Oil and Gas Security Market Size, Share, Trends and Forecast by Component, Security Type, Application, and Region, 2025-2033

Oil and Gas Security Market Size and Share:

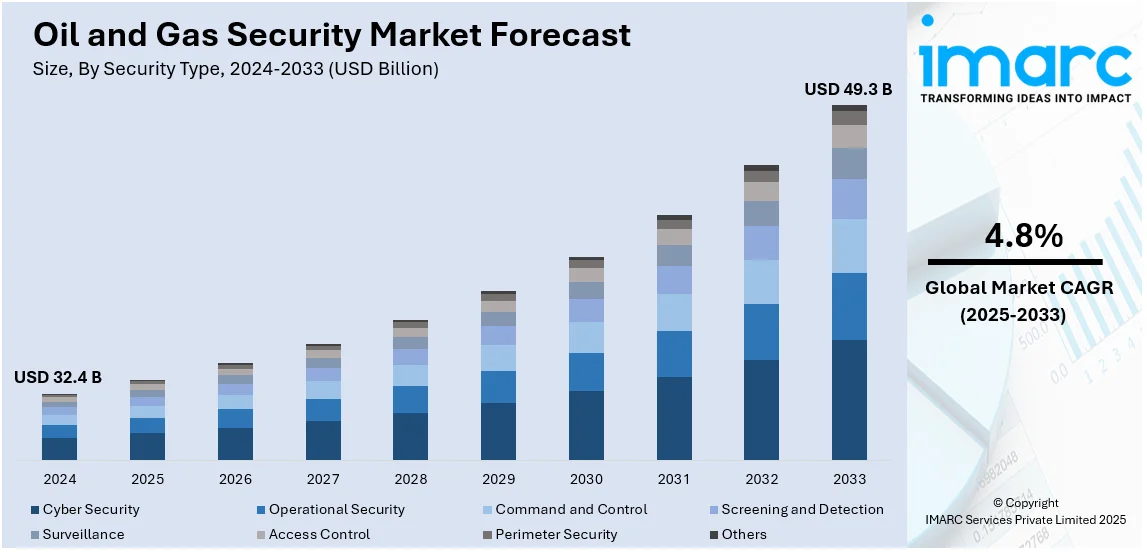

The global oil and gas security market size was valued at USD 32.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 49.3 Billion by 2033, exhibiting a CAGR of 4.8% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024. The increasing threat landscape, stringent regulatory requirements to protect critical infrastructure, mitigate risks, and ensure operational continuity within the industry, and the integration of advanced technologies represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 32.4 Billion |

| Market Forecast in 2033 | USD 49.3 Billion |

| Market Growth Rate (2025-2033) | 4.8% |

Oil and gas requirements are increasing as the need for energy is rising in the residential, commercial, and industrial sectors. As a vital component of global energy supply chains, the oil and gas industry is facing numerous threats, ranging from physical attacks on facilities to sophisticated cyber intrusions targeting operational technology systems. This evolving risk landscape is driving the demand for advanced security solutions, encompassing physical security measures, cybersecurity tools, and integrated risk management frameworks. One of the primary drivers of the market is the growing prevalence of cyberattacks targeting energy infrastructure. With the rise of the Industrial Internet of Things (IIoT) and the digitization of oil and gas operations, critical assets are become increasingly vulnerable to cyber threats. These include ransomware attacks, data breaches, and advanced persistent threats (APTs) aimed at disrupting production, stealing sensitive data, or causing environmental damage.

The increasing complexity of threats to critical energy infrastructure and the rising emphasis on safeguarding the nation’s energy supply is bolstering the market growth. As one of the largest producers and consumers of oil and gas globally, the US is heavily reliant on its extensive network of pipelines, refineries, offshore platforms, and storage facilities. This vast infrastructure presents numerous vulnerabilities to both physical and cyber threats, necessitating substantial investment in advanced security solutions and technologies. Emerging technologies, particularly artificial intelligence (AI) and machine learning (ML), are also propelling the market growth. AI-powered tools are increasingly being utilized for threat detection, risk analysis, and predictive maintenance. The IMARC Group forecasts that the US AI market is anticipated to hit USD 97,084.2 million by 2032. Additionally, the integration of blockchain for securing data transactions and enhancing supply chain transparency is projected to gain traction within the industry.

