North America Power Inverter Market Size, Share, Trends and Forecast by Type, Application, End-Use Sector, and Country, 2026-2034

North America Power Inverter Market Size and Share:

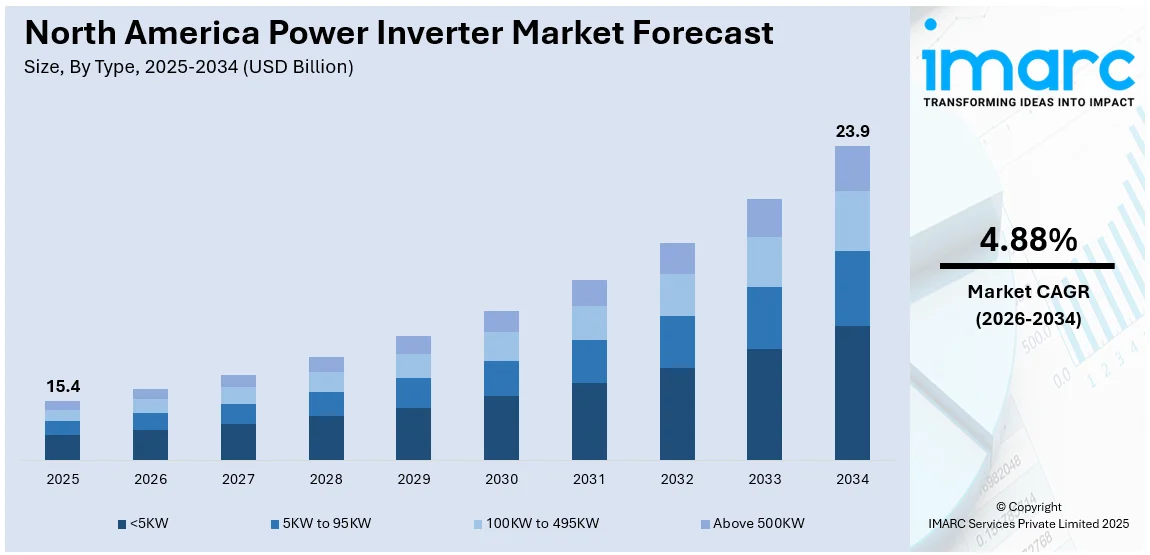

The North America power inverter market size was valued at USD 15.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 23.9 Billion by 2034, exhibiting a CAGR of 4.88% from 2026-2034. The North American power inverter market share is expanding due to rising demand for renewable energy systems, energy storage solutions, and electric vehicle (EV) infrastructure, rapid technological advancements, imposition of government incentives, and heightened focus on energy efficiency, with innovations like microinverters, hybrid systems, and smart technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 15.4 Billion |

|

Market Forecast in 2034

|

USD 23.9 Billion |

| Market Growth Rate 2026-2034 | 4.88% |

As more people and industries shift toward renewable energy like solar and wind, the North America power inverter market demand is increasing. In 2023, the U.S. set a record by installing 31 gigawatts (GW) of solar energy capacity, a 55% increase from 2022, surpassing the 2021 record. By then, the country had 161 GW of installed solar capacity, meeting roughly 5% of its electricity demand. Inverters are essential in these systems, transforming the direct current (DC) produced by solar panels or wind turbines into alternating current (AC) for residential and commercial use. The rise in government incentives, subsidies, and tax benefits to promote renewable energy in North America is making it easier and more affordable for consumers to adopt solar energy. Plus, as the cost of solar panels and wind turbines decreases, more residential and commercial users are making the switch.

To get more information on this market Request Sample

Energy storage systems are gaining popularity as they enable users to store electricity generated by solar panels or wind turbines for later use. This is particularly valuable in regions with inconsistent sunlight or wind. The combination of renewable energy systems and energy storage requires reliable inverters to manage the energy flow. Power inverters are critical for the efficiency and functionality of energy storage systems, as they regulate how energy is stored and discharged. Also, as per the International Energy Agency (IEA), achieving net-zero emissions requires energy storage capacity to grow six times by the year 2030. This means reaching 1,500 GW by that period, thus boosting the adoption of power inverters in the near future.

North America Power Inverter Market Trends:

Increase in Electric Vehicle (EV) Adoption

With the growing popularity of electric vehicles, there is a greater need for EV charging infrastructure. New electric car registrations in the United States totaled 1.4 million in the year 2023, marking an increase by more than 40% in comparison to is 2022 levels. This has created the need for power inverters to convert the electricity used by EV chargers into the right form for efficient charging. As more electric vehicle charging stations pop up across the region, there is a direct impact on the North America power inverter market growth. EV manufacturers and charging station providers rely on high-quality inverters to ensure fast and efficient charging, which is important for user satisfaction and the growth of the electric vehicle market.

