North America Precision Agriculture Market Size, Share, Trends and Forecast by Technology, Type, Component, Application, and Country, 2026-2034

North America Precision Agriculture Market Summary:

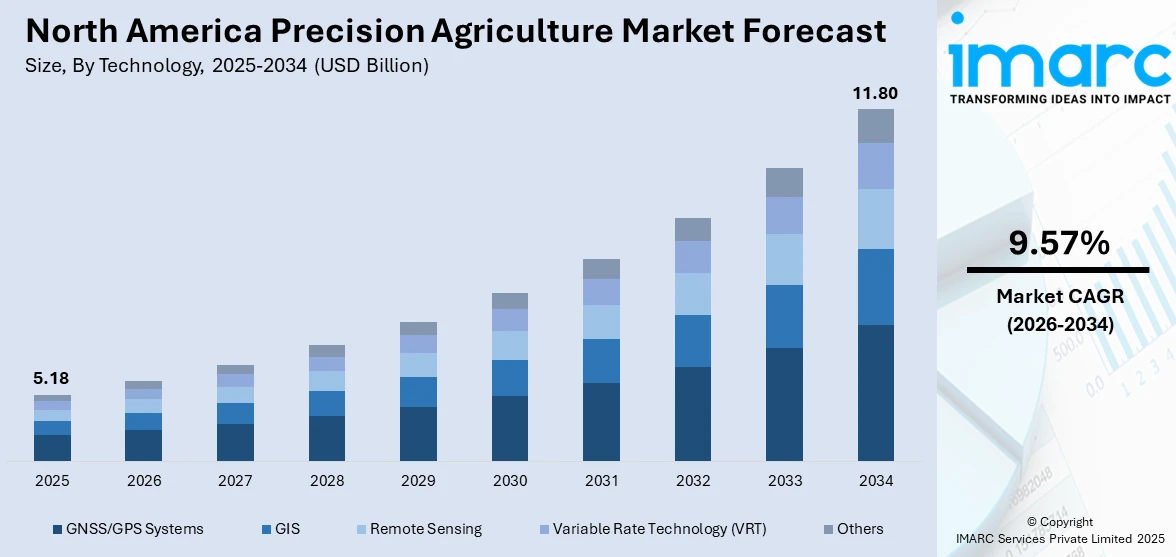

The North America precision agriculture market size was valued at USD 5.18 Billion in 2025 and is projected to reach USD 11.80 Billion by 2034, growing at a compound annual growth rate of 9.57% from 2026-2034.

The North America precision agriculture market is experiencing robust expansion driven by increasing demand for efficient crop production and resource optimization. Farmers across the region are adopting advanced technologies including GPS guidance systems, remote sensing platforms, and variable rate application tools to enhance productivity and sustainability. Rising focus on data-driven farming practices, government support programs, and the growing need for labor efficiency are accelerating technology adoption across agricultural operations throughout the region.

Key Takeaways and Insights:

- By Technology: GNSS/GPS systems dominate the market with a share of 38% in 2025, owing to their foundational role in enabling precise field navigation, automated steering, and accurate positioning for farm equipment operations across diverse agricultural applications.

- By Type: Automation and control systems lead the market with a share of 45% in 2025. This dominance is driven by farmer demand for reduced labor dependency, improved operational precision, and enhanced equipment performance through automated guidance and implement control technologies.

- By Component: Hardware exhibits a clear dominance in the market with 51% share in 2025, reflecting strong farmer investment in physical equipment including GPS receivers, sensors, controllers, and display systems that form the backbone of precision farming operations.

