North America Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Country, 2025-2033

North America Plywood Market Size and Share:

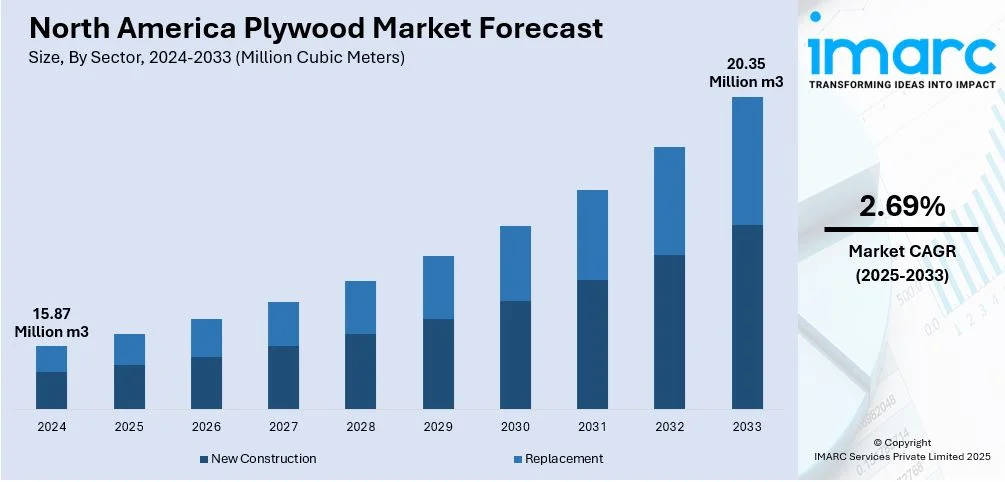

The North America plywood market size was valued at 15.87 Million Cubic Meters in 2024. Looking forward, IMARC Group estimates the market to reach 20.35 Million Cubic Meters by 2033, exhibiting a CAGR of 2.69% from 2025-2033. Sustainable practices, technological advancements, and government investments are key drivers of the market. Besides this, North America plywood market share is driven by the growing demand for eco-friendly materials in construction activities and innovations in production, which improves efficiency and quality of materials. Government support for construction and infrastructure projects further enhances plywood usage, strengthening the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 15.87 Million Cubic Meters |

| Market Forecast in 2033 | 20.35 Million Cubic Meters |

| Market Growth Rate (2025-2033) | 2.69% |

As demand for eco-friendly building materials rises, plywood is becoming a preferred choice due to its sustainability in the North America. Unlike synthetic materials, plywood is made from renewable resources, reducing the carbon footprint of construction projects. The increasing focus on green building standards and certifications is driving the demand for environmentally friendly products. Many customers and builders are now prioritizing the use of sustainable materials like plywood in construction. Regulations and incentives promoting energy-efficient and eco-conscious construction practices further catalyze the use of plywood. The forestry industry is adopting responsible sourcing practices, ensuring that plywood production does not lead to deforestation. Certification systems like FSC (Forest Stewardship Council) are helping ensure that plywood is sourced from sustainably managed forests. Plywood is also biodegradable, contributing to a reduced environmental impact compared to other construction materials.

Innovations in manufacturing processes, such as automated machinery, are streamlining plywood production, reducing labor costs. Advanced cutting and shaping technologies ensure greater precision in plywood dimensions, resulting in reduced material waste. The development of high-performance plywood products, such as moisture-resistant and fire-retardant types, expands market applications. These innovations allow plywood to meet the growing demand in specialized industries, including construction and furniture. Moreover, modern drying technologies improve the consistency and strength of plywood, ensuring better performance in construction projects. Automation in the production line also helps meet increasing demand while reducing production time and cost. New adhesive technologies are improving the durability and environmental performance of plywood, making it more appealing in eco-conscious markets. Advancements in digital design tools allow for better customization of plywood products to suit specific needs. The integration of data analytics and machine learning (ML) in manufacturing processes enhances operational efficiency and predictive maintenance. Research and development (R&D) in the plywood industry led to the creation of innovative, sustainable solutions that align with market trends.

