North America PET Bottle Market Size, Share, Trends and Forecast by Capacity, Colour, Technology Type, End-Use, and Country, 2025-2033

North America PET Bottle Market Size and Share:

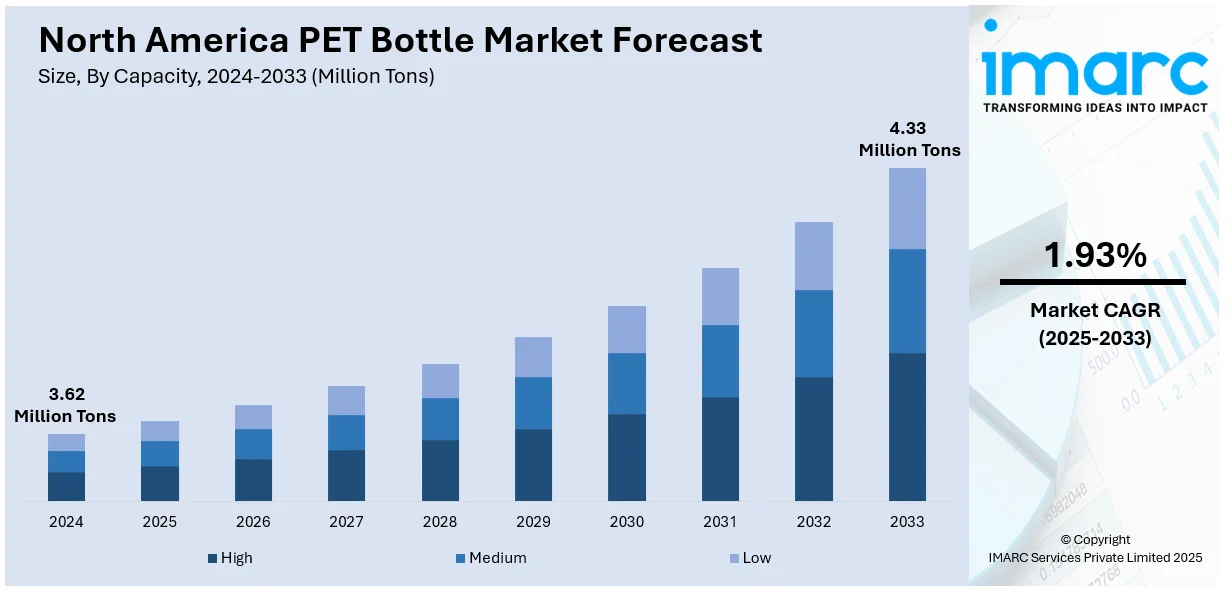

The North America PET bottle market size was valued at 3.62 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 4.33 Million Tons by 2033, exhibiting a CAGR of 1.93% from 2025-2033. The heightened demand for bottled beverages, emerging sustainability trends across the region, increasing focus on lightweight and durability, ongoing advancements in PET bottle technology, and shifting consumer preferences for convenience are some of the factors boosting the North America PET bottle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3.62 Million Tons |

|

Market Forecast in 2033

|

4.33 Million Tons |

| Market Growth Rate 2025-2033 | 1.93% |

The growing demand for bottled beverages continues to be a major driver of the North America PET bottle market growth. As consumer lifestyles become more fast-paced, the need for convenient, portable, and ready-to-drink products has surged. According to industry reports, bottled water alone continues to outperform other beverage categories in terms of growth. The North American bottled water market, valued at over $54.6 billion in 2024, is expected to grow steadily, driven by an increasing preference for healthier beverages over sugary soft drinks. The U.S. bottled water market, for instance, saw sales reaching 15.9 billion gallons in 2023, with bottled water becoming the most consumed beverage in the country by volume. Additionally, the rise in consumer health consciousness has led to a greater shift towards hydration, fueling demand for PET bottles, as they provide a safe, lightweight, and convenient packaging solution for the growing range of bottled beverages.