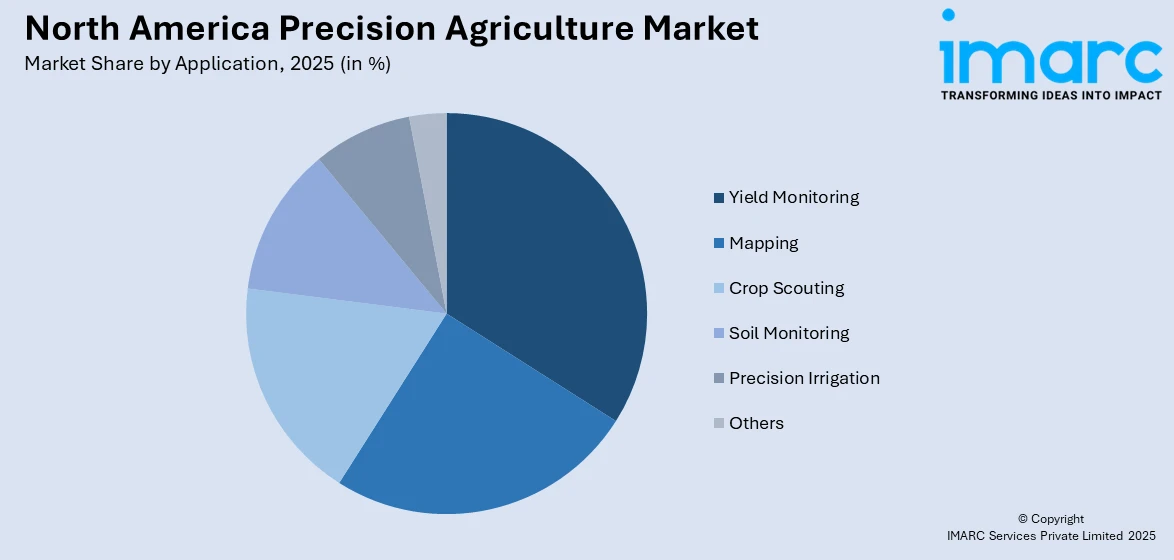

- By Application: Yield monitoring represents the biggest segment with a market share of 32% in 2025, enabling farmers to collect real-time harvest data across field zones for performance assessment, informed replanting decisions, and optimized resource planning for subsequent seasons.

- By Country: United States is the largest country with 79% share in 2025, driven by the presence of large-scale commercial farming operations, advanced agricultural infrastructure, and substantial investments in agricultural technology research and development.

- Key Players: Key players drive the North America precision agriculture market by expanding technology portfolios, enhancing equipment compatibility, and strengthening distribution networks. Their investments in research and development, strategic partnerships, and customer support services accelerate technology adoption and ensure seamless integration of precision solutions across diverse farming operations throughout the region. Some of the key players operating in the industry include Agilent Technologies Inc, Aegon Ltd, Trimble Inc, AGCO Corp, CNH Industrial NV, CropX, Deere & Co, and Topcon Corp.

To get more information on this market Request Sample

The North America precision agriculture market is undergoing significant transformation as farmers increasingly embrace digital technologies to address mounting operational challenges and sustainability requirements. The region benefits from well-established agricultural infrastructure, strong government backing through federal programs and research initiatives, and a highly developed ecosystem of technology providers serving the farming community. Advanced precision tools including satellite-based guidance systems, autonomous machinery, drone platforms, and artificial intelligence-powered analytics are reshaping traditional farming practices by enabling site-specific management decisions. In May 2024, the USDA, University of Nebraska-Lincoln, and Nebraska Innovation Campus broke ground on the USD 160 Million National Center for Resilient and Regenerative Precision Agriculture, a state-of-the-art facility designed to advance research on sustainable crop production, water management, and climate-resilient farming practices. The convergence of rising input costs, labor constraints, and environmental regulations continues to drive farmer interest in precision technologies that optimize resource utilization while maintaining productivity and profitability across the agricultural value chain.

North America Precision Agriculture Market Trends:

Integration of Artificial Intelligence and Machine Learning in Farm Operations

Agricultural operations across North America are increasingly incorporating artificial intelligence and machine learning capabilities into precision farming systems. These advanced analytical tools process vast amounts of data collected from sensors, satellites, and equipment to deliver actionable insights for crop management decisions. Farmers leverage AI-powered platforms for predictive analytics, enabling proactive responses to changing field conditions, pest pressures, and weather patterns. The technology facilitates automated decision-making for irrigation scheduling, fertilizer applications, and harvest timing, significantly enhancing operational efficiency and supporting the North America precision agriculture market growth.