Imposition of Government Initiatives and Policies

North American governments have introduced several initiatives aimed at encouraging energy efficiency and clean energy adoption. Policies such as tax credits, rebates, and incentives for energy-efficient home upgrades have contributed significantly to the growth of the power inverter market. For instance, Mexico's administration has committed to supporting private investment in the energy sector, provided it aligns with the country's energy sovereignty. The plan allocates 54% of the electricity market to the state-owned CFE and 46% to private companies, aiming to create a regulated yet flexible market environment. The U.S. government’s renewable energy goals and the push for reducing carbon footprints have made it easier for consumers and businesses to invest in renewable energy systems, increasing the North America power inverter market share.

Rapid Technological Advancements in Power Inverters

Power inverter technology is constantly evolving. Inverters are becoming more efficient, compact, and capable of handling higher capacities. With advancements like grid-tied inverters, hybrid inverters, and microinverters, the functionality of these devices has expanded, making them more appealing for both residential and commercial applications. Microinverters are small devices attached to each solar panel, enhancing efficiency by allowing independent operation of each panel. This improves the overall performance of solar power systems, driving higher demand for power inverters. Additionally, as per the North America power inverter market outlook, the integration of smart technology in power inverters, such as remote monitoring and real-time diagnostics, is improving their usability and performance. These innovations not only optimize energy management but also provide users with better control and maintenance capabilities, further driving the market.

North America Power Inverter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America power inverter market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, application, and end-use sector.

Analysis by Type:

- <5KW

- 5KW to 95KW

- 100KW to 495KW

- Above 500KW

The 100KW to 495KW power inverter range leads the market share in North America mainly because of its multiple applications in commercial and industrial fields. This capacity range is perfect for medium to large solar installation usage because it makes optimal provision of power output at businesses, factories, and agricultural levels. These inverters are increasingly attractive for companies looking for a means of reducing energy costs and enhancing sustainability, due to their balance of efficiency, cost-effectiveness, and scalability. The demand for inverters in this power range is likely to continue to see strength in industrious adoption of renewable energy solutions.

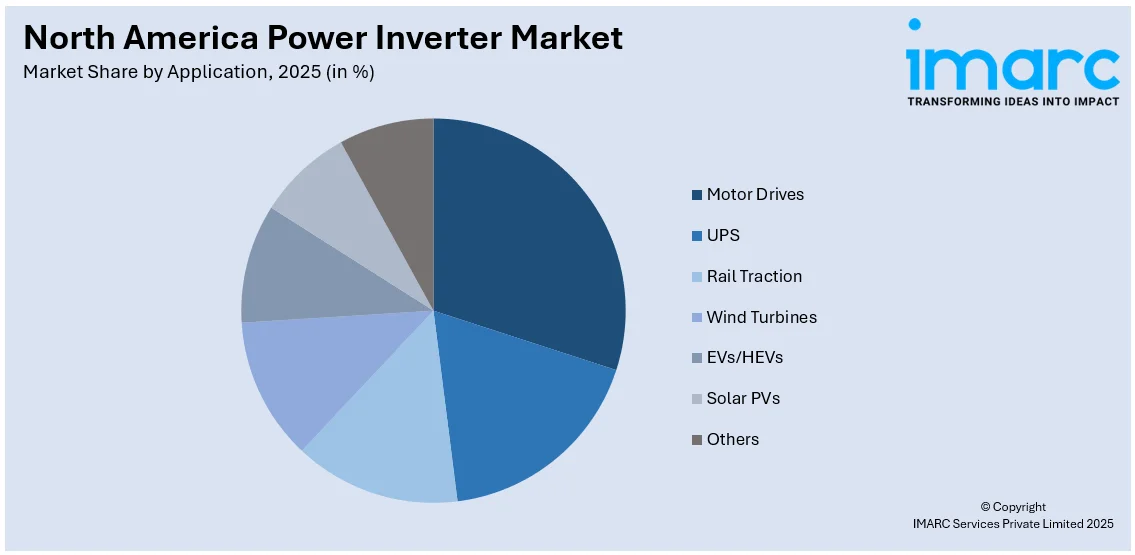

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Motor Drives

- UPS

- Rail Traction

- Wind Turbines

- EVs/HEVs

- Solar PVs

- Others

Motor drives are dominant in the North American power inverter market due to the growing demand for energy-efficient motor control systems in a variety of industries. Motor drives offer protection and control of the speed, torque, and direction of the motors used in applications such as HVAC systems, pumps, conveyor belts, and industrial machinery. The inverters allow for increased efficiency in operations, saving energy and decreasing the cost of maintenance by controlling the performance of motors exactly. As the industries keep improving in the use of energy by cutting down on the operation cost and developing more automation and electrification in industrial processes, it shows there will be a steady upsurge in demand for power inverters for motor drive applications.

