Offshore Support Vessels Market Size, Share, Trends and Forecast by Type, Water Depth, Fuel, Service Type, Application, and Region, 2025-2033

Offshore Support Vessels Market 2024, Size And Trends:

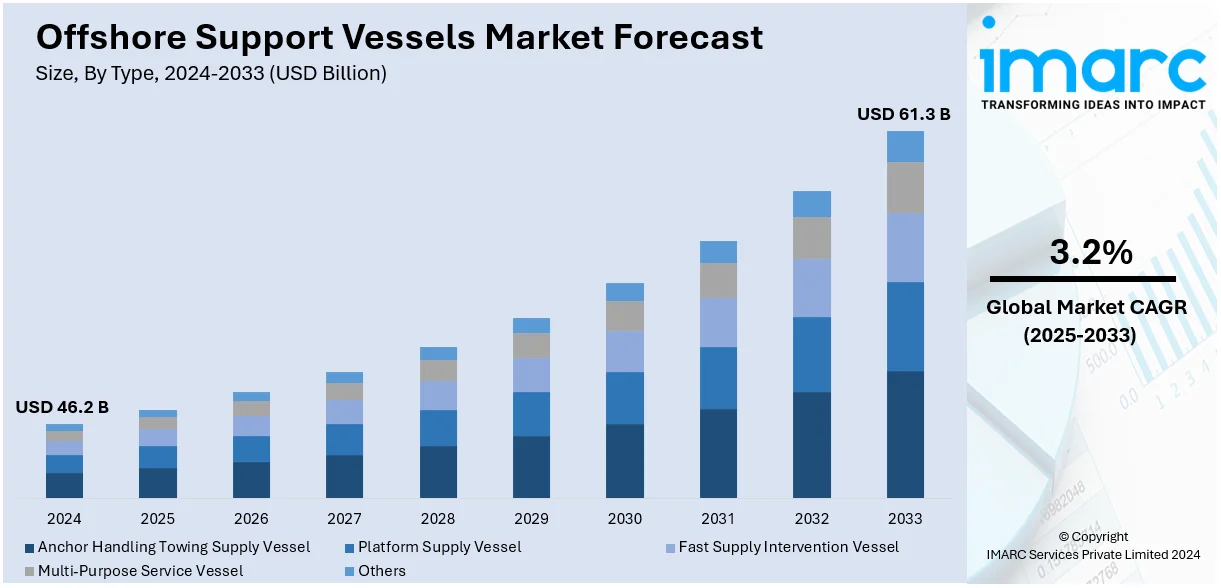

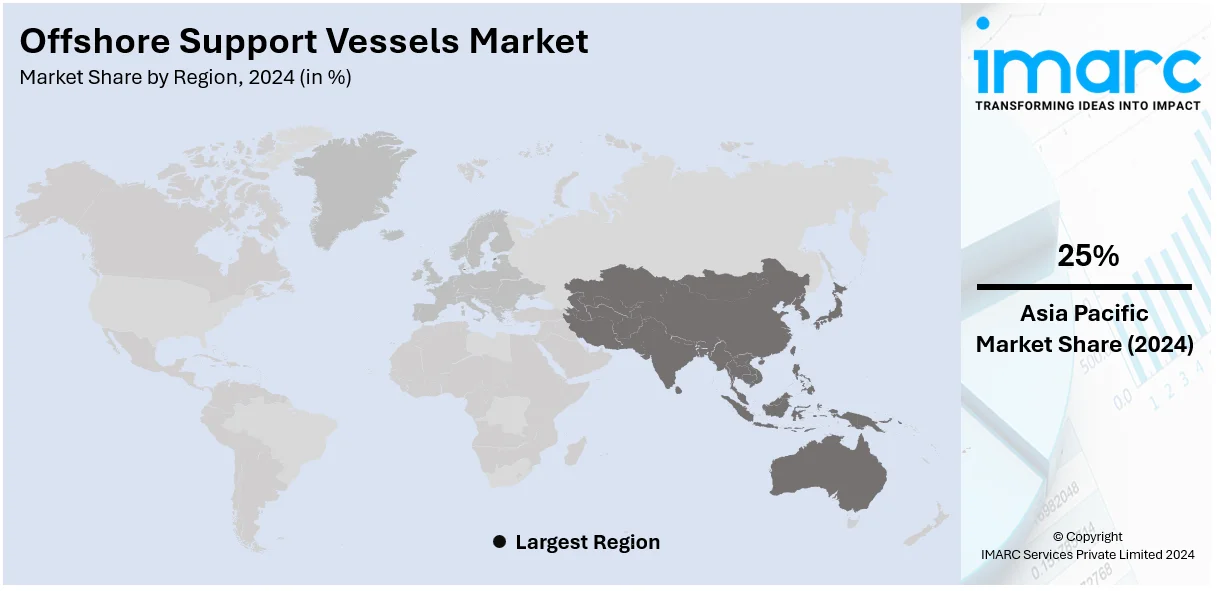

The global offshore support vessels market size was valued at USD 46.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 61.3 Billion by 2033, exhibiting a CAGR of 3.2% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 25% in 2024. Some of the key drivers driving the market include the increasing number of offshore wind energy projects brought about by the emphasis on renewable energy sources, the growth in offshore exploration and production, and the expanding modernization of aging fleets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 46.2 Billion |

|

Market Forecast in 2033

|

USD 61.3 Billion |

| Market Growth Rate (2025-2033) | 3.2% |

As global energy demands rise, the offshore support vessels market is driven by increasing offshore exploration and production activities, particularly in the oil and gas sectors. For instance, in July 2024, India's oil minister emphasized the potential for a $100 billion investment in the country's oil and gas exploration during the Urja Varta conference. He pointed out that only 10% of India's sedimentary basin has been explored with intentions to raise this figure to 16% by the end of 2024 in pursuit of increased energy independence. Expanding offshore wind projects are also boosting demand for specialized vessels. The need for efficient logistics and support in harsh marine environments further enhances OSV adoption. Technological advancements such as dynamic positioning systems and fuel-efficient designs improve operational reliability and cost-effectiveness attracting investment. Regulatory emphasis on safety and environmental compliance drives upgrades and modernization.

The United States offshore support vessels market is driven by increasing offshore oil and gas exploration activities particularly in the Gulf of Mexico. For instance, in September 2024, Talos Energy announced a major discovery of oil and gas at the Ewing Bank 953 well in the Gulf of Mexico with estimated recoverable resources ranging from 15 to 25 million barrels of oil equivalent (MMBoe). Rising investments in offshore wind energy projects aligned