Expansion of Autonomous and Semi-Autonomous Agricultural Equipment

The adoption of autonomous and semi-autonomous farming equipment is accelerating throughout North America as producers seek solutions to persistent labor challenges and operational efficiency demands. These systems utilize advanced sensors, computer vision, and GPS technology to perform field tasks with minimal human intervention, enabling consistent operation quality across extended periods. Autonomous tractors, robotic sprayers, and self-guided harvesters are transforming how agricultural tasks are executed, allowing farmers to cover more acreage while reducing operator fatigue and human error in repetitive operations.

Growing Adoption of Drone Technology for Crop Management

Unmanned aerial vehicles are gaining substantial traction among North American farmers for diverse agricultural applications including crop health monitoring, precision spraying, and field mapping. Drones equipped with multispectral cameras and thermal imaging sensors provide detailed insights into plant stress, irrigation needs, and pest infestations across large acreages. The technology enables rapid field scouting and targeted intervention, allowing producers to address problems before they escalate into significant yield losses while reducing chemical inputs through precision application capabilities.

Market Outlook 2026-2034:

The North America precision agriculture market outlook remains highly favorable as technological advancements continue to reshape farming practices across the region. Increasing farmer awareness regarding the economic and environmental benefits of precision technologies, coupled with expanding government support programs and research investments, is creating a conducive environment for sustained market expansion. The market generated a revenue of USD 5.18 Billion in 2025 and is projected to reach a revenue of USD 11.80 Billion by 2034, growing at a compound annual growth rate of 9.57% from 2026-2034. Key growth catalysts include the rising integration of connectivity solutions in rural areas, the development of more affordable precision tools suitable for mid-sized operations, and the increasing emphasis on sustainable agricultural practices. The convergence of advanced analytics, improved sensor capabilities, and enhanced equipment automation is expected to drive continued adoption across diverse crop types and farm sizes throughout the forecast period.

North America Precision Agriculture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

GNSS/GPS Systems |

38% |

|

Type |

Automation and Control Systems |

45% |

|

Component |

Hardware |

51% |

|

Application |

Yield Monitoring |

32% |

|

Country |

United States |

79% |

Technology Insights:

- GNSS/GPS Systems

- GIS

- Remote Sensing

- Variable Rate Technology (VRT)

- Others

GNSS/GPS systems dominate with a market share of 38% of the total North America precision agriculture market in 2025.

Global navigation satellite systems and GPS technologies form the foundational infrastructure enabling precision agriculture applications throughout North America. These systems provide the accurate positioning data essential for automated steering, variable rate applications, and field mapping operations that define modern precision farming. The technology has achieved widespread adoption among large-scale producers who rely on centimeter-level accuracy for reducing input overlap and optimizing field coverage. Farmers increasingly depend on satellite positioning to execute controlled traffic patterns that minimize soil compaction while maximizing operational efficiency across expansive field operations.

The continued advancement of GPS receiver technology is enhancing positioning accuracy while reducing equipment costs, making precision guidance accessible to a broader range of farming operations. Multi-constellation receivers that integrate signals from GPS, GLONASS, Galileo, and other satellite systems deliver improved reliability and faster signal acquisition, particularly beneficial during challenging atmospheric conditions. Correction services including real-time kinematic positioning enable sub-inch accuracy for demanding applications such as controlled traffic farming, strip-till operations, and precision planting where exact equipment positioning directly impacts crop establishment and yield potential.

Type Insights:

- Automation and Control Systems

- Sensing and Monitoring Devices

- Farm Management Systems

Automation and control systems lead with a share of 45% of the total North America precision agriculture market in 2025.

