Off Highway Vehicle Engine Market Size, Share, Trends and Forecast by Power Output, Engine Capacity, Fuel Type, and Region, 2025-2033

Off Highway Vehicle Engine Market Size and Share:

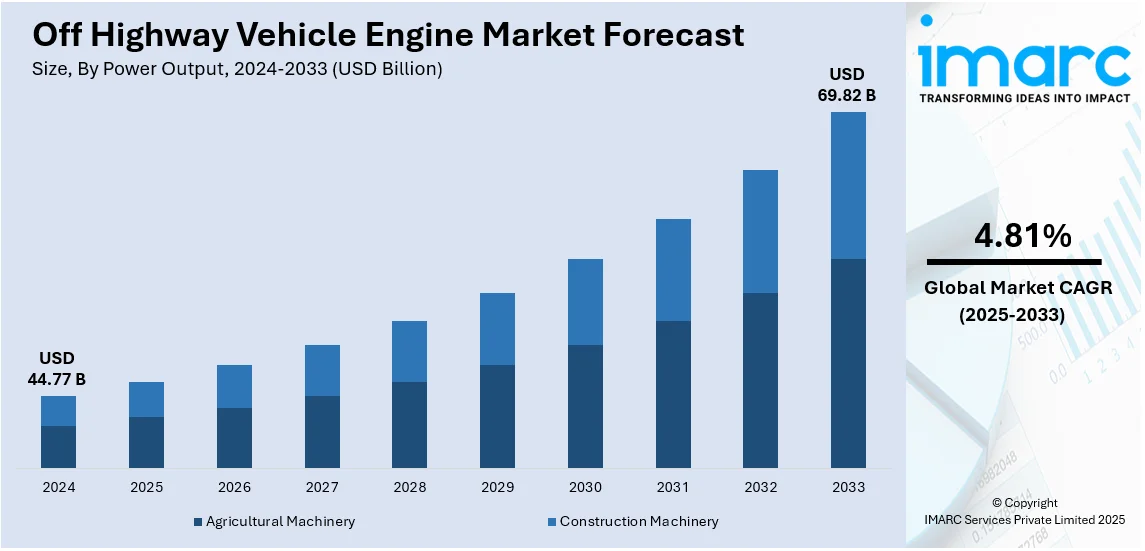

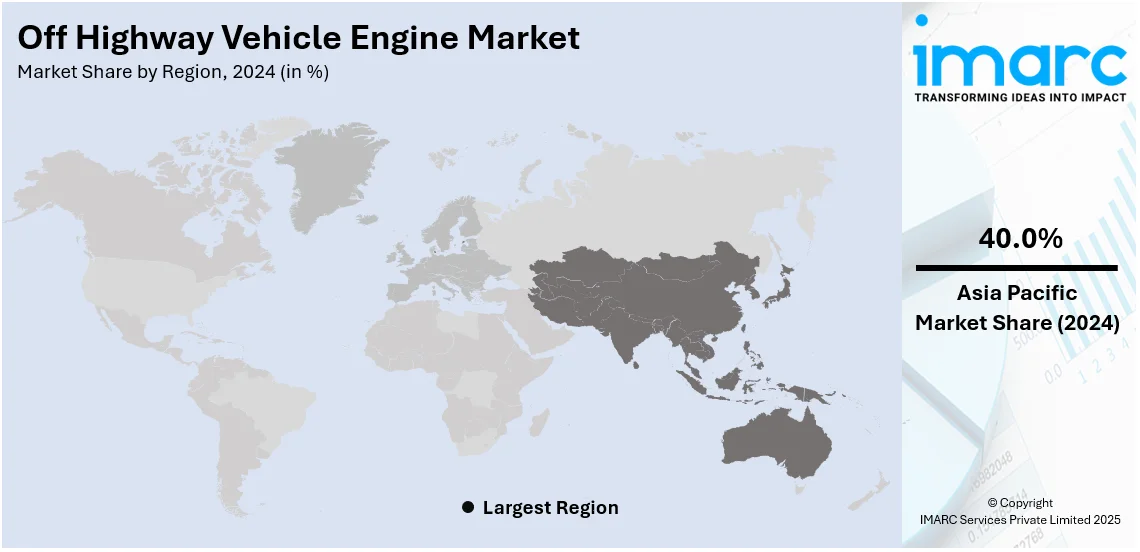

The global off highway vehicle engine market size was valued at USD 44.77 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.82 Billion by 2033, exhibiting a CAGR of 4.81% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 40.0% in 2024. The growth of the region is because of rapid urbanization, expanding construction and mining activities, increasing mechanized farming, strong manufacturing capabilities, and government investments in infrastructure, driving the demand for high-performance off-highway vehicle engines across various applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 44.77 Billion |

