Oil & Gas Fabrication Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Oil & Gas Fabrication Market Size and Share:

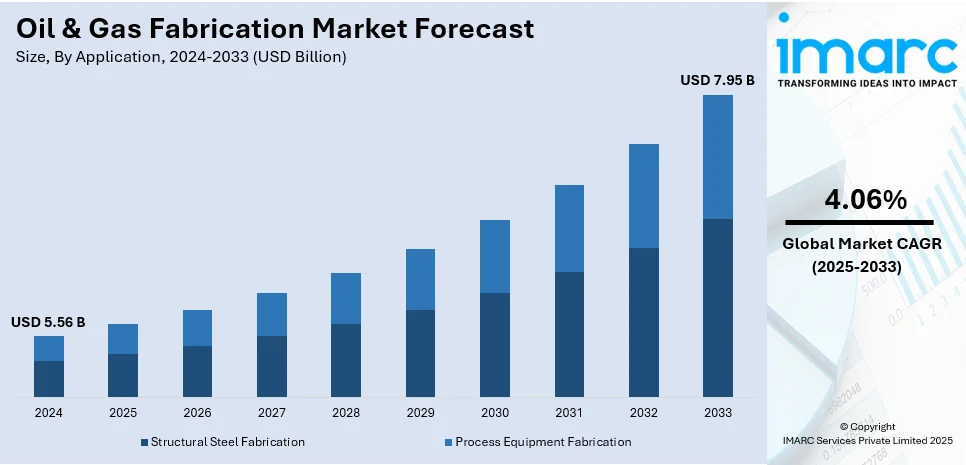

The global oil and gas fabrication market size was valued at USD 5.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.95 Billion by 2033, exhibiting a CAGR of 4.06% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. The rising demand for energy worldwide, the increasing oil and gas production and exploration activities, and the implementation of stringent regulatory compliance represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.56 Billion |

| Market Forecast in 2033 | USD 7.95 Billion |

| Market Growth Rate (2025-2033) | 4.06% |

The global energy consumption is propelling the oil & gas fabrication market because they drive substantial spending on exploratory activities and infrastructure expansion. The growing demand for energy worldwide has driven oil & gas operations to expand their activities particularly in subsea and offshore exploration. The production and maintenance of rigs along with pipelines and storage facilities require fabrication because these elements are fundamental for extracting oil and gas while refining and transporting both resources. The market growth continues to advance due to technological improvements which bring automation and digitalization benefits for efficient and safe fabrication procedures.

In the United States, the oil & gas fabrication market is benefitting from a strong energy sector, with the country remaining one of the largest oil producers globally. For instance, as per industry reports, in August 2024, the United States set a benchmark with the new record, producing an average of 13.4 million barrels per day (b/d) of crude oil. Moreover, the shale boom and the expansion of deepwater drilling projects have spurred demand for specialized fabrication services. Government policies supporting energy independence and infrastructure development further boost the market. Furthermore, as U.S. companies focus on modernization and maintaining aging infrastructure, the demand for high-quality, durable fabrication solutions is expected to continue growing, creating opportunities for market players.

Oil & Gas Fabrication Market Trends:

Increasing Offshore and Onshore Exploration Activities

The global demand for energy is the main driver for huge investments in oil and gas exploration, particularly in offshore fields such as the Gulf of Mexico, North Sea, and South China Sea. With the exhaustion of easily accessible reserves, the industry is resorting to deepwater and ultra-deepwater drilling, which demands the fabrication of specialized structures such as subsea manifolds, pipelines, and offshore platforms. The increasing construction of refineries and LNG infrastructure is also increasing demand for fabricated components, such as pressure vessels, heat exchangers, and modular processing units. Governments and private companies are accelerating exploration and production activities, thus opening vast opportunities for fabrication companies in the building of large oil and gas infrastructure. The International Energy Agency (IEA) projected the demand for global natural gas to increase up to 4,370 billion cubic meters per annum by 2025, up from a 1.5% year-on-year growth trend from 2019 to 2025. This, in turn, strengthens demand for sophisticated fabrication for offshore and LNG infrastructure.

Advancements in Fabrication Technologies

Technological advancements are profoundly transforming the oil and gas fabrication market, making efficiency, precision, and cost-effectiveness much more achievable. Automated welding, robotics, and AI-powered predictive maintenance are now integrated into the fabrication process to minimize errors and increase safety. The digital twin technology is also significant in allowing for real-time monitoring and optimization of fabricated structures and improving project planning and operational efficiency. There is a trend toward modular fabrication, where components are built offsite and assembled on-site, which shortens completion timelines and saves construction costs. As efficiency, reliability, and cost management are set top priorities, companies are clamoring for advanced fabrication techniques. Of particular interest are those innovations from TechnipFMC, which unveiled its series of AI-integrated fabrication solutions in July 2023 as part of the bid to improve efficiency and safety for oil and gas infrastructure development. Similarly, in April 2023, McDermott International introduced IoT-enabled fabrication tools to improve project monitoring and quality control, underscoring the industry's shift towards innovation-driven growth.

