North America Sanitary Napkin Market Size, Share, Trends and Forecast by Type and Distribution Channel, and Country, 2025-2033

North America Sanitary Napkin Market Size and Share:

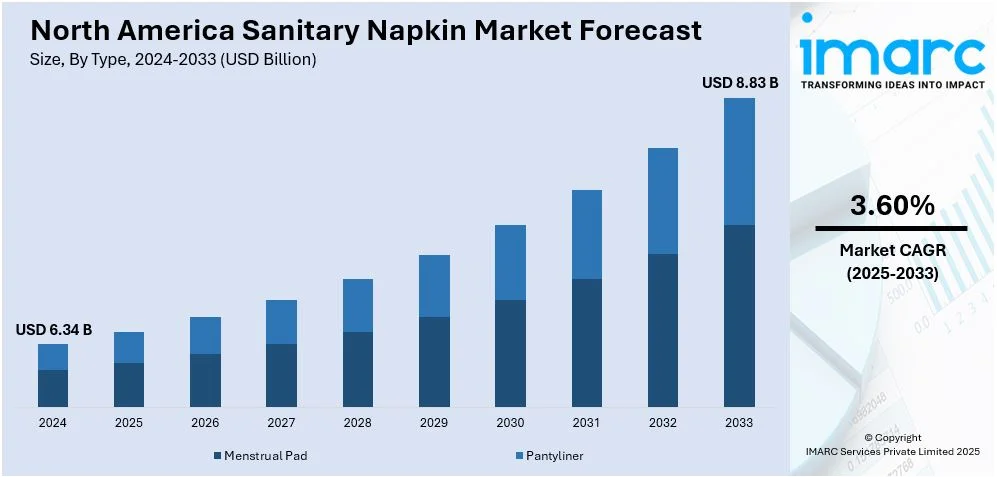

The North America sanitary napkin market size was valued at USD 6.34 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.83 Billion by 2033, exhibiting a CAGR of 3.60% from 2025-2033. The North America sanitary napkin market share is experiencing significant growth driven by increasing consumer demand for comfort, sustainability, and product innovation, with brands focusing on eco-friendly solutions, enhanced product features, and expanding distribution channels to cater to evolving consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.34 Billion |

|

Market Forecast in 2033

|

USD 8.83 Billion |

| Market Growth Rate (2025-2033) | 3.60% |

The North America sanitary napkin market demand is mainly due to an intensified focus in menstrual hygiene and the growing awareness of the need to have high-quality, reliable products. Consumers are becoming highly informed about the health benefits of using comfortable and absorbent sanitary napkins. Consumer awareness, coupled with knowledge regarding what's healthy, safe, and comforting for a lady during periods has observed an immense upsurge in the market of comfort-cum-high standard hygienic sanitary products. Additionally, another important change witnessed in this demand pattern is increasing orders of ecological-friendly, nature-friendly, organic sanitary napkin along with high numbers of conscious people shifting toward environment-friendly solutions. Moreover, several brands have started innovating and launching new products that involve the use of biodegradable materials and plant-based ingredients for consumers who consider being environmentally friendly. For instance, In May 2023, KNH launched biodegradable sanitary pads made from bamboo fibers, offering rapid absorption, breathability, and bacteriostatic properties, aligning with growing consumer demand for eco-friendly feminine hygiene and sustainable packaging solutions. Furthermore, these consumer trends, with wellness and sustainability through effective marketing, have spurred growth within the region.

Apart from changes in consumer preferences, the North American sanitary napkin market is also being supported by amplified and wider distribution channels that have made the product highly accessible to a larger audience. As both offline retail stores and online platforms continue to grow in offering sanitary napkins, consumers now find it easier and more convenient to purchase these products. The boost in disposable incomes across the region has allowed consumers to invest premium, specialized sanitary napkin products, often labeled by marketing communication as superior in comfort, performance, and sustainability. Innovative packaging solutions, like discreet and travel-friendly designs, have enhanced convenience and appeal for the products. Sanitary napkins have also become more appealing due to the advancements in technological features of the product, including odor control, leak protection, and breathability. For example, in August 2023, Kotex upgraded its "U by Kotex" series with enhanced absorbency and eco-friendly materials, responding to the increasing consumer demand for sustainable feminine hygiene products. Further, all these factors are together contributing to the growth of the North American sanitary napkin market outlook.

