North America Perfume Market Size, Share, Trends and Forecast by Perfume Type, Category, Distribution Channel, and Country, 2026-2034

North America Perfume Market Summary:

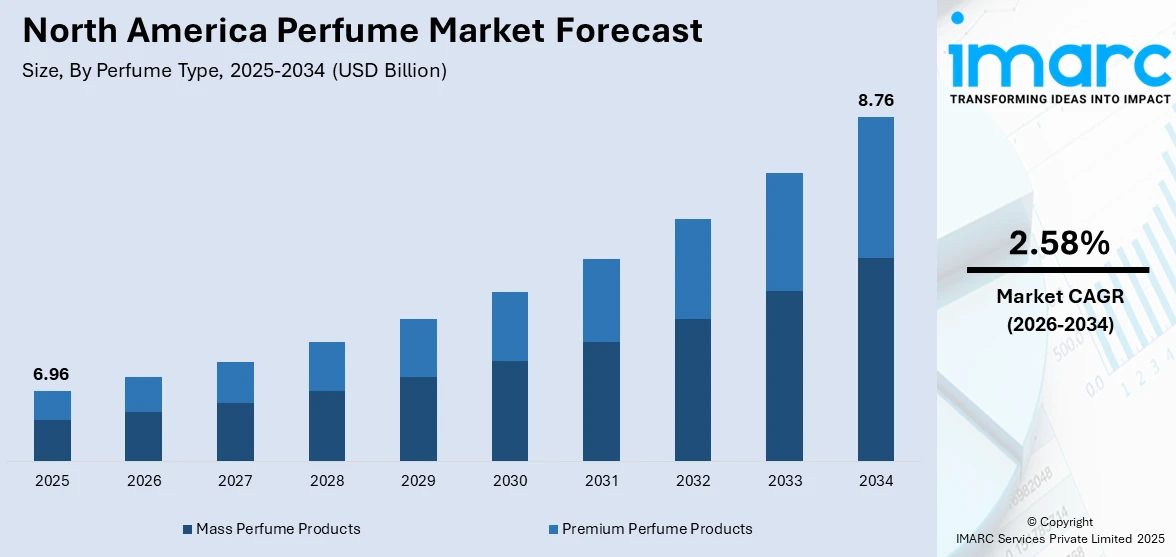

The North America perfume market size was valued at USD 6.96 Billion in 2025 and is projected to reach USD 8.76 Billion by 2034, growing at a compound annual growth rate of 2.58% from 2026-2034.

The North America fragrance market is witnessing ongoing growth fueled by changing user preferences for personal care, self-expression, and wellness-focused scent experiences. Increasing disposable incomes throughout the region, especially in urban centers, are allowing individuals to invest in both mainstream and high-end fragrances. The growing impact of social media platforms, celebrity endorsements, and online marketing strategies is continually transforming buying patterns among younger audiences. Moreover, the increasing need for sustainable, clean-label, and tailored fragrances is reshaping product development focuses and strengthening the North America perfume market share.

Key Takeaways and Insights:

- By Perfume Type: Mass perfume products dominate the market with a share of 57% in 2025, due to their affordability, broad availability across retail channels, and variety of product formats, such as body mists, sprays, and colognes, that appeal to budget-conscious individuals looking for accessible fragrance options.

- By Category: Female fragrances lead the market with a share of 54% in 2025, reflecting the extensive product variety, which ranges from floral to oriental scents, the deep integration of perfume into feminine grooming routines, and targeted marketing campaigns that emphasize the importance of fragrance for expressing one's personal identity.