with the country’s renewable energy goals create demand for advanced OSVs. Technological advancements in vessel design including dynamic positioning and hybrid propulsion systems enhance efficiency and reliability boosting adoption. The push for energy independence and stricter safety and environmental regulations further drive modernization and fleet upgrades. Additionally, the need for efficient logistics and support in offshore construction and maintenance activities contributes to the growing demand for OSVs in the United States market.

Offshore Support Vessels Market Trends:

Rising Offshore Exploration and Production Activities

Offshore exploration and production activities are on the rise to meet the growing global energy demand. Additionally, the exploration and extraction of hydrocarbons from offshore sites are increasing due to the dwindling onshore reserves driving market growth. Offshore exploration provides access to previously untapped resources often situated in difficult and remote locations. An industry report indicates that with more offshore explorations underway the demand for Offshore Support Vessels (OSVs) is surging with the global OSV fleet projected to grow by 15% by 2027. OSVs play a vital role in transporting personnel equipment and supplies to offshore platforms ensuring efficient operations and continuous production. They also support activities such as seismic surveys, drilling and subsea construction.

Increasing Offshore Wind Energy Projects

The growing number of offshore wind energy initiatives propelled by a rising preference for renewable energy sources is creating a positive market environment. According to WINDExchange, by 2023 four fixed-bottom offshore wind power projects received approval along the Atlantic Coast with two already operational and several others in development. Offshore wind farms benefit from stronger and more consistent wind speeds resulting in higher energy production. OSVs are essential for the construction and upkeep of these wind farms facilitating the transport of wind turbine components from onshore assembly sites to offshore locations assisting with installation and foundational tasks and providing maintenance and repair services. Moreover, many countries are increasingly utilizing OSVs to achieve their renewable energy goals and lower carbon emissions positively impacting the market.