North America Sanitary Napkin Trends:

Increased Focus on Organic and Eco-Friendly Products

With heightened consciousness about the environment and rising interest in sustainable lifestyles, the organic and eco-friendly sanitary napkin market in North America is increasing. Manufacturers are investing in ecofriendly biodegradable materials such as, organic cotton, or other alternatives from sustainable sources as consumers show concerns for their immediate environment and related values. For instance, Whisper, a leading feminine hygiene brand, introduced a new line of eco-friendly sanitary napkins in 2024. These products are 100% biodegradable and made from organic cotton, catering to the growing demand for sustainable feminine hygiene options. Moreover, sanitary napkins have become a replacement for the traditional ones made from synthetic materials and chemicals, are these are now made from natural fibers which contain no pesticides. People are focusing on avoiding waste, minimize the chemical's exposure, and not harm nature. Brands are now openly selling their products as sustainable with features, such as compostability, minimalistic packaging, or cruelty-free manufacturing processes. Additionally, the adoption of eco-friendly products is further supported by government regulations and initiatives focused on reducing plastic waste.

Innovation in Product Design and Functionality

There is intensifying demand for innovation product designs and function within the sanitary napkin North American market. Companies are competing more on ensuring their products give maximum comfort, enhancing comfort levels and high performance. Developments such as ultra-thin pads, leakage proof technology and highly absorbable materials make it comfortable and highly efficient to be used. Furthermore, the development of odor-control features and breathable fabrics is improving the overall user experience. Customization is another trend that is picking up steam, with many brands offering varying sizes, absorbency levels, and even napkins designed for different body types. These advancements are aimed at providing a better fit and enhanced comfort while ensuring greater performance. Further, the subscription services and reusable or washable products are transforming the market. The customers enjoy the convenience and versatility brought about by such innovations, thereby leading to more product adoption and expansion of the market.

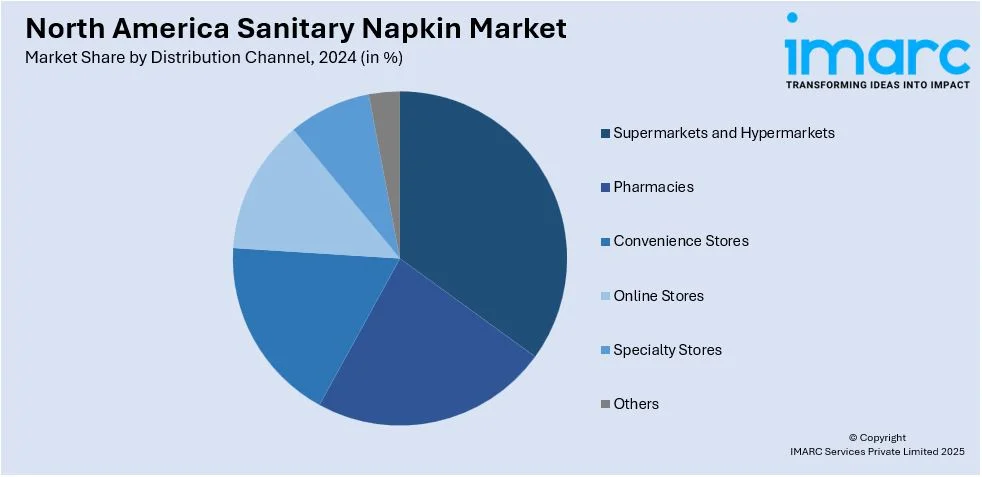

Expansion of Distribution Channels and Accessibility

This significant trend driving growth in the North American sanitary napkin market has been the proliferation of distribution channels, thereby enabling the product to reach a greater consumer base. Sanitary napkins were until recently sold mostly in supermarkets and pharmacies. It is now selling through online mediums, direct-to-consumer offerings, and through subscription-based plans. Growing interest in e-commerce made it more comfortable for customers to buy sanitary pads from their respective homes and purchase them from comfort, leading the online market into a hike. Retailers will also shift into omnichannel strategies and can offer their respective consumers an alternative between store-and-online buying modes. Lastly, health-conscious wellness stores, environment-friendly shops sell organic, Eco-friendly sanitary pad brands more significantly. This increased availability is especially crucial for niche consumers, such as those looking for organic cotton or allergen-free products, which further fuels market growth. The improved variety of choices has made sanitary napkins highly accessible, accelerating their penetration in the North American market.

