Nutritional Bar Market Size, Share, Trends and Forecast by Product Type, Category, End-User, Flavor, Distribution Channel, and Region 2025-2033

Nutritional Bar Market 2024, Size and Trends:

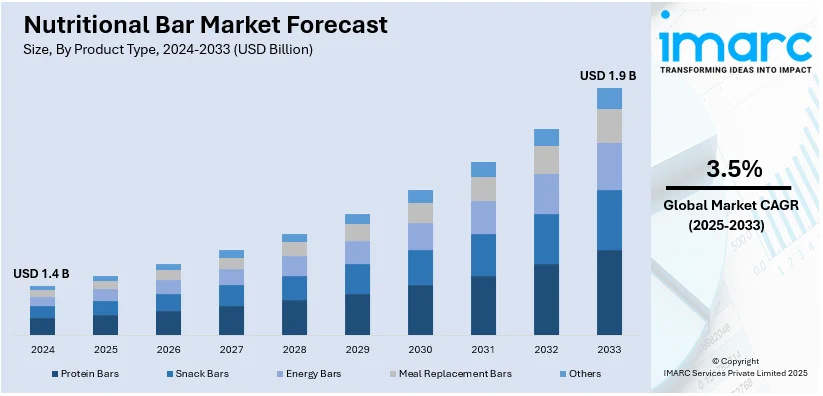

The global nutritional bar market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. North America currently dominates the market, holding a nutritional bar market share of over 37.8% in 2024. High health awareness, widespread fitness culture, advanced product innovation, and a strong presence of key manufacturers along with robust distribution networks are propelling the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate (2025-2033) | 3.5% |

A nutritional bar contains a wide variety of carbohydrates, proteins, vitamins, and minerals, offering a healthy and convenient meal replacement. It is mostly available in the form of a protein bar, energy bar, snack bar, etc. and can be consumed as a regular dietary supplement. Nutritional bars are highly effective after intensive workouts as they help in muscle repair, improve body performance, enhance metabolism, and reduce saturated fat and glucose levels in the body. Owing to this, nutritional bars are widely consumed by athletes or people targeting weight control for curbing their appetite and replacing whole foods.

There are many factors that represent changing consumer behaviors and lifestyle trends in the global market for nutritional bars. One important factor is the growing health consciousness among people, who seek quick, nutrient-dense snacks to meet their hectic, active schedules. Convenient energy sources also contribute to the increasing demand for nutritional bars as part of the fitness trend that includes gym culture and outdoor activities. With the rise of lifestyle-related health issues such as diabetes and obesity, consumers are increasingly opting for healthier snack alternatives, thereby creating a demand for low-sugar, high-protein, and high-fiber bars. According to the World Obesity Atlas, approximately 79% individuals aged 18 and above, will reside in low-and middle-income countries by 2035.

The United States stands out as a key market disruptor, driven by a growing consumer emphasis on health and wellness, along with the desire for convenient, portable snacks. The increasing trend of fitness pursuits and outdoor living has heightened the demand for bars that are rich in protein and boost energy. Growing awareness of dietary requirements, including gluten-free, keto, and vegan alternatives, has spurred innovation in product selections designed for particular consumer tastes. Moreover, the market gains from developments in e-commerce and specific marketing tactics, improving accessibility and exposure. The demand for functional foods targeting energy, weight control, and overall nutrition enhances market expansion.

Nutritional Bar Market Trends:

Growing health and wellness trends

The demand for healthy bars is highly driven by the increasing awareness of health and wellness among customers. According to reports, as of 2023, around 40% of customers worldwide are consciously opting for better food choices, which reflects the trend of faster and nutrient-rich snacks. There is a rising demand for nutritional bars that cater to specific dietary needs because of the popularity of fitness and diet trends such as plant-based, paleo, and keto diets. A study conducted by The Food Institute finds that nearly 60% of American consumers feel protein is a key component in their diet, further fueling the demand for the high-protein bar. On-the-go nutrition demand continues to fuel a boom in demand for nutritional bars as they increased use of functional ingredients such as collagen, probiotics, and adaptogens, driving the nutritional bar market growth.