North America Plywood Market Trends:

Increasing demand for housing

Rapid urbanization and population growth are leading to higher residential construction, increasing plywood usage. As per the data published by the Government of Canada, the investments in building construction increased by 2.7% in November 2024, as compared to 2023. Builders in North America prefer plywood for its strength, durability, and versatility in flooring, roofing, and walls. Rising home renovation and remodeling activities are further driving the need for quality plywood products. Government initiatives supporting affordable housing projects are expanding construction activities, increasing plywood demand. The growing trend of multi-family housing and modular homes is fueling plywood applications in structures. People prefer plywood for its cost-effectiveness and aesthetic appeal in interior and exterior applications. Real estate investments and favorable mortgage rates are encouraging home purchases, influencing plywood usage. Technological advancements in plywood manufacturing are offering enhanced products to meet residential construction demands. Sustainable plywood options are gaining traction due to environmental concerns and regulatory compliance requirements. Increasing disposable incomes enable homeowners to invest in high-quality plywood for home improvements. Construction companies rely on plywood due to its ease of use, lightweight nature, and durability.

Rising government investment in wood product expansion

Government investment in wood product expansion is driving the market in North America significantly. Funding initiatives for sustainable forestry and wood product manufacturing are stimulating plywood production capabilities and availability. Investments in technological advancements are enabling more efficient and cost-effective plywood production processes across the region. These investments also encourage innovation, leading to the development of high-performance plywood that meets industry standards. Moreover, government policies aimed at promoting green building practices are favoring the use of plywood over synthetic materials. Regulations requiring eco-friendly products in construction are increasing plywood demand due to its sustainability. Support for local wood product industries is strengthening the supply chain, ensuring raw material availability for plywood manufacturers. Subsidies and tax incentives for the forestry sector make plywood production more competitive and affordable. Government investment also helps improve the infrastructure for transporting wood products, reducing logistical costs for plywood suppliers. in May 2024, Tolko Industries received an $8 million investment from the Government of British Columbia to expand its operations. This includes developing an Engineered Wood Division, which will produce specialty wood products like plywood for construction and other sectors. The expansion is set to create new jobs and enhance the competitiveness of Tolko in the North American wood products market.

Expanding infrastructure projects

The growing construction sector demands plywood for a variety of applications, from foundations to finishes. Plywood’s versatility makes it ideal for residential projects, including flooring, roofing, and wall sheathing. In commercial construction, plywood is used extensively for structural support, interior finishes, and facades. Increasing investment in infrastructure development increases, plywood plays a crucial role in bridges, tunnels, and transportation projects. For example, in September 2024, Anthem Properties launched its first IPO for the Citizen project in Burnaby, British Columbia, to expedite housing availability in Metro Vancouver. Residential demand is particularly strong due to growing urbanization and population, requiring more housing solutions. The initiative aims to raise up to $82 million to fund a mixed-use development, including market, rental, and affordable homes. Besides this, large-scale commercial developments, such as office buildings and retail centers, continue to drive plywood consumption. The need for plywood in sustainable, green buildings aligns with current environmental regulations and trends. In public infrastructure, plywood is essential in temporary structures like scaffolding and formwork for concrete. Developers increasingly prefer plywood due to its cost-effectiveness, availability, and strength-to-weight ratio, making it a go-to material. With government investments in infrastructure renewal, plywood demand rises in public works projects, such as roads and bridges. Commercial and residential builders are turning to plywood for its flexibility and aesthetic appeal, further impelling market growth.

North America Plywood Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America plywood market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and sector.

Analysis by Application:

.webp)

- Residential

- Commercial

The residential construction sector drives the largest demand for plywood, mainly due to housing needs. As urbanization increases, there is a growing need for residential buildings, leading to higher plywood usage. Plywood is commonly used in residential projects for flooring, walls, roofing, and cabinetry due to its durability and cost-effectiveness. With the rise in home renovation activities, plywood is also in high demand for remodeling projects. The increasing preference for eco-friendly and sustainable building materials is benefiting the use of plywood. This shift is further increasing residential demand, as plywood offers an environmentally conscious option for construction. The trend toward smaller, modular homes is rising the need for affordable materials like plywood, particularly in the residential segment. Given that residential properties often require large quantities of plywood for structural and aesthetic purposes, this segment dominates overall market demand. Moreover, government initiatives focused on affordable housing projects in North America are encouraging for more plywood usage. As the population grows and housing shortages persist, the need for plywood will continue to expand within the residential market.