North America Sanitary Napkin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America sanitary napkin market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Menstrual Pad

- Pantyliner

Menstrual pads are a leading product in the sanitary napkin market are providing the much-needed comfort and hygiene with menstruation. There are regular, overnight, and pantyliner variants that meet the varied needs of consumers. Due to greater convenience and ease of use, with boosted availability, demand for menstrual pads remains consistently high. Additionally, innovations in material, such as organic cotton and eco-friendly variants, are propelling growth since more consumers prefer sustainability. The ongoing research is focused on the improvement of absorbency and skin-friendly properties. Menstrual pads remain a preferred choice for many, thereby holding a substantial share of the North American market. Consumer awareness about menstrual health and hygiene is also accelerating their popularity.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Specialty Stores

- Others

Pharmacies are important in the dispensation of sanitary napkins within North America since they provide easier access to these products for those seeking menstrual hygiene products. A wide variety is usually available from these retail shops, including the traditional and organic variants, that cater to consumers' different needs. Pharmacies are especially chosen by those people who prefer prompt, reliable, and easy access to sanitary napkins without any need for an order on an online site. Many consumers also feel comfortable buying from familiar and trusted pharmacy brands that tend to offer discreet and efficient service. Moreover, pharmacy chains are becoming more vocal in their emphatic promotion of premium, eco-friendly products. This moves directly according to the demand that is seen among consumers for sustainability. Pharmacies located throughout the cities and villages allow sanitary napkins to reach all corners, contributing heavily to overall market growth.

Country Analysis:

- United States

- Canada

United States is one of the most significant sanitary napkin markets in North America due to the diversity of its population, heightening awareness about menstrual health, and higher demands for good quality hygiene products. It grows very much because consumers today are becoming much more conscious of their ecological footprint, thus generating even greater interest in green and organic sanitary products. Moreover, innovations like bio-degradable products, comfort with advanced features and special options suitable for different kinds of needs keep fueling expansion in the US sanitary napkins market. Significant retail chains, along with increased e-commerce avenues, have broadened product distribution and access points for consumers, further improving it. Awareness created through campaigns, along with emerging trends of inclusion and gender-neutral products, makes a change in consumer purchasing decisions, thereby providing a boost in demand for sanitary napkins across the United States.

Competitive Landscape:

The competitive structure of the sanitary napkin market in North America is highly competitive and diversified due to a range of players with varying market share. Established players are emphasizing innovative products, diverse product offerings, and strengthening the brand relationship by retaining customers through loyalty. Heavily focusing on R&D, companies can introduce more comfortable, effective, and eco-friendly products, helping them to cash in on a growing demand by consumers for organic and sustainable offerings. Furthermore, new companies are targeting smaller markets by positioning themselves as producing organic, biodegradable or hypoallergenic products to appeal to environment-conscious consumers. Some of these companies are targeting market leadership and therefore adopting aggressive strategies with respect to marketing, thereby promoting sustainability and comfort at economical prices. Electronic commerce has created new competition wherein customers can readily compare and choose between different producers of baby skincare products. Overall, this market is based on innovation and evolving consumer demand with changing forms of distribution channels.

The report provides a comprehensive analysis of the competitive landscape in the North America sanitary napkin market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Carefree expanded its feminine care portfolio by introducing new pads alongside its liners. Featuring VEOCEL™ Lyocell fibers with Dry Technology, the pads provide enhanced multi-fluid and odor control. The launch is supported by the "Protection for the Protectors" campaign, celebrating moms and their need for superior feminine care solutions.

- In April 2024, Kimberly-Clark introduced Liv by Kotex, a new product line offering dual protection against periods and bladder leaks. Featuring a multi-layer core and leakblock sides, the pads provide up to 100% leak-free protection and 10 times more dryness than period-only pads, catering to evolving feminine hygiene needs.

- In January 2024, Danish femcare startup Mewalii launched its innovative hemp-based period pads, crafted from 100% hemp fibers. The product, free from cotton and plastic, offers a sustainable alternative to traditional feminine hygiene products, focusing on eco-friendly materials with minimal environmental impact, addressing the growing demand for green solutions.

North America Sanitary Napkin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Menstrual Pad, Pantyliner |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Specialty Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America sanitary napkin market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America sanitary napkin market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America sanitary napkin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sanitary napkin market in the North America was valued at USD 6.34 Billion in 2024.

The growth of the North American sanitary napkin market is driven by increasing consumer awareness regarding menstrual health, rising disposable income, and the growing preference for eco-friendly, organic products. Additionally, advancements in product innovation, such as improved comfort and absorbency, and the influence of social movements promoting menstrual hygiene contribute significantly to market expansion.

The North America sanitary napkin market is projected to exhibit a CAGR of 3.60% during 2025-2033, reaching a value of USD 8.83 Billion by 2033.

Menstrual pads are a leading product in the sanitary napkin market, providing the much-needed comfort and hygiene with menstruation. Due to greater convenience and ease of use, with boosted availability, demand for menstrual pads remains consistently high.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)