Automation and control systems encompass the technologies that enable agricultural equipment to perform tasks with minimal human intervention while maintaining precise operational parameters. These systems integrate guidance controllers, implement control modules, and automated section management capabilities that optimize equipment performance across diverse field conditions. The segment benefits from strong farmer demand for solutions that address labor constraints and improve operational consistency during critical agricultural windows. The technology enables precise seed placement, accurate input applications, and efficient harvest operations that directly impact farm profitability and resource utilization efficiency.

The advancement of automation technologies is increasingly focused on enabling fully autonomous field operations that can proceed without continuous operator presence. Modern control systems incorporate sophisticated sensing capabilities, machine vision, and artificial intelligence algorithms that allow equipment to navigate fields, avoid obstacles, and adjust operational parameters in real time. In January 2024, John Deere announced partnerships with satellite communications providers to deliver connectivity solutions enabling remote monitoring and control of autonomous farm equipment in areas lacking cellular infrastructure.

Component Insights:

- Hardware

- Software

Hardware exhibits a clear dominance with 51% share of the total North America precision agriculture market in 2025.

Hardware components including GPS receivers, in-cab displays, sensors, controllers, and automated machinery represent the physical foundation of precision agriculture systems throughout North America. Farmers prioritize hardware investments that deliver immediate operational benefits through improved accuracy, reduced overlap, and enhanced equipment performance. The segment reflects the capital-intensive nature of precision agriculture adoption where physical equipment purchases precede recurring software and service expenditures. Manufacturers continue developing ruggedized designs capable of withstanding harsh agricultural environments while delivering the reliability essential for time-sensitive field operations.

The hardware segment is experiencing innovation driven by demands for improved sensor capabilities, enhanced connectivity, and greater equipment compatibility across mixed-fleet operations. Variable rate controllers, section control modules, and automated implement guidance systems enable precise input applications that reduce waste while optimizing crop performance. In February 2024, the U.S. National Science Foundation invested USD 35 Million in federal funding for agricultural technologies including advanced sensor systems and precision application equipment, supporting research initiatives aimed at developing next-generation precision farming hardware suitable for diverse cropping systems and farm sizes.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Mapping

- Crop Scouting

- Yield Monitoring

- Soil Monitoring

- Precision Irrigation

- Others

Yield monitoring represents the leading segment with 32% share of the total North America precision agriculture market in 2025.

Yield monitoring systems enable farmers to collect real-time harvest data that associates crop output with specific geographic locations within fields, providing essential information for performance assessment and management planning. The technology generates spatial yield maps that identify productivity variations across field zones, enabling data-driven decisions for subsequent growing seasons. Farmers utilize this information to understand which areas of their fields consistently perform well and which zones underperform, guiding targeted interventions and resource allocation strategies.

The data generated through yield monitoring serves multiple purposes beyond immediate harvest assessment, including crop insurance documentation, landlord reporting, and input planning for future seasons. Modern yield monitoring systems integrate with farm management software platforms that enable multi-year analysis of field performance trends and correlation with management practices, input applications, and environmental conditions. The technology provides farmers with objective evidence for evaluating return on investment for precision agriculture technologies and identifying management zones for variable rate applications. This comprehensive data collection capability supports continuous improvement in farming operations by revealing patterns that inform long-term agronomic strategies and operational adjustments.

Country Insights:

- United States

- Canada

United States dominates with a market share of 79% of the total North America precision agriculture market in 2025.

The United States represents the dominant market for precision agriculture technologies in North America, driven by the presence of large-scale commercial farming operations, well-established agricultural infrastructure, and substantial investments in technology research and development. American farmers benefit from access to advanced equipment, comprehensive dealer networks, and robust support services that facilitate precision technology adoption across diverse cropping systems. The country's agricultural sector employs GPS-guided tractors, AI-powered analytics, IoT-based sensors, and drone platforms to optimize production efficiency while managing rising input costs and labor constraints. Midwestern corn and soybean producers demonstrate particularly high adoption rates for precision technologies including yield monitoring and variable rate applications.

