North America PVC Pipes Market Size, Share, Trends and Forecast by Application, and Country, 2025-2033

North America PVC Pipes Market Size and Share:

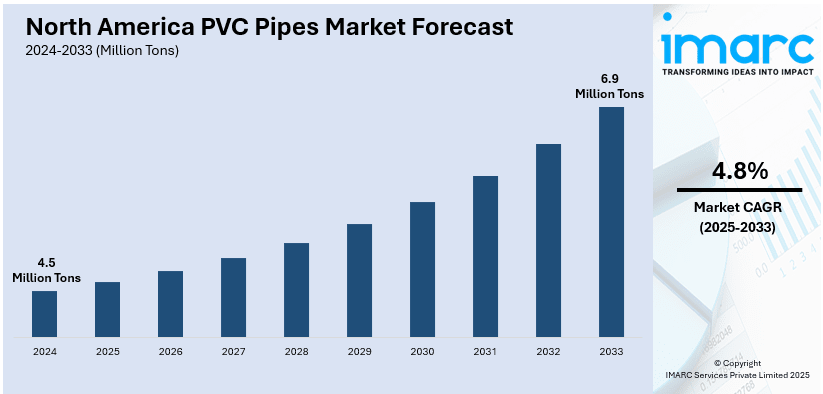

The North America PVC pipes market size was valued at 4.5 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 6.9 Million Tons by 2033, exhibiting a CAGR of 4.8% from 2025-2033. The increasing focus on improving the old water distribution systems and waste water management, rise of green building initiatives to reduce the environmental impact of construction activities, and heightening concerns about water conservation and sustainability are some of the factors impelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4.5 Million Tons |

|

Market Forecast in 2033

|

6.9 Million Tons |

| Market Growth Rate (2025-2033) | 4.8% |

Polyvinyl chloride (PVC) pipes are considered for their durability, cost effectiveness, resistance to corrosion, and ease of installation, which makes them an ideal choice for various applications. In North America owing to macroeconomic factors and industry specific developments, the usage of PVC pipes is increasing. As per the PVC pipes market analysis, policies implemented by the government for promoting sustainable construction practices and upgradation of old water systems are driving the market in North America. The construction sector is one of the most significant consumers of PVC pipes in North America. This is because, over the past few decades, the rate of urbanization and population growth has experienced rapid growth. The demands for housing and commercial space are creating a surge in residential, commercial, and industrial buildings that require large networks of piping for water supply, drainage, and heating, ventilation, and air conditioning (HVAC). This material is ideal for various applications because PVC pipes offer reliable and cost-effective solutions, can easily withstand high-pressure conditions, and are also compatible with a wide variety of fluids and gases.

Green building practices and sustainable construction activities are contributing to the growth of the PVC pipe market. The low energy consumption in manufacturing, relatively lower carbon footprint, and high recyclability of PVC pipes also make them a preferred product among builders and contractors today. Moreover, its easy compliance with stringent building codes and environmental standards makes it fit for modern construction activities. On the other hand, advanced technological capabilities in the form of molecular orientation in PVC-O pipes enhance the mechanical properties, increasing competitiveness in the construction market. The manufacturing process and innovation of material in PVC pipes for North America are changing as well. Improvements of extrusion technologies have increased production lines to high-performance pipes that show improved durability and flexibility.

North America PVC Pipes Market Trends:

Growing Adoption in the Construction Sector

The North American construction sector is a major consumer of PVC pipes, mainly because of the increasing demand for residential and commercial properties. PVC pipes are extensively used in construction projects for water supply lines, drainage systems, and HVAC piping due to their durability, resistance to corrosion, and compatibility with various fluids. The increase in green building initiatives is also driving the demand for PVC pipes. Today in 2024, many companies are manufacturing PVC products that are LEED-Compliant, allowing companies for sustainable construction methods. Manufacturers are gaining much support through builders who require complying to environmental regulations without necessarily affecting their bottom lines. There is also reduced labor from fitting the PVC pipes that lighten the load as they are straightforward to install. Therefore, this has resulted in such pipes being implemented into these extensive construction projects. In 2024, The U.S. Census Bureau and the U.S. Department of Housing and Urban Development announced that privately owned housing units that were authorized in November were seasonally changed at an annual rate of 1,505,000. This is 6.1% above the recorded rate of October. This further increased the usage of PVC pipes in the residential sector for improving water distribution systems in homes.