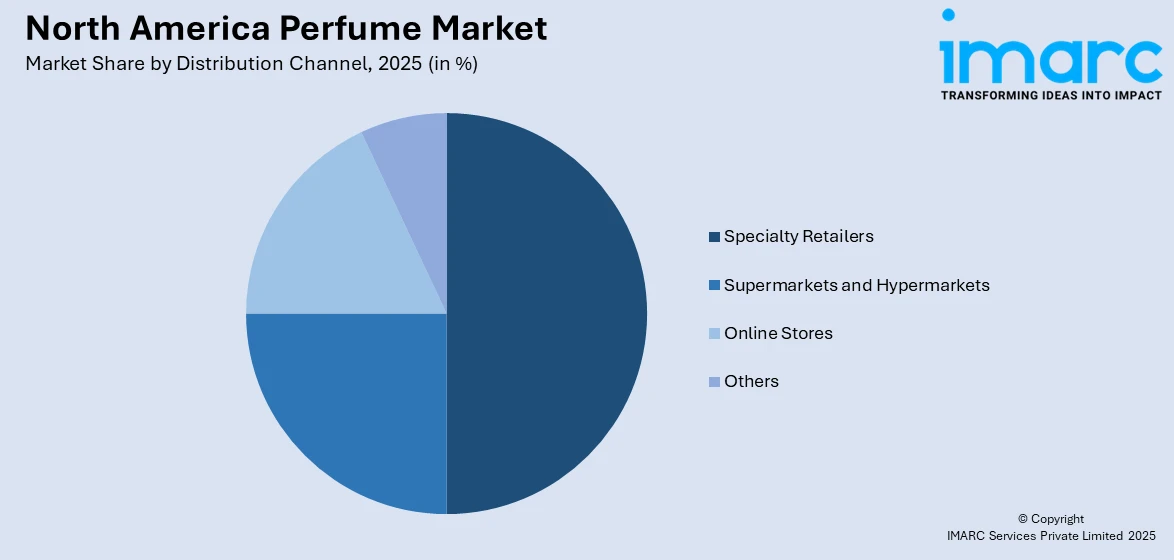

- By Distribution Channel: Specialty retailers represent the largest segment with a market share of 49% in 2025, owing to their carefully chosen product assortments, professional advice services, immersive in-store experiences, and loyalty programs that encourage client engagement and repeat purchases.

- By Country: United States dominates the market with a share of 64% in 2025, driven by significant e-commerce penetration, well-established retail infrastructure, high individual expenditure on beauty goods, and cultural focus on self-expression and personal grooming.

- Key Players: The North America perfume market exhibits robust competitive intensity, with established luxury houses and mass-market manufacturers competing across price segments through product innovation, sustainability initiatives, omnichannel distribution strategies, and strategic partnerships.

To get more information on this market Request Sample

The North America perfume market is influenced by various critical elements, such as the rising demand for high-end and luxury scents, heightened awareness about personal grooming, and changing user preferences. As individuals become more selective regarding fragrance options, there is a shift towards premium, distinctive, and enduring scents. Moreover, the growing number of e-commerce platforms is simplifying the process for buyers to discover and acquire a diverse array of perfumes from international brands. Social media and influencer marketing significantly influence fragrance trends, particularly within younger age groups. Additionally, seasonal releases, partnerships, and products from prestigious fragrance brands maintain the market's vibrancy, contributing to the market growth. In 2024, Polo Est. was introduced by Ralph Lauren Fragrances. 67 Eau de Toilette, a vibrant and athletic fragrance that reimagines the classic Polo scent series. The scent, developed alongside perfumer Marie Salamagne, showcased notes of citrus, vetiver, and pineapple, and is contained in a refillable dark blue bottle.

North America Perfume Market Trends:

Influence of Celebrity and Influencer Endorsements

Celebrity and influencer endorsements are becoming a crucial factor in the North American perfume market, as they attract a dedicated user base and increase brand visibility. When high-profile figures release fragrance lines, they often see a significant boost in sales. In 2025, Bella Hadid expanded her Orebella brand with the launch of Eternal Roots, a fragrance combining woody and fruity notes that symbolize strength, growth, and self-care. The scent, featuring skin-hydrating formulas, became available in the US and Canada through Orebella.com and Ulta, further driving the demand and reinforcing Hadid’s influence in the industry.

