North America Seeds Market Size, Share, Trends and Forecast by Crop Type, Seed Type, Traits, Seed Treatment, and Country, 2025-2033

North America Seeds Market Size and Share:

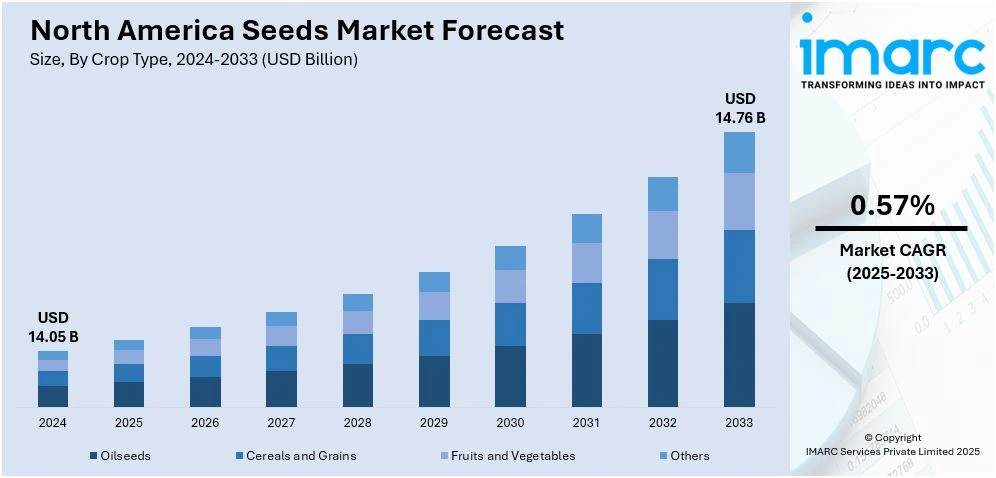

The North America seeds market size was valued at USD 14.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.76 Billion by 2033, exhibiting a CAGR of 0.57% from 2025-2033. The growing demand for high-yielding seeds, adoption of precision agriculture, and increasing preference for organic and non-GMO varieties. These factors enhance crop productivity, optimize farming practices, and cater to changing consumer preferences for healthier, sustainable food, contributing to the expansion of North America seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.05 Billion |

| Market Forecast in 2033 | USD 14.76 Billion |

| Market Growth Rate (2025-2033) | 0.57% |

Increased adoption of precision agriculture is significantly driving the market. Agricultural practices are improving with the use of precision agriculture that uses data and technology to enhance seed efficiency and performance. With the help of global positioning system (GPS), Internet of Things (IoT) devices, and sensors, farmers are making more informed decisions about seed planting. This technology allows for precise planting depths, spacing, and optimal timing, enhancing crop yields. By targeting specific field conditions, farmers can select the best seed varieties for each area. The precision agriculture approach minimizes the use of fertilizers and pesticides, reducing overall operational costs while maximizing crop productivity. Advanced analytics help farmers monitor soil conditions, weather patterns, and pest pressures to select the ideal seed treatments and varieties. This data-driven approach to seed selection ensures better seed performance and consistency across large farming operations. As a result, demand for high-quality seeds that can perform well in these optimized conditions is increasing.

Increasing demand for non-genetically modified organism (non-GMO) and organic seeds is significantly driving the North America seeds market demand. Consumer preference for organic and non-GMO foods is rapidly growing due to health and environmental concerns. As more consumers prioritize natural and sustainable food sources, the demand for organic crops is expanding. Organic farming practices require non-GMO seeds to meet certification standards and cater to health-conscious consumers. Farmers are responding by adopting organic and non-GMO seed varieties to access premium markets and higher profit margins. The growing market for organic produce encourages seed companies to develop and offer non-GMO options. These seeds are increasingly used in crops like vegetables, fruits, and grains, which have strong consumer demand. Moreover, there is rising awareness of the benefits of non-GMO foods, including fewer pesticides and additives. As a result, more farmers are converting to organic farming practices and adopting non-GMO seeds for sustainable production.

