Odor Control System Market Size, Share, Trends and Forecast by System Type, End Use Industry, and Region, 2025-2033

Odor Control System Market Size and Share:

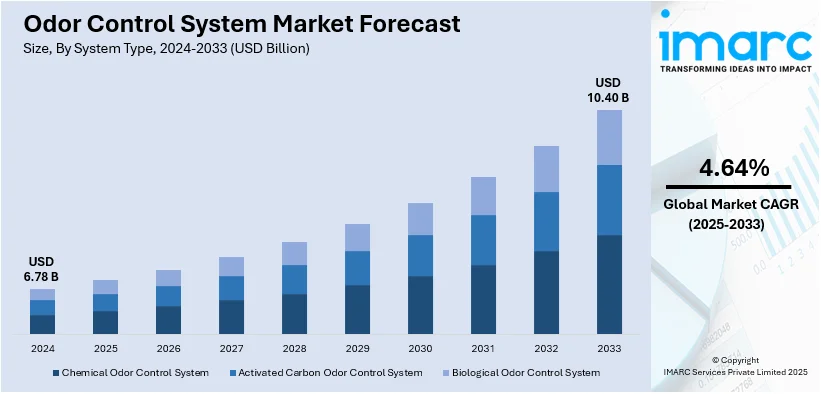

The global odor control system market size was valued at USD 6.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.40 Billion by 2033, exhibiting a CAGR of 4.64% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 42.4% in 2024. This leadership can be attributed to rapid industrialization, strict environmental regulations, rising urbanization, and increasing wastewater treatment facilities. High population density and expanding industries like chemicals, food processing, and wastewater management further drive demand for advanced odor control solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.78 Billion |

|

Market Forecast in 2033

|

USD 10.40 Billion |

| Market Growth Rate (2025-2033) | 4.64% |

Rapid industrialization across the globe is one of the key factors driving the growth of the market. Furthermore, rising environmental consciousness among the masses is also augmenting the market growth. Since odor control systems aid in improving the air quality emitted from the manufacturing plants during oil refining, synthesis of chemical compounds, treatment of materials and processing of agricultural products, they are increasingly being utilized across industrial setups. Moreover, these systems are also installed in public toilets, bus and railway stations, hospitals, shopping complexes and other spaces to minimize pungent odors and maintain public hygiene. In comparison to the traditionally used activated carbon and chemical treatments, odor control systems are more cost-effective, convenient to operate and ecologically cleaner. Additionally, various technological advancements, such as the development of hybrid odor control systems, are acting as other growth-inducing factors. These innovative systems filter the air through multiple stages to eliminate the odorants and are available in combination variants of chemical and biological adsorption. Other factors, including the implementation of favorable government policies, along with extensive research and development (R&D) activities, are anticipated to drive the market further.

The United States is a key market for odor control systems, driven by stringent environmental regulations and increasing industrial emissions control requirements. The expansion of wastewater treatment facilities, food processing plants, and chemical industries necessitates advanced odor management solutions. Technological advancements in biofiltration, activated carbon adsorption, and chemical scrubbing enhance efficiency and compliance. Rising public awareness of air quality and stricter regulatory enforcement further support market growth. Additionally, the growing adoption of smart monitoring systems and sustainable odor control technologies is shaping industry developments, ensuring operational efficiency and environmental safety across various sectors. For instance, in December 2024, Microban International launched its new nature-based odor control technology, named Freshology. This leading-edge technology provides upgraded performance by facilitating broad range of odor neutralization, maintaining textile freshness for a prolonged duration.

Odor Control System Market Trends:

Stringent Environmental Regulations:

The governments and regulatory agencies in almost every corner of the globe, from the European Environment Agency (EEA) to the U.S. Environmental Protection Agency (EPA) and even China's Ministry of Ecology and Environment, have been implementing tougher air quality and emissions standards. For instance, in December 2024, European Union implemented an upgraded Ambient Air Quality Directive, striving to align their 2030 clean air objectives with WHO's strategies. This revised Directive reduces the fine particulate matter limit value (annual) by above half. This new policy will aid the region to attain zero air pollution target by the year 2050. Such regulations against pollutants like volatile organic compounds or hydrogen sulfide, and other smelly chemicals and substances are making industries, whether in wastewater treatment, food processing, or chemical manufacturing, rely on advanced odor control solutions. Compliance with these regulations is crucial to avoid penalties; thus, the demand for efficient odor management systems is a resultant growth driver of this market.

