On-demand Transportation Market Size, Share, Trends and Forecast by Service Type, Vehicle Type, Application, and Region, 2025-2033

On-demand Transportation Market Size and Share:

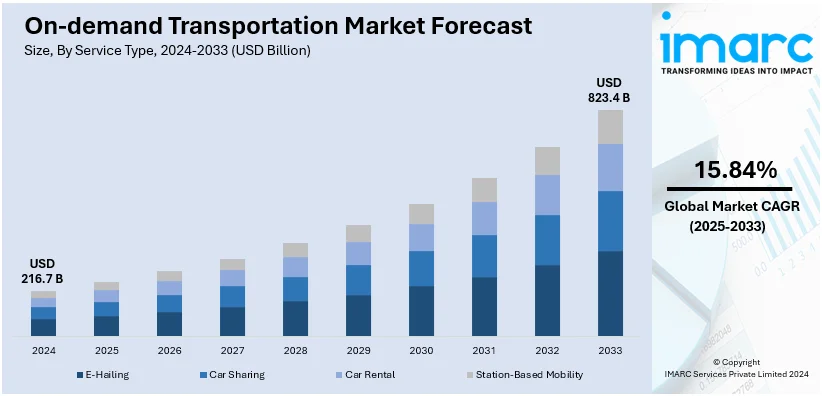

The global on-demand transportation market size reached USD 216.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 823.4 Billion by 2033, exhibiting a growth rate CAGR of 15.84% during 2025-2033. Currently, North America dominates the market, holding a significant share of 35.6% in 2024, driven by widespread adoption of ride-hailing platforms, strong technological infrastructure, and increasing demand for convenient urban mobility solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 216.7 Billion |

|

Market Forecast in 2033

|

USD 823.4 Billion |

| Market Growth Rate (2025-2033) | 15.84% |

Rapid urbanization and growing traffic congestion are major drivers of the on-demand transportation market. As urban populations rise, the need for efficient, flexible, and cost-effective mobility solutions has intensified. For instance, Lyft reported strong Q3 2024 results, achieving a record 24.4 million active riders, reflecting a 9% year-over-year increase, underscoring its growing user base and market presence. On-demand transportation platforms, such as ride-hailing and car-sharing services, address these challenges by offering convenient alternatives to private vehicle ownership. These services reduce reliance on personal cars, alleviate parking issues, and optimize urban traffic flow through advanced algorithms and real-time tracking. Additionally, the integration of smart technologies enhances user experience and operational efficiency. The shift toward sustainable and accessible urban mobility continues to propel the growth of this market.

The United States plays a pivotal role in advancing the on-demand transportation market by fostering innovation, investment, and technological adoption. With leading companies, the market benefits from cutting-edge platforms offering efficient ride-hailing, car-sharing, and bike-sharing services. The U.S. also supports the sector through investments in smart city initiatives and infrastructure, including 5G networks and advanced mapping technologies. Moreover, regulatory frameworks encourage the growth of autonomous and electric vehicles within the on-demand ecosystem. For instance, in 2024, at its GO-GET Zero event, Uber announced app updates and initiatives promoting sustainable travel, aiming for zero emissions by 2040, with Uber Green becoming fully electric in 40 global markets. By integrating advanced technology and sustainability, the U.S. continues to shape the evolution of modern transportation solutions globally.

On-demand Transportation Market Trends:

Technological Advancements in Mobility Solutions

The on-demand transportation market is currently experiencing significant growth, driven largely by rapid technological advancements. These include shared electric vehicle fleets, improved multimodal platforms, sustainability-focused solutions, mobility-as-a-service (MaaS) models, shared autonomous vehicle developments, artificial intelligence integration, and improved urban infrastructure for shared mobility. The German Car Sharing Association states that 20.5% of all car-sharing cars in Germany are electric vehicles. Innovations in mobile technology and app development have streamlined the booking process, making it more user-friendly and accessible. Real-time tracking and payment systems integrated within these apps further enhance the user experience. Moreover, advancements in artificial intelligence (AI) and machine learning (ML) are improving route optimization, reducing wait times, and increasing overall efficiency. Such technological innovations are attracting more users due to enhanced convenience as well as enabling service providers to operate more effectively and at lower costs, thereby stimulating market growth.