|

Market Forecast in 2033

|

USD 69.82 Billion |

| Market Growth Rate 2025-2033 | 4.81% |

The transition to mechanized agriculture is contributing to the need for powerful tractors, harvesters, and various farming machinery. Engines in this category are engineered for optimal efficiency, longevity, and fuel conservation to aid extensive agriculture. Precision farming technologies and automation are further accelerating the need for advanced engine solutions. Moreover, manufacturers are creating advanced engine technologies featuring turbocharging, electronic fuel injection, and hybrid powertrains to enhance performance. These technologies enhance fuel efficiency, boost power output, and improve durability, rendering machinery more dependable in challenging applications. Intelligent diagnostics and digital control systems improve engine efficiency and lower maintenance expenses. Besides this, the growing trend of equipment leasing and rentals in construction and mining industries is catalyzing the demand for efficient, dependable, and easily maintainable engines. Rental businesses focus on robust engines that feature reduced operating expenses and longer lifetimes to optimize their return on investment, prompting manufacturers to create enduring and economical options.

The United States is a crucial segment in the market, driven by the growing preference for leasing heavy machinery, which requires reliable, fuel-efficient engines that offer low maintenance and long operational life. Additionally, the development of fuel-agnostic engines is transforming the off-highway vehicle engine market by offering flexibility, improved fuel efficiency, and reduced emissions. These engines are designed to operate on multiple fuel types, including diesel, natural gas, and alternative fuels, allowing operators to adapt to changing fuel regulations and sustainability goals. In 2024, Cummins announced the launch of its next-generation X15 diesel engine, which was part of the HELM 15-liter fuel-agnostic platform. This engine complied with U.S. EPA and CARB 2027 regulations, offering improved fuel efficiency, lower emissions, and compatibility with multiple fuel types. It supported North America's heavy-duty on-highway market.

Off Highway Vehicle Engine Market Trends:

Rising Agricultural Mechanization and Investment in Innovation

The growing use of agricultural machinery is changing farming methods, improving efficiency, and decreasing reliance on manual labor. Modern machinery has become essential for land development, sowing, gathering, and post-harvest processing, boosting the need for efficient engines and sturdy parts. Governing bodies and private entities are putting resources into updating agriculture, encouraging advancements in machinery and automation. The industry is experiencing substantial capital inflows, exemplified by the USD 200 million investment from the Gates Foundation and the UAE, which is aiding advancements in precision agriculture, intelligent irrigation, and automated harvesting. These efforts encourage the broad use of efficient tractors, harvesters, and additional machinery, speeding up the transition to sustainable and high-yield agricultural methods. Moreover, increasing food demand and the necessity for effective resource use further drive agricultural mechanization, establishing it as a significant factor in market growth in both developing and developed countries.

Expanding Mining Activities and Rising Investments in Metallurgical Industry

The increasing magnitude of global mining operations is fueling the need for high-performance engines in off-highway vehicles, especially in excavators, haul trucks, and drilling machinery. Increasing infrastructure development, urban growth, and industrial expansion have heightened the demand for minerals and metals, leading mining firms to implement more effective and resilient machinery. Both governments and private investors are driving this expansion by making significant foreign direct investments (FDI) in the industry. For example, the India Brand Equity Foundation indicated that FDI inflows in the metallurgical sector reached USD 17.46 billion from April 2000 to December 2023, emphasizing the sector's appeal. This funding facilitates the creation of cutting-edge mining machinery that offers increased power output, enhanced fuel efficiency, and reduced emissions. Moreover, innovations like automated mining equipment and hybrid engines are increasingly improving operational efficiency. With the ongoing growth of global mining operations, the need for robust and dependable off-highway engines is anticipated to increase considerably.