Growing Industrialization and Urbanization:

As reported by World Bank, currently, around 4.4 Billion individuals globally (56%) reside in urban areas. This trend is suspected to thrive continuously, with the urban population estimated to more than double by the year 2050, when close to 7 out of 10 individuals will reside in urban areas. As urban areas grow, industrial sites and waste treatment facilities frequently exist alongside residential neighbourhoods, making Odor management crucial for safeguarding public health and contentment. The growth of these industries, including water treatment for wastewater, food processing, chemical manufacturing, and waste management, in turn keeps increasing the need for efficient odor control systems to ensure air quality and safety at the workplaces. For example, in March 2023, Aquatech International partnered with Fluid Technology Solutions, Inc., which is a prominent advanced membrane and separation technologies developer. They are working towards a next-generation solution in improved brine concentration, advanced separation, and water reuse. These innovations are expected not only to enhance process efficiency but also to address odor emissions, thereby further increasing the need for effective odor control technologies within various industries.

Rising Awareness of Environmental and Health Concerns:

As more awareness of air pollution's ill effects on public health and the environment is achieved, businesses and municipalities are finding investment in odor control technologies for improvement in air quality and to fortify community relationships. As established by the World Health Organization, 7 million deaths are experienced annually as a result of air pollution, classifying it as a significant environmental risk factor. With rising awareness, sophisticated odour management systems are being implemented in wastewater, food processing, and chemical manufacturing industries, as organizations strive to reduce emissions causing harm to the environment and increasingly comply with stricter environmental regulation.

Odor Control System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global odor control system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on system type and end use industry.

Analysis by System Type:

- Chemical Odor Control System

- Activated Carbon Odor Control System

- Biological Odor Control System

Activated carbon odor control system leads the market with around 43.6% of market share in 2024. These systems are widely used due to their high adsorption capacity and efficiency in removing volatile organic compounds (VOCs), hydrogen sulfide, and other odor-causing pollutants. These systems utilize activated carbon media to trap and neutralize airborne contaminants, making them ideal for industries requiring stringent odor management. The technology is preferred for its effectiveness in handling a broad spectrum of odors, long service life, and minimal environmental impact. Industries such as wastewater treatment, chemical processing, and food manufacturing rely on activated carbon systems to comply with regulatory standards and improve air quality. Additionally, advancements in impregnated carbon technology enhance odor removal efficiency, extending system longevity and reducing operational costs. The growing emphasis on sustainable and low-maintenance odor control solutions is further driving demand for activated carbon-based systems. Increasing adoption in municipal and industrial applications underscores their role in achieving regulatory compliance and maintaining environmental sustainability.

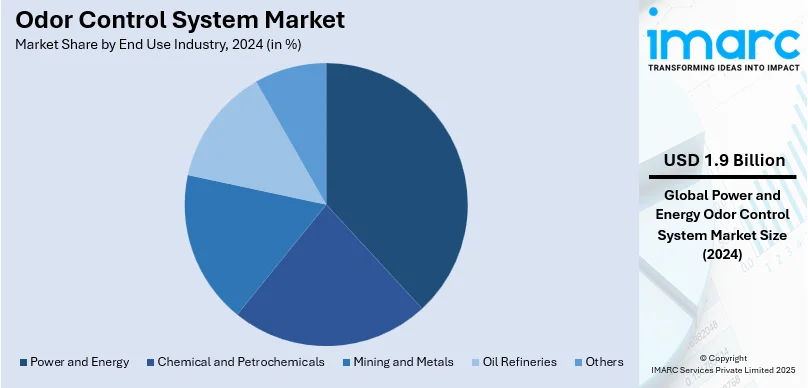

Analysis by End Use Industry:

- Chemical and Petrochemicals

- Mining and Metals

- Power and Energy

- Oil Refineries

- Others

Power and energy leads the market with around 27.6% of market share in 2024, due to its extensive emissions and gas treatment requirements. Power plants, oil refineries, and gas processing facilities generate odorous compounds, including sulfur-based gases and nitrogen oxides, necessitating efficient odor control solutions. Regulatory mandates enforcing strict air quality standards drive the adoption of advanced technologies such as chemical scrubbers, biofiltration, and activated carbon systems. The expansion of renewable energy projects, including biomass and waste-to-energy plants, further increases demand for odor management solutions. These facilities process organic waste, producing emissions that require effective mitigation to prevent environmental and community impact. Additionally, technological advancements in odor control systems enhance operational efficiency while reducing maintenance costs, making them a preferred choice for large-scale industrial applications. The sector's focus on sustainable practices and regulatory compliance continues to drive investments in advanced odor mitigation technologies.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.4%. The key drivers for the odor control system market are rapid growth in petrochemical demand and expansion of renewable energy in the Asia-Pacific region. Industry reports indicate that two-thirds of global petrochemical demand is expected to come from Asia-Pacific over the next decade. Increased demand will lead to the requirement for advanced odor control solutions to manage the emissions and odors produced in petrochemical plants and related industries. The same time, renewable energy is coming to the fore in the region, and according to industry estimates, renewables will account for 30% to 50% of the power generation mix by 2030. As more industries turn towards biomass power generation, waste-to-energy plants, and solar/wind energy production, the necessity for effective odor control technologies in managing biogenic odors, waste emissions, and hydrogen sulfide is also on the rise. This means that odor control systems are an important aspect for both industrial and environmental health in the fast-emerging Asia-Pacific market.

Key Regional Takeaways:

United States Odor Control System Market Analysis

In 2024, United States accounted for 85.40% of the market share in North America. The growth of the U.S. refining and petrochemical industry is a prime growth driver for the odor control system market in the United States. CISA reports that 459 petrochemical plants as well as refineries in 39 U.S. states account for processing 18.8 Million barrels of crude oil daily, which makes up almost 20% of the global refining capacity. This large quantity of oil and petrochemicals produces significant volumes of odoriferous gases and emissions, requiring effective odor control solutions to abide by strict environmental regulations and provide safety for the workers and community. The demand for advanced odor control systems, such as biofilters, chemical scrubbers, and activated carbon solutions, is rising to manage hydrocarbon odors and other industrial emissions. Additionally, the continued regulatory push on air quality standards in refining, petrochemical processing, and related industries further boosts the need for robust and efficient odor management technologies, thus driving expansion in the market.

Europe Odor Control System Market Analysis

The main driver for this odor control system market is noted to be the expansion in electricity generation in Europe. As per industry reports, the electricity generation in the European energy market is estimated to be 5.25 trillion kWh by 2025, and an annual growth rate of 1.58% is anticipated between 2025 and 2029. The more electricity demand grows, especially in power plants, industrial facilities, and waste-to-energy plants, the greater the importance of odor control systems that will reduce the release of harmful gases and unpleasant odors created in the process of electricity production. The growth in the use of biomass to generate power and waste incineration, coupled with natural gas processing, provides a higher increase in the need for odor control services to be implemented against environmental policies and ensure public health. Such technologies as biofilters, scrubbers, and ozone treatment systems are increasingly being found in demand to control emissions and maintain air quality standards for Europe's expanding energy sector.

North America Odor Control System Market Analysis

North America holds a crucial share in the global odor control system market, driven by stringent environmental regulations and rising industrial emissions management. Regulatory organizations, including EPA and the Canadian Environmental Protection Act (CEPA) mandate strict odor control measures across industries, including wastewater treatment, manufacturing, and food processing. Growing urbanization and expanding industrial activities are increasing the demand for advanced odor mitigation technologies, including biofilters, activated carbon systems, and chemical scrubbers. For instance, as per industry reports, in July 2024, the population trends across Canada highlighted an active concentration in urban zones, with around 74.8% of the people living in census metropolitan areas, reflecting an elevation of 0.4% from the year 2023. In addition to this, the region’s robust emphasis on sustainable and energy-efficient solutions is accelerating the utilization of eco-friendly odor control systems. Technological advancements, along with high investment in research and development, are further enhancing system efficiency and operational performance. The presence of key market players and increasing adoption of smart monitoring solutions are supporting continued market expansion in North America.

Latin America Odor Control System Market Analysis

The record-high energy investment of USD 185 Billion in 2024, with the power sector accounting for over 35%, is a major growth driver for the odor control system market in Latin America, as per reports. According to the International Energy Agency (IEA), fossil fuels represent nearly 55% of the investment, while end-use accounts for less than 10%. The increase in investment in the energy sector, especially in fossil fuel power generation, biomass energy, and waste-to-energy plants, is creating a need for effective odor control systems to manage emissions, odors, and pollutants produced during these processes.

As energy production is expanding, mainly in oil refining, natural gas processing, and coal-fired power plants, there will be a growing demand for odor control technologies such as scrubbers, biofilters, and activated carbon systems. These are necessary to abide by environmental regulations and ensure public health, so the odor control system market will grow in this region.