Rising Focus on Sustainability and Regulatory Compliance

The growing pressure to reduce environmental impact is reshaping the oil and gas industry, driving a shift toward sustainable fabrication practices. Stricter regulations on emissions and carbon intensity are prompting companies to focus on developing low-carbon infrastructure, such as carbon capture systems, hydrogen-ready pipelines, and energy-efficient processing units. Fabrication companies are responding by incorporating eco-friendly materials, enhancing waste management, and adopting energy-efficient production methods. Additionally, the diversification of oil and gas companies into cleaner energy sources like LNG and hydrogen is increasing the demand for specialized fabricated components in these emerging sectors. As environmental standards tighten, regulatory-compliant and sustainable fabrication practices are becoming integral to the long-term viability of the industry. According to the International Energy Agency (IEA), around 45 commercial facilities are already operational, applying carbon capture, utilization, and storage (CCUS) technologies to industrial processes, fuel transformation, and power generation, highlighting the growing focus on sustainable solutions in the energy sector. This shift underscores the rising demand for eco-conscious fabrication solutions across the industry.

Oil & Gas Fabrication Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oil and gas fabrication market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

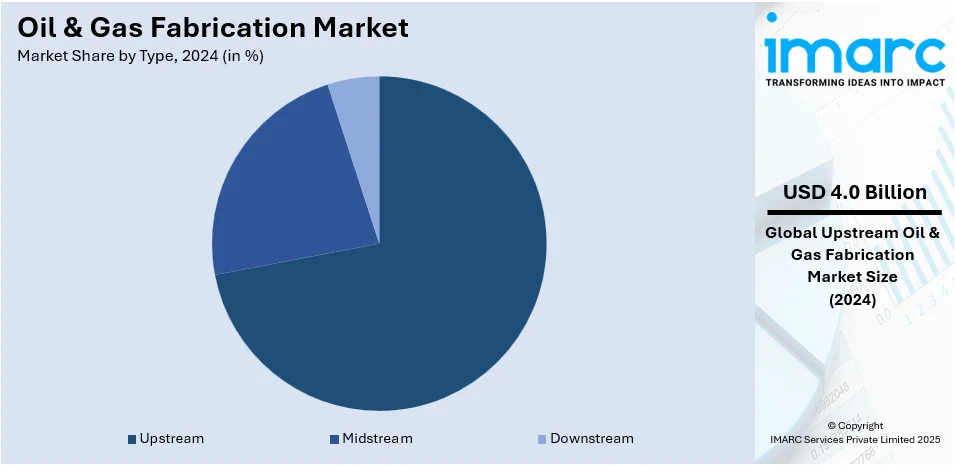

Analysis by Type:

- Upstream

- Midstream

- Downstream

Upstream leads the market with around 72.0% of market share in 2024, encompassing exploration, drilling, and production activities. This segment is driven by increasing demand for energy and the need to develop new oil and gas reserves. The rising focus on deepwater and offshore exploration, along with advancements in drilling technologies, enhances the demand for specialized fabrication services. The segment also benefits from the expansion of oil and gas production in both mature and emerging markets. As companies strive to meet growing energy needs, the upstream segment plays a crucial role in providing the infrastructure and equipment required for efficient extraction and production processes.

Analysis by Application:

- Structural Steel Fabrication

- Process Equipment Fabrication

Structural steel fabrication in the oil and gas sector involves the design, manufacture, and assembly of steel structures used in drilling rigs, platforms, refineries, and pipelines. This application is critical for providing robust, durable frameworks capable of supporting heavy equipment and withstanding extreme environmental conditions. Fabricators focus on precision, quality materials, and compliance with safety and regulatory standards. As infrastructure requirements grow globally, especially in remote or offshore areas, the demand for advanced structural steel fabrication solutions is expanding.

Process equipment fabrication involves manufacturing key components used in the extraction, refining, and processing stages of the oil and gas industry. This includes pressure vessels, heat exchangers, reactors, and separation units. These fabricated components are essential for ensuring efficient and safe processing of oil and gas products. Precision and material strength are critical to withstand high-pressure, high-temperature conditions in operational environments. The growing need for refined and processed energy products drives the demand for specialized process equipment fabrication in the sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 37.6%, driven by rapid industrial growth and increasing energy demand. For instance, according to industry reports, Asia Pacific's power demand surpassed 50% of global consumption in 2023, driven by India, China, and Southeast Asia. The region is a hub for large-scale offshore and subsea projects, supported by advanced fabrication techniques. Additionally, key drivers include expanding energy infrastructure, urbanization, and industrial activity. The market benefits from cost-effective manufacturing capabilities, allowing competitive advantages in fabrication services. However, challenges such as stringent environmental regulations and fluctuating oil prices influence the sector's future growth. The growing demand for energy continues to fuel investments in exploration and production, while evolving technologies enhance fabrication processes and overall sector efficiency.

