North America Pectin Market Size, Share, Trends and Forecast by Raw Material, End Use and Country, 2026-2034

North America Pectin Market Size and Share:

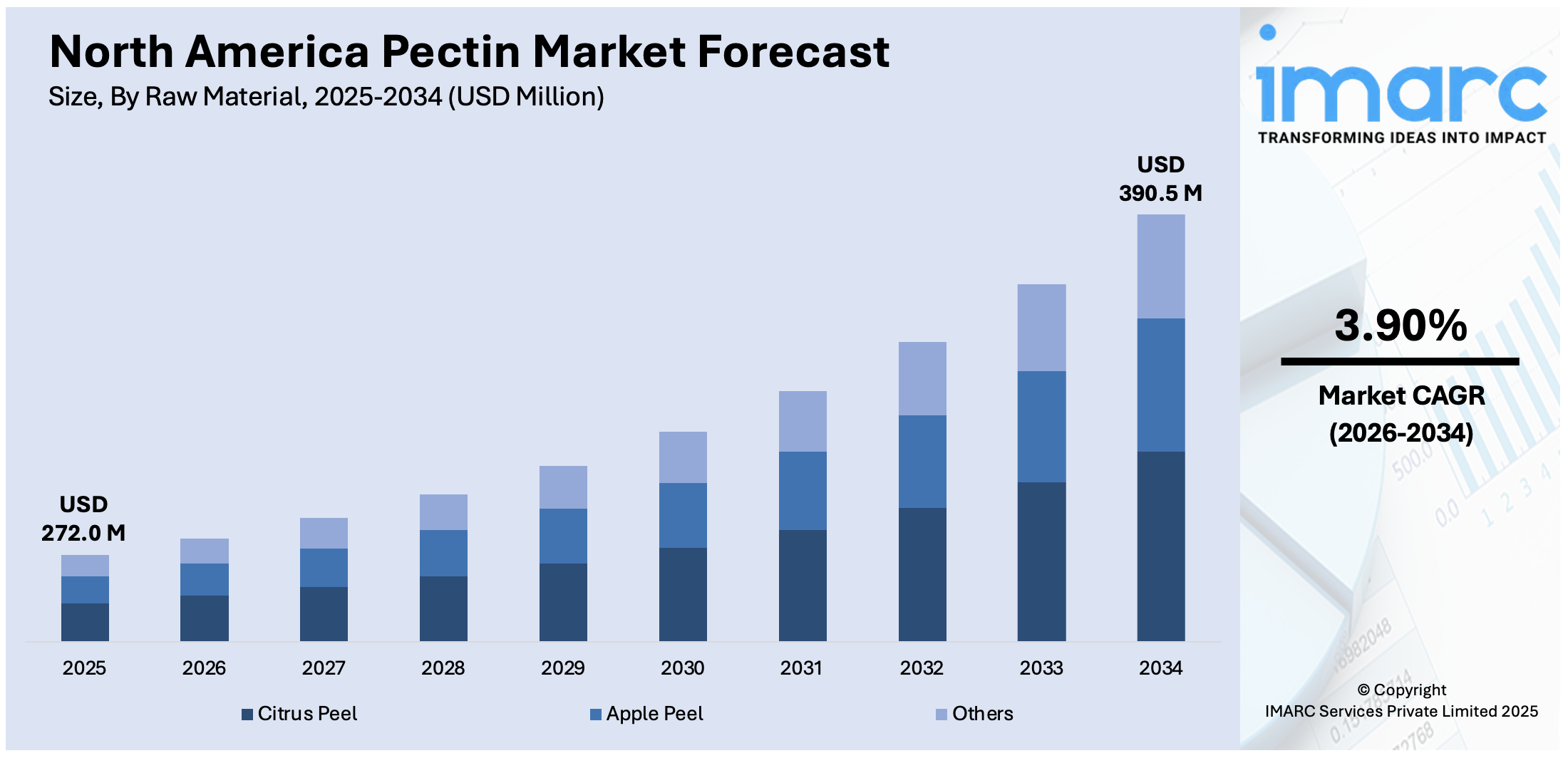

The North America pectin market size was valued at USD 272.0 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 390.5 Million by 2034, exhibiting a CAGR of 3.90% from 2026-2034. The North America pectin market is driven by rising demand for clean-label and natural food ingredients, increasing applications in dairy and beverage sectors, and growing consumer preference for plant-based gelling agents. Additionally, expanding use in pharmaceuticals and personal care products due to its functional benefits supports market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 272.0 Million |