Rising Upgradation of the Aging Fleet

A significant portion of the OSV fleet currently in operation consists of aging vessels that have been in service for many years. For example, the U.S. Coast Guard reports that more than 30% of OSVs in the U.S. fleet are over 25 years old. Operators are increasingly focusing on modernizing their fleets by investing in new and technologically advanced vessels. These updated OSVs provide better fuel efficiency, lower emissions, enhanced safety features and superior operational capabilities. Consequently, upgrading the fleet helps meet strict environmental regulations while improving the efficiency of offshore operations. As a result, ship owners and operators are replacing older vessels with advanced OSVs to maintain competitiveness comply with current industry standards and promote sustainability and innovation.

Offshore Support Vessels Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global offshore support vessels market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, water depth, fuel, service type, and application.

Analysis by Type:

- Anchor Handling Towing Supply Vessel

- Platform Supply Vessel

- Fast Supply Intervention Vessel

- Multi-Purpose Service Vessel

- Others

Anchor handling towing supply vessel leads the market with around 32.3% of market share in 2024. Anchor handling towing supply vessels are robust and adaptable ships designed to manage anchors, tow rigs and undertake various tasks in offshore operations. They come equipped with powerful winches, towing pins and stern rollers enabling them to accurately handle heavy anchor chains and mooring lines. In this capacity, they aid in the installation, relocation and retrieval of offshore drilling rigs. Additionally, they are crucial for providing static positioning support to offshore facilities during critical operations.

Analysis by Water Depth:

- Shallow Water

- Deepwater

Shallow water leads the market with around 60.8% of market share in 2024. Shallow water offshore support vessels (OSVs) are crafted to operate and assist with offshore activities in coastal regions, continental shelves and other relatively shallow offshore areas. Their compact dimensions, shallow draft and maneuverability allow them to access zones with limited depth and restricted infrastructure. Furthermore, in shallow water environments OSVs are instrumental in facilitating activities such as exploration, drilling, well servicing and subsea construction. They transport personnel and equipment, provide supplies to offshore platforms and aid in the movement of goods between onshore bases and shallow water facilities.

Analysis by Fuel:

- Fuel Oil

- LNG

Fuel oil leads the market with around 74.5% of market share in 2024. Fuel oil is a thick and viscous liquid petroleum product obtained from refining crude oil. It is commonly utilized as a fuel source in various maritime applications, including OSVs, since these vessels utilize internal combustion engines that operate on fuel oil to produce the necessary power for propulsion and to run various onboard systems. Consequently, fuel oil-powered OSVs are recognized for their reliability, making them particularly well-suited for long voyages and offshore operations.

Analysis by Service Type:

- Technical Services

- Inspection & Survey

- Crew Management

- Logistics & Cargo Management

- Anchor Handling & Seismic Support

- Others

Technical services offshore support vessels (OSVs) are specialized ships designed with advanced technology and skilled crews to assist in various technical operations in offshore environments. They play a crucial role in the installation, upkeep, and repair of offshore infrastructure, including oil and gas platforms, subsea equipment, pipelines, and underwater structures. Additionally, these vessels support offshore construction and engineering tasks, such as lifting heavy materials and providing diving assistance for underwater projects.

Inspection and survey OSVs are specifically equipped to carry out a wide range of offshore inspections, surveys, and data gathering activities. These vessels come with surveying instruments, remotely operated vehicles (ROVs), and various other inspection tools. They enable operations like bathymetric surveys, environmental assessments, geotechnical studies, and pipeline evaluations.

Crew management OSVs are intended to offer accommodation and logistical support for personnel engaged in offshore activities. These vessels serve as floating living quarters, providing housing and meeting the needs of offshore workers during their operational shifts.

Logistics and cargo management services encompass planning, transportation and handling of goods ensuring efficient and timely delivery. This includes inventory tracking, cargo loading/unloading and supply chain coordination. As global trade expands the demand for streamlined logistics solutions has risen. Advanced technologies like IoT and automation are increasingly employed to enhance accuracy and reduce delays. These services are essential for maintaining operational efficiency and meeting the growing demands of international trade.