Increasing Urbanization and Changing Consumer Preferences

Urbanization is a key driver for the expansion of the on-demand transportation market. Approximately 4.4 billion people, or 56% of the world's population, currently reside in cities, according to World Bank estimates. By 2050, the urban population is predicted to have more than doubled from its current level, with approximately seven out of ten people living in cities. As cities grow and become more congested, the need for reliable, efficient, and flexible transportation options increases. Consumers, particularly in urban areas, are showing a heightened preference for on-demand services over traditional modes of transportation. This shift is accelerated by the growing desire for immediate service and the convenience of booking through smartphones. Additionally, the rising awareness about environmental concerns is leading consumers to opt for shared transportation services, further propelling the market growth.

Supportive Government Policies and Investments

Governments around the world are increasingly recognizing the potential of on-demand transportation services in improving urban mobility. Many are implementing policies and regulations that support the growth of this sector. This typically includes investments in infrastructure to support electric and autonomous vehicles and the implementation of regulations that ensure safety and fair competition. For instance, according to data from the Ministry of Road Transport and Highways, the government has budgeted Rs. 2,35,430 crore (USD 27.47 Billion) for medium-term national highway upgrades under various NHDP phases. Government initiatives aimed at reducing traffic congestion and lowering carbon emissions are also encouraging the adoption of shared and eco-friendly transportation options. This supportive regulatory environment is crucial in fostering the growth and sustainability of the on-demand transportation market.

On-demand Transportation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global on-demand transportation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type, vehicle type, and application.

Analysis by Service Type:

- E-Hailing

- Car Sharing

- Car Rental

- Station-Based Mobility

E-hailing leads the market with around 37.6% of the market share in 2024. E-hailing is the primary segment in on-demand transportation because it provides its customers with a service where they can book rides online or through apps. The rise of this type of segment results from its flexibility, real-time service, and availability in major cities and other suburban areas. Some of the current innovations in ride-sharing companies relate to ride-sharing, various modes of vehicles to choose from, and dynamic price models. The integration of technology for route optimization and enhanced safety features further strengthens its position as the market leader. Its success is also due to the widespread adoption of smartphones and internet connectivity, making e-hailing services accessible to a large customer base.

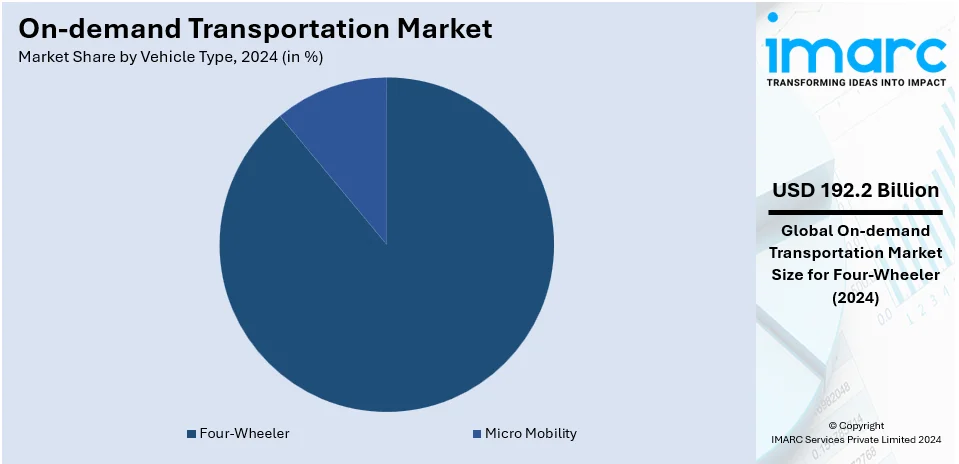

Analysis by Vehicle Type:

- Four-Wheeler

- Micro Mobility

Four-wheeler leads the market with around 88.7% of the market share in 2024. The four-wheeler accounts for the maximum share in the on-demand transportation market mainly due to its immense usage for both personal and commercial purposes. It encompasses cars, vans, SUVs, etc., for multiple customer needs - from single users to group travel. The reasons behind the growth in this segment are comfort, safety, and suitability for a longer distance as well as various terrains. In addition, the integration of sophisticated technologies such as GPS navigation, in-car entertainment, and enhanced safety features further established its popularity. The segment continues to evolve further with electric and hybrid variants of vehicles in order to meet global sustainability goals.