| Market Forecast in 2034 | USD 390.5 Million |

| Market Growth Rate (2026-2034) | 3.90% |

The consumer preference for clean-label and natural food ingredients primarily influences North America pectin market. As awareness with respect to artificial additives and synthetic stabilizers gains momentum, food manufacturers have started shifting to natural alternatives, such as pectin derived from citrus fruits and apples, which is the key ingredient used in jams, jellies, and dairy products, thus providing natural gelling, thickening, and stabilizing properties. Support for clean-label formulations from the regulatory end has only been complemented by increasing consumer vigilance towards ingredient lists, thus increasing demand. This is mainly found in organic and functional foods, which talk about minimally processed ingredients.

To get more information on this market Request Sample

Another significant driver for the market is its growing demand in the dairy and beverage industry. Pectin adds structure and stability to yogurt, fruit-based drinks, and plant-based dairy alternatives in line with the growing demand for non-dairy and functional beverages. In low-sugar and reduced-calorie formulations, pectin is a natural stabilizer and enhances mouthfeel and viscosity without synthetic additives. The demand for healthy, nutrient-rich drinks along with probiotic-enhanced milk and other milk-based products that manufacturers can only ensure through incorporation of pectin. This is also augmented by innovations in beverage processing, such as high-pulp juice formulations.

North America Pectin Market Trends:

Increasing Demand for Plant-Based and Vegan Ingredients

One of the main factors influencing the North America pectin market is the shift towards plant-based and vegan diets. Consumers are looking for alternative solutions to animal-derived stabilizers like gelatin, thus putting a premium on pectin as it comes from a natural source derived from fruits. The increased interest in vegan confectionery, dairy alternatives, and plant-based desserts has resulted in increased demand for pectin as a gelling and thickening agent. Manufacturers are reformulating products in line with clean-label and vegan-friendly claims to further drive growth in the market. Regulatory support for plant-based labeling and the sustainability-focused consumer preference is forcing brands to point out the natural benefits of pectin, thus further establishing its position in the food industry.

Expansion of Functional and Reduced-Sugar Food Products

The increasing use of pectin in North America is fuelled by rising demand for functionally and low sugar food products. The current scenario, with the trend for health-conscious consumption, makes manufacturers utilize pectin for creating a good texture and stability for low-calorie and sugar-free products. In low-sugar jams, yogurts, and beverages, pectin enhances mouthfeel without compromising consistency or flavor. This also sees an uptick due to enhanced interest in gut health and the intake of fiber-enriched foods for which pectin serves as a soluble fiber additive. As regulatory pressures on sugar reduction gain increasing momentum, manufacturers are using it in formulating these products to manage quality without violating changing health trends.

Increasing Adoption in the Pharmaceutical and Personal Care Sectors

Beyond food, the increasing interest in pectin applications is within the pharmaceutical and personal care industry because of its biocompatibility and functional properties. In the pharmaceutical industry, pectin is used as an excipient in drug delivery systems, for wound healing products, and for digestive health supplement applications, considering the gelling and fiber content benefits. Medication formulations increasingly incorporate natural excipients, increasing the demand for pectin. In personal care, pectin's hydrating and film-forming properties make it a popular ingredient in skincare, hair care, and cosmetic products. The clean-label movement in beauty and healthcare industries is increasing the preference for botanical and non-synthetic ingredients, positioning pectin as a sustainable and functional choice.

North America Pectin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America Pectin market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on raw material and end use.

