Oilfield Chemicals Market Size, Share, Trends and Forecast by Product, Location, Application, and Region, 2025-2033

Oilfield Chemicals Market Size and Share:

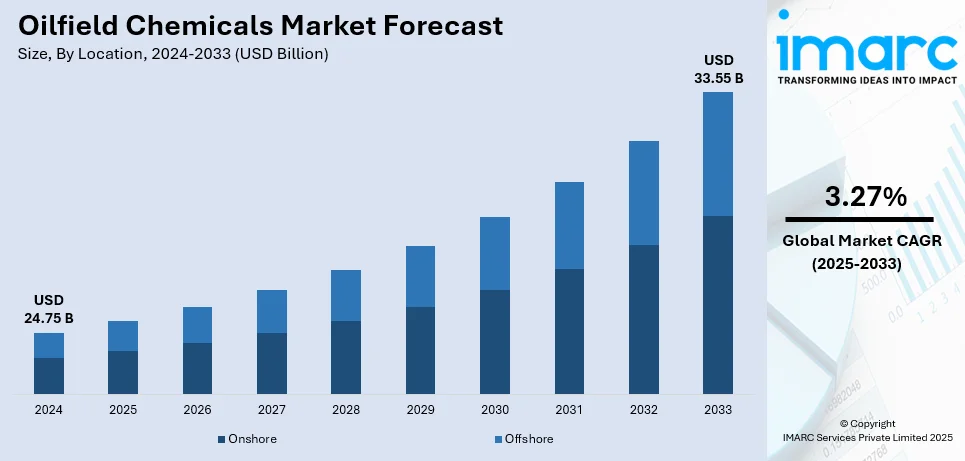

The global oilfield chemicals market size was valued at USD 24.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.55 Billion by 2033, exhibiting a CAGR of 3.27% from 2025-2033. North America currently dominates the market, holding a market share of over 42.7% in 2024. Rapid digitization, rising adoption of bring-your-own-device policies, and the increasing adoption of smartphones and laptops represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.75 Billion |

|

Market Forecast in 2033

|

USD 33.55 Billion |

| Market Growth Rate (2025-2033) | 3.27% |

Rowing exploration and production activities across conventional and unconventional reserves drives the oilfield chemicals market toward dynamic growth patterns. The growing energy consumption stimulated by population expansion and industrialization has driven investments into advanced drilling technologies and enhanced oil recovery (EOR) operations, which leads to higher usage of unique chemicals. In addition, the advancement toward challenging extraction operations in ultra-deepwater drilling increases the need for extreme-performance chemicals that function during severe temperature and pressure conditions. Furthermore, the emphasis on sustainability and environmental regulations together have accelerated market development opportunities through eco-friendly and biodegradable chemical formulation creation.

The United States drives the oilfield chemicals market through its position as a leader in both shale gas and tight oil production. The widespread adoption of hydraulic fracturing and horizontal drilling techniques has escalated demand for drilling fluids and different chemical additives including friction reducers. The country's advanced infrastructure, strong regulatory framework, and investment in research and development drive continuous innovation in oilfield chemical formulations. For instance, in June 2023, Clariant Oil Services introduced PHASETREAT WET, a sustainable solution for oil and gas demulsification. It reduces chemical usage by up to 75%, lowers operational costs, simplifies logistics, and enhances compliance with modern health, safety, and environmental standards. Furthermore, the rising demand for enhanced efficiency and sustainability in domestic oilfield operations positions the United States as a key contributor to the global oilfield chemicals market's growth.

Oilfield Chemicals Market Trends:

Increased Adoption of Digital Solutions and BYOD Policies

The rapid digitization of industries and the increased adoption of bring-your-own-device (BYOD) policies are driving demand for solutions to securely integrate personal devices into organizational networks. For instance, research indicates that approximately 91% of businesses worldwide are engaging in digital transformation initiatives. In the oilfield chemicals industry, these technologies allow employees to securely connect to company networks and access work systems through personal smartphones, laptops, and tablets, thereby enhancing productivity and enabling timely decision-making. This integration aligns with the industry's need for seamless communication and operational management in complex and geographically dispersed oilfield operations.

