidal flooding and enhances stormwater management in coastal regions.

- May 2024: Cla-Val introduced a premium backflow prevention check valve intended to enhance the reliability and cost-efficiency of municipal water systems regarding maintenance while effectively managing water flow.

One-Way Valve Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Brass, Carbon Steel, Others. |

| Applications Covered | Oil and Gas, Power, Chemicals, Water and Wastewater, Pharmaceutical, Others |

| Sales Types Covered | New Sales, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AVK UK Ltd, CIRCOR International, Inc., DHV Industries Inc., Emerson Electric Co., Flowserve Corporation, Lance Valves Inc., PetrolValves S.p.A., SLB, SPX FLOW Inc., The Weir Group PLC, Valvitalia SpA, Velan, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the one-way valve market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global one-way valve market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the one-way valve industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The one-way valve market was valued at USD 4.0 Billion in 2024.

IMARC estimates the one-way valve market to reach USD 5.8 Billion by 2033, exhibiting a CAGR of 3.94% during 2025-2033.

Key factors driving the one-way valve market include growing demand for fluid control in healthcare, automotive, and industrial automation sectors, the push for sustainable energy solutions, advancements in valve technology, increased automation, and the need for reliable and efficient systems that prevent backflow and ensure safety in fluid management.

Asia Pacific currently dominates the market with 38.7% share, driven by rapid industrialization, growing automation in manufacturing, and high demand from sectors like healthcare, oil and gas, and automotive. The region's expanding infrastructure and technological advancements further fuel market growth and adoption of fluid control solutions.

Some of the major players in the one-way valve market include AVK UK Ltd, CIRCOR International, Inc., DHV Industries Inc., Emerson Electric Co., Flowserve Corporation, Lance Valves Inc., PetrolValves S.p.A., SLB, SPX FLOW Inc., The Weir Group PLC, Valvitalia SpA, and Velan.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)