Key Regional Takeaways:

United States Oil & Gas Fabrication Market Analysis

The United States oil and gas fabrication market is poised to be positively impacted by gigantic investments in infrastructure and exploration activities. According to the United States Energy Information Administration (EIA), in 2021, 7.44 billion cubic feet per day (Bcf/d) of interstate natural gas pipeline capacity were added to the United States. This implies growing demand for the transportation of natural gas. This expansion necessitates a demand for the high-value fabrication of pipelines, compressor stations, and gas processing plants. United States is the world's biggest oil and natural gas producer; hence, due to the persistent increase in the production level, the demand for the fabrication of drilling rigs, offshore platforms, and refineries also increases accordingly. It is also accelerating demand for fabricated components in these sectors. The country's commitment to reducing emissions and investing in cleaner energy sources like LNG and hydrogen will continue to benefit the oil and gas fabrication market, with both old and new energy infrastructures driving its future growth.

North America Oil & Gas Fabrication Market Analysis

The North America oil & gas fabrication market is experiencing steady growth, fueled by robust demand for energy, particularly in the U.S. and Canada. Increasing investments in shale oil and gas extraction, offshore drilling, and infrastructure upgrades are driving market expansion. The region benefits from advanced technologies and innovations, including automation and digitalization, enhancing efficiency and safety in fabrication processes. Additionally, government initiatives aimed at energy independence and sustainability, such as regulatory support for green energy projects, further bolster market dynamics. For instance, in September 2024, the U.S. Department of Energy (DOE) announced plans to allocate over USD 3 billion to 25 battery projects across 14 states, focusing on mineral processing, battery production, and recycling. However, fluctuating oil prices and environmental concerns present challenges for future growth in the sector.

Europe Oil & Gas Fabrication Market Analysis

The oil and gas fabrication market in Europe is projected to exhibit healthy growth, given the strict environmental laws and the desire for greener energy. The EU Climate Law adopted on 24 June 2021 imposes a mandatory obligation to reduce emissions by 55% by 2030 and reach climate neutrality by 2050, as put forward by the European Commission. Such ambitious targets are prompting the oil and gas industry to invest in low-carbon technologies, such as carbon capture, utilization, and storage (CCUS) systems, hydrogen-ready pipelines, and energy-efficient processing units. Increasingly, the fabrication companies have started to work on sustainable solutions and adjust their operations according to regulatory standards. Not only is the demand for fabricated components increasing due to these investments in renewable energy and offshore and onshore infrastructure across Europe but it is also driven by a steady rising requirement for cleaner forms of energy including LNG, hydrogen, and biofuels, placing Europe at the center of the drive towards a low-carbon future.

Asia Pacific Oil & Gas Fabrication Market Analysis

The Asia Pacific oil and gas fabrication market is growing at a very high rate, driven by significant energy transitions and infrastructure developments in the region. According to government reports, India has set an ambitious target to raise the share of natural gas in its energy mix from 6.3% to 15% by 2030, which will require substantial investments in natural gas pipelines, storage facilities, and processing plants. This demand for infrastructure will raise the demand for oil and gas fabrication services, particularly in pipeline construction, compression stations, and LNG terminals. Additionally, because of the rise in investments of Asia Pacific countries such as China, Japan, and South Korea in LNG and renewable energy sources, the need for advanced fabrication solutions will also rise. The region's oil and gas fabrication sector will continue to grow as countries move toward energy security and reducing carbon emissions. The sector will benefit from both traditional and emerging energy projects.

Latin America Oil & Gas Fabrication Market Analysis

One of the key growth drivers in the Latin American oil and gas fabrication market is the fact that Brazil leads the world in offshore oil production. The country derives 96.7% of its oil production from offshore fields, resulting in considerable investment in infrastructures such as subsea pipelines, drilling rigs, and platforms, as per reports. Petrobras, the national oil company, holds a majority share of 73% of Brazil's oil and gas production, meaning demand for special fabrication services shall continue to remain substantial to support its vast activities in the pre-salt oil fields.

The oil and gas industry has been one of the significant contributors to Brazil's economy for some time, accounting for around 10% of Brazil's GDP, as reported by the International Trade Administration. As Brazil continues to expand offshore exploration and production, fabrication companies are taking advantage of the increasing demand for high-quality, durable infrastructure. Moreover, as reported by industry research, with a focus on growing energy security in Latin America through diversification to natural gas and LNG, it is poised that fabrication firms should meet the demands of the new low-carbon energy infrastructure throughout the region.