Rising Demand for Transparency and Ethical Practices

The North American perfume market is witnessing a shift driven by the increasing user demand for transparency and ethical practices in product formulations. People are becoming more conscious about the ingredients in their fragrances, seeking brands that prioritize clear labeling and sustainability. Market players are responding to this shift by adopting more transparent ingredient labeling and investing in sustainable sourcing practices. For instance, in 2024, Sephora Canada exclusively launched Henry Rose, a genderless fine fragrance line created by Michelle Pfeiffer. Known for its commitment to ingredient transparency, Henry Rose was the first fragrance to earn both EWG Verified® and Cradle to Cradle Certified™ distinctions, highlighting the growing importance of ethical standards in fragrance production.

Personalized Fragrance Experiences

Advances in technology are enabling perfume brands to offer personalized fragrance experiences for consumers. Many brands now offer custom scent creation services, allowing individuals to tailor their fragrances to their preferences. With the use of artificial intelligence (AI) and advanced scent technologies, brands can now provide personalized recommendations based on individual taste, preferences, and lifestyle. This personalized approach enhances user engagement and satisfaction, fostering stronger brand loyalty and increasing market share for companies offering customized perfume options. For example, in 2025, Unilever invested €100 million to open a new fragrance lab in Trumbull, Connecticut, aimed at enhancing its fragrance expertise. This lab leveraged AI and user insights to create personalized and superior scents, reinforcing Unilever’s commitment to offering unique products.

Market Outlook 2026-2034:

The North America perfume market is expected to maintain steady growth throughout the forecast period, supported by stable economic conditions, changing user preferences, and ongoing innovations in fragrance formulations and delivery methods. The market generated a revenue of USD 6.96 Billion in 2025 and is projected to reach a revenue of USD 8.76 Billion by 2034, growing at a compound annual growth rate of 2.58% from 2026-2034. This growth is driven by increasing demand for premium and personalized fragrances, alongside advancements in packaging and marketing strategies that cater to evolving individual lifestyles.

North America Perfume Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Perfume Type | Mass Perfume Products | 57% |

| Category | Female Fragrances | 54% |

| Distribution Channel | Specialty Retailers | 49% |

| Country | United States | 64% |

Perfume Type Insights:

- Premium Perfume Products

- Mass Perfume Products

Mass perfume products dominate with a market share of 57% of the total North America perfume market in 2025.

Mass perfume products lead the market because they are widely accessible and reasonably priced. These fragrances cater to a broad user base, offering a variety of scent options that appeal to different preferences. With competitive pricing and extensive distribution channels, mass perfumes make it easy for people to access them across department stores, drugstores, and online platforms. This accessibility, combined with attractive price points, ensures that mass perfumes remain a popular choice for the majority of fragrance buyers.

Additionally, mass perfume products benefit from strong brand recognition and aggressive marketing strategies. Established brands often utilize celebrity endorsements, digital campaigns, and promotional events to enhance visibility and foster user engagement. These marketing tactics, combined with competitive pricing, effectively attract and retain price-sensitive buyers. The strategic use of high-profile endorsements and targeted promotions cultivates a loyal client base, driving repeat purchases and sustaining long-term brand success. By balancing quality, visibility, and affordability, mass perfume products dominate the market.

Category Insights:

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

Female fragrances lead with a market share of 54% of the total North America perfume market in 2025.

Female fragrances account for the majority of the market share, primarily driven by a larger user base and strong demand for a wide range of scent profiles. Fragrances for women play an important role in the personal care sector, featuring a wide range of floral, fruity, and oriental scents to meet various tastes. In 2024, Victoria Beckham Beauty launched a pop-up in New York to showcase its new scent, 21:50 Rêverie. The fragrance, with notes of vanilla, cedarwood, and tonka bean, showcased the increasing popularity of luxurious women's perfumes.