Analysis by End-Use Sector:

- Utility

- Residential

- Commercial and Industrial

Based on the North America power inverter market forecast, the utility sector is the largest end-use segment in the market, driven by the growing incorporation of renewable energy sources like solar and wind into the power grid. Power inverters are crucial for converting the DC power generated by renewable sources into AC power, enabling it to be fed into the electricity grid for distribution. As utilities aim to diversify energy portfolios and meet renewable energy targets, the demand for large-scale inverters to manage power generation, grid stability, and energy storage systems is rising. Additionally, advancements in inverter technology, such as grid-tied and hybrid inverters, are enhancing the ability of utilities to optimize energy flow and increase the efficiency of renewable energy integration, making this industry an important driver of market growth.

Country Analysis:

- United States

- Canada

- Mexico

The United States is the biggest country in the North American power inverter market, mainly because of its large investments in renewable energy infrastructure and technological advancements. As the U.S. continues to lead in solar energy systems, energy storage solutions, and electric vehicle (EV) infrastructure, the demand for power inverters has surged, particularly in residential, commercial, and utility-scale applications. Government incentives, including tax credits and renewable energy mandates, have further amplified the adoption of energy-efficient systems, making the U.S. the giant in this game. Also, with increased emphasis on carbon emissions reduction and grid resilience, utilities and businesses are investing in advanced technologies for power inverters, which makes the USA a large market in this region.

Competitive Landscape:

As per the North America power inverter market trends, key players are investing and expanding their products with new technology innovations to gain a competitive edge. Major players are concentrating on the development of more advanced inverters that would come with features such as remote monitoring, real-time diagnostics, and advanced energy management. This will enhance efficiency, reduce the maintenance cost, and provide better control to users. Moreover, these players are making higher efforts in the renewable energy segment by providing dedicated inverters for solar and wind solutions, which are needed for high power applications in energy systems. Strategic partnerships and collaborations are being formed by companies with utility providers, automotive manufactures, and companies dealing with solar installation firms to boost the market position. Further, there is a growing emphasis on sustainability and reducing carbon footprints, with key players introducing energy-efficient solutions that meet global environmental standards. As the market grows, these players are also working on expanding their presence in emerging markets and strengthening their R&D capabilities to cater to diverse industry needs.

The report provides a comprehensive analysis of the competitive landscape in the North America power inverter market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Enphase Energy launched its Busbar Power Control software, enabling larger solar and energy storage systems without upgrading the home electricity panel. The software optimizes power efficiency, maximizes self-consumption, and increases power exports to the grid. It enhances system design flexibility, benefiting homeowners and solar installers.

- In December 2024, SolarEdge Technologies shipped its new SolarEdge Home Battery 'USA Edition,' completing its range of U.S.-made solar and storage products eligible for the Domestic Content Bonus Credit. The battery offers 9.7kWh of storage and integrates with SolarEdge ONE, optimizing energy savings. It joins the company's domestic content solar inverters and power optimizers, boosting incentives for solar-plus-storage systems.

- In September 2024, GE Vernova Inc. introduced its 6 MVA, 2000-volt direct current utility-scale inverter, accompanied by a multi-megawatt pilot installation in North America. This advancement is designed to lower solar energy costs and accelerate the shift toward renewable energy and decarbonization.

- In September 2024, Sineng Electric completed its inaugural shipment of power conversion systems (PCS) to the U.S. for a 140.8MW/140.8MWh energy storage project in Texas, representing a key milestone in the company’s entry into the North American market.

- In September 2024, Solis launched two new string inverters, the S5-GC125K-US (125 kW) and S5-GC60K-LV-US (60 kW), for the US and Canadian markets, offering a maximum efficiency of 98.5%. Both models feature multiple MPPT channels, fuse-free architecture, and tailored options for repowering projects. They are designed for high reliability, optimal performance, and wide temperature ranges.

North America Power Inverter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | <5KW, 5KW to 95KW, 100KW to 495KW, Above 500KW |

| Applications Covered | Motor Drives, UPS, Rail Traction, Wind Turbines, EVs/HEVs, Solar PVs, Others |

| End-Use Sectors Covered | Utility, Residential, Commercial and Industrial |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America power inverter market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America power inverter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America power inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America power inverter market was valued at USD 15.4 Billion in 2025.

The growth of the North American power inverter market is driven by rising adoption of renewable energy systems, imposition of government incentives for clean energy, increasing demand for electric vehicles, rapid advancements in inverter technology, and the push for energy efficiency across residential, commercial, and industrial sectors.

IMARC Group estimates the market to reach USD 23.9 Billion by 2034, exhibiting a CAGR of 4.88% from 2026-2034.

Motor drives represented the largest market, driven by the widespread use of power inverters in industrial and commercial motor control systems, enhancing energy efficiency, optimizing performance, and reducing operational costs across various sectors like manufacturing, HVAC, and automation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)