Federal government support through USDA programs, research funding, and conservation incentives encourages farmers to adopt precision farming technologies that improve productivity while reducing environmental impact. The country maintains a well-developed infrastructure for agricultural research and development, with leading agritech companies and land-grant universities investing substantial resources in precision agriculture innovations that address evolving challenges facing the agricultural sector.

Market Dynamics:

Growth Drivers:

Why is the North America Precision Agriculture Market Growing?

Rising Demand for Sustainable and Efficient Agricultural Practices

The increasing emphasis on sustainable agriculture is driving significant adoption of precision farming technologies across North America as farmers seek methods to optimize resource utilization while minimizing environmental impact. Growing awareness of soil health preservation, water conservation, and reduced chemical runoff is prompting agricultural producers to implement precision tools that enable site-specific management practices. Regulatory pressures related to nutrient management and water quality are encouraging farmers to adopt technologies that document input applications and demonstrate environmental stewardship. Precision agriculture enables farmers to apply fertilizers, pesticides, and water only where and when needed, reducing waste and protecting natural resources while maintaining productivity. The technology supports variable rate applications that match inputs to specific field conditions, preventing over-application in productive areas while ensuring adequate nutrition in less fertile zones. Environmental monitoring capabilities help farmers track the impact of their management decisions and adjust practices accordingly. Consumer and market demands for sustainably produced agricultural products further incentivize precision technology adoption as farmers seek to meet certification requirements and command premium prices for environmentally responsible production.

Increasing Government Support and Research Investments

Government initiatives and substantial public investments in agricultural technology research are accelerating the development and adoption of precision farming solutions throughout North America. Federal agencies provide financial assistance, loan programs, and conservation incentives that reduce the financial barriers to technology adoption for farmers of various scales. Research funding supports the development of new precision agriculture tools, improved sensors, and advanced analytical capabilities that address the evolving needs of agricultural producers. Land-grant universities collaborate with federal agencies and industry partners to conduct applied research that translates laboratory innovations into practical farming solutions. Extension services and agricultural education programs help farmers understand and implement precision technologies effectively on their operations. Government-funded connectivity initiatives aim to expand broadband access in rural areas, enabling farmers to fully utilize data-intensive precision agriculture applications. Public-private partnerships bring together resources and expertise from multiple sectors to address complex challenges in agricultural technology development. These coordinated efforts create a supportive ecosystem that encourages technology innovation, commercialization, and farm-level adoption across the precision agriculture spectrum.

Persistent Labor Shortages and Rising Operational Costs

The agricultural sector across North America faces ongoing challenges related to labor availability and rising operational costs that are compelling farmers to seek technology-driven solutions. Difficulty recruiting and retaining skilled agricultural workers creates pressure to adopt automation and precision technologies that reduce labor dependency while maintaining operational efficiency. Rising wages and labor-related compliance requirements increase the economic incentive for farmers to invest in equipment and systems that automate repetitive tasks and reduce manual labor hours. Precision agriculture technologies enable individual operators to manage larger acreages more effectively by automating guidance, monitoring, and decision-making functions that previously required additional personnel. Automated steering systems reduce operator fatigue and enable extended working hours during critical planting and harvest windows when timeliness directly impacts yield and quality outcomes. Data management platforms consolidate information from multiple sources, reducing the administrative burden associated with record keeping and regulatory compliance. The combination of labor efficiency gains and improved operational precision generates compelling return on investment that motivates continued technology adoption across farming operations.

Market Restraints:

What Challenges the North America Precision Agriculture Market is Facing?

High Initial Acquisition Costs and Uncertain Return on Investment

The substantial upfront investment required for precision agriculture technologies presents a significant barrier to adoption, particularly for small and mid-sized farming operations with limited capital resources. Acquisition costs for comprehensive precision systems including GPS receivers, displays, controllers, sensors, and associated software can be prohibitive for producers operating on narrow profit margins. The uncertainty surrounding return on investment timelines and the complexity of quantifying benefits across variable growing conditions make purchase decisions challenging for risk-averse farmers. Limited access to affordable financing options specifically designed for agricultural technology purchases further constrains adoption among operations that would benefit from precision tools.