Moreover, the growing influence of beauty trends and social media is further increasing the popularity of female fragrances. With influencers and celebrities endorsing specific scents, women’s perfumes gain considerable attention, driving user interest and purchase behavior. In addition, fragrance brands are increasingly offering customization options, allowing buyers to create personalized scents, which enhances the appeal. As a result, female fragrances remain the leading category in the market, with both mainstream and niche brands catering to a broad demographic.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Retailers

- Online Stores

- Others

Specialty retailers exhibit a clear dominance with a 49% share of the total North America perfume market in 2025.

Specialty retailers represent the largest segment owing to their curated selection of high-quality fragrances and personalized shopping experiences. By offering a diverse range of brands and scent profiles, they cater to individual preferences. Well-trained staff provide expert recommendations, enhancing the shopping experience. This personalized approach fosters brand loyalty and encourages repeat purchases. For example, in 2025, Olfactory NYC, a custom fragrance maker, expanded its U.S. presence by opening a store in Dallas' West Village, marking its ninth location. Such expansions demonstrate the continued appeal of specialty retailers as preferred destinations for discerning perfume buyers.

Additionally, specialty retailers frequently have exclusive relationships with high-end and luxury fragrance companies, providing goods that are hard to get in mass-market stores. Their shops are ideally situated in busy neighborhoods, drawing a wide range of clients looking for both mainstream and specialty scents. Specialty retailers are the preferred option for discriminating buyers owing to the tactile sensation of testing smells in-store and the opportunity to receive personalized assistance.

Country Insights:

- United States

- Canada

United States dominates with a market share of 64% of the total North America perfume market in 2025.

United States holds the biggest market share due to its large user base and high purchasing power. The well-established retail infrastructure of the country, including both physical stores and e-commerce platforms, ensures widespread availability of a wide variety of perfume brands. The growing interest in beauty and personal care further contributes to the market’s size and influence in the region. Additionally, the country benefits from being home to several global fragrance companies and industry leaders, making it a hub for innovation in scent development, packaging, and marketing strategies.

The influence of celebrities, social media, and celebrity-endorsed fragrance lines also plays a significant role in shaping trends, further cementing the dominance of United States in the North American perfume market. Major cities like New York, Los Angeles, and Miami also serve as key markets, with a strong cultural focus on fashion and self-expression driving the demand for perfumes. For instance, in 2025, Match Perfumes debuted in the US with an exclusive launch party in New York City. The brand offered 40 high-quality "inspired-by" fragrances that deliver affordable luxury. The event featured influencers and a personalized fragrance experience, highlighting the brand's commitment to providing premium scents at accessible prices.

Market Dynamics:

Growth Drivers:

Why is the North America Perfume Market Growing?

Rising Disposable Incomes

Economic prosperity across North America is significantly improving individual purchasing power for discretionary beauty products including fragrances. Rising disposable incomes, particularly in metropolitan areas, enable people to invest in premium and luxury perfumes that were previously considered aspirational purchases. Personal income rose by $71.6 billion (0.3 percent at a monthly rate) in September 2024, as per estimates published by the U.S. Bureau of Economic Analysis, reflecting the financial capacity of people to allocate spending toward personal care and grooming products. This economic foundation supports both entry-level mass fragrance purchases and trade-up behavior toward prestige brands, driving overall market growth across price segments.

Growing E-Commerce Sales

The rise of online shopping has significantly transformed the North American perfume market by offering buyers greater convenience and access to a wider range of products than traditional retail stores. Online platforms provide not only an extensive selection but also innovative features, such as subscription services, virtual fragrance consultations, and online-exclusive product launches. These advancements are enabling smaller, niche brands to gain visibility and reach larger audiences. According to the Census Bureau of the Department of Commerce in 2025, online retail sales in Q3 2025 reached $310.3 billion, reflecting a 1.9% increase from the previous quarter, underscoring the growing dominance of e-commerce in user purchasing behavior.

