Oil and Gas Corrosion Protection Market Report by Type (Coatings, Paints, Inhibitors, and Others), Location (Offshore, Onshore), Sector (Upstream, Midstream, Downstream), and Region 2025-2033

Market Overview:

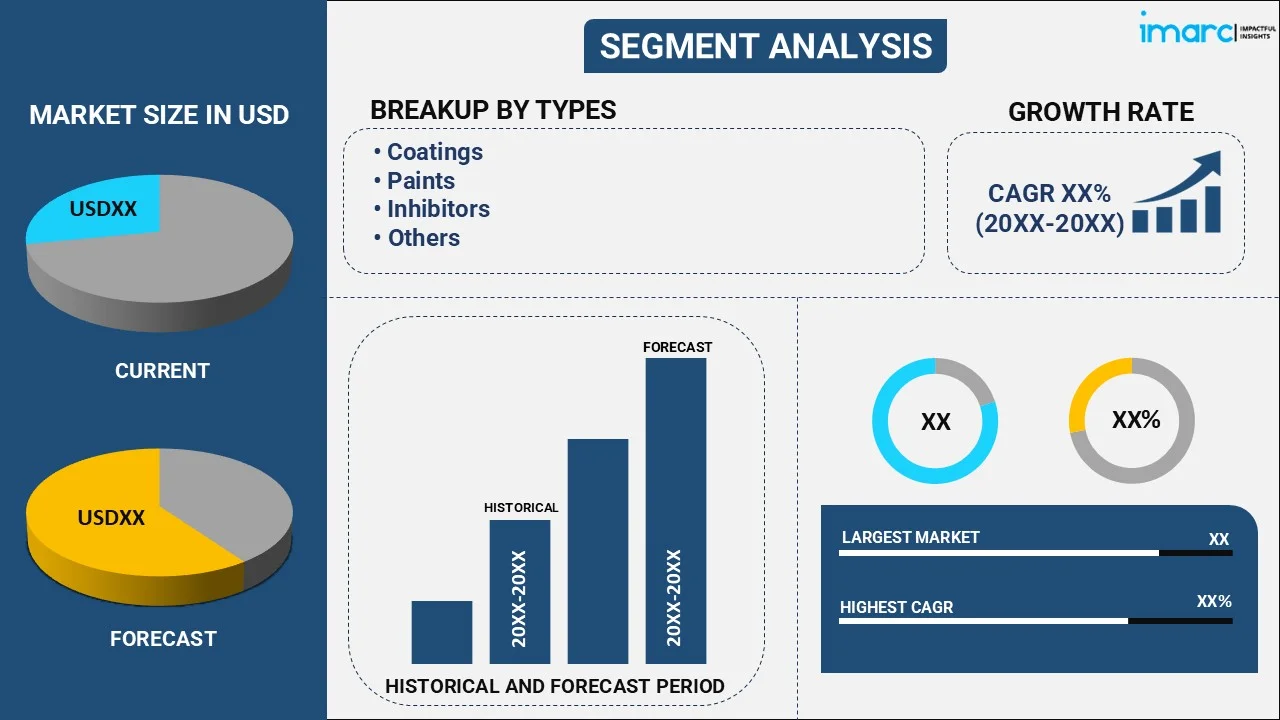

The global oil and gas corrosion protection market size reached USD 11.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.19% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.1 Billion |

|

Market Forecast in 2033

|

USD 16.4 Billion |

| Market Growth Rate 2025-2033 | 4.19% |

Oil and gas corrosion protection refers to the utilization of anti-corrosive systems and technologies to prevent the degradation of metals such as steel, nickel, copper, titanium and chromium, in aqueous environments. It involves the mitigation, monitoring, inspection and cleaning of crude oil and natural gas wells and pipelines. It utilizes cathodic and anodic protection, material selection, chemical dosing and the application of inhibitors and protective external and internal coatings. These solutions are used against oxygen, galvanic, crevice, erosion, microbiologically induced, sweet, sour and stress corrosions in upstream, midstream and downstream pipeline systems. Oil and gas corrosion protection aids in increasing plant availability, preventing pipe rust, leaks and minimizing environmental damage.

Oil and Gas Corrosion Protection Market Trends:

The increasing offshore oil and gas exploration activities, along with the rising demand for effective corrosion protection systems for wells, risers, drilling rigs and pipeline connectors, is one of the key factors driving the growth of the market. Crude oil is highly corrosive in nature and oil and gas corrosion protection solutions aid in prolonging the life of oil and water ballast tanks, hull externals and decks. Moreover, the widespread adoption of corrosion protection solutions in the transportation industry for moving natural gas, oil, intermediate products and fuel is providing a thrust to the market growth. Various product innovations, such as the development of epoxy-based coatings, are acting as other growth-inducing factors. Product manufacturers are also launching advanced coating materials manufactured using alkyd, polyurethanes and acrylic compounds for enhanced substrate protection, water- and heat resistance and improved physical properties. Other factors, including extensive infrastructural development, especially in the developing economies, along with the implementation of favorable government policies, are anticipated to drive the market toward growth.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global oil and gas corrosion protection market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, location and sector.

Breakup by Type:

- Coatings

- Paints

- Inhibitors

- Others

Breakup by Location:

- Offshore

- Onshore

Breakup by Sector:

- Upstream

- Midstream

- Downstream

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being 3M Company, Aegion Corporation, Akzo Nobel N.V, Ashland Global Specialty Chemicals Inc., Axalta Coating Systems Ltd., BASF SE, Chase Corporation, Hempel A/S, Jotun A/S, Metal Coatings Corp., RPM International Inc. and The Sherwin-Williams Company.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Type, Location, Sector, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Aegion Corporation, Akzo Nobel N.V, Ashland Global Specialty Chemicals Inc., Axalta Coating Systems Ltd., BASF SE, Chase Corporation, Hempel A/S, Jotun A/S, Metal Coatings Corp., RPM International Inc. and The Sherwin-Williams Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global oil and gas corrosion protection market was valued at USD 11.1 Billion in 2024.

We expect the global oil and gas corrosion protection market to exhibit a CAGR of 4.19% during 2025-2033.

The rising demand for gas corrosion protection solutions in upstream, midstream, and downstream pipeline systems, as they aid to increase plant availability, prevent pipe rust and leaks, and minimize environmental damage, is primarily driving the global oil and gas corrosion protection market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous offshore oil and gas exploration activities, thereby negatively impacting the global market for oil and gas corrosion protection.

Based on the type, the global oil and gas corrosion protection market can be segmented into coatings, paints, inhibitors, and others. Currently, coatings hold the largest market share.

Based on the location, the global oil and gas corrosion protection market has been divided into offshore and onshore, where offshore currently exhibits a clear dominance in the market.

Based on the sector, the global oil and gas corrosion protection market can be categorized into upstream, midstream, and downstream. Currently, midstream accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Middle East and Africa currently dominates the global market.

Some of the major players in the global oil and gas corrosion protection market include 3M Company, Aegion Corporation, Akzo Nobel N.V, Ashland Global Specialty Chemicals Inc., Axalta Coating Systems Ltd., BASF SE, Chase Corporation, Hempel A/S, Jotun A/S, Metal Coatings Corp., RPM International Inc., and The Sherwin-Williams Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)