Rising demand for on-the-go nutrition

The market for nutritional bars has grown dramatically because of the hectic life of modern consumers, growing demand for portable, on-the-go nutrition solutions. More than 50% of customers worldwide reported snacking more than thrice a day in 2023 as per The Food Institute, and because of their convenience and well-balanced nutrition, nutritious bars are becoming a popular choice. Given that over 55% of the population of Earth resides in cities as reported by World Bank, where fast lives require demand for fast but healthy food intake options, urbanization has been one of the largest factors. A majority of the customers are giving up on traditional meals and choosing ready-to-eat snacks, while nutritional bars are replacing traditional breakfast items, further propelling the nutritional bar market outlook.

Increased focus on clean label and natural ingredients

More emphasis on clean label and natural ingredients-The market for nutritious bars is increasingly being influenced by the trend of consumers toward natural ingredients and clean label products. A 2023 survey found that over 50% of respondents worldwide preferred less sugar in snacks and made from natural, non-GMO components. In response, the market created formulas that have plant-based, gluten-free, and organic ingredients to satisfy consumer preferences. With the increasing trend of vegan diets among 10 million vegan Americans as per Forbes, sales of plant-based nutritional bars increased in the United States. Similarly, most consumers looking to reduce their intake of artificial additives opt for natural sweeteners such as dates, honey, and stevia over artificial sugars in nutritional bars.

Nutritional Bar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global nutritional bar market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product type, category, end-user, flavour, and distribution channel.

Analysis by Product Type:

- Protein Bars

- Snack Bars

- Energy Bars

- Meal Replacement Bars

- Others

Protein bars leads the market with around 53.6% of nutritional bar market share in 2024, due to their broad popularity among health-focused consumers and fitness fans. They are preferred for their capacity to offer a fast, convenient source of high-quality protein crucial for muscle recovery, energy, and fullness. As awareness grows regarding protein's importance in weight control and general wellness, these bars have become essential for active people and those looking for healthier snack options. The increasing diversity of flavors, formulations, and dietary choices, including plant-based and low-sugar protein bars, has expanded their customer base, fueling considerable market expansion.

Analysis by Category:

- Animal Derived

- Plant-Based

Plant-based leads the market with around 65.7% of market share in 2024, due to the ever-growing shift by consumers toward healthier, sustainable, and ethical food choices. There is a marked rise in demand driven by awareness and concern regarding health and environment among consumers of vegan and vegetarian diets. Being natural, free from allergens, and nutritionally dense, plant-based bars align with the clean-label trends, made with nuts, seeds, and plant proteins. They also appeal to a wider audience, including flexitarians looking to reduce meat and dairy consumption. Moreover, improvements in plant-based protein formulations have improved taste and texture, making these products very appealing to health-conscious consumers and driving the nutritional bars market growth.

Analysis by End-User:

- Adults

- Children

Based on the nutritional bar market forecast, The adult segment dominates the sugar substitutes market due to the rising prevalence of lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases. Adults are increasingly adopting sugar substitutes as a healthier alternative to traditional sugar to manage calorie intake and maintain overall health. This demographic drives demand for low-calorie and natural substitutes, such as stevia, erythritol, and monk fruit, as part of fitness and weight management regimens.

The children segment represents a growing opportunity in the sugar substitutes market, driven by parental concerns over childhood obesity, dental health, and sugar-related health issues. Manufacturers are introducing sugar-free and reduced-sugar products, such as candies, beverages, and snacks, catering to children’s taste preferences while minimizing health risks. Regulatory guidelines promoting reduced sugar content in children’s diets have also accelerated product innovation in this category.