Oil and Gas Security Market Trends:

Increasing Cases of Threat in Industry

The evolving threats in the oil and gas industry is constantly driving the demand for strong security measures. According to World Pipelines, in 2024, 67% of energy, oil, gas, and utilities organizations suffered from ransomware attacks, with 80% developing data encryption. The average recovery cost per incident was approximately USD 3.12 Million. As cyber threats, geopolitical tensions, and terrorist activities go on to pose risks to the oil and gas infrastructure, it is a fact that oil and gas companies are actively pursuing advanced security solutions. Oil and gas security measures include not only emergency response planning but also crisis management protocols along with resilience strategies. Major companies are also adopting the ongoing measures to protect critical assets, prevent disruptions, and ensure the safety of personnel. This constant evolution of threats makes it an ever-present and continuously driving force behind the growth of the market, due to this increased focus on security measures.

Integration of Advanced Technologies

Ongoing technological advancements are contributing to the growth of the market. Innovations like the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and data analytics offer new possibilities for enhancing security capabilities. Oil and gas companies are adopting these technologies to improve surveillance and threat detection, reduce response times, and increase overall situational awareness. Gradient Flow stated that adoption rates of advanced technologies, including IoT, AI, machine learning, and data analytics, are slowly increasing in the US population, especially among sectors such as oil and gas. Around 45% of U.S. enterprises have implemented AI within their operations, with projections to increase by 30% over the next five years, as per an industrial report data. The integration of advanced technologies allows for real-time monitoring, predictive analytics, and the automation of security processes, enabling more efficient and effective security operations. As technology continues to advance, it drives the demand for cutting-edge security solutions, fostering the growth of the market.

Increasing Requirements for Regulatory Compliance

The stringent regulatory environment governing the oil and gas industry plays a significant role in driving the demand for security solutions. Governments and regulatory bodies of various countries are imposing stringent requirements to safeguard critical infrastructure, prevent environmental incidents, and protect public safety. Oil and gas companies must comply with these regulations and standards, which include specific security measures and protocols. To meet regulatory obligations, companies are continuously investing in advanced security technologies, personnel training, and comprehensive security frameworks, which is driving the market. According to an industrial report data, the average data breach affecting the energy industry costs USD 4.72 Million surged from USD 4.65 Million in 2021. Companies are working towards compliance and collaborating with industry associations, security experts, and regulatory bodies to exchange knowledge, experiences, and strategies. This collaboration facilitates the development of industry-wide security standards and benchmarks.

Oil and Gas Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oil and gas security market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, security type and application.