Analysis by Application:

- Passenger Transportation

- Goods Transportation

Passenger transportation lead the market in 2024. Passenger transportation is the most prominent service sector of the on-demand transportation market, primarily involved in carrying an individual or a group of individuals from one place to another. The need for personal mobility, especially in cities and towns, has grown, which explains this segment's significant market share. This encompasses car-sharing, taxis, ride-hailing, shuttle services, etc., with variations catering to varied customer needs. The growth of this segment is due to increasing urbanization, an increase in smartphone and internet penetration, and the shift in consumer preferences toward convenience and on-demand services. Additionally, innovations in payment methods, ride-sharing, and integration with public transit systems enhance the appeal and accessibility of passenger transportation services.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.6%. North America held the biggest market share due to its high smartphone penetration, advanced infrastructure, and the presence of key industry players. The region demonstrates a strong preference for on-demand services owing to their convenience and efficiency. Increasing urbanization and a culture of technology adoption further stimulate market growth. North America is also leading in terms of regulatory frameworks and investments in innovative transportation technologies, like autonomous vehicles and electric cars, which are shaping the future of on-demand transportation in this region.

Key Regional Takeaways:

United States On-Demand Transportation Market Analysis

On-demand transportation has become highly sought after due to the country's factors, such as increasing urbanisation and advancements in technology, and changed expectations from consumers. According to data by Centre for Sustainable Systems, 83% of Americans reside in cities, thus creating a more urgent need for flexible and easy transportation options. The business is dominated by platforms such as Uber and Lyft; Uber makes 19 million trips every day worldwide, and a significant number of those are within the United States. As over 85% of Americans now own a smartphone (as per reports), ride-hailing services have become readily accessible with improvements in smartphone penetration. The user experience is enhanced through cashless payment options, GPS, and AI-based route optimization. The growing gig economy is also helping with the availability of drivers, since 36% of American workers are gig workers according to reports, many of whom work for ride-hailing services. Carpooling and ridesharing are some of the shared mobility solutions that are becoming increasingly popular as they reduce costs and have a smaller environmental footprint. The growth of ride-hailing fleets on electric vehicles is also supported by government initiatives in cities such as New York and Los Angeles to reduce carbon emissions and traffic congestion.

Europe On-Demand Transportation Market Analysis

The main drivers of on-demand transportation are the high pace of urbanisation, environmentally sensitive consumers, and the broad use of cutting-edge mobility technologies in Europe. According to an industrial report, since nearly 72% of people in Europe live in cities, urban mobility is a major issue. Along with Uber, other well-known services that provide localised and reasonably priced solutions are Bolt and Free Now. Electric vehicles have increasingly been absorbed into ride-hailing fleets as a direct consequence of stricter emission rules such as the commitment of the EU to be net zero by 2050. For Europe, it is reported that EVs or hybrid cars take up about 20% of all sales today. The final factor is how well apps could easily merge public transport with ride-hailing services. Moreover, micro-mobility options such as bikes and e-scooters are changing the on-demand transportation environment. Germany, France, and the UK dominate the market; one in five adults uses ride-hailing applications regularly.

Asia Pacific On-Demand Transportation Market Analysis

The Asia-Pacific is the largest market for on-demand transportation, owing to rapid urbanization, cost-effectiveness, and technological advancements. In addition to the major cities, a market of more than 4.5 billion is living in that region. Also, cities like Beijing, Tokyo, and Mumbai face severe congestion as millions of rides are completed by ride-hailing services such as Grab, Didi, and Ola everyday. Sharp Smartphone penetration in those regions, particularly in nations such as India increased its penetration to reach 45% or around 600 Million in the year 2023, as per reports. More electricity may come from younger, tech-intensive customers and increasing consumption spending. Of over 10% of vehicles for ride-sharing available in China these days, numerous governments in these countries, namely China and Singapore, are fostering electric mobility through policies. Meanwhile, in saturated cities, it is also showing micro-mobility services involving e-scooters and bikes on sharing networks that are gaining huge acceptance. It is expanding due to the increasing trend of carpooling to save costs and address environmental issues.

Latin America On-Demand Transportation Market Analysis

Increasing urbanization, insufficient public transport, and growing penetration of smartphones are key drivers for on-demand transport in Latin America. According to reports, over 80% of the population in Latin America lives in cities, where there is a strong need for flexible forms of transportation. In countries like Brazil and Mexico, Cabify, Uber, and 99 ride-hailing service have been much in demand. According to an industry report, above 75% of population of the region is having access to internet, which further supports app-based transport. Lack of effective infrastructure in public transports also makes them replaceable to an extent by many places and because of lower cost, a considerable number of customers often prefer rideshare and carpooling. Adoption is being accelerated by government initiatives to control the industry and provide safety standards, which are progressively fostering user trust.