North America Seeds Market Trends:

Growing demand for high-yielding seeds

Farmers are adopting hybrid seeds to improve crop productivity, ensuring better resistance to pests and diseases. Genetically modified (GM) seeds with herbicide tolerance and insect resistance are widely used for large-scale farming operations. Advanced biotechnology innovations, such as gene editing and clustered regularly interspaced short palindromic repeats (CRISPR), are enhancing seed quality and adaptability. Hybrid seeds offer better yield stability, making them a preferred choice for commercial farming enterprises. Rising global food demand is pushing farmers to invest in superior seed varieties for higher production. High-yielding seeds help optimize land use, reducing pressure on natural resources and improving sustainability. Increased research and development (R&D) efforts are driving innovations in seed breeding for better crop performance. Seed companies are focusing on producing region-specific hybrids to suit diverse climatic and soil conditions. The expansion of precision agriculture technologies is enabling efficient planting of hybrid and GM seeds. For example, in February 2024, Norfolk Plant Sciences developed genetically modified purple tomatoes for US home gardeners. These tomatoes are infused with snapdragon genes, are rich in anthocyanins, antioxidants linked to health benefits.

Rising demand for biofuel crops

The increasing demand for biofuel crops is significantly influencing the market. Farmers are progressively cultivating high-yield corn and soybean strains to aid ethanol and biodiesel manufacturing. Government initiatives supporting renewable energy are fostering extensive farming of biofuel crops in various areas. Producing ethanol from corn necessitates high-yield seeds that provide improved starch content and effective fuel conversion. As reported by the US Energy Information Administration, the biofuel production capacity in the US increased by 7%, amounting to 24 billion gallons annually (gal/y) by early 2024. Fuel ethanol, primarily derived from corn and mixed with gasoline, continues to be the foremost source of US biofuels capacity, which increased by 2% to 18.0 billion gallons per year. The capacity for biodiesel production stayed steady at 2.1 billion gallons per year in January 2024. In addition, cutting-edge seed technologies assist farmers in cultivating biofuel crops that have enhanced resistance to pests and diseases. The growth of the biofuel sector is driving the need for genetically engineered (GE) seeds that are resistant to herbicides and drought conditions. Increasing crude oil prices are urging policymakers to allocate resources to biofuel production to ensure energy security. Seed firms are creating specific hybrid types to improve efficiency and profits in the biofuel industry. Techniques in precision agriculture are enhancing seed selection to increase yields for biofuel crop production, thereby influencing market expansion.

Changing climate conditions and need for resilient crops

Evolving climate conditions and the demand for robust crops are fueling the market growth. Severe weather occurrences including droughts, floods, and heatwaves, are driving farmers to look for resilient crop types. From June to September 2024, climate scientists at Environment and Climate Change Canada analyzed 37 of the most severe heatwaves in 17 areas throughout the nation. Seeds capable of enduring environmental stressors are increasingly important for agricultural production in North America. Seeds that are drought-resistant and heat-tolerant are highly sought after to guarantee consistent crop production in challenging situations. Businesses are spending huge money in research and development (R&D) to innovate crops that can withstand future climate challenges. The uncertain characteristics of climate change are heightening the need for seed advancements in water-saving crops. Government and agricultural agencies are aiding the creation of crops that thrive in stressful climate conditions. Progress in biotechnology is significantly contributing to the creation of genetically modified seeds for environmental sustainability. Farmers are progressively adopting precision agriculture methods to enhance the planting of robust crops.

North America Seeds Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America seeds market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on crop type, seed type, traits, and seed treatment.

Analysis by Crop Type:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Melons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Others

- Alfalfa

- Clovers and Other Forage

- Flower Seed

- Turf Grasses

Cereals and grains account for the largest segment in the seeds market due to their widespread cultivation. These crops including corn, wheat, and rice, are essential staples in the North American diet. They are crucial for both food production and animal feed, driving consistent demand for high-quality seeds. The increasing need for biofuel production, especially ethanol, further drives the demand for cereal crops like corn. Cereals and grains are more adaptable to various climates, making them a reliable choice for farmers. Their role in ensuring food security worldwide contributes to their dominance in the market. With innovations in seed technology, farmers can now grow higher-yielding and disease-resistant varieties of cereals and grains. Growing consumer awareness regarding healthier food options also supports the demand for cereals, further expanding the market. Government subsidies and agricultural policies supporting these crops further catalyzing the demand for quality seeds. Additionally, cereals are extensively used in processed food, which further increases their market share.