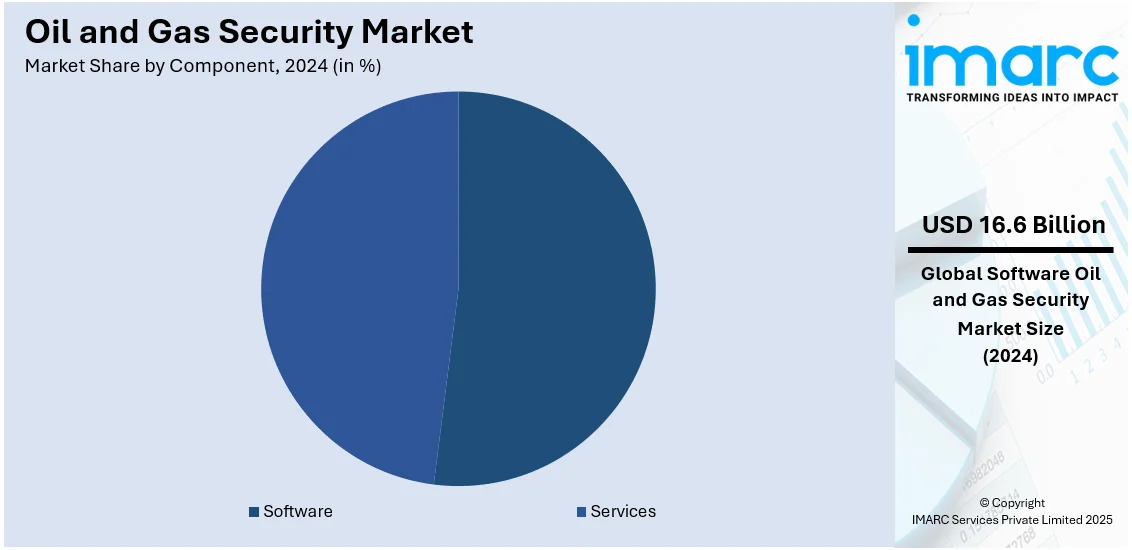

Analysis by Component:

- Software

- Services

Software leads the market with 51.2% of market share in 2024. With the increasing reliance on digital systems and interconnected technologies within the industry, the demand for software-based security solutions is rising globally. These software components offer advanced capabilities to detect, prevent, and respond to security threats effectively. Additionally, the oil and gas industry is becoming vulnerable to cyber-attacks, which can have devastating consequences. Software-based security solutions, including firewalls, intrusion detection systems, and encryption tools, help protect critical infrastructure and sensitive data from unauthorized access, malware, and other cyber threats. These solutions continuously evolve to address emerging cyber risks, ensuring the industry remains resilient in the face of evolving cybersecurity challenges. Moreover, the integration of technologically advanced software helps improve situational awareness, coordination, and response times, enhancing the overall effectiveness of security measures across the oil and gas infrastructure.

Analysis by Security Type:

- Cyber Security

- Operational Security

- Command and Control

- Screening and Detection

- Surveillance

- Access Control

- Perimeter Security

- Others

Surveillance applications are the largest segment, positively impacting the market. These applications provide sophisticated monitoring and surveillance capabilities that enable companies to enhance the security of their critical infrastructure, assets, and personnel. Oil and gas companies employ a variety of surveillance technologies, such as closed-circuit television (CCTV) cameras, thermal imaging cameras, drones, and satellite imagery, to monitor their facilities and surrounding areas. These systems provide real-time video feeds and data, and thus, security personnel proactively identify and respond to potential threats, unauthorized access, or suspicious activities. With these surveillance applications, companies can prevent security breaches, theft, sabotage, and other security incidents. In addition, advanced analytics capabilities can be integrated, allowing the detection of abnormal behavior, unauthorized entry, or other security breaches in real time.

Analysis by Application:

- Exploring and Drilling

- Transportation

- Pipelines

- Distribution and Retail Services

- Others

Exploring and drilling activities within the oil and gas industry are significant drivers of the market. These activities involve locating, extracting, and processing oil and gas reserves, often in remote and challenging environments. As exploration and drilling operations expand, the demand for comprehensive security solutions is increasing worldwide to protect critical infrastructure, personnel, and assets involved in these activities.

The transportation of oil and gas by road and rail requires robust security measures to prevent theft, accidents, and disruptions, which is driving the demand for efficient security solutions. Companies are employing security personnel, implementing tracking systems, and developing secure logistics protocols to minimize risks and protect the transportation infrastructure. These measures ensure the continuous and secure movement of oil and gas products overland.

The expansion of pipeline infrastructure, the need for specialized pipeline security solutions, and regulatory compliance requirements all contribute to the growth of the market. By investing in advanced security measures specific to pipeline protection, companies can mitigate risks, safeguard critical infrastructure, and ensure the safe and uninterrupted transportation of oil and gas resources through extensive pipeline networks.

The expansion of distribution and retail services within the oil and gas industry drives the growth of the security market. Investments in secure storage facilities, transportation security, and retail security solutions contribute to the protection of assets, prevention of theft, and overall integrity of the oil and gas supply chain. By implementing comprehensive security measures, companies can mitigate risks, ensure operational continuity, and maintain the trust and safety of consumers and business partners.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America represented the highest market share at 33.5%. The North American region possesses substantial reserves of oil and natural gas, making it one of the largest producers. Moreover, the geopolitical influence of the US plays an ongoing role in its dominance. With its global military presence and strategic alliances, the country is continuously working to secure oil and gas supply chains and protect international energy interests. Furthermore, the ongoing advancements in technology, such as the Internet of Things (IoT) and data analytics, are transforming the market. Companies are leveraging these technologies to enhance real-time monitoring, predictive analytics, and situational awareness, thereby improving overall security effectiveness. Additionally, the strict regulatory environment in North America, including safety standards and environmental regulations, is driving the need for robust security measures. The IMARC Group predicts that the US data analytics market is expected to exhibit a growth rate (CAGR) of 26.80% during 2024-2032.

