North America Pharmaceutical Contract Packaging Market Size, Share, Trends and Forecast by Industry, Type, Packaging, and Country, 2025-2033

North America Pharmaceutical Contract Packaging Market Size and Share:

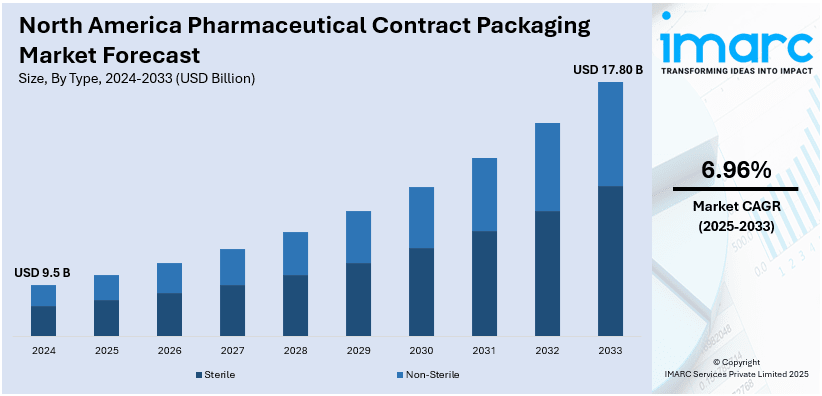

The North America pharmaceutical contract packaging market size was valued at USD 9.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.80 Billion by 2033, exhibiting a CAGR of 6.96% from 2025-2033. The market expansion is mainly propelled by escalating outsourcing trends, stricter regulatory needs, and the magnifying need for specialized packaging solutions. Increase in pharmaceutical production, innovations in biologics, and the robust requirement for cost-effective, compliant, and sustainable packaging solutions further boost market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 17.80 Billion |

| Market Growth Rate (2025-2033) | 6.96% |

The growth of the North America pharmaceutical contract packaging market is driven by the increasing demand for outsourcing packaging services to enhance efficacy, lower expenditure, and guarantee regulatory adherence. Pharmaceutical companies are increasingly partnering with contract packaging organizations (CPOs) to leverage their expertise in specialized packaging formats, including blister packs, vials, and prefilled syringes. Strict regulatory needs implemented by governmental organizations, mainly including the U.S. Food and Drug Administration (FDA) and Health Canada necessitate advanced serialization and traceability solutions, further expands North America pharmaceutical contract packaging market share. For instance, in January 2025, FDA announced escalating implementation of Drug Supply Chain Security Act that aims to attain an electronic as well as inter-operable method to trace particular drugs in their packaged form as they progress across the supply chains. Additionally, the growing cases of chronic disorders and the rising production of generic and biologic drugs have increased the need for innovative and secure packaging solutions that ensure drug stability and patient safety.

Advancements in packaging technologies, such as smart packaging, tamper-evident solutions, and child-resistant designs, are fueling market expansion. For instance, in October 2024, MM Packaging, a pharma packaging firm, unveiled its leading-edge packaging services, encompassing serialization solutions, child-resistant packaging, RFID and NFC integrated solutions, and anti-counterfeiting abilities. Moreover, the escalating focus on environmentally friendly as well as sustainable packaging, driven by regulatory guidelines and consumer preferences, has encouraged the adoption of recyclable and biodegradable materials. The rapid growth of e-commerce and direct-to-patient distribution models has also heightened the need for secure, temperature-controlled, and customized packaging solutions. Furthermore, the increasing complexity of pharmaceutical formulations, including personalized medicines and high-potency drugs, has accelerated North America pharmaceutical contract packaging market growth.

North America Pharmaceutical Contract Packaging Market Trends:

Rising Adoption of Sustainable Packaging Solutions

The North America pharmaceutical contract packaging market is experiencing a strong gravitation toward eco-friendly as well as sustainable packaging solutions. Increasing regulatory pressure and growing environmental awareness among consumers are driving the adoption of biodegradable, recyclable, and reusable materials. For instance, as per industry reports, 30% of individuals across the U.S. prefer purchasing products with environmentally friendly profile, while 78% customers acknowledge a sustainable living habit. In line with this, 61% people are aware regarding the environmental impacts that can affect the health adversely. As a result, pharmaceutical companies are actively seeking contract packaging providers that offer innovative solutions, such as plant-based plastics, compostable blister packs, and minimalistic packaging designs to reduce waste. Additionally, sustainability initiatives like carbon footprint reduction and energy-efficient production processes are becoming key differentiators for contract packaging organizations (CPOs), influencing market dynamics and fostering long-term industry growth.

