North America Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033

North America Potato Chips Market Market Size and Share:

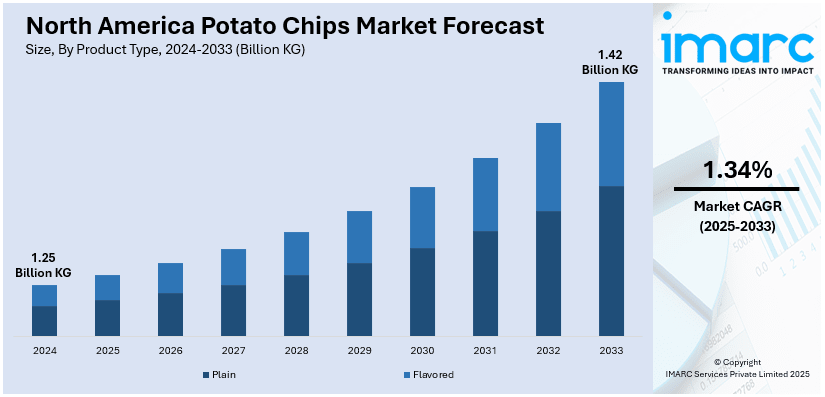

The North America potato chips market size was valued at 1.25 Billion KG in 2024. Looking forward, IMARC Group estimates the market to reach 1.42 Billion KG by 2033, exhibiting a CAGR of 1.34% from 2025-2033. The market is experiencing significant growth driven by increasing consumer demand for diverse flavors, healthier options and sustainable practices. Health-conscious trends are fueling the popularity of baked and low-fat chips while sustainability initiatives such as ecofriendly packaging and sustainable sourcing are gaining momentum across the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1.25 Billion KG |

|

Market Forecast in 2033

|

1.42 Billion KG |

| Market Growth Rate (2025-2033) | 1.34% |

The primary driver for the North America potato chips market growth is increasing consumer demand for convenient and on-the-go snack options. Busy lifestyles and a growing preference for ready-to-eat foods have ensured that potato chips remain a staple in the snacking industry. Health-conscious consumers are also seeking healthier alternatives such as baked or low-fat options which expands the market. For instance, in March 2024, Alicia Lahey announced the launch of Humble Ketchup Chips a healthier organic alternative to traditional ketchup-flavored chips in Canada. Crafted with clean and natural ingredients these vibrant purple chips promise the beloved ketchup taste without artificial additives providing a guilt-free snacking option for consumers nationwide.

Another key driver is the continuous product innovation in flavors and textures which appeals to a wide range of consumer preferences. The trend of unique, bold and ethnic flavors is attracting younger consumers and offers opportunities for brands to differentiate themselves. For instance, in August 2024, PepsiCo's Frito-Lay launched three new Lay's potato chip flavors in the US: Wavy Tzatziki, Masala and Honey Butter. Inspired by global cuisines Wavy Tzatziki reflects Mediterranean tastes, Masala showcases Indian spices and Honey Butter offers a sweet Korean twist. These factors are collectively creating a positive North America potato chips market outlook.

North America Potato Chips Market Trends:

Flavored Variations

North America potato chips market is flavored variations as consumers look for novelty and variety. These bold and unique flavors such as spicy, savory and ethnic-inspired options are particularly a hit among the younger group of consumers. Flavors like sriracha, truffle and even regional specialties like jalapeño cheddar or taco diversify traditional potato chip offerings. For instance, in March 2024, Lay's® launched its "Flavor That Hits Home lineup featuring four fan-favorite chip flavors: Crispy Taco, BLT Sandwich, Fried Pickles with Ranch and Kettle Cooked Lime & Cracked Pepper. This trend satisfies the growing interest in adventurous taste experience and allows brands to remain competitive by sticking out in the market.

Health-Conscious Choices

Health-conscious choices are increasingly shaping the North America potato chips market as consumers opt for healthier snack options. There is a marked shift towards baked chips which are perceived to be lower in fat and calories compared to the traditional fried varieties. Low-fat, low-sodium and gluten-free options are gaining popularity among those seeking to reduce their intake of unhealthy ingredients. For instance, in November 2023, PepsiCo announced its plans to reduce sodium by 15% in its U.S. Lay’s Classic Potato Chips targeting 140 mg of sodium per serving. By 2030, the company aims for 75% of its convenient foods portfolio to meet the World Health Organization's sodium guidelines while promoting a variety of nutritional options including legumes and whole grains. Consumers are opting for chips made with natural or organic ingredients avoiding artificial preservatives and additives.

Rising Focus on Sustainability

Sustainability initiatives are gaining importance in the North America Potato Chips Market. Many brands are focusing on ecofriendly packaging and sustainable sourcing. Manufacturers are adopting recyclable, biodegradable or compostable materials to replace plastic further avoiding any type of plastic waste and its environmental footprint. There is also a growing focus on sourcing potatoes from sustainable farms that prioritize soil health and biodiversity. For instance, in December 2024, Campbell's Company announced its plans to launch a regenerative agriculture pilot for potatoes in partnership with Ahold Delhaize supporting farms in North Carolina, New York and Michigan. The initiative focuses on improving soil health and reducing emissions with plans to integrate these potatoes into popular products like Kettle Brand chips and Campbell's soups. Brands are also exploring sustainable production methods that reduce energy consumption and water usage.