Key Regional Takeaways:

United States Oil and Gas Security Market Analysis

In North America, the United States accounted for 84.30% of the total market share. Critical infrastructure protection, as well as advanced technologies, continue to fuel growth in the US market. In the Department of Homeland Security budget for 2023, approximately USD 2.93 Billion was assigned to CISA for energy infrastructure protection, of which an increased allocation of dollars will go to cybersecurity and physical surveillance systems. Apart from this, the Science and Technology Directorate was granted USD 901.3 Million for research and development activities that will help improve the security of infrastructure. Federal funding drives the market's growth as companies like Honeywell International and Halliburton provide integrated security solutions. The market is also influenced by the growing adoption of AI-based monitoring systems and drones for perimeter security. Technological advancements combined with expansion in domestic production ensure consistent growth, and export opportunities for U.S.-based security firms further enhance the country's position as a leader in the global oil and gas security sector.

Europe Oil and Gas Security Market Analysis

Increased regulatory emphasis and investment in cutting-edge security measures drive Europe's market. The European Commission estimates that around EUR 150 Billion (USD 160.5 Billion) of pledges is involved in the REPowerEU plan to gain independence over energy, which indirectly fuels demand for strong oil and gas infrastructure security. The conflict in Ukraine has brought geopolitical tensions to a boil, which means that energy security is of high concern, and countries like Germany and France are now increasing funding for advanced monitoring and surveillance technologies. With the adoption of renewable energy systems, new security protocols have to be integrated into them. The leading players are driving innovation, such as predictive maintenance tools and cyber defense systems. The strict regulation of the EU ensures the implementation of environmentally friendly and sustainable security solutions. Europe becomes a major innovator in oil and gas infrastructure protection.

Asia Pacific Oil and Gas Security Market Analysis

The market is growing in the Asia Pacific with increased investments in energy infrastructure and cyber threats. In 2022, investments in energy infrastructure in Asia reached USD 20.5 Billion, with a significant percentage directed towards oil and gas facilities, Asian Development Bank reports. Emerging technologies such as IoT-enabled systems and real-time threat monitoring are gaining momentum. Collaboration between global and regional security providers, such as "Digital India" in India, improves innovation. The growing interest in sustainable energy production and storage also impacts security measures, positioning the Asia Pacific as a pivotal market for oil and gas security advancements.

Latin America Oil and Gas Security Market Analysis

Latin America's market is growing with rising energy production and increased security threats. An industrial report showed that Brazil's oil and gas sector attracted USD 33.5 Billion in investments during 2023, and the investment in security systems for offshore platforms was impressive. Mexico and Colombia are investing more in surveillance and threat detection technologies to combat organized crime and protect pipelines. Petrobras and Pemex are the major players integrating advanced solutions, such as AI and blockchain, for infrastructure security. Further, government-backed programs attempt to modernize existing systems while promoting local manufacturing. The growing middle class of Latin America indirectly drives the demand for energy, requiring more robust security measures to safeguard critical assets and maintain market stability.

Middle East and Africa Oil and Gas Security Market Analysis

Investments in energy efficiency and infrastructure protection influence the market in the Middle East and Africa. According to Saudi Arabia's 2022 energy report, energy mix in the country still highly relies on fossil fuels. Energy mix remains dominated by oil, taking a significant share of 64.2%, while natural gas took the second position with 35.7% of total consumption. Even though renewable energy, including wind and solar, accounted for just 0.2% of electricity generation in 2022, Saudi Arabia targets 50% of renewable electricity by 2030. The country's energy-related CO2 emissions totalled 533 Mt CO2, or 1.56% of global emissions. Energy efficiency gains in key sectors, such as transport and building, which include mandatory insulation for new buildings, are aligned with Saudi Arabia's long-term energy strategies. These developments, coupled with the nation's increasing investment in renewable energy, are further driving this market to ensure resilience against future challenges.