Technological Advancements

Ongoing advancements in off-highway vehicle engines are fueling the market expansion by enhancing efficiency, power generation, and operational dependability. Producers are concentrating on cutting-edge engine innovations to satisfy the rising needs of construction, mining, and agriculture. The introduction of John Deere’s 85 P-Tier excavators in 2023, which showcases an 18% boost in horsepower and a turbocharged engine for improved performance at high altitudes, underscores this trend. These improvements boost fuel efficiency, torque output, and overall machinery productivity, making them ideal for challenging earthmoving and construction tasks. Moreover, innovations in technology, such as electronic control systems, emissions reduction methods, and hybrid powertrains, are influencing the development of next-generation equipment. These advancements allow for improved performance in harsh conditions, lowering maintenance expenses and downtime. With ongoing investments in research and development (R&D) by companies, the market is experiencing a transition towards high-performance, fuel-efficient engines, which further strengthens the demand for advanced power solutions for off-highway vehicles.

Off Highway Vehicle Engine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global off highway vehicle engine market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on power output, engine capacity, and fuel type.

Analysis by Power Output:

- Agricultural Machinery

- Upto 30 HP

- 31-50 HP

- 51-80 HP

- 81-140 HP

- 140+ HP

- Construction Machinery

- Upto 100 HP

- 101-200 HP

- 201-400 HP

- 400+ HP

Agricultural machinery engines range from small units under 30 HP for small farms to over 140 HP for industrial-scale farming. Engines with lower horsepower are suited for small farms, horticulture, and precision agriculture, providing fuel efficiency and cost savings. Mid-power engines ranging from 31 to 80 HP drive utility tractors and harvesters, enhancing efficiency for medium-sized farms with sophisticated hydraulic systems. High-capacity equipment in the 81-140 HP category is crucial for extensive commercial agriculture, incorporating precision farming techniques and improved fuel efficiency. Engines greater than 140 HP are utilized in large-scale agricultural enterprises, where enhanced productivity, durability, and sophisticated automation aspects promote their use.

Construction machinery engines vary from compact units under 100 HP for urban projects to over 400 HP for heavy-duty mining and infrastructure development. Low-power engines power mini excavators, skid-steer loaders, and compact loaders, which are commonly utilized in urban construction and landscaping because of their agility and effectiveness. Engines in the mid-range (101-200 HP) power backhoe loaders and medium wheel loaders, essential for road construction and infrastructure development. The 201-400 HP category fuels large excavators, graders, and bulldozers, managing tough tasks in mining and extensive construction endeavors. Engines exceeding 400 HP prevail in high-performance equipment like mining trucks and big dozers, providing exceptional power for severe operating conditions.

Analysis by Engine Capacity:

- <5L Capacity

- 5L-10L Capacity

- >10L Capacity

<5L capacity stand as the largest component in 2024, holding 46.7% of the market share. Engines with a capacity of less than 5 liters lead the market because of their efficiency, adaptability, and affordability across multiple uses, such as compact construction tools, small farming equipment, and material handling machines. These engines deliver adequate power for light to medium-duty jobs while ensuring fuel efficiency and reduced emissions, in accordance with strict environmental standards. Their small dimensions allow for simpler incorporation into more compact devices, decreasing total vehicle weight and improving agility. Improvements in engine technology, such as turbocharging and electronic fuel injection, enhance performance while meeting changing emission regulations. The increasing need for compact construction and agricultural equipment, especially in urban infrastructure initiatives and precision farming, further propels market acceptance. Moreover, reduced maintenance expenses and extended service life increase their attractiveness to fleet managers. As sectors pursue effective and dependable power options, sub-5L engines remain the favored selection for numerous off-highway uses.

