North America Shrimp Feed Market Size, Share, Trends and Forecast by Type, Ingredient, and Country, 2025-2033

North America Shrimp Feed Market Size and Share:

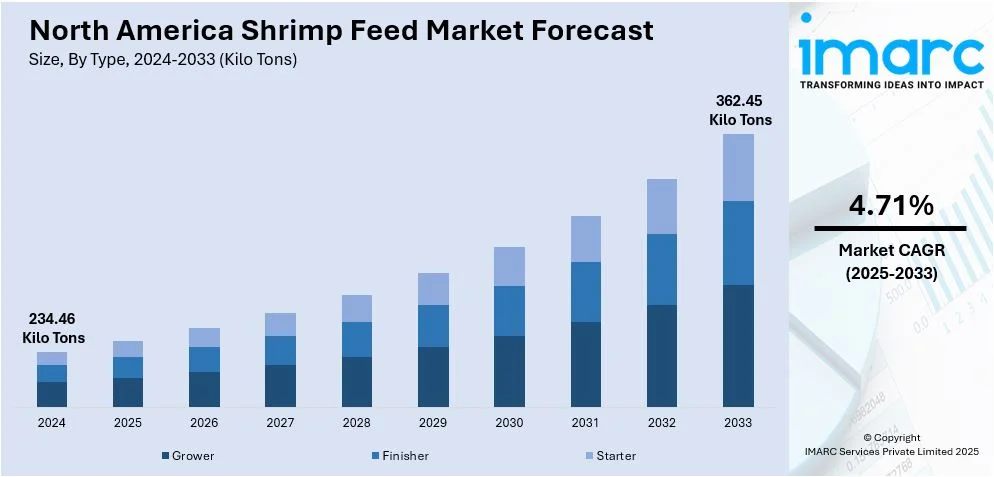

The North America shrimp feed market size was valued at 234.46 Kilo Tons in 2024. Looking forward, IMARC Group estimates the market to reach 362.45 Kilo Tons by 2033, exhibiting a CAGR of 4.71% from 2025-2033. The North America shrimp feed market share is expanding, driven by the rising shift towards plant-based and alternative protein sources, such as soybean meal and insect protein, which reduces the impact on wild fish populations, along with the growing demand for fresh and high-quality shrimp, encouraging farmers to broaden operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

234.46 Kilo Tons |

|

Market Forecast in 2033

|

362.45 Kilo Tons |

| Market Growth Rate (2025-2033) | 4.71% |

The increasing demand for controlled-environment shrimp farming is positively influencing the market in North America. Indoor and land-based shrimp farms employ advanced water filtration and monitoring systems to create optimal growing conditions, requiring precisely formulated feed to maximize shrimp health and yield. These farms focus on sustainability and efficiency, favoring nutrient-rich and easily digestible feed that minimizes waste and maintains water quality. Since controlled environments allow year-round shrimp production, the demand for consistent and high-performance feed is rising. Farmers also adopt automated feeding systems, ensuring shrimp receive the right nutrition at the right time. With more shrimp farms transitioning to controlled settings for better outputs and environmental benefits, feed manufacturers are developing tailored solutions.

Technological advancements are fueling the North America shrimp feed market growth. They are improving feed quality, efficiency, and sustainability. Modern feed formulations include probiotics, enzymes, and immune-boosting additives to enhance shrimp farming and health. Precision aquaculture technologies, such as automated feeding systems and artificial intelligence (AI)-oriented monitoring, help farmers to optimize feed usage and reduce waste. Additionally, innovations in ingredient processing like microencapsulation offer nutrient absorption, ensuring shrimp get the most out of their feed. Alternative protein sources, such as insect meal and algae-based feeds, have become popular as sustainable options. Moreover, digital platforms and e-commerce sites make it easier for farmers to access high-quality feed and receive data-driven recommendations for better farm management.

North America Shrimp Feed Market Trends:

Increasing focus on sustainable aquaculture

The rising focus on sustainable aquaculture with farmers and feed manufacturers looking for eco-friendly solutions is impelling the market growth across the region. Traditional shrimp farming depends on fishmeal, which depletes marine resources and increases environmental concerns. To address this, the industry is shifting towards plant-based and alternative protein sources like soybean meal and insect protein, reducing the impact on wild fish populations. Sustainable feed formulations also include probiotics and immune-boosting additives to improve shrimp health and minimize antibiotic use. With more shrimp farms adopting environment friendly practices, feed companies are wagering on high-performance and cost-effective solutions. Government policies and regulations and user demand for responsibly farmed seafood items further encourage the adoption of sustainable feed. In December 2024, the National Marine Fisheries Service (NOAA) Fisheries, the prominent United States federal agency, announced that the council completed the strategic plan for aquaculture economic development, highlighting government intentions to invest in infrastructure, initiate new research and development (R&D) programs, and allocate capital to the domestic aquaculture industry.