Analysis by Flavor:

- Chocolate

- Fruit and Nut

- Caramel

- Peanut Butter

- Vanilla

- Coconut

- Cookies and Cream

- Others

Chocolate leads the market in 2024, as most consumers prefer this flavor and is used with virtually any ingredient in a bar, such as nuts, fruits, and protein powder. Chocolate also offers a richer taste and an indulgent sense that appeals to a wide spectrum of consumers, ranging from fitness-enthusiastic protein seekers to casual snacker. Chocolate is compatible with many ingredients in a bar. In addition, manufacturers often use chocolate as a base to mask the taste of less palatable but nutritious components, making it a preferred choice. The flavor's nostalgic and comforting appeal further reinforces its popularity across all age groups.

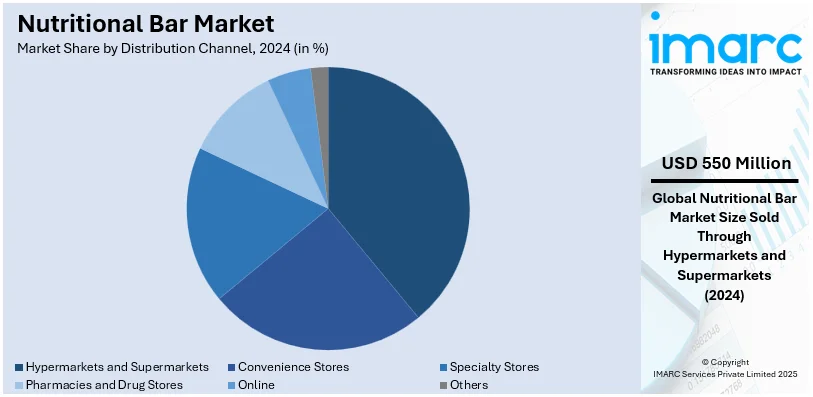

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies and Drug Stores

- Online

- Others

Supermarkets and hypermarkets lead the market with around 38.9% of market share in 2024, these large retail outlets provide extensive shelf space for nutritional bar brands, ranging from mass-market favorites to premium selections. According to global nutritional bar market insights, the demand for nutritional bars is driven by the increasing consumer preference for convenience, which supermarkets and hypermarkets fulfill through their accessibility and diverse product range. This accessibility makes them pivotal in driving Nutritional Bar sales across various regions.

Regional Analysis

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of over 37.8%, due to high consumer demand for premium and innovative nutritional bar products, a strong presence of leading brands like Hershey's and Mars, and well-established retail networks. In addition, the region's focus on product diversification, such as organic and health-oriented nutritional bars, drives market growth. For example, Hershey's ongoing innovation in healthier options like reduced-sugar nutritional bars highlights the region's adaptability to changing consumer preferences.

Key Regional Takeaways:

United States Nutritional Bar Market Analysis

In 2024, the United States accounts for over 87.6% of the nutritional bar market in North America. The market is dominated by the US as American consumers increasingly desire to have fast healthy snacking products. With people in the United States getting aware of the healthy aspects of diet, nutritional bars are also an alternative for common snacks and thereby, have generated increased demand because of increasing American obesity cases-the CDC report found that around 42% American adults fall in the category of obese, increasing the demand of weight loss items such as protein and meal replacement bars. The sales are rising because of the growing tendency for on-the-go consumption, specifically among the 63% of working people. Demand of protein and energy bars for muscle recovery after workout is highly driven by the fitness industry, which media reports say has over 41,000 gyms and 64 million members.

Consumer preferences are also evolving, with diets like gluten-free, vegan, and keto changing the way products are manufactured. Retail expansion supports the market; it has over 300,000 grocery stores, and there are strong online sales platforms as reported. E-commerce now accounts for more than 15% of overall retail online sales as per reports.