The sustainability trends driving growth in the North America PET bottle market demand reflect growing environmental awareness among both consumers and businesses. The increasing demand for eco-friendly products and packaging solutions has accelerated the adoption of recyclable and recycled materials. PET is widely recognized for being one of the most recyclable plastics, with over 30% of PET bottles in the U.S. being recycled every year since 2019, according to NAPCOR, a number that continues to rise thanks to increased awareness and recycling infrastructure improvements. Furthermore, more companies are making commitments to use recycled PET (rPET) in their packaging. Leading beverage companies have set ambitious goals to increase the rPET content in their bottles. This approach supports the increasing shift toward a circular economy, where products are recycled and reused, minimizing the environmental impact of plastic waste. The growing consumer preference for sustainable packaging solutions further boosts the North America PET bottle market share.

North America PET Bottle Market Trends:

Increasing Focus on Lightweight and Durability

As per the latest North America PET bottle market outlook, the lightweight and durability of PET bottles continue to make them an attractive choice for manufacturers and consumers alike. These properties offer multiple advantages, including cost savings in transportation and reduced environmental impact. PET bottles are significantly lighter than alternatives like glass or metal, making them easier and more economical to ship. This has contributed to their dominance in industries like beverages, where the need for efficient distribution is key. For example, PET bottles used in the beverage industry reduce the transportation weight compared to glass, leading to lower fuel consumption and greenhouse gas emissions. In addition, PET bottles are more durable than glass, which makes them safer for handling and less likely to break during production, transportation, or consumption. This durability factor has made PET bottles a preferred option for consumer goods, particularly those sold in bulk or in outdoor environments.

Ongoing Advancements in PET Bottle Technology

Based on the recent North America PET bottle market forecast, advancements in PET bottle technology have played a significant role in the material's continued dominance in packaging. Over the years, innovations in PET bottle production have focused on reducing material use without sacrificing the strength or functionality of the bottles. The practice of lightweighting has become widespread. According to industry reports, this has led to reduced environmental impact by using less plastic while maintaining durability. Lightweighting has contributed to a reduction in carbon emissions related to production and transportation, as lighter bottles require less energy to produce and transport. Furthermore, advancements in barrier technology have enabled PET bottles to offer improved protection for products, especially beverages, extending shelf life and preserving quality. Modern PET bottles can now be designed with multiple layers to protect against oxygen and UV light, preventing degradation of sensitive contents.

Shifting Consumer Preferences for Convenience

Consumer preferences for convenience packaging are a key driver of PET bottle market growth. Recently, on-the-go lifestyles have become more noticeable, especially in North America. Consumers lean more towards convenience with their daily routines, which in turn drives the choices in packaging. Light, resealable, and portable, PET bottles fit this bill perfectly. The boom in bottled water, ready-to-drink teas, juices, and sports drinks is because consumers are looking for beverages that will fit with their busy lives. Due to their ability to protect the contents while remaining convenient to carry and drink, PET bottles are still the main choice within the beverage industry. The trend continues in respect of other packages, from snacks to pharmaceuticals, making PET packaging more attractive. As convenience is still a major consumer priority, it can be expected that consumption of PET bottles will remain on the rise over the next years.

North America PET bottle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America PET bottle market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on capacity, colour, technology type, and end-use.

Analysis by Capacity:

- High

- Medium

- Low

In the North American market for PET bottles, medium-sized bottles enjoy the largest market, because consumers look for beverages that help them balance convenience and volume. These bottle sizes are commonly used for bottled water, soft drinks, juices, and ready-to-drink beverages. Apart from being a reasonable serving for individual consumption, this bottle size is also suitable for group occasions. Medium-sized bottles are preferred by retailers since they are inexpensive and easy to carry, targeting consumers who seek something larger than single-serving but smaller than bulk-sized bottles. Assisted by penetration among health-conscious consumers in favor of bottled water and low-calorie beverages available in these sizes, this segment has scaled recent growth.

Analysis by Colour:

- Transparent

- Colored

Transparent PET bottles dominate the North American market, making up the majority of the PET bottle industry. The preference for transparent bottles is mainly driven by customer demand for visibility and product transparency. Transparent PET bottles allow consumers to see the content inside, especially important for beverages such as water, soft drinks, and juices, where clarity is identified as purity and quality. Transparent PET bottles have always been the packaging of choice for manufacturers because these bottles allow easy visibility of branding and labeling that significantly influences consumer purchase decisions. These colorless containers have no apparent color and provide a neutral appearance, which is an added benefit because they match various types of products without affecting their visible appeal.