Growing shrimp consumption

The increasing shrimp consumption is offering a favorable North America shrimp feed market outlook. Shrimp is a popular seafood choice due to its versatility, taste, and health benefits, leading to high production across the region. Restaurants and seafood suppliers are constantly seeking fresh and high-quality shrimp, encouraging farmers to expand operations. With more shrimp farms, the need for high-performance feed is rising, as farmers look for efficient nutrition solutions to improve growth rates and shrimp health. Moreover, nutrient-rich feed formulations are becoming popular since people prefer responsibly farmed seafood items. As shrimp remains a staple in North American diets, feed manufacturers continue to innovate, ensuring a steady supply of superior quality feed to support the shrimp farming industry. According to the IMARC Group, the shrimp market size in the United States (US) attained 983,000 Tons in 2024. In the future, IMARC Group anticipates the market will hit 1,280,000 Tons by 2033, showing a 3% growth rate (CAGR) from 2025 to 2033.

Rising e-commerce and direct-to-farm sales

The increasing e-commerce and direct-to-farm sales are making shrimp feed more accessible and efficient for farmers in North America. As per the information given on the official website of the United States government, the Department of Commerce's Census Bureau revealed that the forecast for US retail e-commerce sales in the third quarter of 2024 reached USD 300.1 Billion, reflecting an increase of 2.6 percent from the second quarter of 2024. In the third quarter of 2024, e-commerce sales represented 16.2 percent of overall sales. Online platforms allow shrimp farmers to compare products, read reviews, and order high-quality feed without depending on traditional distributors. This reduces costs and ensures a steady supply, even in remote areas. Direct-to-farm sales eliminate middlemen, giving farmers better prices and fresher feed. Besides this, many companies offer subscription-based services and bulk ordering options, making feed management easier. Digital platforms also provide valuable data on feeding schedules and farm efficiency, helping farmers to optimize shrimp growth.

North America Shrimp Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America shrimp feed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and ingredient.

Analysis by Type:

- Grower

- Finisher

- Starter

Grower accounts for the largest market share. It plays an important role in the shrimp farming cycle, helping shrimp to achieve optimal growth and weight before harvest. This type of feed is packed with essential nutrients, proteins, and vitamins to support rapid development and improve survival rates. Since shrimp spend most of their lifecycle in the grower stage, farmers require a consistent and high-quality feed supply to ensure strong yields. Grower feed is also designed to enhance feed conversion efficiency, lowering waste and drawing profitability for shrimp farmers. With a high demand for high-quality shrimp in the US and Canada, farmers depend on advanced grower feed formulations to meet various expectations. Additionally, big firms continue to innovate by introducing sustainable, plant-based, and nutrient-rich grower feeds that promote healthier shrimp and minimize environmental impact.

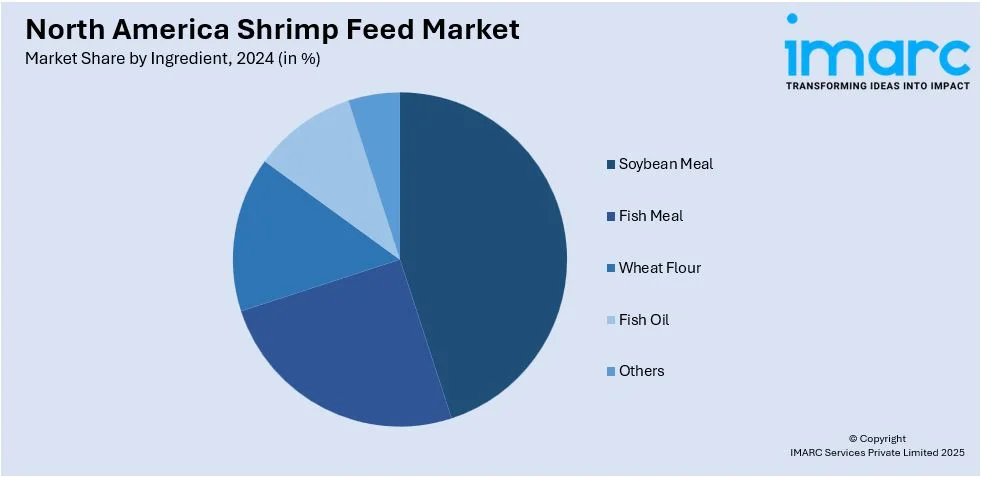

Analysis by Ingredient:

- Soybean Meal

- Fish Meal

- Wheat Flour

- Fish Oil

- Others

Soybean meal represents the largest segment. It is a highly nutritious, cost-effective, and sustainable protein source for shrimp farming. It provides essential amino acids, improves shrimp growth rates, and enhances overall feed efficiency. Farmers prefer soybean meal as an alternative to fishmeal, which is more expensive and less environment friendly. With the high requirement for sustainable aquaculture, soybean meal has become popular due to its lower environmental impact and consistent availability. It also blends well with other feed ingredients, making it a versatile option for formulating balanced shrimp diets. Additionally, North America has a strong soybean production industry, ensuring a steady supply at competitive prices. Big manufacturers continue to innovate by offering soybean meal digestibility and nutritional value, further positioning its dominance in shrimp feed formulations. As shrimp farming expands and sustainability becomes a priority, soybean meal remains the top choice for farmers looking for an effective solution.