Middle East and Africa On-Demand Transportation Market Analysis

On-demand mobility is expanding significantly in the Middle East and Africa (MEA) area as a result of rising urbanisation, a youthful population, and growing digitalisation. Given that 60% of people in the Middle East live in cities, cities like Dubai and Riyadh are important markets. With localised features like cash payments and multilingual apps, ride-hailing firms like Careem and Uber are the industry leaders. Due to the region's over 50% smartphone usage, as per reports, these platforms are widely accessible. On-demand transport is encouraged under government initiatives to create smart cities, especially in Saudi Arabia and the United Arab Emirates, as a part of mobility policies. Africa's lack of effective public transit is being addressed by the platforms like Bolt, which is growing in nations like Nigeria and Kenya and providing reasonably priced alternatives.

Competitive Landscape:

The on-demand transportation market is highly competitive, characterized by the presence of global leaders, regional players, and emerging startups. Dominant companies lead the market with extensive networks and advanced app-based platforms. Competitive strategies include technological innovation, dynamic pricing models, and partnerships with autonomous and electric vehicle manufacturers. For instance, in 2024, Lyft announced a partnership with Mobileye to integrate self-driving technology into its platform, enabling autonomous vehicles to join its rideshare network, providing seamless access for fleet operators and riders. Regional companies focus on localized services, catering to specific markets with cost-effective solutions. Startups continue to disrupt the landscape by introducing niche services such as peer-to-peer car-sharing and eco-friendly transport options. This dynamic competition fosters innovation, enhancing service quality, operational efficiency, and user experience across the industry.

The report provides a comprehensive analysis of the competitive landscape in the on-demand transportation market with detailed profiles of all major companies, including:

- ANI Technologies Pvt. Ltd

- Avis Budget Group Inc.

- Bayerische Motoren Werke AG

- Daimler AG

- Ford Motor Company

- Gett Inc.

- Grab Holdings Inc.

- International Business Machine Corporation

- Lyft Inc.

- Robert Bosch GmbH

- Toyota Motor Corporation

- Uber Technologies Inc.

Latest News and Developments:

- December 2024: Zoomcar intends to extend its reach into a wider segment of the transportation sector by introducing a chauffeur-driven taxi rental service in Bengaluru, a city in southern India.

- December 2024: A rural village on-demand transport service has been introduced by Lichfield District Council, enabling locals to schedule trips using a phone or mobile app. By offering flexible travel options, the service improves connectivity in places with little access to public transport. By filling in the gaps in conventional bus routes and encouraging sustainable mobility, this project helps residents be more accessible.

- November 2023: The Toyota Mobility Foundation (TMF) and the Metropolitan Evansville Transit System (METS) have announced the launch of METS Micro, an on-demand, app-based public transit pilot service. This service aims to provide convenient transportation options for residents in the Evansville area. METS Micro also allows users to book rides through a mobile application, providing flexibility and convenience.

On-Demand Transportation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | E-Hailing, Car Sharing, Car Rental, Station-Based Mobility |

| Vehicle Types Covered | Four-Wheeler, Micro Mobility |

| Applications Covered | Passenger Transportation, Goods Transportation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ANI Technologies Pvt. Ltd, Avis Budget Group Inc., Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, Gett Inc., Grab Holdings Inc., International Business Machine Corporation, Lyft Inc., Robert Bosch GmbH, Toyota Motor Corporation, Uber Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the on-demand transportation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global on-demand transportation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the on-demand transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The on-demand transportation market was valued at USD 216.7 Billion in 2024.

The on-demand transportation market is projected to exhibit a CAGR of 15.84% during 2025-2033, reaching a value of USD 823.4 Billion by 2033.

The on-demand transportation market is driven by increasing urbanization, rising smartphone penetration, advancements in app-based platforms, and growing preferences for cost-effective, convenient mobility solutions. Additionally, factors such as traffic congestion, environmental concerns, and the integration of electric and autonomous vehicles further accelerate the market's growth and adoption.

North America currently dominates the market, accounting for a share of around 35.6%. The dominance is driven by rising e-commerce activities, increasing consumer preference for fast deliveries, advancements in logistics technologies, expanding urbanization, and the need for sustainable, efficient transport solutions.

Some of the major players in the on-demand transportation market include ANI Technologies Pvt. Ltd, Avis Budget Group Inc., Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, Gett Inc., Grab Holdings Inc., International Business Machine Corporation, Lyft Inc., Robert Bosch GmbH, Toyota Motor Corporation, and Uber Technologies Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)