Advancements in Water Management and Sustainability

The increasing concerns associated with water conservation and sustainability are promoting the use of PVC pipes in water management and environmental applications. Water scarcity challenges are worsening in California, which currently faces record-breaking droughts in 2024, and according to a published news article by Los Angeles Times, the availability of water in California can decline radically in the next 20 years. As a response, municipalities and private sectors are investing in efficient water distribution systems where PVC pipes play a crucial role because of their leak-resistant properties and low maintenance requirements. According to reports, PVC pipes reduce water loss during distribution compared to older metal pipes, which makes them essential for improving resource efficiency. 2024 also witnessed the introduction of innovative PVC pipe technologies designed for sustainable water management. Moreover, PVC pipes have been widely adopted for underground sewer networks due to their resistance to root intrusion and cracking.

Infrastructure Modernization and Government Investments

Infrastructure modernization, particularly for water supply, sewage systems, and public utilities, is one of the main reasons driving the PVC pipes market in North America. Governments in the United States and Canada are allocating considerable funds toward upgrading aging water infrastructure. For instance, the U.S. Environmental Protection Agency (EPA) declared $3.6 billion in new year fund allotment to upgrade water infrastructure and retain the safety of communities. In addition to the already announced $2.6 billion, this $6.2 billion in investments for Fiscal Year 2025 is to help communities upgrade the water infrastructure. Furthermore, 2024 has seen product launches tailored directly to modern infrastructure requirements. These innovations have helped drive up the adoption of PVC pipes for critical infrastructure projects, especially in urban areas.

North America PVC Pipes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America PVC pipes market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application.

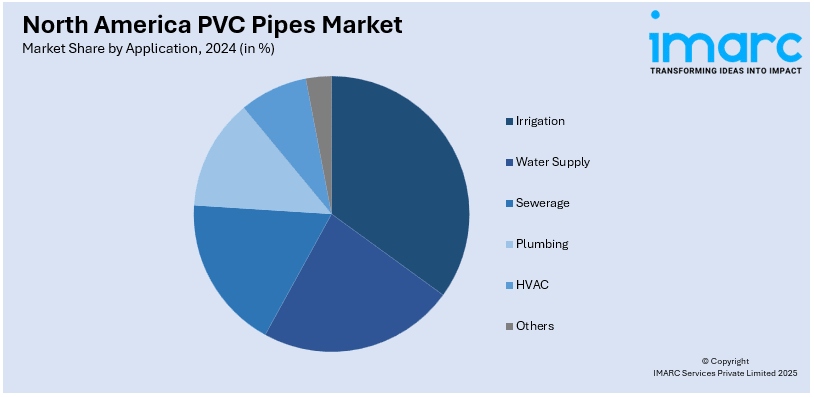

Analysis by Application:

- Irrigation

- Water Supply

- Sewerage

- Plumbing

- HVAC

- Others

Irrigation represents the largest part due to several reasons. PVC pipes have wide applications in different types of irrigation, from the traditional surface to high-efficiency drip and sprinkler. In surface irrigation, the PVC pipes find their applicability as a delivery pipe for conveying water from reservoirs to a field for irrigation. There is lesser friction loss owing to their smooth inner sides, thus assuring efficient transmission of water over significant distances. Furthermore, PVC pipes in the flood irrigation system are employed for the establishment of a temporary or permanent distribution network that facilitates uniform water application among the farmlands. Drip irrigation is one of the most widely used techniques to save water, which depends on PVC pipes extensively for its delivery system. PVC is primarily used in drip irrigation mainlines and sub-mainlines because they can endure constant water pressure without degradation. In sprinkler irrigation, the PVC pipes act as a riser and lateral line transporting pressurized water up to the sprinklers uniformly for irrigation. Such applications testify to the versatility of the PVC pipes in meeting specific needs of irrigation, that is, in both smaller and larger agricultural and gardening applications, delivering water safely. Water saving is being an increasing concern in farming and landscaping, and PVC contributes toward the cause by saving water with the reduction in losses at transportation. This allows PVC pipes to reduce friction internally and maintain a smooth internal surface for the smooth flow of water with minimum chances of leakage. Also, PVC pipes can work efficiently with high technologies like automation and precision farming systems for further usage in modern agriculture. In addition, the material is recyclable and works towards circular economy ideas of sustainability within the irrigation sector.