Country Analysis:

- United States

- Canada

United States enjoys the leading position in the market. It is recognized for its large scale aquacultural activities, advanced feed technology, and high shrimp consumption. With the rising demand for high-quality seafood items, shrimp farming is expanding, creating the need for premium shrimp feed. The US has a high number of feed manufacturers that invest in R&D activities to develop nutrient-rich, sustainable, and efficient feed formulations. Farmers prefer reliable feeds that improve shrimp growth rates and reduce environmental impact. Additionally, as per the North America shrimp feed market price analysis, the country has a steady supply of ingredients like soybean meal, making feed production cost-effective. Government support for sustainable aquaculture practices and strict regulations further ensure high-quality feed production. In January 2024, the Global Shrimp Council (GSC) unveiled a marketing initiative designed to increase shrimp consumption, beginning with the US market. The group came up with its “Global Shrimp – Happy Protein” program, which aligns with the firm’s primary goal of promoting more frequent shrimp consumption among individuals. This further increased the need for high-quality shrimp feed.

Competitive Landscape:

Key players in the regional market work on creating high-quality items for catering to the high North America shrimp feed market demand. They emphasize formulating feeds with balanced protein, vitamins, and essential nutrients to improve shrimp yield and overall farm productivity. Big companies also work closely with shrimp farmers, providing technical support and training to optimize feeding practices. Many key players also develop eco-friendly and plant-based feed alternatives to reduce environmental impact. They focus on forming strong distribution networks and partnerships with aquaculture businesses to ensure that high-quality feed is widely available. Additionally, mergers, acquisitions, and collaborations help companies to expand their market presence and innovate faster. As demand for shrimp rises, big firms continue to improve feed efficiency, promote sustainable practices, and introduce advanced feed solutions.

The report provides a comprehensive analysis of the competitive landscape in the North America shrimp feed market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: The US Grains Council invited aquaculture nutritionists from Ecuador and Panama to the US to encourage sustainable practices for distiller's grains with soluble (DDGS) and corn-fermented proteins (CFPs) in the aquaculture sector. Ecuador is the top producer of shrimp feed globally and showcases the most significant market opportunity for incorporating DDGS and CFPs in aquaculture diets, thus boosting DDGS’s exports.

- July 2024: String Bio, a well-known biotech firm, obtained the ‘Generally Recognized as Safe (GRAS)’ designation for its novel microbial protein, PRO-DG, which is intended for use in crustacean feed in the US. The company utilized the SIMP platform to achieve an optimal amino acid profile, leading to enhanced digestibility and performance, as confirmed in multiple aqua trials. The shrimp's tolerance to the protein was also demonstrated in peer-reviewed studies.

- March 2024: Kuehnle AgroSystems (KAS), a natural product manufacturer based in Hawaii, U.S., which is known for its innovative approach to generating natural astaxanthin from microalgae, declared that it secured USD 3 Million in funding. Astaxanthin is an essential ingredient in the diets of farm-raised salmon and shrimp. The firm intends to speed up the commercialization of the patented method to generate premium natural algae astaxanthin.

- January 2024: Innovafeed, a prominent biotechnology company, inaugurated the Innovation and Research Center to produce insect-based ingredients in Decatur, Illinois. It signifies the company's initial move towards industrial production in North America. The firm also plans to construct a large processing facility to provide insect protein to aquaculture businesses on land and in the sea in Canada and Alaska, Chile, and potentially shrimp producers in Ecuador.

- April 2023: Atarraya, a well-recognized sustainable shrimp production company based in the US, which is known for making Shrimpbox, initiated a Series B fundraising round of USD 25 Million. It aims to start an early-adopter program in specialized markets to simplify the initiation process by supplying postlarvae, feed, training, and software that effectively operates the complete biofloc system. It intends to conclude the year with 40 units, and by 2024, 400 units located in various regions of the US.

North America Shrimp Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Grower, Finisher, Starter |

| Ingredients Covered | Soybean Meal, Fish Meal, Wheat Flour, Fish Oil, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America shrimp feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America shrimp feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America shrimp feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America shrimp feed market in the region reached 234.46 Kilo Tons in 2024.

The rising demand for shrimp, both domestically and for export, is encouraging farmers to improve production, thereby increasing the need for high-quality feed. Besides this, technological advancements in aquafeed formulations, including better nutrient profiles and digestibility, are enhancing shrimp growth rates and farm efficiency. Moreover, the rising adoption of sustainability, with more companies developing eco-friendly and plant-based feed alternatives to reduce reliance on fishmeal, is fueling the market growth.

The North America shrimp feed market is projected to exhibit a CAGR of 4.71% during 2025-2033, reaching 362.45 Kilo Tons by 2033.

Grower accounted for the largest North America shrimp feed type market share due to its essential role in shrimp growth, high nutritional value, cost-effectiveness, and strong demand from commercial shrimp farms for optimal yield.

Soybean meal represented the largest North America shrimp feed type market share, owing to its high protein content, cost-effectiveness, sustainability, and widespread use as a key plant-based alternative to fishmeal in shrimp diets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)