Analysis by Sector:

- New Construction

- Replacement

New construction projects are a key driver in the plywood market, accounting for the majority of market share. With growing urban populations and expanding cities, the demand for new buildings has surged significantly. Residential, commercial, and industrial projects require large quantities of plywood for walls, roofs, and floors. Builders favor plywood because it is cost-effective, durable, and versatile, making it ideal for new construction applications. New construction also benefits from plywood’s lightweight nature, which reduces transportation costs and labor time. As the global population continues to rise, more housing, office spaces, and public infrastructure are needed, further driving the demand for plywood. The construction industry’s reliance on plywood for both structural support and aesthetic finishes is significant in new builds. Government initiatives and infrastructure investments further promote the use of plywood in the new construction sector. New construction projects tend to have large-scale material needs, and plywood is often the go-to choice due to its flexibility. The trend of sustainable building also affects new construction, with plywood being a key player in eco-friendly developments.

Country Analysis:

- United States

- Canada

The United States holds a dominant position in the North American plywood market due to its large construction sector. As one of the world’s largest economies, the US drives substantial demand for plywood in residential, commercial, and infrastructure projects. As per United States Census Bureau, in 2024, approximately 1,471,200 housing units received building permit approvals. In December 2024, the seasonally amended yearly rate for private housing number moved up to 1,499,000 units. The country’s robust real estate market and continuous urban expansion contribute significantly to plywood consumption. The construction industry in the US is growing rapidly, with a strong emphasis on both new construction and renovation, creating a steady demand for plywood. Additionally, the government is focus on affordable housing and infrastructure development, which further catalyzes the demand for plywood. With a large number of manufacturers and suppliers, the US plywood market benefits from a well-established production and distribution network. The country’s significant investments in public works, commercial buildings, and residential developments continue to support the market growth. The US also leads the North American market in adopting sustainable building practices, where plywood’s eco-friendly attributes align well with customer preferences.

Competitive Landscape:

Key players drive market expansion by providing a wide range of plywood products to various industries. Through constant innovation, they enhance the quality and functionality of plywood to meet diverse customer needs. Leading players invest in advanced manufacturing technologies, increasing production efficiency and reducing costs. They focus on improving sustainability by offering eco-friendly plywood options, aligning with the growing environmental concerns. By ensuring a steady supply of raw materials, these companies maintain strong supply chains and avoid disruptions. Strategic partnerships with suppliers, distributors, and customers allow key players to reach broader markets. Additionally, large players often engage in extensive marketing campaigns, educating customers about the benefits of plywood. Through mergers and acquisitions, they expand their market presence and operational capacity. They also play a pivotal role in shaping industry standards, influencing product design and performance. Many top companies have diversified their product offerings, including specialized plywood types for different applications like furniture and flooring. For example, in May 2024, Snarkitecture, which is a Brooklyn-based company, teamed up with Made by Choice to create a striking furniture collection inspired by Finnish design. The "Lieksa" collection features chairs and tables with mountain-like forms, made from birch plywood. The functional yet artistic designs include hidden compartments, combining creativity with practicality.

The report provides a comprehensive analysis of the competitive landscape in the North America plywood market with detailed profiles of all major companies.

Latest News and Developments:

- March 2024: Richelieu America Ltd. acquired Allegheny Plywood Company, a distributor of cabinet-grade plywood and laminates in the Northeastern US. This acquisition strengthens Richelieu’s market presence and helps the company in expanding its product portfolio.

- October 2023: Anne-Sophie Rosseel designed a colorful, modular furniture collection that encourages kids to assemble their own pieces. The interactive, customizable furniture promotes creativity while offering functional designs. With bright, engaging colors and adaptable elements, the collection aims to make furniture assembly a fun and educational experience for children. Made with birch plywood, it is non-toxic and made with plant-based dies.

North America Plywood Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Cubic Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, North America plywood market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America plywood market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America plywood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plywood market in the North America was valued at 15.87 Million Cubic Meters in 2024.

The North American plywood market growth is driven by factors, such as increasing demand in the construction sector, particularly residential and commercial projects. Sustainable practices favor plywood due to its eco-friendly attributes, while technological advancements in production improve efficiency and product quality. Government investments in housing and infrastructure further increase plywood utilization, which propels the market growth.

The North America plywood market is projected to exhibit a CAGR of 2.69% during 2025-2033, reaching a value of 20.35 Million Cubic Meters by 2033.

The residential segment accounted for the largest share of the market. This is primarily due to the rising demand for new housing, home renovations, and remodeling projects, where plywood is widely used in flooring, walls, roofing, and cabinetry. The growing urban population and the need for affordable housing further drive plywood usage in residential construction.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)