North America Silica Sand Market Size, Share, Trends and Forecast by End Use, and Country, 2025-2033

North America Silica Sand Market Size and Share:

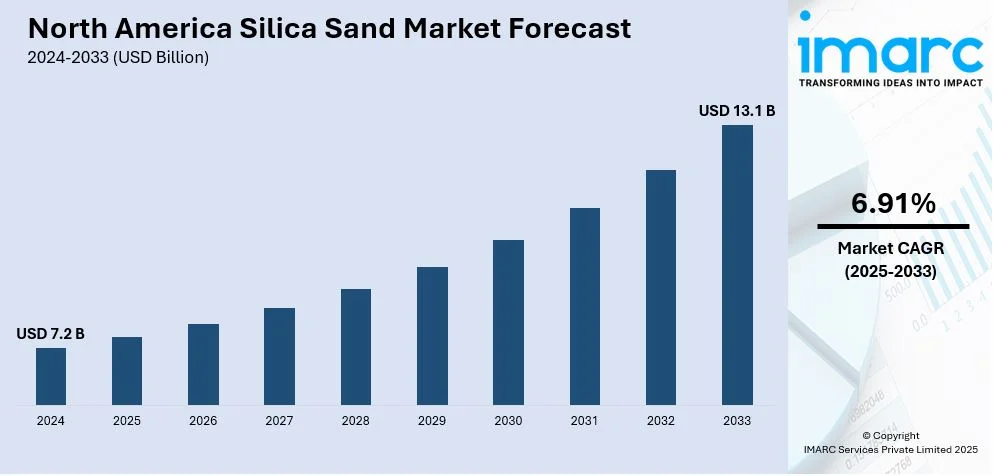

The North America silica sand market size was valued at USD 7.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.1 Billion by 2033, exhibiting a CAGR of 6.91% from 2025-2033. The North America silica sand market share is expanding, driven by the growing investments in advanced techniques like dust suppression methods and water recycling systems that help to minimize the environmental impact of mining, along with the expansion and improvement of transportation infrastructure, which reduces shipping costs, making silica sand more accessible.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 13.1 Billion |

| Market Growth Rate (2025-2033) | 6.91% |

The rising use of high-purity silica is impelling the market growth in North America. Industries require more refined sand for specialized applications. High-purity silica sand is essential in sectors like glassmaking, solar panel production, and electronics where the quality of the material directly impacts the end product. As demand for clean, durable, and efficient products rises, companies are sourcing silica sand that meets these standards. Additionally, the shift towards high-purity silica sand results in improvements in item quality to remove impurities. This trend is particularly noticeable in the large scale renewable energy sector activities where high-purity silica sand is crucial for solar panel manufacturing.

Advancements in technology are fueling the North America silica sand market growth. They aid in improving mining and processing techniques, making it more efficient to extract and refine silica sand. Automated mining equipment and advanced sorting systems help to increase production and reduce operational costs. Improved processing methods also ensure that the sand meets higher purity standards, which is crucial for industries like fracking and electronics. Besides this, innovations in dust control, water recycling, and environmental monitoring assist in minimizing mining’s impact on the surrounding areas. Additionally, technology enhances transportation logistics, ensuring quicker and more cost-effective delivery of sand to key industries.

North America Silica Sand Market Trends:

Rising focus on sustainable mining

The increasing focus on sustainable mining is encouraging companies to adopt eco-friendly practices while maintaining production. Government investments to regulate stricter environmental regulations enable mining firms to reduce water usage, control dust emissions, and restore mined land. As per the information provided on the official website of the United States government, the Department of the Interior and the Office of Surface Mining Reclamation and Enforcement (OSMRE) revealed over USD 244 Million of funding from Biden-Harris Administration for fiscal year 2024 to tackle hazardous and polluting abandoned mine lands, generate well-paying, family-supporting jobs, and stimulate economic growth in coal communities throughout Pennsylvania, US. Additionally, many companies wager on water recycling systems and dust suppression methods to minimize their environmental impact. Sustainable mining also improves community relations, helping companies to secure permits and maintain long-term operations.

Growing investments in construction projects

The increasing investments in construction projects are offering a favorable North America silica sand market outlook. As per the data published on the official website of the United States Census Bureau, construction expenditures in December 2024 were anticipated at an annual rate of USD 2,192.2 Billion, reflecting an increase of 0.5 percent compared to the revised November figure of USD 2,180.3 Billion. This is creating a higher demand for silica sand used in asphalt and other building materials. Silica sand, also called quartz sand or frac sand, is essential in producing cement, which is a key component in roads and bridges. With government agencies and private sectors spending resources on housing, construction activity is at a high level, driving the demand for silica sand. The expansion of residential, commercial, and industrial construction projects further contributes to the market growth.