Increasing Demand for Serialization and Track-and-Trace Solutions

Regulatory mandates from the key regulatory bodies in both Canada and the U.S. are propelling the need for advanced serialization and track-and-trace technologies in pharmaceutical packaging. The implementation of the U.S. Drug Supply Chain Security Act (DSCSA) demands comprehensive product authentication and traceability measures to combat counterfeit drugs and ensure patient safety. Consequently, pharmaceutical companies are partnering with contract packaging firms that offer sophisticated serialization solutions, including barcoding, RFID tagging, and blockchain-enabled tracking systems. These technologies enhance supply chain transparency, minimize drug diversion risks, and improve regulatory compliance, making serialization a key market trend in the region. For instance, in August 2024, U.S. Diversion Control Division announced that an elevation in independent pharmacies theft cases has been observed during 2023, with around 900 burglaries including controlled substances theft.

Growth of Personalized and Specialty Drug Packaging

The increasing demand for biologics, specialty drugs, and personalized medicine is driving innovations in pharmaceutical contract packaging. For instance, industry reports indicate that personalized medicine industry across the U.S. was evaluated at USD 184.73 Billion in the year 2024, with projections indicating market valuation of USD 387.40 Billion by the year 2033. Such advanced therapies require customized packaging solutions, such as temperature-sensitive vials, prefilled syringes, and single-dose packaging, to maintain efficacy and patient safety. Additionally, patient-centric packaging designs, including easy-to-open formats and adherence-enhancing solutions, are gaining traction to improve treatment outcomes. Contract packaging organizations are investing in flexible packaging lines and advanced technologies to accommodate the complex requirements of specialty pharmaceuticals, ensuring compliance with stringent storage and handling regulations while meeting the growing demand for tailored drug delivery solutions.

North America Pharmaceutical Contract Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America pharmaceutical contract packaging market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on industry, type, and packaging.

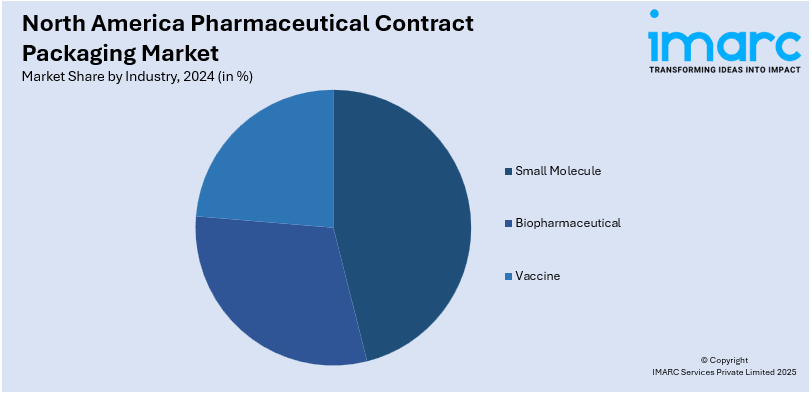

Analysis by Industry:

- Small Molecule

- Biopharmaceutical

- Vaccine

The small molecule portion of the market is dominated as liquid dosage and oral solid form are widely preferred. Pharmaceutical manufacturers are increasingly considering contract packaging organization (CPO) for delivering cost-effective models with the high demand for generics. Advanced package technologies such as blister packs, bottles, or pouches maximize product stability coupled with strictest regulatory compliance norms. Growth in the treatments of chronic diseases and a rising geriatric population are increasing the demand for packaging of small molecules. Also, track-and-trace as well as serialization policies push the need for more advanced solutions to ensure integrity and prevent counterfeit. All of these factors put together support this segment's stable growth, placing it as an important driver for the contract packaging industry.

The biopharmaceutical market is growing steadily in North America's pharmaceutical contract packaging market on account of high demand for the biologics and biosimilars segment. These treatments are complex therapies that require custom packaging solutions, encompassing vials, prefilled syringes, or cold chain logistics - which ensure stability and efficacy. Packaging organizations invest heavily in advanced technology to meet stiff regulatory requirements to ensure sterility. Pharmaceutical companies continue to outsource for cost optimization and streamlined operations. In such a scenario, the role of a CPO becomes crucial for offering customized packaging solutions. Rising prevalence of chronic diseases and growing investment in biologics further drives the growth of the market. Advancements in both materials with sustainable profile and smart packaging enhance efficiency further and support the changing requirements of the biopharmaceutical industry.

