O-ring Seals Market Report by Type (Synthetic Rubber, Thermoplastic Elastomer), Application (Electrical and Electronic Products, Aerospace Equipment, Energy, Food and Beverages, Healthcare and Medical, Automotive and Transportation, Machinery Manufacturing, and Others), and Region 2026-2034

Global O-ring Seals Market:

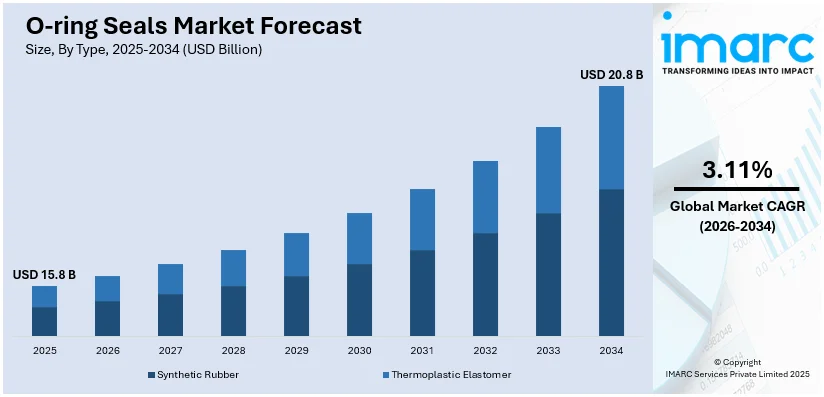

The global o-ring seals market size reached USD 15.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 20.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.11% during 2026-2034. Continuous development of new materials, along with the rising focus of key players on reducing maintenance and downtime costs, is propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2034 | USD 20.8 Billion |

| Market Growth Rate 2026-2034 | 3.11% |

O-ring Seals Market Analysis:

- Major Market Drivers: The increasing demand for customized sealing solutions to meet specific requirements for several end-use industries, including aerospace, automotive, manufacturing, etc., represents one of the primary factors propelling the market.

- Key Market Trends: Extensive investments in R&D activities to introduce miniaturized O-ring seals that can be used in the production of compact and lightweight devices are creating lucrative growth opportunities in the market. Moreover, the rising number of production, drilling, and pipeline operations is further stimulating the global market.

- Geographical Trends: Asia Pacific exhibits a clear dominance in the market. This can be attributed to the elevating awareness among consumers towards preventive sealing. Additionally, the inflating levels of industrialization are expected to fuel the regional market in the coming years.

- Competitive Landscape: According to the O-ring seals market overview, some of the prominent companies include AB SKF, ElringKlinger AG, Freudenberg & Co. KG, Hutchinson SA (TotalEnergies SE), NOK Corporation, Parker Hannifin Corporation, Trelleborg AB, and Zhongding Group, among many others.

- Challenges and Opportunities: Compliance with industry regulations, particularly in sectors, such as aerospace, automotive, pharmaceuticals, etc., adds complexity to the manufacturing and supply chain processes. However, ongoing innovations, collaborations, and a proactive approach to quality management are projected to fuel the market over the forecasted period.

To get more information on this market Request Sample

O-ring Seals Market Trends:

Technological Advancements

The shifting preferences among key players from traditional methods like compression molding and injection molding towards computer numerical control (CNC) machining and additive manufacturing that allow to produce complex geometries and custom designs with tight tolerances are among the O-ring seals market recent opportunities. For example, in October 2023, Inkbit, one of the leading players in advanced additive manufacturing solutions, launched the TEPU 50A elastomer as an alternative to molded or cast silicones and rubbers for prototyping. In line with this, these novel technologies enable enhanced efficiency, precision, and customization, which is acting as another significant growth-inducing factor. For instance, in September 2022, Chromatic 3D Materials developed a Smooth-Mode technology that enables 3D printing of durable rubber parts. High-quality polyurethane parts, such as gaskets, seals, grommets, bladders, etc., can be 3D printed without post-processing requirements or surface finishing via this technology. Moreover, the emerging popularity of sealing solutions that offer high performance and reliability, along with the escalating demand for novel materials, is further strengthening the market. For example, in October 2023, Freudenberg launched a polyurethane-based material, 98 AU 30500, as a highly effective alternative to conventional polytetrafluoroethylene (PTFE) seals. In addition to this, it exhibits superior performance characteristics and optimal hydrolysis resistance. Furthermore, the widespread adoption of automation by manufacturers can minimize maintenance and downtime costs related to O-ring seals, which, in turn, will continue to fuel the O-ring seals market outlook in the foreseeable future. For instance, with the development of robotic sealing and cobot sealing for enhanced flexibility, Broetje-Automation offers high-tech sealing processes for the aerospace industry. In July 2023, Broetje-Automation also showcased its novel sealing developments for aerospace at the JEC World and the Paris Airshow.