Competitive Landscape:

Companies specializing in oil and gas security are engaged in a range of activities aimed at safeguarding the infrastructure, personnel, and assets of the oil and gas industry. These companies are conducting thorough threat assessments to identify potential security risks and vulnerabilities specific to oil and gas facilities. They are deploying physical security measures to protect oil and gas infrastructure, including the installation and monitoring of surveillance systems, access control systems, and perimeter security. Additionally, they are involved in personnel security by conducting screening, background checks, and providing security awareness training. In the face of emergencies such as natural disasters or security breaches, oil and gas security companies are ready to respond with specialized teams for immediate support and incident management. They are also actively involved in cybersecurity measures, offering services such as network monitoring, vulnerability assessments, and incident response for offering protection against cyber threats. Furthermore, they are providing intelligence services and risk analysis to ensure oil and gas companies stay updated about possible threats and take better decisions. In 2024, CruxOCM announced that it has closed a USD 17 million Series A funding round. Leading the round was M12 (Microsoft's Venture Fund) and ONEOK, supported by Raven Indigenous Capital Partners and others, with the aim of focusing investment on sustainable technology for oil and gas energy security.

The report provides a comprehensive analysis of the competitive landscape in the oil and gas security market with detailed profiles of all major companies, including:

- ABB Ltd.

- Cisco Systems Inc.

- General Electric Company

- Honeywell International Inc.

- Intel Corporation

- Lockheed Martin Corporation

- Microsoft Corporation

- Parsons Corporation

- Siemens Aktiengesellschaft

- Waterfall Security Solutions

Latest News and Developments:

- August 2024: Honeywell launched its Emissions Management Suite, a certified end-to-end solution for offshore oil and gas platforms and marine vessels. The system measures, monitors, reports, and reduces emissions, including methane leaks. It gives real-time visibility to help companies balance emissions and production and drive net-zero operations in offshore environments while supporting energy transition goals.

Oil and Gas Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Security Types Covered | Cyber Security, Operational Security, Command and Control, Screening and Detection, Surveillance, Access Control, Perimeter Security, Others |

| Applications Covered | Exploring and Drilling, Transportation, Pipelines, Distribution and Retail Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Cisco Systems Inc., General Electric Company, Honeywell International Inc., Intel Corporation, Lockheed Martin Corporation, Microsoft Corporation, Parsons Corporation, Siemens Aktiengesellschaft, Waterfall Security Solutions etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oil and gas security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oil and gas security market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oil and gas security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Oil and gas security encompasses the measures and technologies implemented to protect critical energy infrastructure, assets, personnel, and data within the oil and gas industry from physical and cyber threats. These solutions include cybersecurity tools, physical surveillance systems, perimeter protection, and emergency response protocols to ensure operational continuity and mitigate risks.

The oil and gas security market was valued at USD 32.4 Billion in 2024.

IMARC estimates the global oil and gas security market to exhibit a CAGR of 4.8% during 2025-2033.

The market is primarily driven by the increasing prevalence of cyberattacks, stringent regulatory requirements, technological advancements such as AI and IoT, and the rising complexity of threats to critical infrastructure. The need for operational continuity in energy supply chains further fuels demand for advanced security solutions.

In 2024, software represented the largest segment by component, driven by the rising reliance on digital systems to detect, prevent, and mitigate cyber and physical threats effectively.

Surveillance leads the market by security type owing to its sophisticated monitoring technologies, such as drones, CCTV, and thermal imaging, which enhance real-time threat detection and asset protection.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market due to its extensive energy infrastructure and advanced security technologies.

Some of the major players in the global oil and gas security market include ABB Ltd., Cisco Systems Inc., General Electric Company, Honeywell International Inc., Intel Corporation, Lockheed Martin Corporation, Microsoft Corporation, Parsons Corporation, Siemens Aktiengesellschaft, Waterfall Security Solutions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)