Innovation in Product Offerings

The North American perfume market is being propelled by ongoing innovations in product formulations and packaging. Brands are continuously experimenting with new scent combinations, improving lasting power, and developing various delivery systems, such as roll-ons, sprays, and mists, to cater to diverse user preferences. In 2025, O Boticário launched its first mushroom-based fragrance in the US, EGEO Cogu and EGEO Cogu Mellow, featuring Boletus Edulis mushrooms. Developed with Symrise, these scents blend gourmand, woody, vanilla, and pear elements, offering customizable layering options. Furthermore, sustainable packaging solutions, including recyclable and biodegradable materials, are gaining traction, attracting environmentally conscious individuals.

Market Restraints:

What Challenges the North America Perfume Market is Facing?

High-Cost Barriers Limiting Premium Segment Accessibility

The high price points of premium and luxury fragrances create accessibility challenges for price-sensitive buyers, restricting market penetration among lower and middle-income demographics. Despite the long-term value offered by higher-concentration formulations, many people hesitate to invest due to the lack of affordable entry points or flexible financing options. This price sensitivity limits broader adoption, hindering growth within certain user segments.

Counterfeit Products Eroding Consumer Trust

The rise of counterfeit fragrances through unauthorized retail channels and online marketplaces threatens user safety and brand integrity. These fake products, often containing harmful ingredients, erode user confidence, especially in digital platforms where product authentication is difficult. As a result, both people and legitimate brands face increased risks, with counterfeit fragrances undermining trust and potentially damaging reputations in the fragrance industry.

Regulatory Restrictions on Fragrance Ingredients

Evolving regulatory requirements on fragrance ingredients and labeling present compliance challenges for manufacturers. Stricter regulations on synthetic compounds and allergen disclosures raise production costs and complexity. Brands must balance these new standards with the need to preserve desired scent profiles and meet user expectations for product performance. Navigating these regulatory changes requires significant effort, impacting both formulation processes and overall product development strategies.

Competitive Landscape:

The North America perfume market exhibits robust competitive intensity characterized by the presence of multinational luxury conglomerates, prestige beauty companies, and emerging niche fragrance houses competing across price segments and distribution channels. Market dynamics reflect strategic positioning, ranging from heritage luxury brands emphasizing craftsmanship and exclusivity to accessible mass-market manufacturers targeting value-conscious buyers. The competitive landscape is increasingly shaped by sustainability initiatives, digital marketing capabilities, omnichannel distribution strategies, and personalization technologies. Companies are investing in clean fragrance formulations, refillable packaging systems, and AI-powered scent customization to differentiate offerings and capture evolving user preferences.

Recent Developments:

- December 2025: House of Perfumes launched its full fragrance portfolio in North America, targeting the US, Mexico, and Canada. The collection includes three brands, Mahaya (luxury oud), John Ashwood (affordable niche), and Louis Olivier (everyday scents).

- December 2025: IMH Fragrance announced a partnership with Quiksilver to launch its first-ever fragrance collection, set for release in early 2026 in the US and Canada. The collection will feature four signature scents inspired by Quiksilver's surf-and-snow culture. It will debut at Cosmoprof Miami 2026 and be available online and in select retailers by February 2026.

North America Perfume Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Perfume Types Covered | Premium Perfume Products, Mass Perfume Products |

| Categories Covered | Female Fragrances, Male Fragrances, Unisex Fragrances |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Retailers, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The North America perfume market size was valued at USD 6.96 Billion in 2025.

The North America perfume market is expected to grow at a compound annual growth rate of 2.58% from 2026-2034 to reach USD 8.76 Billion by 2034.

Mass perfume products dominated the market with a 57% revenue share in 2025, driven by their cost-effectiveness, widespread availability across retail channels, and diverse product formats including body mists, sprays, and colognes that cater to price-conscious users.

Key factors driving the North America perfume market include advances in technology enabling personalized fragrance experiences, with brands leveraging AI and scent technologies to tailor perfumes to individual preferences. For example, Unilever invested €100 million in 2025 to open a fragrance lab in Connecticut, boosting personalization and innovation.

Major challenges include high-cost barriers limiting premium segment accessibility, counterfeit products eroding user trust through unauthorized channels, evolving regulatory restrictions on fragrance ingredients, and intensifying competition among established brands and emerging niche players.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)