Strong transportation networks

The well-established transportation networks ensure the efficient movement of sand from mines to key industries. Silica sand is often mined in specific regions like Wisconsin and Texas. but is needed in distant locations for fracking operations, glass production, and construction projects. Railways, trucks, and barges help to connect sand mines to these industries, allowing timely and cost-effective delivery. The expansion and improvement of transportation infrastructure reduce shipping costs, making silica sand more accessible and increasing its demand. As energy companies and manufacturers require large quantities of silica sand, a reliable transportation system ensures that supply chains remain smooth and uninterrupted. Moreover, with ongoing government investments in railway infrastructure, the reliability of these logistics networks continues to grow. In January 2025, the Federal Railroad Administration (FRA) of the US Department of Transportation announced that it allocated over USD 1.1 Billion with the financial support from the Railroad Crossing Elimination Grant Program to 123 rail initiatives, enhancing or examining over 1,000 highway-rail crossings across the country. This further enhances the availability of silica sand in different parts of the region.

North America Silica Sand Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America silica sand market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on end use.

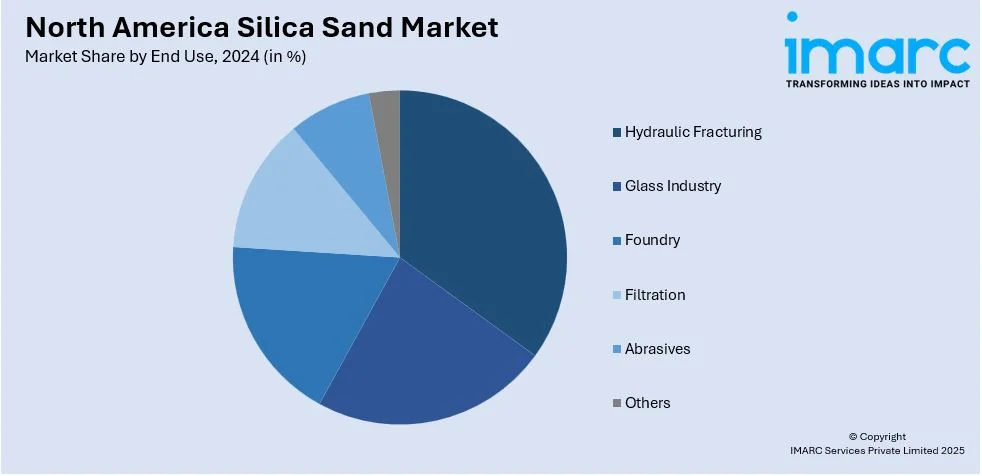

Analysis by End Use:

- Hydraulic Fracturing

- Glass Industry

- Foundry

- Filtration

- Abrasives

- Others

Hydraulic fracturing represents the largest segment. Hydraulic fracturing, also known as fracking, heavily depends on high-purity silica sand to extract oil and gas from underground rock formations. In this method, a mixture of water, chemicals, and sand is injected into rocks to create and hold open small fractures, allowing oil and gas to flow out. Since shale oil and gas production keeps growing in the US and Canada, the demand for silica sand stays high. Major shale regions like the Permian Basin and Bakken employ massive amounts of sand, making it a crucial part of the energy industry. North America has abundant silica sand deposits, enabling a cost-effective and easily accessible resource for fracking companies. To minimize costs, many companies mine and process silica sand closer to drilling sites. As hydraulic fracturing remains a key process for oil and gas extraction, the need for silica sand continues to dominate the market.

Country Analysis:

- United States

- Canada

United States enjoys the leading position in the market. It has vast natural reserves and a well-developed infrastructure for mining and transportation. The country has major silica sand deposits, especially in states like Wisconsin, Texas, and Illinois, where high-purity silica sand is easily accessible. Besides this, the expanding shale oil and gas industry activities, driven by hydraulic fracturing, is the biggest employer of silica sand, using Millions of Tons each year to extract fuel from deep underground. The US also has a strong industrial sector that utilizes silica sand in glassmaking, construction, and manufacturing. Advanced mining technology and efficient logistics, including rail and trucking networks, further help to move large quantities of silica sand to key drilling regions like the Permian Basin. Additionally, the rising automotive sales encourage the usage of silica sand since it is adopted to make glass needed for vehicle manufacturing, particularly in windows, windshields, and other components. According to the information given on the official website of the Federal Reserve Bank of St. Louis, In December 2024, retail sales of motor vehicles (domestic cars) hit 1.919 Million in the US.