Rising Reliance on Mobile Devices and Outsourced Services

According to GSMA, more than half of the global population, equating to roughly 4.3 billion individuals, owns smartphones, significantly influencing industries worldwide, including the oilfield chemicals market. Businesses increasingly rely on mobile devices to streamline field operations, enhance monitoring, and enable secure communication. Moreover, outsourcing IT services for enterprise operations is gaining traction, catalyzing demand for advanced chemical solutions tailored for specific applications. The rising use of digital systems in oilfield management ensures improved productivity and cost-efficiency, making these technologies indispensable for driving growth and meeting the sector's operational challenges.

Focus on Security and Operational Safety

The rising prevalence of cyber-attacks and data breaches is significantly influencing the oilfield chemicals market. For instance, as per industry reports, in 2024, the global average cost of a data breach reached USD 4.88 million, representing a 10% increase from the previous year and marking the highest total to date. To address these risks, leading market players are offering advanced security features such as encryption, secure access, and remote wipe. These measures protect sensitive operational data, mitigate risks, and enhance overall safety. The increasing demand for data security presents lucrative growth opportunities for companies to expand their portfolios and improve operational safety.

Oilfield Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oilfield chemicals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, location, and application.

Analysis by Product:

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

The reliability of oilfield equipment depends heavily on inhibitors to prevent corrosion and scaling while protecting pipelines from various detrimental processes. Protective layers formation along with dynamic reaction modifiers, enable these chemicals to prolong infrastructure lifespan. Inhibitors are extensively used in drilling, production, and transportation stages, especially in environments with high salinity or acidic conditions. Growing exploration activities and the demand for efficient, cost-effective protection measures are driving their adoption, making inhibitors a critical segment of the oilfield chemicals market.

Crude oil production depends on specialized chemicals known as demulsifiers to split water from oil when they are mixed together as emulsions. When emulsions break down through these chemicals, it improves crude oil quality which simultaneously increase oil purity levels and decrease operational expenses. The products display critical use across offshore setups and heavy crude extraction activities because emulsions abundantly appear in these areas. Increasing global energy demand and advancements in demulsifier formulations to address environmental concerns are boosting market growth. Manufacturers focus on delivering effective, environmentally friendly demulsifiers that ensure efficient oil-water separation while meeting regulatory standards.

The use of rheology modifiers manages both flow characteristics and viscosity levels in drilling fluids and related formulation materials employed during oilfield procedures. Rheology modifiers function as essential fluids stabilizers in pressurized and heated conditions to enable both technical drilling and enhanced well efficiency. Their application reduces energy consumption and equipment wear by optimizing fluid behavior. As oil exploration moves to deeper and more challenging environments, the demand for advanced rheology modifiers continues to grow, driving innovation and product development within this segment.

Extensive market growth for friction reducers occurs due to the increasing industrywide implementation of unconventional drilling practices, including shale gas extraction. Manufacturers prioritize developing environmentally friendly high-performance formulations, which support operational efficiency and meet environmental regulations. The increasing use of unconventional drilling approaches such as shale gas extraction drives the expanding friction reducer market segment. The manufacturing industry concentrate on developing high-performance and biodegradable formulations to fulfill environmental regulations while enhancing operational efficiency.

Oilfield systems remain contaminant-free through biocide interventions which stop microbial activity and avoid complications from biofouling along with corrosion and reservoir souring. The chemical compounds enable protection of production equipment together with pipelines to maintain reliable facility operation and resource quality preservation. The rising demand for oilfield biocides stems from improved extraction techniques as well as robust regulation requirements for microbial control in challenging settings. Manufacturers develop sustainable biocidal products which extend shelf life and comply with environmental protection laws.

Surfactants are versatile oilfield chemicals used to reduce surface tension and enhance fluid behavior in drilling, production, and enhanced oil recovery (EOR) applications. They improve oil mobility, emulsification, and wetting properties, making them indispensable in maximizing resource extraction. Surfactants are gaining traction due to advancements in chemical formulations that offer higher efficiency and lower environmental impact. The rise in EOR projects and the need for cost-effective recovery solutions are driving growth in this market segment.

Foamers are used in oilfield operations to generate and stabilize foam, aiding in gas-lift applications, removing liquids from gas wells, and enhancing production efficiency. They are essential in optimizing well performance, particularly in low-pressure environments or mature wells. The growing demand for effective deliquification techniques and advancements in foam formulations are propelling this segment. Foamers are increasingly sought after for their ability to improve operational efficiency while reducing environmental risks, aligning with industry sustainability goals.

