North America Vinyl Flooring Market Size, Share, Trends and Forecast by Product Type, Sector, and Country, 2026-2034

North America Vinyl Flooring Market Size and Share:

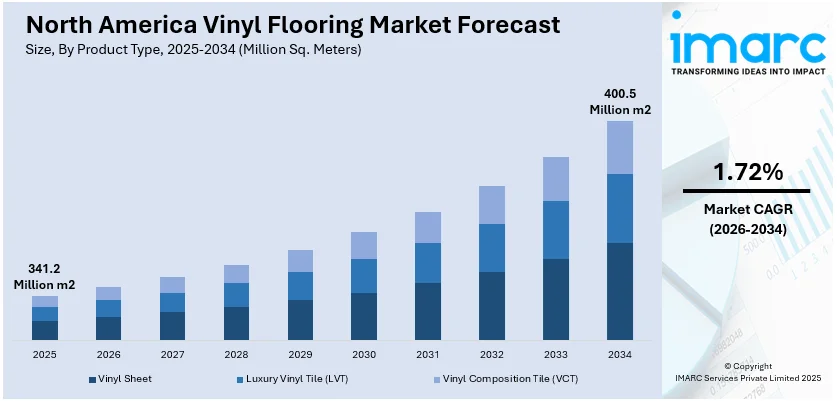

The North America vinyl flooring market size reached 341.2 Million Sq. Meters in 2025. Looking forward, IMARC Group estimates the market to reach 400.5 Million Sq. Meters by 2034, exhibiting a CAGR of 1.72% from 2026-2034. The North America vinyl flooring market share is expanding due to rising demand for durable, cost-effective, and low-maintenance solutions, with innovations in design, sustainability, and ease of installation driving growth across residential and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

341.2 Million Sq. Meters |

|

Market Forecast in 2034

|

400.5 Million Sq. Meters |

| Market Growth Rate (2026-2034) | 1.72% |

The North America vinyl flooring market is being strongly driven by growing demand for cost-efficient, durable, and aesthetically versatile flooring solutions. Vinyl flooring presents an affordable alternative to higher-end materials like hardwood, stone, and ceramics, making it appealing for both residential and commercial spaces. One of its main advantages is that it replicates the look and feel of high-quality, expensive materials without the weight. Moreover, vinyl flooring is versatile and requires only a low level of maintenance, so it's more than acceptable for homes with children or pets and for high-traffic areas. Product quality has taken a huge leap in recent years, with manufacturers offering highly resistant vinyl options to stains, moisture, and wear. For example, in February 2024, Interface, Inc. launched new flooring collections, including Modern Trio™, noraplan unita™, and Upon Common Ground™, while expanding its carbon-negative product range in the EMEA region. Moreover, with such advancements, vinyl flooring designs are becoming innovated to further its appeal into diverse consumer markets. Easy installation in glue-down, click-lock, and peel-and-stick also helps expand the market's preference for the flooring product.

To get more information on this market Request Sample

Its compatibility with modern interior design trends is also fueling the increasing popularity of vinyl flooring in North America, for both renovation and new construction. With the growth of homeowners who are interested in affordable yet stylish options for updating the personal living space, vinyl offers convenience through the imitation of natural materials while providing better durability and easier care. Expansion of the commercial sectors, such as hospitality, healthcare, and education are also contributing to the growth of the North America vinyl flooring market outlook, where vinyl flooring is being preferred due to its functionality and aesthetic versatility in these settings. Furthermore, green building standards and eco-friendly initiatives are intensely affecting manufacturers to develop vinyl flooring products with reduced environmental footprints, such as minimal VOC-emitting products made from recycled materials. For instance, in June 2024, Shaw Industries launched EcoWorx™ Resilient, a fully recyclable, PVC-free flooring for commercial use. It offers design, performance, sustainability, and low embodied carbon, with free recycling through Shaw’s re[TURN]® Program. Moreover, these factors along with the growth of construction and real estate industries in North America are likely continuing to positively support the vinyl flooring market.