Competitive Landscape:

Key players in the region work on developing advanced mining technology to meet the North America silica sand market demand. Big companies wager on operating large mines and processing facilities, ensuring a steady supply of high-purity silica sand. They also develop logistics networks, including rail and trucking services, to transport sand efficiently to fracking sites and manufacturing plants. These firms invest in research to improve sand quality and durability, making it more effective for hydraulic fracturing. Strategic mergers and acquisitions help them to strengthen their market position and broaden their user base. By adapting to industry needs and maintaining steady production, key players keep the market competitive and growing across the area. For instance, in May 2024, Covia, a top supplier of mineral oriented solutions, announced the total acquisition of the Industrial Minerals Division of R.W. Sidley, which offers good quality silica-based items used in industrial, sports, and filtration applications. The purchase of the silica sand mining business of Sidley in Thompson, Ohio, inculcates the reserves and quarry, as well as machinery, specific buildings, and equipment required for tasks.

The report provides a comprehensive analysis of the competitive landscape in the North America silica sand market with detailed profiles of all major companies, including:

- Badger Mining Corporation

- Capital Sand Company, Inc.

- Covia Holdings Corporation

- Eagle Materials, Inc.

- Hi-Crush, Inc.

- Liberty Materials, Inc.

- Manley Bros. of Indiana, Inc.

- Short Mountain Silica (Subsidiary of Thiele Kaolin Company)

- Signal Peak Silica

- Source Energy Services

- Superior Silica Sand LLC

- U.S. Silica Holdings, Inc.

Latest News and Developments:

- July 2024: US Silica Holdings, a prominent industrial minerals and logistics company, launched the greenfield mine and processing facility in Utica, Illinois, increasing its silica sand production capacity by 1.5 Million Tons. The firm aims to accommodate the rising demand for silica sand utilized in oil and gas extraction. It also disclosed that it obtained approval from the town of Fairchild, US, to establish a frac sand mine and plant with an annual capacity of 3 Million Tons.

- July 2024: Atlas Energy Solutions, Inc., a leading firm developing oilfield solutions provider, intended to utilize autonomous trucks created by Kodiak Robotics for transporting fracking sand to oil and natural gas wells in the Permian Basin, Texas, U.S. starting in early 2025.

- February 2024: The Manitoba government authorized the Canadian Premium Sand company’s silica sand initiative, located close to Lake Winnipeg, Canada, to extract silica sand in Hollow Water First Nation and establish a solar glass manufacturing plant in Selkirk. The mining and production site is anticipated to generate USD 2 billion in provincial taxes over ten years, equating to USD 200 Million each year.

- February 2024: ProFrac Holding Corp. a proppants manufacturing service provider in the oilfield sector (OFS) across the United States, revealed its intentions to enlist its Alpine silica frac sand division, based in the US, into a standalone public entity through an initial public offering (IPO).

- February 2024: Atlas Energy Solutions revealed that it finalized a binding agreement with Hi Crush Inc., a comprehensive service provider for hydraulic fracturing operations that supplies frac sand production, to purchase all of Hi-Crush’s proppant production assets in the Permian Basin along with its North American logistics operations in a deal valued at USD 450 Million. This contract seeks to bring together two of the most pioneering companies in frac sand under Atlas.

North America Silica Sand Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Hydraulic Fracturing, Glass Industry, Foundry, Filtration, Abrasives, Others |

| Countries Covered | United States, Canada |

| Companies Covered | Badger Mining Corporation, Capital Sand Company, Inc., Covia Holdings Corporation, Eagle Materials, Inc., Hi-Crush, Inc., Liberty Materials, Inc., Manley Bros. of Indiana, Inc., Short Mountain Silica (Subsidiary of Thiele Kaolin Company), Signal Peak Silica, Source Energy Services, Superior Silica Sand LLC, and U.S. Silica Holdings, Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the North America silica sand market forecast, and dynamics from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America silica sand market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America silica sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America silica sand market in the region was valued at USD 7.2 Billion in 2024.

The automotive and construction industries rely on high-purity silica sand for glass production, including windows, bottles, and fiberglass, thereby impelling the market growth. Besides this, technological advancements to offer improved mining and processing techniques are enhancing efficiency and silica sand quality. Moreover, the well-established rail and trucking infrastructure supports large-scale distribution of silica sand, ensuring steady supply to key sectors.

The North America silica sand market is projected to exhibit a CAGR of 6.91% during 2025-2033, reaching a value of USD 13.1 Billion by 2033.

Hydraulic fracturing accounted for the largest North America silica sand end use market share due to high demand for proppants in shale gas extraction, enabling improved oil and gas recovery, well efficiency, and sustained energy production growth.

Some of the major players in the North America silica sand market include Badger Mining Corporation, Capital Sand Company, Inc., Covia Holdings Corporation, Eagle Materials, Inc., Hi-Crush, Inc., Liberty Materials, Inc., Manley Bros. of Indiana, Inc., Short Mountain Silica (Subsidiary of Thiele Kaolin Company), Signal Peak Silica, Source Energy Services, Superior Silica Sand LLC, U.S. Silica Holdings, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)