Europe Nutritional Bar Market Analysis

The market for nutritional bars in Europe is driven by rising exercise involvement and awareness of good eating. More than half of Europeans place a high value on making healthy food choices, and the market is led by nations like Germany, the UK, and France. According to a report, at the end of 2023, the European members numbered about 67.6 million, up approximately 4.7 million or 7.5% from 62.9 million in 2022. This trend for fitness showed clearly and fuelled the protein and energy bar market. Plant-based nutritious bars have gained more popularity due to the growing veganism movement. Reports indicate about 3% of Europeans claim to be vegans. This has also been boosted by governmental programs that push for healthy lifestyles, such as the UK sugar reduction program that encourages people to choose better snacking options. With busy lifestyles and rapid urbanisation across the continent, convenient, take-along snacks are increasingly in demand. Nutritional bars are now readily available due to the expansion of e-commerce platforms and major retail chains such as Tesco and Carrefour. More recently, there is also the push for sustainability: European consumers are increasingly opting for environmentally friendly packaging for such products.

Asia Pacific Nutritional Bar Market Analysis

Nutritious bar market in the Asia-Pacific is developing rapidly because of the changes in dietary patterns, urbanization, and increase in disposable income. The three leaders in this region are China, Japan, and India; in 2030, according to media reports, China's city population will have increased to 940 million. According to the media report, India's middle class is supposed to rise by 2025 to 580 million. The growing awareness of fitness in metropolitan areas is an increasing demand for energy and protein bars. India alone, for instance, reported over 10 million gym-goers. Moreover, as the Western diet gained popularity, the demand for nutrient-dense convenience foods grew as well. The growth of e-commerce is also affecting the availability and visibility of nutritional bars, especially in countries like China, where online shopping accounted for more than 27% of all retail sales in 2023, according to data from the Chinese government. The emphasis on health brought about by the pandemic has also increased demand for functional nutritional goods and those that improve immunity. Local inventions and flavours are particularly important because product development for this broad market is influenced by regional tastes.

Latin America Nutritional Bar Market Analysis

The market for nutritious bars in Latin America is being driven by changes in lifestyle and growing health consciousness. The two biggest providers are Brazil and Mexico, with Brazil boasting more than 30,000 gyms and serving more than 7.9 million members. The area has a middle class of over 30% population according to data from the World Bank, who are seeking relatively affordable yet healthy snack alternatives. The demand for protein bars as energy-boosting supplements is on the rise with increased participation in sports and fitness activities among younger consumers. With online grocery sales in Latin America increasing by significantly, e-commerce is a growing channel that increases product availability. In addition, government initiatives that promote healthy eating and restrict sugar consumption have made nutritional bars even more popular as a balanced snack choice.

Middle East and Africa Nutritional Bar Market Analysis

Due to rising urbanisation and health concern, nutritional bars are increasingly popular in the Middle East and Africa (MEA) area. Two of the most significant markets are the United Arab Emirates and Saudi Arabia. The fitness industry in the UAE has over 1,000 gyms, according to reports, and a high per capita income promotes high-end products purchasing. According to reports, lifestyle diseases like diabetes affect more than 25% of adults in the GCC region, which has made them opt for a healthier snacking range. The growing retail industry in the region, which consists of modern supermarkets chains and convenience stores, is a factor that will complement and enhance the availability of products. The affluent middle class in several countries across the continent, including South Africa, is driving demand for nutrient-rich snacks at affordable prices. One of the reasons why nutritional bars have become so popular lately is through partnerships with local stores and awareness efforts about balanced diets.

Competitive Landscape:

Major companies in the nutritional bar market focus on strategic initiatives such as product innovation and branding, leading to the expansion of a customer base and markets, driving the nutritional bar market demand. Continuous new flavors, formulations, and dietary specificities are added to meet consumers' diverse choices. R&D investments allow companies to enhance the nutritional profile of their respective products, such as increasing protein levels or reducing sugar. Many players are using sustainable practices, like sourcing organic ingredients and eco-friendly packaging, to attract the environmentally conscious consumer. Fitness influencers and targeted digital marketing campaigns amplify product visibility and brand loyalty. Companies are also expanding their distribution networks, using e-commerce platforms, and entering untapped markets to expand their consumer base. Furthermore, collaboration with retailers and offering promotional discounts further strengthens their market presence. These combined efforts enable key players in the rapidly expanding industry to compete.