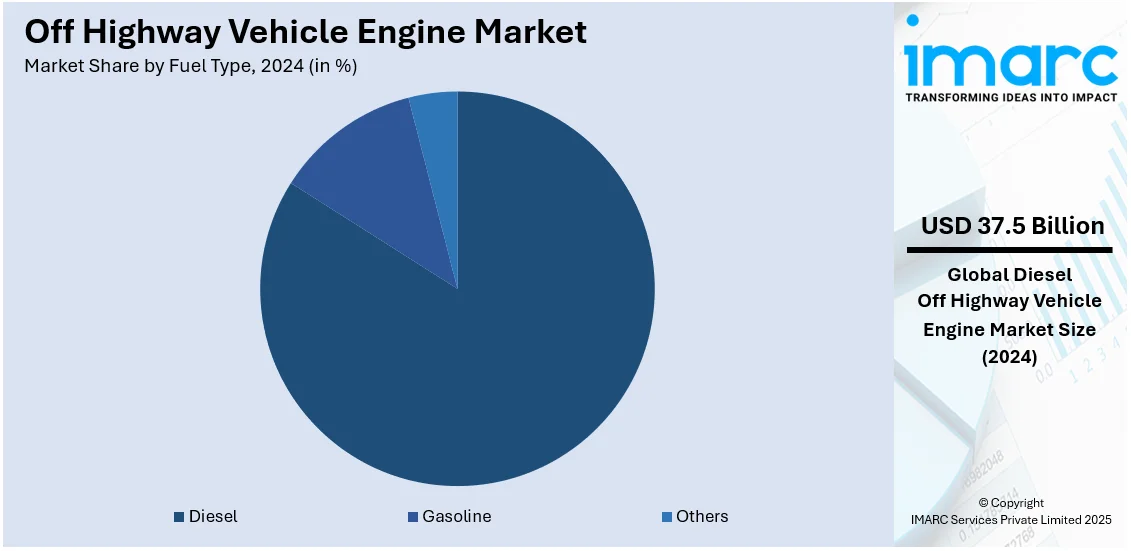

Analysis by Fuel Type:

- Diesel

- Gasoline

- Others

Diesel represents the largest segment, accounting 83.8% of market share in 2024. Diesel leads the market owing to its high energy density, excellent torque performance, and fuel efficiency, which make it perfect for challenging applications in agriculture, mining, and construction. Diesel engines provide enhanced durability and dependability, guaranteeing steady performance during heavy loads and challenging operating environments. Their capacity to produce greater torque at reduced RPMs improves operational efficiency, especially in heavy-duty equipment. Moreover, progress in diesel engine technology, such as enhanced fuel injection systems and turbocharging, leads to reduced emissions and increased efficiency, in line with changing regulatory requirements. The extensive accessibility of diesel fuel and a robust refueling network also reinforce its prevalence. Despite increasing interest in alternative energy sources, diesel continues to be the favored option due to its economical nature and extended durability. Ongoing advancements in emissions control technologies, such as selective catalytic reduction and diesel particulate filters, continue to uphold its significance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. It dominates the market due to rapid urbanization, industrialization, and rising demand for advanced machinery in construction, mining, and agriculture. Expanding infrastructure projects and increasing mechanized farming are driving the need for high-performance engines with enhanced fuel efficiency, durability, and emission compliance. For instance, in 2025, India and South Korea signed an agreement to enhance cooperation in logistics and infrastructure development. The collaboration aims to improve logistics efficiency and connectivity in India, with potential for future expansion into broader infrastructure areas. Strong manufacturing capabilities support large-scale engine production, ensuring cost-effectiveness and technological advancements. Government investments in infrastructure development and industrial expansion further boost the demand for heavy-duty equipment, increasing engine adoption. Additionally, stringent emission norms encourage innovation in hybrid and fuel-efficient engines, shaping market dynamics. Advancements in engine thermal management, power output, and electronic control systems enhance operational efficiency, are further supporting the market growth.

Key Regional Takeaways:

United States Off Highway Vehicle Engine Market Analysis

In North America, the market portion held by the United States was 87.80% of the overall total. United States experiences increased demand for off-highway vehicle engines as the automotive sector witnesses significant investment, leading to advancements in engine efficiency and performance. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. Manufacturers focus on enhancing power output, fuel efficiency, and durability to meet the evolving requirements. The integration of electronic control units and telematics in off-highway vehicle engines allows real-time monitoring, ensuring optimized operations and reduced maintenance costs. The emphasis on sustainable energy solutions has further driven innovations in hybrid and alternative fuel-based engines. The automotive sector’s financial backing has facilitated research into reducing engine weight while maintaining structural integrity, contributing to enhanced productivity. The expansion of infrastructure projects has increased the necessity for robust machinery, reinforcing the demand for high-performance off-highway vehicle engines. The incorporation of advanced cooling systems and turbocharging techniques has improved efficiency, making engines more adaptable to diverse environmental conditions. The growing reliance on automated and semi-autonomous machinery has propelled the adoption of technologically advanced off-highway vehicle engines, aligning with industry requirements for enhanced operational efficiency and sustainability.