Analysis by Location:

- Onshore

- Offshore

Onshore stand as the largest component in 2024, holding around 63.5% of the market. The segment dominates due to extensive exploration and production activities on land. Onshore operations are more cost-effective and logistically manageable compared to offshore projects, driving higher demand for drilling fluids, corrosion inhibitors, and enhanced oil recovery chemicals. With a significant share of global crude oil and natural gas production occurring in onshore fields, this segment remains critical for market growth. Additionally, advancements in technologies like horizontal drilling and hydraulic fracturing have amplified the use of oilfield chemicals in unconventional onshore reserves, further reinforcing its leadership in the market.

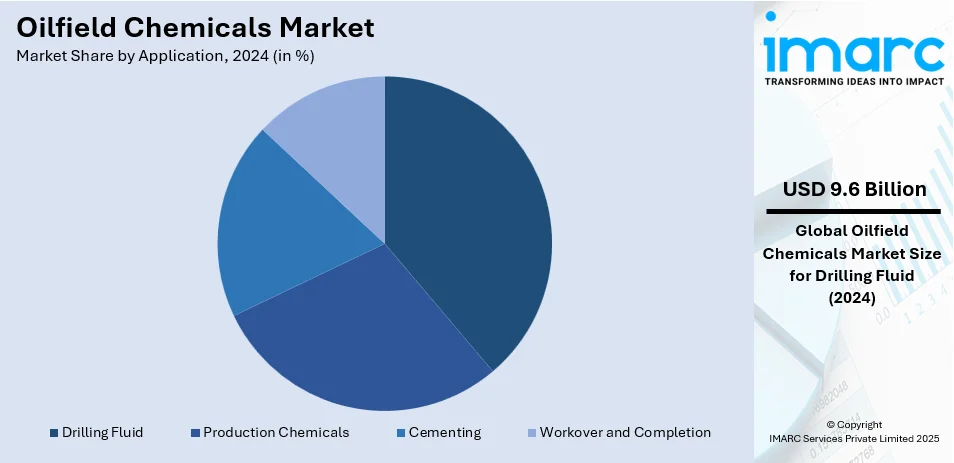

Analysis by Application:

- Drilling Fluid

- Production Chemicals

- Cementing

- Workover and Completion

Drilling fluid stand as the largest component in 2024, holding around 38.7% of the market. This is driven by its critical role in wellbore stability, cuttings removal, and pressure control during drilling operations. These fluids, also known as drilling muds, are essential for reducing friction, cooling equipment, and preventing blowouts. The increasing complexity of drilling activities, including horizontal and deepwater drilling, has elevated the demand for advanced, high-performance drilling fluids. Innovations in eco-friendly and non-toxic formulations are further enhancing their adoption, aligning with industry efforts to balance operational efficiency with environmental sustainability.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.7%. The large market share originates from the extensive oil and gas exploration activities of North America, particularly in the United States and Canada. The region's dominance is fueled by the widespread adoption of advanced drilling techniques, including hydraulic fracturing and horizontal drilling, in unconventional reserves like shale formations. The robust infrastructure, technological advancements, and significant investments in exploration and production further strengthen North America's position. Additionally, the region's focus on environmentally sustainable solutions has driven demand for innovative oilfield chemicals, ensuring operational efficiency while adhering to stringent environmental regulations.

Key Regional Takeaways:

United States Oilfield Chemicals Market Analysis

In 2024, United States accounted for 85.00% of the market share in North America. The increasing reliance on cloud-based platforms has become a key catalyst for the expansion of managed mobility services. According to survey, more than 51% of businesses are now utilizing cloud services. The ongoing integration of cloud technology has allowed businesses to enhance their mobility infrastructures, providing seamless connectivity, scalability, and security for a growing mobile workforce. As businesses embrace flexible working models, the demand for efficient management of mobile devices, applications, and data also rises. With organizations shifting to cloud-based solutions, they require reliable services to ensure smooth transitions, data security, and better control over mobile assets. This adoption is fuelled by the desire to streamline operations, lower it costs, and improve employee productivity, all while maintaining a high level of security and compliance. As mobility continues to evolve, cloud technology serves as the backbone for organizations seeking to optimize and manage their mobility strategies effectively, ensuring a competitive edge in an increasingly digital world.