Limited Rural Connectivity and Infrastructure Challenges

Inadequate broadband and cellular network coverage in agricultural regions significantly constrains the effectiveness of precision farming technologies that rely on real-time data transmission and cloud-based services. Many precision agriculture applications require consistent connectivity for remote monitoring, data synchronization, and access to analytical platforms that inform management decisions. The large geographic areas and low population density characteristic of farming regions make network infrastructure deployment economically challenging without subsidies or other incentives. Farmers operating in connectivity-limited areas cannot fully leverage advanced precision technologies, creating disparities in technology adoption and associated productivity benefits across the agricultural sector.

Lack of Interoperability Standards and Data Management Concerns

The absence of uniform standards for data formats and equipment communication protocols creates compatibility challenges that impede seamless integration of precision agriculture technologies from different manufacturers. Farmers typically operate mixed fleets of equipment from various brands, and the inability of these systems to share data effectively limits the value proposition of precision technologies. Concerns regarding farm data ownership, privacy, and third-party access create hesitation among producers considering adoption of connected precision platforms that transmit operational information to cloud-based services. The complexity of managing and interpreting large volumes of precision agriculture data requires technical expertise that many farming operations lack, reducing the practical value of data collection capabilities.

Competitive Landscape:

The North America precision agriculture market features a competitive landscape characterized by the presence of established agricultural equipment manufacturers, specialized technology providers, and emerging agritech innovators. Market participants compete through product differentiation, technology integration capabilities, and comprehensive service offerings that address the diverse needs of farming operations. Leading companies invest substantially in research and development to advance automation capabilities, improve sensor technologies, and enhance data analytics platforms. Strategic partnerships between equipment manufacturers and technology companies are reshaping competitive dynamics by combining agricultural expertise with digital innovation capabilities. Companies are increasingly focusing on mixed-fleet compatibility and retrofit solutions that enable farmers to upgrade existing equipment rather than requiring complete system replacements. The market witnesses ongoing consolidation as established players acquire specialized technology firms to expand their precision agriculture portfolios and accelerate time-to-market for innovative solutions.

Some of the key players include:

- Agilent Technologies Inc

- Aegon Ltd

- Trimble Inc

- AGCO Corp

- CNH Industrial NV

- CropX

- Deere & Co

- Topcon Corp

North America Precision Agriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

xploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | GNSS/GPS Systems, GIS, Remote Sensing, Variable Rate Technology (VRT), Others |

| Types Covered | Automation and Control Systems, Sensing and Monitoring Devices, Farm Management Systems |

| Components Covered | Hardware, Software |

| Applications Covered | Mapping, Crop Scouting, Yield Monitoring, Soil Monitoring, Precision Irrigation, Others |

| Countries Covered | United States, Canada |

| Companies Covered | Agilent Technologies Inc, Aegon Ltd, Trimble Inc, AGCO Corp, CNH Industrial NV, CropX, Deere & Co, Topcon Corp, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The North America precision agriculture market size was valued at USD 5.18 Billion in 2025.

The North America precision agriculture market is expected to grow at a compound annual growth rate of 9.57% from 2026-2034 to reach USD 11.80 Billion by 2034.

GNSS/GPS systems dominated the market with a share of 38%, owing to their foundational role in enabling precise field navigation, automated steering, and accurate positioning for farm equipment across diverse agricultural operations.

Key factors driving the North America precision agriculture market include rising demand for sustainable farming practices, increasing government support and research investments, persistent labor shortages, growing adoption of automation technologies, and expanding connectivity infrastructure in agricultural regions.

Major challenges include high upfront acquisition costs, limited rural connectivity and broadband infrastructure, lack of interoperability standards between equipment manufacturers, data privacy concerns, technical complexity limiting adoption among smaller operations, and uncertain return on investment calculations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)