The vaccine segment would be one of the notable contributors to the share of the North America pharmaceutical contract packaging market because of growing immunization programs and pandemic preparedness initiatives. A vaccine is something that needs high-specialized packaging, including vials, prefilled syringes, and temperature-controlled solutions, for guaranteeing product stability and strict adherence to regulatory compliance. The accelerated demand for services in the category of contract packaging during the pandemic has emphasized scalable and efficient supply chain solutions. The demand for advanced cold chain and sterile packaging technologies is increasingly seeking assistance in these areas from contract packaging partners. Government funding and public health initiatives will continue to ensure the production and distribution of vaccines. As global health priorities evolve, innovations in packaging, including single-dose formats and smart labeling, further strengthen the segment’s growth trajectory.

Analysis by Type:

- Sterile

- Non-Sterile

The sterile form stands as the dominant segment in the pharmaceutical contract packaging industry across North America principally due to strict regulatory requirements and an escalating requirement for aseptic packaging services. The magnifying momentum of enhanced drug formulations, biologics, and injectables increases the demand for specialized packaging that maintains the integrity and safety of the product. In addition to this, CPOs are currently making heavy investments in leading-edge techniques and premium-quality of cleanroom facilities to cater to the strict industry norms. The ever-expanding biopharmaceutical industry with manufacturers looking for outsourcing solutions for better profitability and adherence with cGMP as well as FDA regulations is adding fuel to this growth. With increased concern for sterility certification as well as contamination, pharmaceutical firms have started looking at contract packagers as a key for dependable, secure, and cost-efficient sterile packaging solutions for North America.

The non-sterile type of packaging leads the market in North America, driven by the intense requirement for nutraceuticals, solid dosage forms, and over-the-counter medications. Powders, tablets, or capsules are a significant percentage of this segment, while pouches, blister packs, and bottles make flexible packaging solutions that contribute to growth. Additionally, increasing consumer interest in unit dose and child-resistant packaging helps strengthen market demand in the region. In addition to this, CPOs continue to advance in technologies pertaining to tamper-evident, labeling, and serialization to address changing customer as well as regulatory safety needs. The increase in contract manufacturing relationships and the high demand for affordable packaging solutions fuels the non-sterile growth, which serves as a pivotal part of North America's pharmaceutical packaging market.

Analysis by Packaging:

- Plastic Bottles

- Caps and Closures

- Blister Packs

- Prefilled Syringes

- Parenteral Vials and Ampoules

- Others

Plastic bottles hold a significant share in the North America pharmaceutical contract packaging market due to their durability, cost-effectiveness, and versatility. Widely used for solid and liquid medications, these bottles provide barrier protection against moisture and contaminants. Growing demand for child-resistant and senior-friendly packaging drives innovation in design. Regulatory compliance and sustainability concerns are encouraging the adoption of recyclable and biodegradable materials, further shaping market growth in this segment.

Caps and closures play a critical role in ensuring product rectitude and safety within the pharmaceutical contract packaging market. Tamper-evident, child-resistant, and easy-open closures are increasingly preferred to meet regulatory requirements and enhance user convenience. Demand for advanced materials, such as polypropylene and aluminum, is growing due to their protective properties. Manufacturers are also focusing on sustainable solutions, including recyclable and lightweight designs, to align with evolving environmental regulations.

Blister packs are a dominant packaging solution for solid-dose pharmaceuticals, offering superior protection against moisture, light, and contamination. Their unit-dose format enhances medication adherence and patient safety, making them a preferred choice for prescription and over-the-counter drugs. Advancements in thermoforming and cold-forming technologies have improved barrier properties and cost efficiency. Increasing regulatory emphasis on track-and-trace solutions is further driving demand for serialized and tamper-evident blister packaging.

Prefilled syringes are experiencing strong market growth due to their convenience, accuracy, and ability to reduce medication errors. These ready-to-use delivery systems enhance patient safety and compliance, particularly in biologics and injectable therapies. Rising demand for self-administration devices is further fueling adoption. Advanced materials, including cyclic olefin polymers, are gaining traction for their superior stability and barrier properties. Contract packaging providers are focusing on aseptic filling and innovative safety features to meet stringent regulatory standards.