Anchor handling and seismic support services are vital for offshore exploration and marine construction. These involve deploying and managing anchors for vessels, rigs and platforms as well as supporting seismic surveys for resource exploration. The increasing focus on oil and gas exploration has driven demand for these services. Advanced equipment and trained personnel ensure precision and safety during operations contributing to the efficiency of offshore activities and minimizing environmental impact.

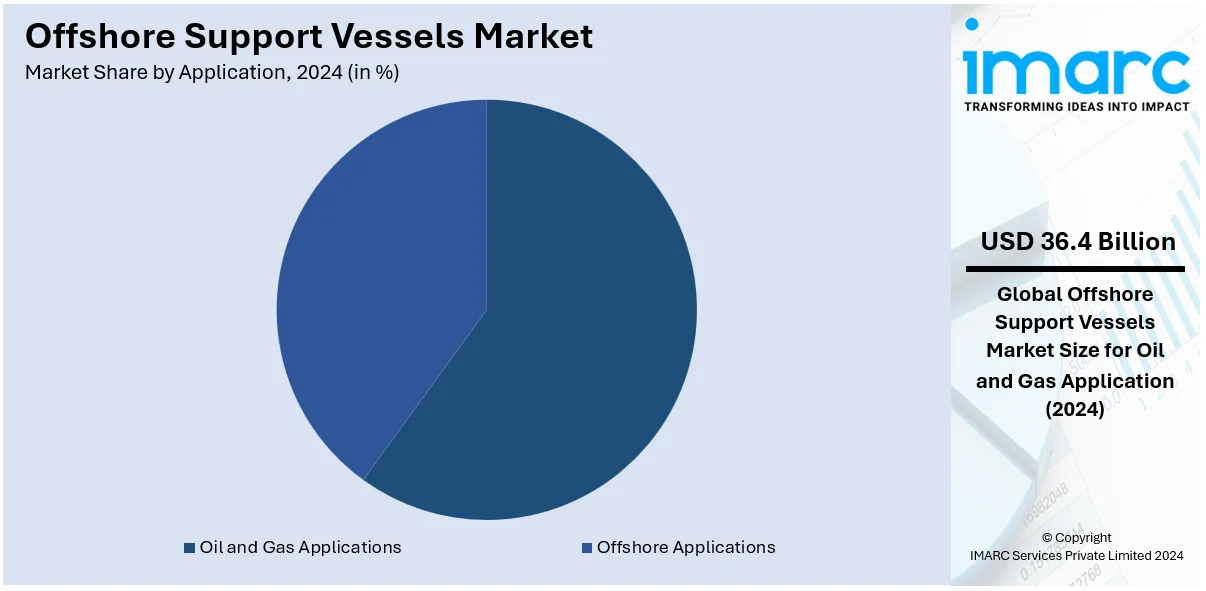

Analysis by Application:

- Oil and Gas Applications

- Offshore Applications

Oil and gas applications leads the market with around 78.9% of market share in 2024. The increasing use of OSVs in the oil and gas sector for facilitating offshore exploration, production, and transportation activities is driving market expansion. These vessels are vital throughout the entire lifecycle of offshore oil and gas initiatives. During the exploration stage, OSVs aid in seismic surveys and assist with the movement of exploration teams and equipment to distant offshore locations. They also offer logistical assistance by supplying materials and provisions to exploration vessels and platforms. In the production stage, OSVs are critical for transporting personnel, equipment, and supplies to offshore drilling rigs, production platforms, and floating production units.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 25%. The Asia Pacific region holds the largest market share due to its extensive offshore reserves. Additionally, the growing interest in renewable energy sources is aiding market growth in this area. In conjunction with this, the rising requirement for OSVs for port support and logistical services is further fostering market development. Furthermore, the increasing offshore exploration and production activities driven by the surging demand for energy are propelling market growth in the Asia Pacific region.