Middle East and Africa Oil & Gas Fabrication Market Analysis

The Nigerian National Petroleum Company Limited announced in October 2022 a proposed USD 25 Billion gas pipeline project from Nigeria to Morocco, which will transform the Middle East and Africa oil and gas fabrication market into a desirable growth driver. This 3,840-mile (5,600 kilometers) West African pipeline will run along the coast to Italy and Spain, creating an important alternate supply route for European countries seeking to decrease dependence on Russian gas, according to industry reports. The massive size of the project will drive substantial demand for fabricated components, including pipelines, subsea manifolds, and specialized infrastructure for storage and transportation. Region-specific fabrication companies would be crucial for surmounting technical and regulatory barriers in this high-profile pipeline. As energy markets around the globe continue to transform, the construction of such pipelines highlights a fast-growing trend: the increased need for highly developed fabrication services for the purpose of diversification in energy sources to fuel future expansion in Middle East and African oil and gas fabrication.

Competitive Landscape:

The oil & gas fabrication market is highly competitive, driven by companies offering a broad range of services, including offshore platform construction, pipeline fabrication, and maintenance. Competition is primarily fueled by technological innovations, cost efficiency, and the capability to manage complex, large-scale projects. Market players focus on improving safety standards, reducing environmental impact, and enhancing operational efficiency to maintain a competitive edge. Additionally, firms pursue strategic partnerships, mergers, and acquisitions to expand their service offerings and market presence. For instance, in December 2024, Petrobras launched LABi3D at CENPES, its research center in Rio de Janeiro, marking a key advancement in digital transformation of the oil and gas industry. The alliance between 3DCRIAR and LABi3D led to its position as one of Latin America's premier additive manufacturing facilities which specializes in polymeric production. This competitive dynamic is further amplified by the growing demand for energy and infrastructure development globally.

The report provides a comprehensive analysis of the competitive landscape in the oil and gas fabrication market with detailed profiles of all major companies, including:

- Drydocks World

- Eversendai Corp (Vahana Holdings SDN. BHD.)

- Honiron Corporation

- Integrated Flow Solutions Inc.

- Kobay Technology Bhd

- Lamprell Plc

- Larsen & Toubro Limited

- Lefebvre Engineering FZC

- Northern Weldarc Ltd

- Oil States Industries Inc.

- STI Group

- WF Steel and Crane

Latest News and Developments:

- January 2025: Lamprell signed a multi-year framework agreement with ADNOC Group that will supply it with wellhead towers as the company expands ADNOC's offshore infrastructure while enhancing production in the area.

- June 2023: Bechtel reportedly completed the installation phase of its major pipeline project in the Permian Basin and is set to enhance oil-transportation efficiency in one of the U.S.'s largest oil-producing areas.

- April 2023: Snelson won a construction contract for an Appalachian Basin new-build natural gas pipeline that aims to enhance the overall gas distribution infrastructure in the eastern United States.

Oil & Gas Fabrication Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upstream, Midstream, Downstream |

| Applications Covered | Structural Steel Fabrication, Process Equipment Fabrication |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Drydocks World, Eversendai Corp (Vahana Holdings SDN. BHD.), Honiron Corporation, Integrated Flow Solutions, Inc., Kobay Technology Bhd, Lamprell Plc, Larsen & Toubro Limited, Lefebvre Engineering FZC, Northern Weldarc Ltd, Oil States Industries, Inc., STI Group, WF Steel and Crane, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oil & gas fabrication market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oil & gas fabrication market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oil & gas fabrication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oil & gas fabrication market was valued at USD 5.56 Billion in 2024.

IMARC estimates the global oil & gas fabrication market to reach USD 7.95 Billion in 2033, exhibiting a CAGR of 4.06% during 2025-2033.

The market is driven by increasing global energy demand, advancements in extraction technologies, and infrastructure expansion. Growing investments in offshore drilling, shale oil extraction, and energy independence initiatives further propel the market. Additionally, regulatory support for green energy projects and the need for modernization drive demand for specialized fabrication services.

Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. This regional leadership is fueled by expanding energy demands, substantial investments in infrastructure, and large-scale oil and gas projects. The region's robust industrial growth and technological advancements further strengthen its market leadership.

Some of the major players in the oil & gas fabrication market include Drydocks World, Eversendai Corp (Vahana Holdings SDN. BHD.), Honiron Corporation, Integrated Flow Solutions, Inc., Kobay Technology Bhd, Lamprell Plc, Larsen & Toubro Limited, Lefebvre Engineering FZC, Northern Weldarc Ltd, Oil States Industries, Inc., STI Group, WF Steel and Crane, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)