Widespread Usage in Automotive

O-rings are important components in the automotive industry. They create a secure seal between two surfaces and prevent leaks by keeping oil and other fluids well-contained. Moreover, automotive O-rings can be produced from a wide array of materials to meet a variety of performance needs. Besides this, automotive systems require O-rings to manufacture secure seals and prevent leaks. Key players like Fournier Rubber & Supply Co. use a diverse selection of elastomers to create O-rings that adhere to the preferences of consumers across the industry. Apart from this, the rising consumer consciousness towards preventive sealing solutions that aid in minimizing leaks and complying with safety regulations is also positively influencing the market. For example, one of the wholesale distributors of O-rings and related sealing products, the Global O-Ring and Seal, offers enhanced seals that are tailored to meet the stringent Part Production Approval Process (PPAP) requirements, thereby ensuring consistent production to specific tolerances with defined process capability levels (Cpk). In addition to this, stringent regulatory standards and safety requirements are also providing lucrative opportunities to industry players in the automotive industry. These regulations ensure the quality and reliability of O-rings are maintained. For example, the Ministry of Surface Transport (MoST) in India initiated a permanent Automotive Industry Standard Committee (AISC) to provide requirements and methods of testing for O-rings for automotive applications. This is stimulating the O-ring seals market demand across the country.

Increasing O-ring Materials Demand

O-ring seals are generally manufactured by using a wide array of materials tailored to withstand the demanding conditions encountered in automotive applications. Materials, including nitrile rubber (NBR), offer cost-effectiveness, enhanced compatibility with petroleum-based fluids, flexibility, etc., thereby making them suitable for sealing applications in transmissions, engines, fuel systems, etc. For example, in January 2023, Kumho Petrochemicals Co. Ltd. announced its plans for the expansion of its nitrile butadiene rubber (NBR) production capacity in South Korea. O-ring seals made by adopting polytetrafluoroethylene are gaining extensive traction, as they exhibit excellent performance under high temperatures (up to 500°F) and resistance to chemical exposure. This, in turn, is propelling the O-ring seals market's recent prices. For instance, in April 2020, the Advanced Materials Division at 3M introduced a novel service for prototyping and serial production of complex 3D printed polytetrafluoroethylene (PTFE) parts. Furthermore, advanced novel materials, including ethylene propylene diene monomer, find extensive applications involving oxygenated solvents, brake fluids, and alkali solvents in hydraulic environments. In July 2023, Trelleborg, one of the developers of precision bearings, seals, and polymer components, introduced its new H2Pro range of advanced hydrogen sealing materials. They include a unique thermoplastic polyurethane (TPU) and ethylene propylene diene monomer (EPDM) rubber for very low temperatures. These materials are projected to fuel the market in the coming years.

O-ring Seals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the O-ring seals market forecast at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the type and application.

Breakup by Type:

- Synthetic Rubber

- Thermoplastic Elastomer

Synthetic rubber holds the largest share of the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic rubber and thermoplastic elastomer. According to the report, synthetic rubber represented the largest segment.

Engineered to mimic natural rubber while providing optimal performance characteristics, synthetic rubber variants like fluor elastomers (FKM), nitrile rubber (NBR), silicone rubber, etc., are preferred choices for O-ring seal production. Strategic initiatives, including new product launches, mergers and acquisitions, production expansion, etc., are driving the growth in the O-ring seals market share. For instance, in May 2023, ARLANXEO announced the construction of its synthetic rubber production plant in Jubail, Saudi Arabia, with a production capacity of 140 kilotons per annum. Similarly, in May 2023, Sinopec initiated operations for its synthetic rubber plant in China. The project is a joint venture between Baling New Material and Hainan Refining & Chemical, Co, a subsidiary of Sinopec.