North America Vinyl Flooring Market Trends:

Sustainability and Eco-Friendly Innovations

The growing demand for environment-friendly and green products is playing a significant role in the expansion of the North America vinyl flooring market. As consumers and business entities become highly aware of their purchases like ecological implications, flooring products that reduce environmental damage gain preferences. Responding to the changing needs of consumers, vinyl flooring manufacturers develop products that have higher recycled material content, making less use of virgin vinyl. For example, in March 2024, Mohawk Industries launched PureTech Plus Native Ridge, an eco-friendly luxury vinyl flooring with 70% recycled content, an 80% renewable core, triple the scratch resistance of LVT, and a lifetime pet scratch warranty. Furthermore, innovation through the production process like reducing the number of harmful chemicals and volatile organic compounds (VOC) makes vinyl flooring attract ecologically conscious consumers. Even certifications like FloorScore and GreenGuard are gaining weight to ensure that the products meet environmental standards. North America is already experiencing a growing preference for green buildings and living spaces that are more ecofriendly. Additionally, the demand for vinyl flooring accommodating the values continue to grow, as eco-friendly building materials become significant priority in both residential and commercial building projects.

Customization and Design Flexibility

Increased demand for customization of design trends vinyl flooring in North America has a rising market with a greater emphasis on escalating the demand for design customization. From its ancient and traditional outlooks, modern technological advancement makes vinyl flooring products versatile to consumer selection with options available in terms of color, texture, or even pattern. It is very popular with homeowners and interior designers because it can replicate the look of natural materials like hardwood, stone, and ceramic tiles at just a fraction of the cost. Its flexibility in design offers it unique appeal for creating unique interiors, whether for residential spaces, retail stores, or offices. The availability of luxury vinyl tiles (LVT) and planks (LVP) also adds to its design possibilities since high-definition printing technology is added. Since aesthetic value is integral to the process of purchasing the flooring, such a trend is bound to see the momentum forward as vinyl floors are likely to be the sought-after choice both in renovation as well as in new construction ventures.

Growing Demand in Commercial Sectors

The growth of the market is intensely observed in North America with the rise of vinyl flooring usage in various commercial sectors, such as healthcare, hospitality, retail, and education. Commercial premises look for easy maintenance, low cost, and long-lasting floors that can tolerate heavy footfalls and stains or moisture. Vinyl fulfills this need as it is more resistant to stains, moisture, and high traffic. Vinyl floors are becoming suitable for environments that range from hospitals and schools to restaurants and hotels. They are also used for noise-reducing purposes and slip-resistant qualities, particularly in public facilities where safety and comfort are prioritized. Furthermore, the renovating of old commercial buildings according to modern standards is also making vinyl popular among the commercial crowd. As businesses continue to focus on functionality, low maintenance, and visual appeal, vinyl flooring is becoming highly common for new builds and remodels in commercial spaces across North America.

North America Vinyl Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America vinyl flooring market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and sector.

Analysis by Product Type:

- Vinyl Sheet

- Luxury Vinyl Tile (LVT)

- Vinyl Composition Tile (VCT)

Luxury Vinyl Tile (LVT) is emerging as the leading product type within the North America vinyl flooring market, mainly because of its superior performance and aesthetic appeal. LVT provides a high-end look with natural materials such as hardwood, stone, and ceramics at a much lower cost. The growing consumer preference for stylish, durable, and cost-effective flooring options has seen LVT rise dramatically in usage across both residential and commercial applications. LVT is known for its durability, water resistance, and ease of maintenance, making it a particularly attractive option for areas prone to moisture, such as kitchens, bathrooms, and basements. In addition, advanced design capabilities, such as high-definition printing and embossing techniques, make it easy for LVT to mimic the look and feel of actual wood or stone. These features, coupled with other simple installation processes such as click-lock or glue-down, are the drivers for continued market demand for LVT.

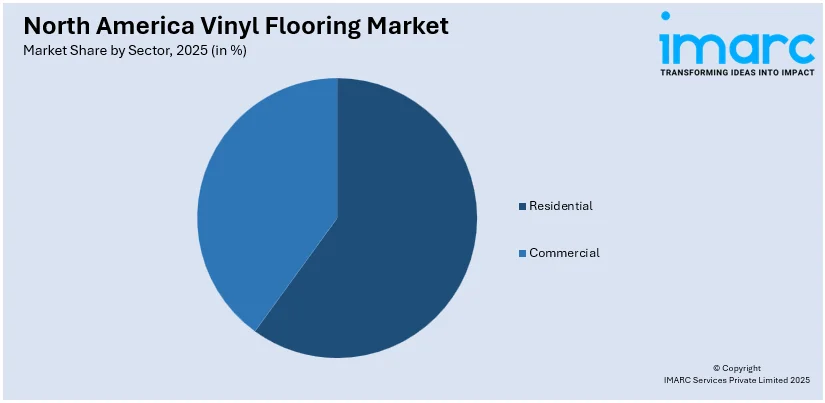

Analysis by Sector:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential is the biggest consumption factor of the North America vinyl flooring market, mainly with accelerated LVTs. Homeowners' preference for LVT also increased due to the factor that it combines style, durability, and affordability in one product. With its versatility, LVT can now be widely applied in homes-from the living room to bedrooms, kitchens, to bathrooms-and, thus expanding its market presence. The reason why LVT has gained immense popularity in modern times is its ability to simulate the appearance of natural materials without the associated high price or maintenance. Additionally, LVT is naturally resistant to moisture and scratches, meaning it presents a more practical option for households with young children, pets, or high traffic. The growing trend of DIY home improvement projects is also accelerating the demand for LVT, as it is easier to install compared to traditional hardwood or stone flooring.