North America Potato Chips Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America potato chips market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Plain

- Flavored

Plain potato chips lead the North American market because of their timeless appeal and widespread consumer preference. The simplicity of plain chips makes them a versatile snack easily paired with dips or enjoyed on their own. Despite the growing trend for flavored varieties plain chips remain a staple in households, convenience stores and restaurants. The nostalgia and familiarity attached to them make them a safe consumer purchase across generations. Plain chips are generally perceived as healthier compared to the potently flavored ones thereby adding to their continued popularity in the market. Plain chips consistently available and affordable outperform newer trend-driven options making them a go-to snack.

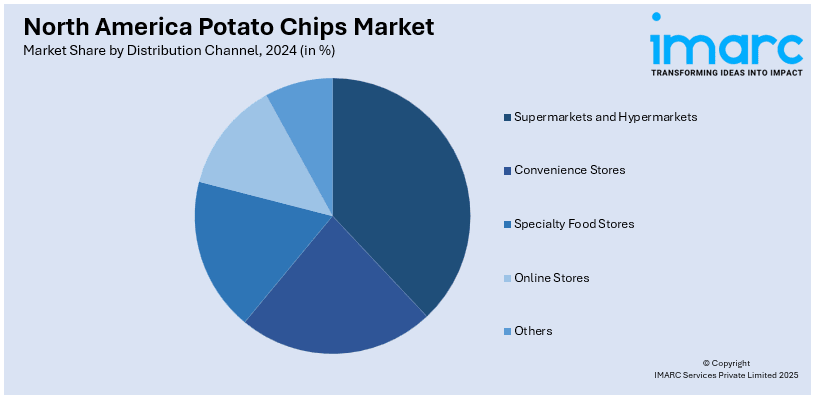

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

According to the North America potato chips market report, supermarkets and hypermarkets are the leading distribution channels in the North American potato chips market mainly because of their high availability and wide range of products. The large store formats also allow for effective in-store promotions, discounts and visibility encouraging impulse buys. Besides, the supermarkets and hypermarkets have developed a strong customer base and also restock their lines of potato chips periodically. Convenience and wide selection at competitive prices make these stores stand strongly in the market. The increasing demand for organic and healthier snack options also adds to their dominance as they are able to attract a wider spectrum of health-conscious customers.

Regional Analysis:

- United States

- Canada

The United States dominates the North American potato chips market mainly due to its enormous and diversified consumer base developed retail infrastructure and high demand for snack food. The US market is known for its great demand for traditional as well as innovative snack foods where customers are looking for a wide variety of flavors and packaging sizes. Major national brands along with numerous regional players contribute to a competitive landscape driving growth. The trend toward healthier snack options and sustainable practices further shapes the market dynamics as consumers increasingly prioritize clean-label ingredients and ecofriendly packaging. These factors create significant opportunities for innovation and brand differentiation.

Competitive Landscape:

The market is highly competitive with many players competing for the significant North America potato chips market share through product innovation, pricing strategies and strong distribution networks. Key competitors are focusing on diversifying their product portfolios by offering healthier options like baked, low-fat and organic chips to cater to health-conscious consumers. Flavored variants continue to grow in popularity with new and unique flavor profiles being introduced regularly. Companies are leveraging promotional campaigns, partnerships and regional expansions to strengthen their competitive positions.

The report provides a comprehensive analysis of the competitive landscape in the North America potato chips market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Lay's announced that it will be bringing its highly-requested All Dressed chips to the U.S. for the first time. Previously available only in Canada these chips combine the flavors of Barbecue, Salt & Vinegar and Sour Cream & Onion.

- In June 2024, Ruffles and KFC announced the launch of a limited edition collaboration featuring Ruffles Double Crunch KFC Zinger potato chips. To complement this spicy treat a Plunge Bucket a cold plunge tub shaped like a KFC bucket will be given away.

- In May 2024, Utz® introduced new Mike’s Hot Honey EXTRA HOT potato chips featuring three times the heat of the original flavor. Available nationwide through September these gluten-free chips are part of a collaboration with Mike’s Hot Honey following the success of the original chips.

- In April 2024, Jackson's, the Snack Super™ brand launched its sweet potato chips in Ontario, Canada through an exclusive partnership with Longo's. Available in five flavors the chips are made with premium ingredients such as avocado oil. This marks Jackson's significant expansion into the Canadian market.

North America Potato Chips Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion KG |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Type Covered | Plain, Flavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America potato chips market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America potato chips market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potato chips market was valued at 1.25 Billion KG in 2024.

Key drivers include the increasing demand for convenient, on-the-go snack options, rising health-conscious consumer choices, continuous innovation in flavors, and growing sustainability initiatives such as eco-friendly packaging and sustainable sourcing of ingredients.

IMARC estimates the potato chips market to reach 1.42 Billion KG by 2033, exhibiting a CAGR of 1.34% during 2025-2033.

The plain potato chips segment holds the largest market share due to their timeless appeal, simplicity, versatility, and widespread consumer preference.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)