Europe Off Highway Vehicle Engine Market Analysis

Europe witnesses growing off-highway vehicle engine adoption as automotive manufacturers prioritize reducing emissions through innovative engine designs. For instance, the EU has a set target for 2030 of a 55 % net reduction in greenhouse gas emissions. The implementation of direct fuel injection and variable valve timing has optimized combustion efficiency, minimizing fuel wastage and lowering carbon footprints. Advances in combustion chamber mixing techniques enhance fuel-air distribution, improving engine performance across various applications. Exhaust gas recycling systems have been integrated to curtail harmful emissions, aligning with stringent environmental regulations. The transition toward hybrid and alternative fuel-powered engines reflects industry efforts to meet sustainability goals. Increased investment in research and development has accelerated the adoption of energy-efficient off-highway vehicle engines, ensuring compliance with evolving emission standards. This market growth is also supported by the expansion of the construction sector. For instance, in June 2024, compared to May 2024, seasonally adjusted construction production increased by 1.7% in the euro area and by 1.4% in the EU. This surge in construction activities is driving the demand for high-performance off-highway vehicle engines, further boosting market expansion.

Asia Pacific Off Highway Vehicle Engine Market Analysis

Asia-Pacific sees rising off-highway vehicle engine demand as investment in agriculture drives the need for powerful and efficient engines to support modernized farming equipment. For instance, in 2020, the Indian government will invest approximately USD 4.32 Million in 346 agritech startups, aiming to boost the growth of the agricultural sector. The adoption of precision agriculture and mechanized farming techniques has increased reliance on high-performance engines that offer improved fuel efficiency and durability. Technological advancements in engine design, including optimized combustion systems and enhanced air filtration mechanisms, contribute to prolonged engine lifespan and reduced emissions. Expanding irrigation projects and government incentives for farm mechanization have further accelerated demand for off-highway vehicle engines. The development of multi-functional agricultural machinery has led to innovations in variable-speed engines, allowing efficient adaptation to different field conditions. Increased usage of tractors, harvesters, and other heavy-duty equipment has propelled the need for engines with high torque output and minimal maintenance requirements.

Latin America Off Highway Vehicle Engine Market Analysis

Latin America sees increasing off-highway vehicle engine demand due to the expansion of the mining sector and the rising need for load haul dump machines to support large-scale excavation activities. For instance, Latin America accounts for about 48% of the global copper reserves, 20% of the global gold reserves, over 60% of the global lithium reserves, 50% of the global silver reserves, and an unspecified percentage of the global potash reserves. Enhanced engine durability and high torque performance have become essential for operating in extreme mining conditions, ensuring minimal downtime. Advancements in fuel-efficient engine designs reduce operational costs while maintaining high productivity. The integration of telematics and remote monitoring technologies allows real-time diagnostics, preventing unexpected failures and optimizing engine performance.

Middle East and Africa Off Highway Vehicle Engine Market Analysis

Middle East and Africa experience growing off-highway vehicle engine adoption driven by the expansion of the construction sector and increased usage of forklift trucks for transporting heavy building materials across rough terrain. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. The demand for high-powered engines with superior load-handling capabilities has intensified, ensuring efficiency in material transportation. Fuel efficiency improvements and enhanced engine durability contribute to reduced operational costs in large-scale projects. The incorporation of advanced hydraulic systems and electronic controls has optimized engine performance, improving maneuverability in challenging environments.