Analysis by Technology Type:

- Stretch Blow Molding

- Injection Molding

- Extrusion Blow Molding

- Thermoforming

- Others

In the North American PET bottle market, stretch blow molding technology is the most widely adopted by many industries for production. The stretch blow molding process is popular because it is highly efficient, provides lightweight bottles, is strong, and offers design flexibility for many different shapes and sizes. This technology stretches the PET material before blowing it into its mold, allowing for uniform wall thickness and lowered resin consumption. It has become one of the most adopted beverage bottling materials, especially in the production of such varied contents as bottled water, juices, and carbonated beverages. It produces bottles to be strong and lightweight-also making them easy to transport-and cutting the cost of packing and distribution. The advancements in stretch-blow-molding technology have in fact altered the barrier property of bottles, which has enhanced beverage shelf life and thereby safeguarded product quality.

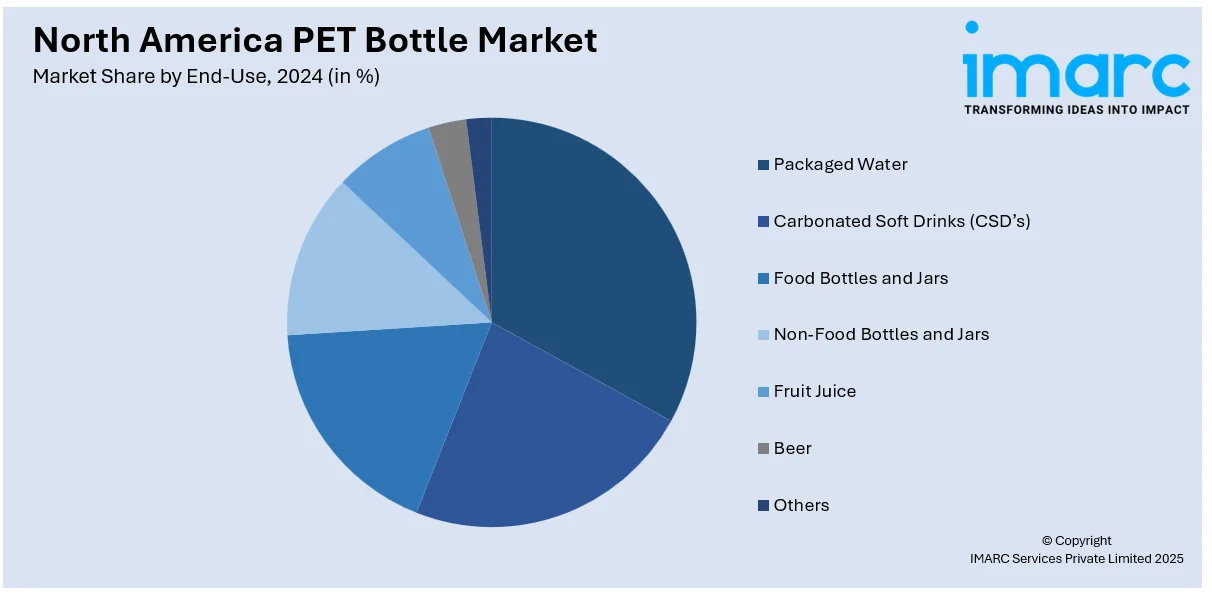

Analysis by End-Use:

- Packaged Water

- Carbonated Soft Drinks (CSD’s)

- Food Bottles and Jars

- Non-Food Bottles and Jars

- Fruit Juice

- Beer

- Others

The North American bottled water segment is the leading PET segment due to an increased awareness of health and an on-the-go preference for hydration. The acceptance of bottled water as a healthy, convenient alternative to sugary drinks supports the demand for PET bottles.

The carbonated soft drinks (CSDs) segment remains to be one of the main end-use categories for PET bottles since the demand for lightweight, durable packaging will grow along with the growth of the beverage industry. Given its low price tag and ability to withstand carbonation pressure, PET has become the preferred material for CSD producers.

PET bottles and jars are increasingly popular packaging for sauces, condiments, and preparation spreads. With this versatility and the ability to preserve the quality of food, PET has become the preferred medium in food packaging. Trends favoring swelling consumer convenience and ready-to-eat foods add strength to the demand for PET in the other segment.