Key Regional Takeaways:

North America Offshore Support Vessels Market Analysis

North America's offshore support vessels market is experiencing robust growth driven by expanding offshore oil and gas activities and increasing renewable energy projects. The U.S. Department of Energy's target to achieve 30 GW of offshore wind energy capacity by 2030 has significantly boosted demand for OSVs particularly for construction, maintenance and logistics support. The Gulf of Mexico remains a critical hub with a high concentration of active oil rigs fostering the need for advanced OSVs. Canadian offshore projects particularly in the Atlantic add to regional demand. Hybrid-powered vessels and dynamic positioning systems are gaining traction as operators seek to comply with stringent environmental regulations. Government policies promoting renewable energy and domestic energy independence further enhance growth opportunities. Advanced technologies such as digital navigation and energy efficient designs are transforming the regional OSV market driving operational efficiency and sustainability.

United States Offshore Support Vessels Market Analysis

In 2024, the United States accounted for a share of 88.90% of the North American market. The offshore support vessels (OSV) market in the U.S. is growing due to high offshore oil and gas activities and growing offshore wind energy projects. According to the U.S. Department of Energy, the country is set to install 30 GW of offshore wind energy capacity by 2030, which will increase demand for OSVs. Offshore drilling in the Gulf of Mexico also promotes expansion, as more than 570 oil rigs were estimated to be operating in 2023. Market leaders were Tidewater and Edison Chouest Offshore, who emphasized technologically advanced vessels. Domestic supply and pressure on the administration to cut imports push additional growth forward, and all federal policies that encourage a renewable energy project also give a push to OSVs. Hybrid-powered vessels and dynamic positioning systems that meet the demanding environmental standards of the market.

Europe Offshore Support Vessels Market Analysis

OSV market in Europe is on the rise, considering aggressive renewable energy targets of the region and development of oilfields offshore. As WindEurope reports, installations for offshore wind in Europe set a new record with 3.8 GW in 2023. OSV demand is fueled by the UK and Germany. For example, the UK alone budgeted more than USD 23.2 Billion in its latest budget to finance renewable energy infrastructure, an industrial report stated. A move being made by leading players includes Maersk Supply Service and DOF Group for innovation in fuel-efficient vessels with low emissions. OSVs are encouraged by such regulations of the European Union demanding green shipping solutions. Thus, hybrid and electric OSVs are gaining popularity day by day. Digitalization in navigation and safety, a growing trend, enhances its operational efficiency, thus increasing Europe's market share among OSVs.

Latin America Offshore Support Vessels Market Analysis

Latin America's OSV market is expanding due to increased offshore oil and gas operations, especially in Brazil and Mexico. The National Petroleum Agency reports that no offshore oil block auctions are scheduled for 2024, but new auction notices will be published in 2025. This is due to new guidelines set by the National Energy Policy Council in December 2023 in defining local content rules in future bidding cycles, VALOR INTERNACIONAL reported. But the ANP auctioned in December 2023 offers 165 deep-water areas in the Pelotas Basin, off southern state of Rio Grande do Sul. Petrobras managed to secure 29 blocks and Shell and CNOOC joined the fray (OGJ). The December 2023 auction has already been driving demand for Offshore Support Vessels (OSVs) in Brazil as the country keeps on expanding its offshore exploration activities.

Middle East and Africa Offshore Support Vessels Market Analysis

Increasing offshore drilling in the region, together with regional investment in offshore renewables, forms the Middle East and Africa OSV market. As estimated by the International Renewable Energy Agency (IRENA), by 2030, the UAE will develop an installed offshore wind capacity of 3 GW, making this increase the demand for OSVs. In the region, Africa countries such as Angola and Nigeria dominate with approximately 60% regional offshore oil production. Leaders are Topaz Energy and Logistics, among others, focused on the regional demand; they are offering specialized ships. Green technologies and encouraging government policies on maritime innovations support the sustainable growth curve. The shift in the trend of OSV in this region, by diversification into renewable energy projects is a major shift in their industry dynamics.

Competitive Landscape:

Leading manufacturers are consistently modernizing their fleets with newer, technologically advanced vessels. Contemporary OSVs are crafted to be more fuel-efficient, environmentally friendly, and outfitted with cutting-edge equipment to adapt to the evolving needs of offshore operations. Additionally, many firms are broadening their service offerings by including inspection and survey services, subsea operations, and support for renewable energy. Moreover, several companies are emphasizing sustainability and eco-friendly practices in the sector, taking steps such as using cleaner fuels, incorporating renewable energy solutions, and encouraging environmentally conscious operations. Furthermore, prominent manufacturers are dedicating resources to research and development (R&D) efforts to enhance vessel capabilities and improve operational efficiency.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bourbon

- Cyan Offshore Pty Ltd.