Analysis by Raw Material:

- Citrus Peel

- Apple Peel

- Others

Citrus peel holds the majority share in the North America pectin market due to its high pectin content, cost-effectiveness, and widespread availability. Derived primarily from oranges and lemons, citrus peel pectin offers superior gelling and stabilizing properties, making it the preferred choice for food and beverage (F&B) applications. The strong citrus processing industry in the United States ensures a stable and consistent raw material supply, reducing dependency on imports. Additionally, sustainability initiatives promoting the utilization of fruit byproducts have further increased the adoption of citrus peel-derived pectin. Its functionality in clean-label and reduced-sugar formulations, particularly in jams, dairy products, and beverages, continues to drive demand, reinforcing its dominance in the regional pectin market.

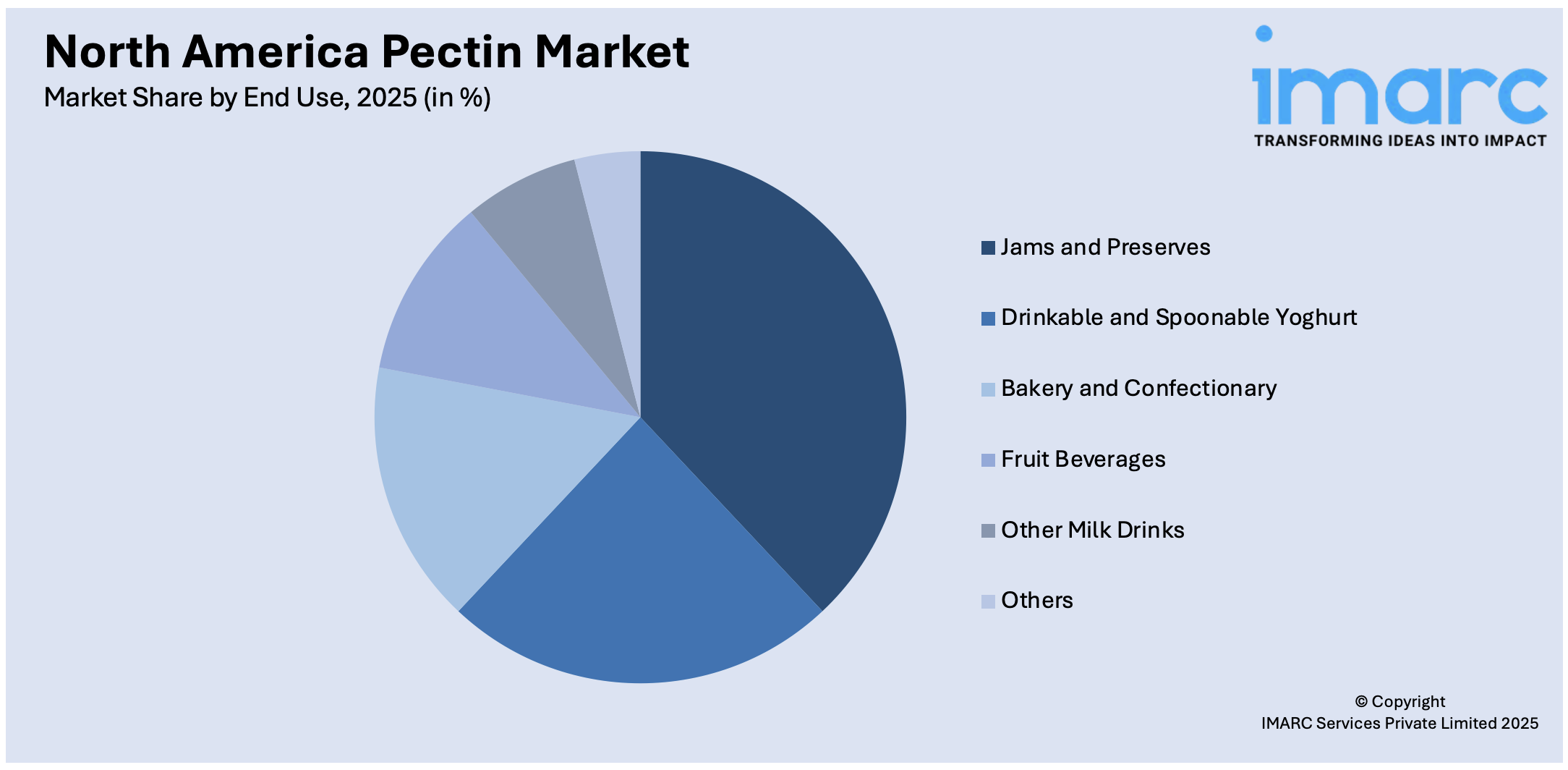

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Jams and Preserves

- Drinkable and Spoonable Yoghurt

- Bakery and Confectionary

- Fruit Beverages

- Other Milk Drinks

- Others

Jams and preserves dominate the North America pectin market due to their high dependence on pectin as a gelling and thickening agent. The increasing consumer preference for natural and reduced-sugar spreads has driven demand for high-quality pectin, which enhances texture and shelf stability. Manufacturers are reformulating products to meet clean-label and organic trends, further boosting pectin usage. Additionally, the growing popularity of homemade and artisanal jams has increased market demand. The United States and Canada have a strong tradition of fruit-based spreads, supporting consistent pectin consumption. With rising health-consciousness, the shift toward low-calorie and fiber-enriched fruit preserves is also reinforcing the dominance of jams and preserves in the pectin market.

Country Insights:

- United States

- Canada

The United States holds the majority North America pectin market share due to its well-established F&B industry, strong demand for clean-label ingredients, and advanced manufacturing capabilities. The growing consumer preference for natural thickeners in dairy, bakery, and confectionery products has driven widespread pectin adoption. Additionally, the increasing focus on reduced-sugar formulations in jams, jellies, and functional beverages supports market growth. The country benefits from a robust supply chain, with domestic and imported citrus and apple processing ensuring a steady raw material flow. Furthermore, continuous research and development efforts in pharmaceutical and personal care applications are expanding pectin’s usage, reinforcing the United States’ dominance in the regional market.

Competitive Landscape:

The North America pectin market features a competitive landscape driven by innovation, supply chain integration, and strategic partnerships. Key players focus on expanding production capacities and enhancing extraction technologies to improve pectin yield and quality. Companies are investing in research and development to create specialized pectin formulations catering to clean-label, vegan, and reduced-sugar product trends. Vertical integration with citrus and apple processing industries ensures a stable raw material supply, reducing dependency on imports. Mergers and acquisitions are prevalent as firms aim to strengthen market presence and diversify product portfolios. Additionally, sustainability initiatives, including waste reduction and eco-friendly extraction processes, are becoming crucial differentiators in maintaining a competitive edge within the regional pectin market.

The report provides a comprehensive analysis of the competitive landscape in the North America pectin market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Tate & Lyle completed its acquisition of CP Kelco from J.M. Huber Corporation, strengthening its position in the global specialty food and beverage market. The deal includes CP Kelco’s operations in the U.S., China, and Denmark, enhancing Tate & Lyle’s portfolio in pectin, specialty gums, and natural ingredients. This initiative aligns with the growing consumer preference for healthier, more flavorful, and sustainable food options globally.

- In March 2024, Captek Softgel International opened its first gummy manufacturing facility in La Mirada, CA. The 60,000-square-foot plant can produce 1.5 billion gummies annually, including pectin, agar, carrageenan, and gelatin-based varieties. Featuring starch-free production and pilot-scale equipment, it enhances flexibility and speeds time-to-market. The SQF-certified facility, staffed by experts with 25 years of experience, is pursuing organic, kosher, and halal certifications to expand its nutraceutical gummy offerings.

North America Pectin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Citrus Peel, Apple Peel, Others |

| End Uses Covered | Jams and Preserves, Drinkable and Spoonable Yoghurt, Bakery and Confectionary, Fruit Beverages, Other Milk Drinks, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America Pectin market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America Pectin market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America Pectin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America Pectin market was valued at USD 272.0 Million in 2025.

The North America pectin market was valued at USD 390.5 Million in 2034 exhibiting a CAGR of 3.90% during 2026-2034.

The growth of the North America pectin market is driven by rising consumer demand for clean-label, natural ingredients in F&B’s, increasing adoption of plant-based and vegan diets, and the expanding use of pectin in dairy, functional foods, and pharmaceutical applications due to its natural gelling, thickening, and stabilizing properties.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)