Europe Oilfield Chemicals Market Analysis

The growing adoption of managed mobility services within the banking, financial services, and insurance (BFSI) sector is driven by the need for improved security, compliance, and mobility management. According to reports, the EU had 784 foreign bank branches in 2021, including 619 from other EU Member States and 165 from non-EU countries. Financial institutions are increasingly relying on mobile devices for communication, transaction processing, and client interactions, creating a need for enhanced mobile device management and security solutions. As regulations become stricter and financial data breaches continue to rise, the need for secure, compliant mobility solutions is paramount. Managed services help these organizations efficiently manage large fleets of mobile devices while ensuring that they are in line with regulatory requirements and cybersecurity protocols. These services also facilitate the integration of mobile technologies into existing it infrastructures, offering enhanced control, real-time monitoring, and risk management capabilities to safeguard sensitive financial data, ensuring business continuity and operational efficiency.

Asia Pacific Oilfield Chemicals Market Analysis

The adoption of managed mobility services is being propelled by the rapid rise of small and medium-sized enterprises (SMEs). According to India Brand Equity Foundation, the number of MSMEs in India is expected to increase from 6.3 crore to approximately 7.5 crore, growing at a CAGR of 2.5%. SMEs in this region increasingly seek to streamline operations, improve productivity, and enhance security using mobile technologies. As these businesses embrace mobile solutions for customer engagement, internal communications, and operational efficiency, they require robust managed services to handle the complexities of device management, security, and application deployment. These enterprises benefit from outsourcing their mobility management to reduce costs associated with in-house it departments. By leveraging external expertise, SMEs can focus on their core competencies while ensuring their mobile workforce operates efficiently and securely, all within a flexible, cost-effective model tailored to their needs.

Latin America Oilfield Chemicals Market Analysis

The adoption of managed mobility services is also growing due to the expanding demand in the retail and healthcare sectors. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), 62% of Brazil's 7,191 hospitals are privately owned. Both industries are experiencing rapid digital transformation, with mobile technologies playing an essential role in improving operational efficiencies, customer experience, and patient care. Retailers are increasingly using mobile devices for inventory management, point-of-sale transactions, and customer service, while healthcare providers rely on mobile devices for telemedicine, patient monitoring, and electronic health record (ehr) management. As a result, these industries need secure and efficient management of mobile devices, applications, and data. By adopting managed mobility services, these organizations can ensure a seamless, secure, and compliant mobile environment that enhances productivity and maintains high levels of security, ultimately improving service delivery and operational performance.

Middle East and Africa Oilfield Chemicals Market Analysis

The growing it and telecom sectors in this region are driving the adoption of managed mobility services. For instance, total expenditure on information and communications technology (ICT) in the Middle East, Türkiye, and Africa (META) is projected to hit USD 238 billion this year, reflecting a 4.5% increase from 2023. As mobile technologies continue to shape business operations, organizations in these industries increasingly rely on managed mobility services to streamline device management, optimize performance, and improve security. With mobile solutions playing a central role in network management, customer support, and infrastructure monitoring, these organizations require effective management of mobile devices, applications, and data to ensure operational efficiency. Managed mobility services provide a scalable, flexible solution to meet the demands of this fast-paced sector, allowing businesses to focus on innovation while ensuring secure, efficient, and compliant mobility practices.

Competitive Landscape:

The competition remains strong with many domestic and international players competing for oilfield chemicals market share. Companies competing in the market prioritize product development alongside sustainable formulation technologies and strategic partnership establishment as their key differentiating strategies. The active development of high-performance chemicals designed to address complex drilling and production obstacles represents a key competitive dimension. Mergers, acquisitions, and partnerships acts as another significant contributor to expand market presence and portfolio offerings. In addition, strict regulatory pressure regarding environmental compliance, motivates companies and scientists to develop sustainable solutions. The market’s competitiveness is further intensified by the demand for affordable, reliable solutions that boost operational efficiency while satisfying industry development requirements. For instance, in May 2024, BASF expanded its oilfield chemicals production capacity at the Tarragona site to meet growing demand. The new Basoflux paraffin inhibitors enhance sustainability, efficiency, and reliability, reducing solvent use in oil production.