Parenteral vials and ampoules remain essential in pharmaceutical contract packaging, particularly for injectables and biologic drugs. Glass vials are preferred for their chemical stability, while plastic alternatives are gaining attention for their break resistance and lightweight properties. Increased demand for lyophilized drug formulations has driven advancements in vial technology. Stringent regulatory requirements for sterility and traceability have encouraged innovations in labeling, tamper-proof sealing, and serialization to ensure product safety and compliance.

Country Analysis:

- United States

- Canada

The United States holds notable share of the North America pharmaceutical contract packaging market, driven by a well-established pharmaceutical industry and stringent regulatory requirements. The presence of leading contract packaging organizations (CPOs) supports high demand for innovative and compliant packaging solutions. Growth in biologics, specialty drugs, and personalized medicine is fueling advancements in prefilled syringes, blister packs, and smart packaging. Increasing focus on sustainability and serialization policies, typically constituting of the Drug Supply Chain Security Act (DSCSA), further propels market expansion. Rising outsourcing trends among pharmaceutical companies continue to strengthen the role of contract packaging providers.

Canada’s pharmaceutical contract packaging market is expanding due to increasing demand for cost-effective and compliant packaging solutions. The country’s strong regulatory framework, governed by Health Canada, necessitates high-quality packaging to ensure product safety and traceability. Growth in generic and biosimilar drugs is driving investments in advanced packaging technologies, including child-resistant and tamper-evident solutions. Additionally, rising pharmaceutical exports and partnerships with global CPOs are contributing to market expansion. Sustainability initiatives and the adoption of eco-friendly materials are shaping future developments in Canada’s contract packaging sector.

Competitive Landscape:

The market exhibits robust competition, with major firms currently emphasizing on tactical partnerships, capacity expansions, and technological advancements to fortify their market grip. Leading CPOs are investing in automation, smart packaging, and serialization solutions to meet stringent regulatory requirements and enhance operational efficiency. Market participants are also expanding their service portfolios to include specialized packaging for biologics, personalized medicine, and controlled substances. Mergers, acquisitions, and collaborations with pharmaceutical manufacturers are common strategies to gain a competitive edge. For instance, in June 2024, Bayer and PAPACKS strategically collaborated to design fiber-based packaging solutions for pharmaceutical brands, including Claritin, Aspirin, and Bepanthe. This packaging would be biodegradable, aiding companies to achieve their sustainability targets. Additionally, the growing emphasis on sustainable packaging solutions is shaping market dynamics, influencing investment decisions and innovation efforts.

The report provides a comprehensive analysis of the competitive landscape in the North America pharmaceutical contract packaging market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Gland Pharma, a major firm with robust distribution network in the U.S., announced the receival of US FDA approval for its injectable emulsion that will be packaged in single dose ampoules. This approval highlights potential packaging demands for the product distribution across the U.S. market.

- In July 2024, AWT Labels & Packaging Inc., a flexible packaging and custom labels firm, announced tactical acquisition of American Label Technologies, a RFID label provider for North America's healthcare segment. This move will aid AWT in expanding its RFID abilities as well as market share.

- In April 2024, SnapSlide LLC, a U.S.-based firm specializing in pharma packaging, launched its new product line for child-resistant caps. This product comes in a user-friendly design with a two-step-based opening to facilitate child resistance.

- In April 2024, Aptar Pharma announced the expansion of its production plant in New York to cater to the magnifying need for pharmaceutical products across North America. A major portion of this proliferated plant will be actively focusing on production of stoppers that will be film-coated, called ETFE PremiumCoat.

North America Pharmaceutical Contract Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Industries Covered | Small Molecule, Biopharmaceutical, Vaccine |

| Types Covered | Sterile, Non-Sterile |

| Packaging Covered | Plastic Bottles, Caps and Closures, Blister Packs, Prefilled Syringes, Parenteral Vials and Ampoules, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America pharmaceutical contract packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America pharmaceutical contract packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America pharmaceutical contract packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America pharmaceutical contract packaging market was valued at USD 9.5 Billion in 2024.

The market growth is impacted by magnifying outsourcing trends, stricter regulatory needs, elevating pharmaceutical production, and the demand for advanced packaging solutions. The augmentation of serialization mandates, biologics, specialty drugs, and sustainability ventures further bolster market expansion across the region.

IMARC estimates the North America pharmaceutical contract packaging market to reach USD 17.80 Billion by 2033, exhibiting a CAGR of 6.96% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)