Competitive Landscape:

Major participants in the market are concentrating on technological innovations, adherence to emission standards, and improving fuel efficiency to boost performance. They are putting resources into research and development (R&D) to incorporate hybrid and electric powertrains, enhance thermal management, and maximize torque output. Strategic alliances and acquisitions are broadening their product offerings and market presence. Businesses are enhancing their distribution systems and post-sale services to boost client assistance. Digitalization, which encompasses telematics and predictive maintenance technologies, is improving operational efficiency. Moreover, manufacturers are adapting to changing regulatory requirements by creating low-emission and high-efficiency engines to remain competitive in the global marketplace. For instance, in 2024, Volvo Trucks announced plans to launch trucks powered by hydrogen combustion engines, starting on-road tests in 2026. The trucks aimed to decarbonize heavy transport by using green hydrogen, offering a complement to other sustainable options like electric and fuel cell trucks. This initiative supports Volvo's net zero goal and provides an alternative for regions with limited charging infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the off highway vehicle engine market with detailed profiles of all major companies, including:

- AB Volvo

- AGCO Corporation

- Caterpillar Inc.

- Cummins Inc.

- Deere & Company

- Deutz AG

- Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.)

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation

- Mahindra & Mahindra Ltd.

- Weichai Power Co. Ltd

- Yanmar Holdings Co. Ltd.

Latest News and Developments:

- November 2024: The German PoWer consortium, led by Mahle, developedmhydrogen-powered off-highway vehicle engines for construction and agriculture. The three-year project, funded with €5.1 Million, brings together OEMs, suppliers, and academics. Supported by TÜV Rheinland, it aims to advance hydrogen-engine powertrain concepts.

- February 2024: Cummins unveiled its H2 internal combustion engine optimized for off-highway vehicle engines at Intermat 2024. The upgraded B6.7H engine features enhanced durability and components tailored for heavy-duty applications in harsh environments. Cummins aimed to launch all variants by 2026-27, enabling an easier transition from diesel to hydrogen power.

- January 2024: Bosch Rexroth partnered with Modine to integrate EVantage thermal management systems into its ELION portfolio for electrified off-highway vehicle engines. This collaboration enhanced efficiency in electrified machinery used in construction, agriculture, and mining. The partnership aims to support global adoption of sustainable off-highway vehicle solutions.

- April 2023: New Holland introduced the TE6 straddle tractor range, designed for narrow vineyards requiring compact and maneuverable off-highway vehicle engines. The new models optimized vineyard operations with advanced performance and efficiency. The company plans commercial availability by the end of 2023.

Off Highway Vehicle Engine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Outputs Covered |

|

| Engine Capacities Covered | <5L Capacity, 5L-10L Capacity, >10L Capacity |

| Fuel Types Covered | Diesel, Gasoline, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, AGCO Corporation, Caterpillar Inc., Cummins Inc., Deere & Company, Deutz AG, Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.), J C Bamford Excavators Ltd., Komatsu Ltd., KUBOTA Corporation, Mahindra & Mahindra Ltd., Weichai Power Co. Ltd and Yanmar Holdings Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the off highway vehicle engine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global off highway vehicle engine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the off highway vehicle engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The off highway vehicle engine market was valued at USD 44.77 Billion in 2024.

The off highway vehicle engine market is projected to exhibit a CAGR of 4.81% during 2025-2033, reaching a value of USD 69.82 Billion by 2033.

Rising infrastructure projects, mechanized agriculture, and mining activities are fueling the demand for off-highway vehicle engines. Stricter emissions regulations drive innovation in fuel efficiency and hybrid powertrains. Advancements in engine durability, torque, and thermal management enhance performance, while increasing construction equipment rentals further support the market growth.

Asia Pacific currently dominates the off highway vehicle engine market, accounting 40.0% in 2024. The dominance of the region is because of rapid urbanization, expanding construction and mining activities, increasing mechanized farming, strong manufacturing capabilities, and government investments in infrastructure, driving the demand for high-performance off-highway vehicle engines across various applications.

Some of the major players in the off highway vehicle engine market include AB Volvo, AGCO Corporation, Caterpillar Inc., Cummins Inc., Deere & Company, Deutz AG, Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.), J C Bamford Excavators Ltd., Komatsu Ltd., KUBOTA Corporation, Mahindra & Mahindra Ltd., Weichai Power Co. Ltd and Yanmar Holdings Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)