The report provides a comprehensive analysis of the competitive landscape in the oilfield chemicals market with detailed profiles of all major companies, including:

- Albemarle Corporation

- Ashland

- Baker Hughes Company

- BASF SE

- CES Energy Solutions Corp.

- ChampionX Corporation

- Chevron Phillips Chemical Company

- Clariant AG

- Halliburton

- Huntsman International LLC

- Kemira Oyj

- Stepan Company

- The Dow Chemical Company

- The Lubrizol Corporation

Latest News and Developments:

- September 2024, TCS introduced two AI-powered cybersecurity solutions, Managed Detection and Response (MDR) and Secure Cloud Foundation, in partnership with Google Cloud. These solutions aim to improve threat detection, response, and cloud security governance in hybrid environments.

- September 2024, DXC Technology partnered with Dell to launch Enterprise Intelligence Services (EIS). This service integrates AI, data analytics, and cloud technology to optimize managed services, helping organizations streamline operations and improve customer experiences, reinforcing DXC's position in multi-cloud solutions.

- September 2024, IBM and NTT DATA introduced SimpliZCloud, a fully managed cloud service for financial institutions. Built on IBM's LinuxONE platform, it improves infrastructure performance, reduces costs, and supports AI/ML applications through a subscription model, focusing on sustainability and hybrid cloud solutions.

- September 2024, Accenture acquired NaviSite to enhance its managed services portfolio, particularly in application and infrastructure management. This acquisition strengthens Accenture’s ability to modernize digital infrastructure for clients in the US and Canada, emphasizing AI, cloud, and data-driven solutions.

- August 2024, Stratix Corporation expanded its partnership with Omnissa to improve Managed Mobility Services (MMS). Using generative AI and cloud-based computing, the collaboration streamlines endpoint management and enhances operational efficiency. Stratix leverages Omnissa’s Workspace One Unified Endpoint Management for secure enterprise device management.

- March 2024, Dynamic Digital Transformation (DDT), a joint venture between DMI and Dynamic Solutions Technology, secured a USD14.5 million contract with the U.S. Treasury. The contract focuses on providing enterprise mobility management services (EMMS) to the Office of the Comptroller of the Currency (OCC), enhancing mobility solutions and expanding DMI's presence in the enterprise mobility sector.

Oilfield Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Inhibitors, Demulsifiers, Rheology Modifiers, Friction Reducers, Biocides, Surfactants, Foamers, Others |

| Locations Covered | Onshore, Offshore |

| Applications Covered | Drilling Fluid, Production Chemicals, Cementing, Workover and Completion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Albemarle Corporation, Ashland, Baker Hughes Company, BASF SE, CES Energy Solutions Corp., ChampionX Corporation, Chevron Phillips Chemical Company, Clariant AG, Halliburton, Huntsman International LLC, Kemira Oyj, Stepan Company, The Dow Chemical Company and The Lubrizol Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oilfield chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oilfield chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oilfield chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oilfield chemicals market was valued at USD 24.75 Billion in 2024.

IMARC estimates the global oilfield chemicals market to reach USD 33.55 Billion in 2033, exhibiting a CAGR of 3.27% during 2025-2033.

The market is primarily driven by increasing global energy demand, the need for efficient and sustainable production processes, and advancements in drilling technologies. Additionally, the rise in unconventional oil and gas exploration, along with environmental regulations promoting safer and more eco-friendly operations, further fuels market growth and innovation.

North America currently dominates the market, holding a significant share of 42.7% in 2024. This can be attributed to the region's extensive oil and gas production, particularly from shale resources. The growing demand for advanced chemicals to enhance production efficiency and comply with environmental regulations further bolsters the market. Additionally, technological advancements in extraction methods continue to support North America's dominance in this industry.

Some of the major players in the oilfield chemicals market include Albemarle Corporation, Ashland, Baker Hughes Company, BASF SE, CES Energy Solutions Corp., ChampionX Corporation, Chevron Phillips Chemical Company, Clariant AG, Halliburton, Huntsman International LLC, Kemira Oyj, Stepan Company, The Dow Chemical Company and The Lubrizol Corporation,?etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)