The non-food bottles and jars segment caters to the packaging of household and personal care clean agents like shampoos and lotions. The strength, recyclability, and versatility of PET provide an ideal material for a political-wide variety of non-food products, supporting growth in this diversified sector of the market.

Fruit juice applications continue to see steady growth in PET bottle usage, driven by increasing customer demands for fresh, convenient beverages. Highly lightweight and non-breakable, PET is becoming an increasingly popular option in large-scale juice processing because it offers excellent preservation properties for juice quality.

The beer segment increasingly adopts PET bottles as an alternative to traditional glass packaging. PET can withstand the freshness of beer and is durable and light, making it attractive for breweries. Its adoption has been particularly notable in the craft beer market, where convenience and innovation are important.

Country Analysis:

- United States

- Canada

The United States is the largest market for PET bottles in North America, holding the majority of the market share. This supremacy can be attributed to many reasons, including the large and diversified beverage industry in the country, which leads to a subsequent large demand for PET packaging. Also, the largest beverage companies are located in the U.S., all of which depend on PET bottles for packaging their products. The sound development of capacity for manufacturing and recycling, alongside increasing focus on sustainability and circular economy initiatives, should heighten the demand for PET bottles. Governmentefforts to reduce plastic wastage and improve recycling rates have accelerated the growth of recycled PET (rPET) in the country's packaging space. Sweeping demand across the beverage, food, and personal care segments has kept the U.S. as the largest player in the PET bottle market in North America.

Competitive Landscape:

Leading players in the North American PET bottle market are actively pursuing strategies to maintain their competitive edge and align with evolving consumer and environmental demands. Major companies continue to dominate the market by focusing on innovation, sustainability, and expanding their product offerings. These companies are investing heavily in recycled PET (rPET), aiming to reduce their environmental footprint and meet consumer demand for more sustainable packaging solutions. In addition to sustainability efforts, these players are also embracing technological advancements in bottle production, such as lightweighting and stretch blow molding, to reduce material use and improve cost efficiency. They are also expanding their product portfolios to cater to the growing demand for bottled water, plant-based drinks, and functional beverages.

The report provides a comprehensive analysis of the competitive landscape in the North America PET bottle market with detailed profiles of all major companies.

Latest News and Developments:

- In March 2024, Coca-Cola North America introduced a new lightweight PET bottle design for its sparkling beverage range. This innovation aims to reduce the amount of plastic used in packaging while maintaining the quality and durability of the bottles.

- In February 2024, Califia Farms, a prominent plant-based beverage brand, made a significant shift by switching to 100% recycled PET bottles for its entire product line across the U.S. and Canada. This includes their range of creamers, plant milks, teas, and coffees.

- In October 2024, Silgan Holdings Inc. acquired Weener Plastics Holdings B.V., a leading producer of plastic packaging solutions for food, personal care, and healthcare products. Weener has a global network of 19 facilities spread mainly across the Americas and Europe.

- In August 2023, Berry Global, a US based manufacturer of plastic packaging products, launched fully recycled PET bottles for luxury water brand.

- In February 2023, Danone revealed plans to invest approximately $65 million in building a new PET bottle production facility in Jacksonville, Florida. This investment aims to enhance the company’s capacity to meet growing consumer demand while reinforcing its commitment to sustainability.

North America PET Bottle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | High, Medium, Low |

| Colours Covered | Transparent, Colored |

| Technology Types Covered | Stretch Blow Molding, Injection Molding, Extrusion Blow Molding, Thermoforming, Others |

| End-Uses Covered | Packaged Water, Carbonated Soft Drinks (CSD’s), Food Bottles and Jars, Non-Food Bottles and Jars, Fruit Juice, Beer, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America PET bottle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America PET bottle market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America PET bottle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America PET bottle market was valued at 3.62 Million Tons in 2024.

The market is expanding rapidly due to the heightened demand for bottled beverages, emerging sustainability trends across the region, increasing focus on lightweight and durability, ongoing advancements in PET bottle technology, and shifting consumer preferences for convenience.

IMARC estimates the North America PET bottle market to exhibit a CAGR of 1.93% during 2025-2033, reaching 4.33 Million Tons in 2033.

Medium holds the majority share in the capacity segment of the North America PET bottle market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)