The report provides a comprehensive analysis of the competitive landscape in the nutritional bar market with detailed profiles of all major companies, including:

- Abbott, Clif Bar & Company

- General Mills Inc.

- Halo Foods

- Kellogg Co.

- Mars Incorporated

- Natural Balance Foods

- Quaker Oats Company

- The Simply Good Foods Company

- The Nature's Bounty Co.

- The WhiteWave Foods Company,

Recent Developments:

- In September 2024, Forever Living Products (India) launched its Forever New Protein and Nut Energy Bars, offering a wholesome, on-the-go snack for modern lifestyles. Packed with protein, natural ingredients like fruits, nuts, and prebiotics, these bars are free from preservatives, artificial colors, and flavors. Designed to boost energy and mood, they cater to diverse nutritional needs, promoting healthy living and balanced nutrition.

-

June 2024: The Hershey Company subsidiary ONE Brands launched the protein bars known as Reese's Peanut Butter Lovers. Each bar combines the traditional Reese's peanut butter flavour with nutritional advantages, including 18 grammes of protein and 3 grammes of sugar. The first time Hershey's has incorporated its iconic candy flavours into protein bars was when ONE Brands introduced Hershey's Cookies 'n' Crème flavoured protein bars.

- May 2024: Tandem Foods, the world leader in nutritious snacks, was formed through the merger of TruFood Manufacturing and Bar Bakers. Through this combination, Bar Bakers' expertise in snacks like cookies and different nutrition bars is combined with TruFood's knowledge of chocolate, baked granola and nutrition bars. The combined firm has expanded its production capability by operating eight manufacturing plants.

- In March 2024, Uttar Pradesh Governor Anandiben Patel launched a nutritional program emphasizing millet’s role in combating malnutrition, aligning with 2023 as the International Year of Millets. Organized by Vedanta’s Anil Agarwal Foundation at the modernized Nand Ghar anganwadi in Kashi Vidyapith block, the program distributed millet bars to children.

- In March 2024, Mumbai-based wellness startup Nutrizoe introduces Zoe Bars, India’s first energy bars designed specifically for women. Packed with protein, multivitamins, and minerals like Vitamin A, B-complex, C, D, and Zinc, the preservative-free, 100% vegetarian bars provide instant energy and curb dessert cravings. Fortified with Whey, Biotin, and Folate, Zoe Bars support immunity, healthy hair, skin, bones, and blood formation, offering a nutritious solution for women’s dietary needs.

Nutritional Bar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Protein Bars, Snack Bars, Energy Bars, Meal Replacement Bars and Others |

| Categories Covered | Animal-Derived, Plant-based |

| End Users Covered | Adults, Children |

| Flavors Covered | Chocolate, Fruit and Nut, Caramel, Peanut Butter, Vanilla, Coconut, Cookies and Cream and Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Pharmacies and Drug Stores, Online and Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Abbott, Clif Bar & Company, General Mills Inc., Halo Foods, Kellogg Co., Mars Incorporated, Natural Balance Foods, Quaker Oats Company, The Simply Good Foods Company, The Nature's Bounty Co., The WhiteWave Foods Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nutritional bar market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global nutritional bar market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nutritional bar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nutritional bar market was valued at USD 1.4 Billion in 2024.

IMARC estimates the nutritional bar market to exhibit a CAGR of 3.5% during 2025-2033.

The global nutritional bar market is driven by increasing health consciousness, demand for convenient and functional snacks, rising fitness trends, growing preference for plant-based and dietary-specific options, and expanding e-commerce accessibility.

North America dominates the market due to high health awareness, widespread fitness culture, advanced product innovation, and a strong presence of key manufacturers coupled with robust distribution networks.

Some of the leading companies in the market include Abbott, Clif Bar & Company, General Mills Inc., Halo Foods, Kellogg Co., Mars Incorporated, Natural Balance Foods, Quaker Oats Company, The Simply Good Foods Company, The Nature's Bounty Co., The WhiteWave Foods Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)