Country Analysis:

- United States

- Canada

- Mexico

The North America vinyl flooring market is dominated by the United States because of strong consumer demand for durable, cost-effective flooring solutions. Construction and renovation projects are growing, and residential as well as commercial spaces increasingly opt for luxury vinyl tile (LVT) to spur the market's expansion.

In Canada, vinyl flooring is constantly on the hike with the country experiencing rapid urbanization and rising interest in the sustainability and low maintenance of floors. LVT demand is intensely high, particularly in residential and commercial applications, as it presents an excellent versatile, aesthetic, and durable solution that many homeowners and businesses are looking for.

The rate of growth in the vinyl flooring market is very significant in Mexico, mainly because of rapid growth in the construction and real estate sectors. The demand for higher quality flooring at modest prices in both residences and commercial buildings has led to heightened adoption of vinyl products, including LVT, across the country.

Competitive Landscape:

The North America vinyl flooring market operates in a highly competitive market with multiple large multinational players, regional manufacturers, and emerging brands. This market is highly fragmented with the focus placed on product differentiation using innovations in design, durability, and installation methods. Constant research and development by key players aim at improving both performance and aesthetic appeal of vinyl flooring, for example, the new form of luxury vinyl tile (LVT) with advanced printing techniques to replicate wood and stone materials. In addition, companies are employing sustainability practices like utilizing recycled materials and low-VOC products to meet this escalating consumer demand for green options. Competitive strategies also include enlargement of the network through both traditional channels of retail, such as in the case of Dell, and e-commerce. In addition to the above, part of competitive positioning is the ability to be price-competitive or to offer customized variants that are convenient for customers, such as easy installation.

The report provides a comprehensive analysis of the competitive landscape in the North America vinyl flooring market with detailed profiles of all major companies.

Latest News and Developments:

- In July 2024, AHF Products launched Ingenious Plank®, a groundbreaking hybrid resilient flooring that sets new standards for sustainability, performance, and design. PVC-free and made with renewable wood fibers, it offers superior durability, waterproofing, and acoustic benefits. With eco-friendly materials and easy installation, Ingenious Plank is ideal for residential and light commercial use.

- In February 2024, Mannington and other resilient flooring suppliers launched a range of innovations aimed at maintaining market leadership. Notable advancements include PVC-free options, improved SPC quality, and the return of WPC.

- In February 2024, Tarkett launched Collective Pursuit™, a non-PVC flooring collection featuring high-performance wood and stone visuals. The collection offers durability, ease of maintenance, and sustainability, being LBC Red List Free and ortho-phthalate–free, marking a significant step in the company’s commitment to eco-friendly solutions.

- In January 2024, Mohawk Industries introduced innovative flooring solutions, including PureTech, SolidTech Signature, and PETPremier. These products emphasize sustainability, durability, and advanced aesthetics, aligning with market demands and enhancing dealer profitability. Mohawk continues to lead the flooring industry by delivering high-performance, eco-friendly solutions that meet evolving consumer needs.

North America Vinyl Flooring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Sq. Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vinyl Sheet, Luxury Vinyl Tile (LVT), Vinyl Composition Tile (VCT) |

| Sectors Covered | Residential, Commercial |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America vinyl flooring market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America vinyl flooring market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America vinyl flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vinyl flooring market in the North America reached 341.2 Million Sq. Meters in 2025.

Key drivers of the North America vinyl flooring market include increasing demand for cost-effective and durable flooring options, growing home renovation projects, technological advancements in design and installation, rising consumer preference for low-maintenance solutions, and the shift toward sustainable and eco-friendly flooring products.

The North America vinyl flooring market is projected to exhibit a CAGR of 1.72% during 2026-2034, reaching a volume of 400.5 Million Sq. Meters by 2034.

Luxury Vinyl Tile (LVT) accounted for the largest market share in the North American vinyl flooring market due to its durability, realistic design options, water resistance, and ease of installation, making it the preferred choice for both residential and commercial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)