Country Analysis:

- United States

- Canada

United States hold the biggest North America PVC pipes market share owing to the increasing focus on infrastructure modernization. PVC pipes are essential for water distribution, wastewater management, and stormwater drainage systems, all of which are critical to supporting urban growth. In particular, the growing emphasis on smart city initiatives has encouraged the use of advanced PVC piping systems that are compatible with modern monitoring and automation technologies. Additionally, the rising demand for high-capacity infrastructure, such as large-scale water transportation systems and underground cable conduits, is expanding the scope of PVC pipe applications. These pipes are increasingly being used in urban utilities due to their ability to withstand extreme conditions, resist chemical corrosion, and reduce maintenance costs over time. The agricultural industry represents another major contributor to the PVC pipe sector in the United States. PVC pipes are widely used in irrigation systems, where they provide a cost-effective and durable solution for water delivery. As farmers and agricultural businesses adopt more efficient and smart irrigation technologies to address water scarcity and improve crop yields, the demand for PVC pipes is increasing significantly. The IMARC Group predicts that the US smart agriculture market is projected to exhibit a growth rate (CAGR) of 9.50% during 2024-2032.

Competitive Landscape:

One of the primary strategies adopted by market players is investing in product innovation to meet the changing requirements of industries such as construction, agriculture, and water management. Companies are focusing on developing advanced PVC piping systems with improved durability, chemical resistance, and pressure-handling capacity. For example, several manufacturers are producing chlorinated polyvinyl chloride (CPVC) pipes, which offer superior resistance to high temperatures, making them suitable for applications such as hot water distribution and industrial processes. Automation and advanced manufacturing technologies are also embraced by key players to enhance production efficiency and product quality. Many companies have adopted extrusion techniques and automated quality control systems to minimize defects and improve the consistency of their PVC pipe products. This focus on technological advancement has allowed companies to meet stringent regulatory standards and build a reputation for reliability in the market. To address growing demand, particularly in emerging markets, many PVC pipe manufacturers are expanding their production capacities and diversifying their geographic presence. Key players are setting up new manufacturing facilities or upgrading existing ones to increase output and reduce production costs through economies of scale. For instance, in 2024, Westlake Pipe & Fittings announced its plan to set up a new molecular oriented PVC (PVCO) pipe plant at Wichita Falls, Texas.

The report provides a comprehensive analysis of the competitive landscape in the North America PVC pipes market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Zekelman Industries entered into a joint venture with Maverick Pipe to expand its offering of made in USA strut channel, PVC fence items, and PVC conduit.

- May 2024: Westlake Pipe & Fittings declared the opening of a new distribution center in Lakeland, Florida, reaching a milestone in its strategic expansion efforts. The new facility has up to 200,000 sq feet warehouse storage for PVC fittings and an extra 4 acres for pipe storage.

North America PVC Pipes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Irrigation, Water Supply, Sewerage, Plumbing, HVAC, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America PVC pipes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America PVC pipes market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America PVC pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

PVC pipes, or polyvinyl chloride pipes, are lightweight, durable, and corrosion-resistant pipes widely used for water supply, drainage, irrigation, plumbing, and HVAC systems. Their cost-effectiveness, ease of installation, and compatibility with various fluids make them ideal for construction, agriculture, and water management applications.

The North America PVC pipes market was valued at 4.5 Million Tons in 2024.

IMARC estimates the North America PVC pipes market to exhibit a CAGR of 4.8% during 2025-2033.

The market is driven by infrastructure modernization, sustainable construction practices, government investments in upgrading water systems, green building initiatives, and increasing demand for efficient water management solutions amid growing concerns about water conservation and environmental sustainability.

In 2024, irrigation represented the largest segment by application, driven by the growing need for efficient water delivery systems in agriculture and landscaping.

On a regional level, the market has been classified into the United States and Canada, wherein the United States currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)