- DOF Group ASA

- Grupo CBO

- Havila Shipping ASA

- Hornbeck Offshore

- Nam Cheong Limited

- Ostensjo Rederi

- Pacific Radiance Ltd.

- Sea 1 Offshore

- SEACOR Marine

- Solstad

- Tidewater Inc.

- Vroon

Recent Developments:

- December 2024: Geoquip Marine added its new vessel, taking form after the conversion of Geoquip Silvretta into a geotechnical services platform from the supply vessel of its class. It completes installation, to be finished within spring 2025 of its biggest drilling rig-GMTR150-to undertake most energy projects for offshore use along the north Europe shore.

- November 2024: Bourbon Logistics has been awarded a new fully integrated logistics contract in Namibia by an Oil & Gas operator for a 6-month exploration campaign. The contract includes freight forwarding, logistics base services, and marine services. During the project, 50 staff will be employed, 96% of whom will be Namibian.

- September 2024: Maersk Supply Service has obtained a contract with Cenovus Energy for a new Field Support Vessel. To be built by Crist S.A. in Poland and delivered in 2027, the 110-meter-long, DP3 ice-classed vessel will provide field support to operations at White Rose Field offshore Canada.

- August 2024: Havila Shipping ASA has been awarded a contract by Peterson Den Helder for its platform supply vessel, Havila Borg. The contract is undisclosed in value and is for two wells for 200 days, with options for eight more wells. The operations are expected to start within two weeks.

- April 2023: Bourbon Marine & Logistics declared its collaboration with Tethys Marine & Logistics, a Guyanese company. Through this collaboration, they are able to fully comply with the latest local content rules and become Guyana's first indigenous operator of offshore support vessels.

Offshore Support Vessels Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Anchor Handling Towing Supply Vessel, Platform Supply Vessel, Fast Supply Intervention Vessel, Multi-Purpose Service Vessel, Others |

| Water Depths Covered | Shallow Water, Deepwater |

| Fuels Covered | Fuel Oil, LNG |

| Service Types Covered | Technical Services, Inspection and Survey, Crew Management, Logistics and Cargo Management, Anchor Handling and Seismic Support, Others |

| Applications Covered | Oil and Gas Applications, Offshore Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bourbon, Cyan Offshore Pty Ltd., DOF Group ASA, Grupo CBO, Havila Shipping ASA, Hornbeck Offshore, Nam Cheong Limited, Ostensjo Rederi, Pacific Radiance Ltd., Sea 1 Offshore, SEACOR Marine, Solstad, Tidewater Inc., Vroon, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the offshore support vessels market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global offshore support vessels market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the offshore support vessels industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Offshore Support Vessels (OSVs) are specialized ships designed to support offshore oil and gas exploration, production, and renewable energy projects. They provide vital services such as transporting equipment, personnel, and supplies, as well as offering logistical support, anchor handling, and subsea operations.

The offshore support vessels market was valued at USD 46.2 Billion in 2024.

IMARC estimates the global offshore support vessels market to exhibit a CAGR of 3.2% during 2025-2033.

The market is driven by increasing offshore exploration and production activities, expanding renewable energy projects, fleet modernization, and technological advancements such as dynamic positioning systems and fuel-efficient designs.

Anchor handling towing supply vessels represented the largest segment by type in 2024, driven by their robust design and adaptability for managing anchors and mooring lines.

Shallow water OSVs lead the market by water depth, owing to their maneuverability and suitability for operations in coastal and continental shelf regions.

Fuel oil is the leading segment by fuel, driven by their reliability and suitability for long voyages and offshore operations.

The oil and gas application is the leading segment by application, driven by the growing offshore exploration and production activities to meet rising global energy demand.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global offshore support vessels market include Bourbon, Cyan Offshore Pty Ltd., DOF Group ASA, Grupo CBO, Havila Shipping ASA, Hornbeck Offshore, Nam Cheong Limited, Ostensjo Rederi, Pacific Radiance Ltd., Sea 1 Offshore, SEACOR Marine, Solstad, Tidewater Inc., Vroon, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)