Middle East and Africa Odor Control System Market Analysis

A huge growth driver for the odor control system market will be the anticipated rise in oil and natural gas production in the Middle East and Africa (MENA) region. According to an industry report, oil production is expected to grow by 75% and natural gas by triple fold in the MENA region by 2030, placing it in the frontline of the energy market of the world. Therefore, MENA's share of world oil production will increase from 35% today to 44% by 2030.

This rapid growth in oil and gas extraction and processing requires effective odor control systems to manage the emissions and odors generated during operations such as oil refining, natural gas processing, and petrochemical manufacturing. Technologies such as biofilters, scrubbers, and activated carbon systems are of significant importance because of environmental requirements. They should help ensure workers' safety and health and people's safety near production sites. Growing energy production in the region will lead to growing demand for reliable odor control solutions across MENA.

Competitive Landscape:

The competitive landscape is highlighted by the presence of key players focusing on technological advancements, strategic partnerships, and product innovation. For instance, in May 2024, Syneco Systems, Inc. entered into a tactical aliiance with Dorian Drake to proliferate its global footprint in odor control solutions segment. Dorian Drake will aid Syneco with its widespread distributional channel. Furthermore, leading companies invest in research and development to enhance filtration efficiency, energy optimization, and compliance with environmental regulations. Market participants engage in mergers, acquisitions, and geographic expansions to strengthen their market position. In addition, the rising demand for sustainable and cost-effective odor control solutions is driving competition among manufacturers offering biofiltration, activated carbon, and chemical scrubber technologies. Customization of odor control systems to meet industry-specific requirements further differentiates market players, fostering innovation and expanding product portfolios across various applications.

The report provides a comprehensive analysis of the competitive landscape in the odor control system market with detailed profiles of all major companies, including:

- AER Control Systems LLC

- Bulbeck Enviro Pty Ltd.

- Catalytic Products International Inc.

- Durr Systems Inc. (Dürr Aktiengesellschaft)

- Environmental Integrated Solutions Limited (CECO Environmental Corp.)

- Evoqua Water Technologies LLC

- Kch Services Inc.

- Olfasense UK Ltd.

- Romtec Utilities Inc.

- Tholander Ablufttechnik GmbH

Recent Developments:

- September 2024: Ecolab launched its new range of bio-based odor neutralizers for industrial areas. The solutions provided by this approach encompass industries in food processing and manufacturing, curbing odors while being part of supportive solutions for sustainability through reduced chemical emissions.

- July 2024: AAF International developed modular odor control units suitable for flexible use across various sectors such as wastewater, waste, and manufacturing industries. These modulable systems present increased flexibility when installed and enhance the easy integration of operational solutions for business performance.

- July 2024: Male' Water and Sewerage Company implemented an odor control system in one of its pump stations located within Male'. Air quality improved across the surroundings from the new installations.

Odor Control System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Chemical Odor Control System, Activated Carbon Odor Control System, Biological Odor Control System |

| End Use Industries Covered | Chemical and Petrochemicals, Mining and Metals, Power and Energy, Oil Refineries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AER Control Systems LLC, Bulbeck Enviro Pty Ltd., Catalytic Products International Inc., Durr Systems Inc. (Dürr Aktiengesellschaft), Environmental Integrated Solutions Limited (CECO Environmental Corp.), Evoqua Water Technologies LLC, Kch Services Inc., Olfasense UK Ltd., Romtec Utilities Inc. and Tholander Ablufttechnik GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the odor control system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global odor control system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the odor control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The odor control system market was valued at USD 6.78 Billion in 2024.

IMARC estimates the odor control system market to reach USD 10.40 Billion by 2033, exhibiting a CAGR of 4.64% during 2025-2033.

The market is propelled by stringent environmental policies, amplifying awareness regarding air quality management, and increase in adoption across industrial and municipal sectors. Growth in manufacturing, waste treatment, and chemical processing sectors further bolsters need. Enhancements in activated carbon technologies, filtration, or biofiltration, improve system adoption as well as efficacy.

Asia Pacific currently dominates the odor control system market, accounting for a share exceeding 42.4%. This dominance is fueled by magnified industrialization, strict environmental regulations, and escalating investments in wastewater treatment and air quality management across major economies like Japan, China, or India.

Some of the major players in the odor control system market include AER Control Systems LLC, Bulbeck Enviro Pty Ltd., Catalytic Products International Inc., Durr Systems Inc. (Dürr Aktiengesellschaft), Environmental Integrated Solutions Limited (CECO Environmental Corp.), Evoqua Water Technologies LLC, Kch Services Inc., Olfasense UK Ltd., Romtec Utilities Inc., Tholander Ablufttechnik GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)