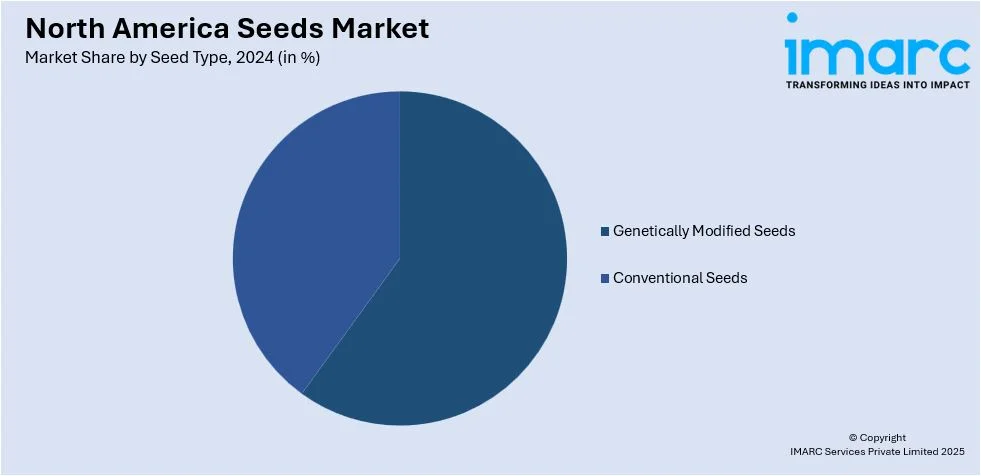

Analysis by Seed Type:

- Genetically Modified Seeds

- Conventional Seeds

Genetically engineered seeds lead the market because of their enhanced effectiveness in agricultural yield. Farmers are increasingly choosing genetically modified seeds due to their improved resistance to pests, diseases, and herbicides. These seeds yield more, making them crucial for extensive commercial farming and satisfying increasing food needs. Genetically modified technology plays a crucial role in creating crops that succeed in harsh environmental conditions like drought and extreme temperatures. They lessen reliance on chemical pesticides, decreasing total farming expenses and enhancing profitability. These advantages promote extensive acceptance among farmers, resulting in a notable market share. The swift progress in biotechnology is facilitating the creation of crops with enhanced nutritional value, further impacting demand for genetically engineered seeds. Additionally, the process for obtaining regulatory approvals for genetically modified crops is becoming more efficient, promoting increased market acceptance in North America. The growing worldwide acceptance of genetically modified products and their significance in tackling food security issues are key elements leading to their prevalence. Through advancements in gene editing methods. such as CRISPR, genetically modified seeds are expected to dominate the seed market, offering answers to urgent agricultural issues.

Analysis by Traits:

- Herbicide-Tolerant

- Insecticide-Resistant

- Others

The others category within seed traits demonstrates dominance due to the growing variety of specialized traits. Traits like pest resistance, herbicide tolerance, and drought tolerance, often grouped under "others," are increasingly prioritized. These traits are developed to meet the challenges posed by climate change, diseases, and environmental stressors. As climate conditions fluctuate, farmers require seeds with tailored traits to ensure crop survival and high yields. The demand for customized seed traits, including resistance to specific pests or improved nutritional content, is rapidly growing. Research and development (R&D) in this area allow seed companies to cater to niche markets and region-specific agricultural needs. These traits also include innovations in seed coating and treatments that enhance seedling establishment and growth. The combination of multiple beneficial traits, such as combined pest resistance and drought tolerance, is essential for farmers facing varied challenges. Moreover, advancements in biotechnology are enabling the development of multi-trait seeds that offer superior performance across diverse conditions. The market for these customized trait combinations is expanding, as farmers seek efficiency and sustainability in their operations.

Analysis by Seed Treatment:

- Treated

- Non-Treated

Treated seeds leads the market share owing to their enhanced ability to resist diseases and pests effectively. Seed treatments involve the application of chemicals or biological agents to protect seeds during early growth stages. These treatments significantly increase seedling vigor and improve germination rates, leading to higher crop yields. Farmers increasingly opt for treated seeds to ensure uniform crop establishment and reduce the risk of crop loss. The adoption of seed treatments is growing due to the need for more sustainable farming practices. Treated seeds provide protection from soil-borne diseases, helping reduce the reliance on chemical pesticides and fertilizers. By offering improved seedling survival and resistance to environmental stress, treated seeds support more robust crop production. The cost-effectiveness of treated seeds, which reduce the need for additional pest control measures, is a major factor. Government support and awareness about the benefits of seed treatment technologies further fuel market growth. Moreover, innovations in bio-based seed treatments, including natural fungicides and insecticides, are gaining traction as eco-friendly alternatives.