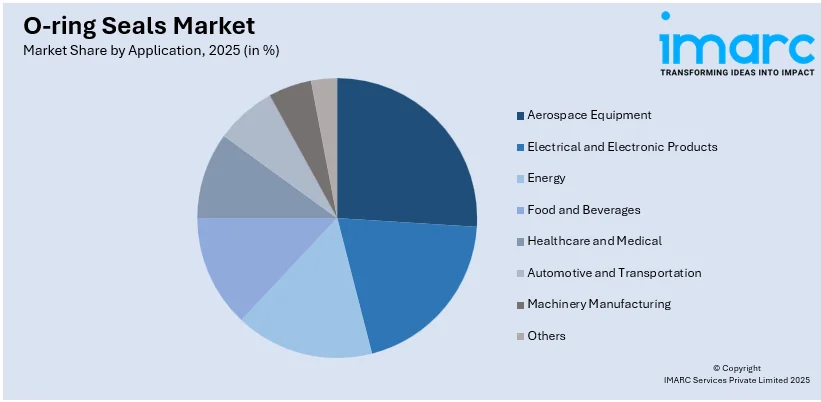

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Electrical and Electronic Products

- Aerospace Equipment

- Energy

- Food and Beverages

- Healthcare and Medical

- Automotive and Transportation

- Machinery Manufacturing

- Others

Aerospace equipment accounted for the largest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes electrical and electronic products, aerospace equipment, energy, food and beverages, healthcare and medical, automotive and transportation, machinery manufacturing, and others. According to the report, aerospace equipment represented the largest market segmentation.

According to the O-ring seals market statistics, the growth in this segmentation is driven by stringent performance requirements and critical sealing applications within the aerospace industry. Additionally, the demanding operating conditions, such as extreme temperatures, high pressures, and exposure to aggressive fluids, necessitate seals with exceptional durability, chemical resistance, and reliability. Besides this, the rising focus on precision engineering, reliability, and safety will continue to fuel the growth in this segmentation over the forecasted period. For example, in June 2023, Park Aerospace Corp. developed the Aeroadhere FAE-350-1 structural film adhesive product that can be used for bonding aerospace primary and secondary structures.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The easy availability of cheap labor, along with the close proximity to raw material suppliers, is elevating the O-ring seals market revenue across Asia Pacific. Moreover, the expanding automotive industry is escalating the demand for these mechanical seals, which is also acting as another significant growth-inducing factor. For instance, according to the data reported by the International Organization of Motor Vehicle Manufacturers (OICA), around 30,160,966 units of vehicles were produced in 2023 in China, which increased from around 27,020,615 units in 2022. Apart from this, the growing number of production, drilling, and pipeline operations is further strengthening the regional market. For example, it is estimated that shale gas production in China is expected to reach around 280 billion cubic meters by 2035. This, in turn, will create significant opportunities for mechanical seals, such as O-ring seals, in the coming years.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major O-ring seals market companies have also been provided. Some of the key players in the market include:

- AB SKF

- ElringKlinger AG

- Freudenberg & Co. KG

- Hutchinson SA (TotalEnergies SE)

- NOK Corporation

- Parker Hannifin Corporation

- Trelleborg AB

- Zhongding Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

O-ring Seals Market Recent Developments:

- March 2024: Precision Polymer Engineering (PPE), one of the world’s leading manufacturers of high-performance molded elastomer seals, launched Perlast G77X, a perfluoro elastomer (FFKM) sealing material that provides high-temperature performance with exceptional low compression set.

- March 2024: ARLANXEO, one of the global leaders in performance elastomers, showcased its innovative and sustainable rubber portfolios at the India Rubber Expo 2024, underlining its commitment to serving the consumers in the wider Asia Pacific region with high-quality products and services.

- February 2024: Freudenberg Sealing Technologies entered into a new purchase agreement with Ypsomed, one of the medical technology specialists, for portable insulin pump seals.

O-ring Seals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Synthetic Rubber, Thermoplastic Elastomer |

| Applications Covered | Electrical and Electronic Products, Aerospace Equipment, Energy, Food and Beverages, Healthcare and Medical, Automotive and Transportation, Machinery Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB SKF, ElringKlinger AG, Freudenberg & Co. KG, Hutchinson SA (TotalEnergies SE), NOK Corporation, Parker Hannifin Corporation, Trelleborg AB, Zhongding Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global O-ring seals market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global O-ring seals market?

- What is the impact of each driver, restraint, and opportunity on the global O-ring seals market?

- What are the key regional markets?

- Which countries represent the most attractive O-ring seals markets?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the O-ring seals market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the O-ring seals market?

- What is the competitive structure of the global O-ring seals market?

- Who are the key players/companies in the global O-ring seals market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the o-ring seals market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global o-ring seals market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the o-ring seals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)