Country Analysis:

- United States

- Canada

The United States is the dominant player in the market because of its advanced agricultural infrastructure. The country has a large-scale, commercial farming sector that drives substantial demand for high-quality seeds. The US is home to some of the world’s leading seed companies, which innovate and supply a wide variety of seed types. US farmers increasingly rely on genetically modified seeds, further driving the domestic seed market. The adoption of precision agriculture technologies, which optimize seed selection and planting, is widespread in the US. In May 2024, John Deere announced to launch a new Precision Upgrade Business unit aimed at making precision farming accessible to thousands of growers. The initiative offers affordable upgrades to existing machinery with advanced technologies, enabling farmers to enhance productivity and sustainability. It includes solutions for all brands of equipment, helping growers optimize operations without investing in entirely new machinery. Besides this, the government’s agricultural policies, including subsidies and support for sustainable farming, strengthen the domestic seed market growth. The US is also a major producer of biofuel crops, particularly corn, driving demand for specialized seeds. Favorable climate conditions in certain regions of the region enable diverse crop cultivation, requiring a variety of seed types. The large consumer base for both conventional and organic crops further support seed market growth.

Competitive Landscape:

Key players are continuously financing research and development (R&D) to enhance seed quality and production, through major breakthroughs in technology. For example, in November 2024, Corteva Agriscience announced a major advancement in wheat technology, utilizing gene-editing techniques to enhance wheat varieties. This breakthrough aims to improve productivity and sustainability in wheat farming. The new wheat technology is expected to help address challenges in global food security by offering more resilient and efficient crops, benefiting farmers and the agricultural industry. These major companies are focusing on developing genetically modified and hybrid seed varieties to meet market demands. By introducing advanced seed technologies, key players ensure crops can withstand environmental stresses and yield higher outputs. Strategic acquisitions and mergers enable companies to broaden their product offerings and enhance market access. Through partnerships with agricultural organizations, key players are gaining access to valuable farming insights and technology. Industry leaders are also working on developing seeds with improved nutritional profiles to cater to changing consumer preferences. They are increasingly investing in precision agriculture tools to optimize the use of their seed varieties. Additionally, large players in the market are promoting sustainability by introducing eco-friendly seed options that benefit both farmers and the environment. They are also focused on expanding their market presence by entering new geographical regions and diversifying their seed offerings.

The report provides a comprehensive analysis of the competitive landscape in the North America seeds market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: HZPC Americas Corp. launched a new Seed Potato Dealer Network across North America, partnering with three key dealers in the US and Canada. This shift from direct sales to a licensing model will enhance seed supply efficiency, supporting regional potato growers and commercial users. The move aims to streamline distribution and improve market access for seed potatoes.

- December 2024: Bene Seeds, Inc. and Johnny’s Selected Seeds introduced co-developed tomato varieties designed to enhance yield and flavor. These varieties aim to meet market demand for high-quality, flavorful produce. The collaboration blends the expertise of both companies to provide growers with improved seed options for better agricultural performance and crop quality.

- September 2024: Hudson Valley Seed Company opened a new retail store and education center in Accord, New York. The center offers a variety of seeds and gardening tools, alongside educational resources. It aims to foster sustainable gardening practices in the Hudson Valley by hosting workshops and community events, supporting local gardeners and growers.

- February 2024: The Government of United States invested $18 million to enhance the native seed supply, aimed at improving climate resilience and ecosystem restoration. This funding, from the Inflation Reduction Act, will support seed collection, production, and infrastructure. It will also assist underserved communities, including Tribes, in strengthening local seed resources for sustainable land management and restoration efforts.

- September 2023: Bayer launched two innovative products for Canadian potato growers: Emesto Complete, a combined fungicide and insecticide seed-piece treatment, and Velum Rise, a fungicide/nematicide for in-furrow application. These solutions are designed to safeguard potato crops against pests and diseases, aiming to enhance yield and crop quality.

North America Seeds Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered |

|

| Seed Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Traits Covered | Herbicide-Tolerant, Insecticide-Resistant, Others |

| Seed Treatments Covered | Treated, Non-Treated |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, North America seeds market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America seeds market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The seeds market in the North America was valued at USD 14.05 Billion in 2024.

The North America seeds market growth is driven by several key factors. These include the rising demand for high-yielding and hybrid seeds, advancements in genetically modified (GM) crops, and the rising demand of precision agriculture. Additionally, the demand for biofuel crops and the need for climate-resilient varieties are crucial. Growing consumer preferences for organic and non-GMO seeds, along with government support, further fuel market growth.

The North America seeds market is projected to exhibit a CAGR of 0.57% during 2025-2033, reaching a value of USD 14.76 Billion by 2033.

Cereals and grains accounted for the largest share of the market. This segment includes key crops like corn, wheat, and rice, which are essential for food production, livestock feed, and biofuel production. The widespread demand for high-quality seeds, especially for biofuel crops like corn, drives this segment’s dominance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)