North America Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2026-2034

North America Peanut Butter Market Size and Share:

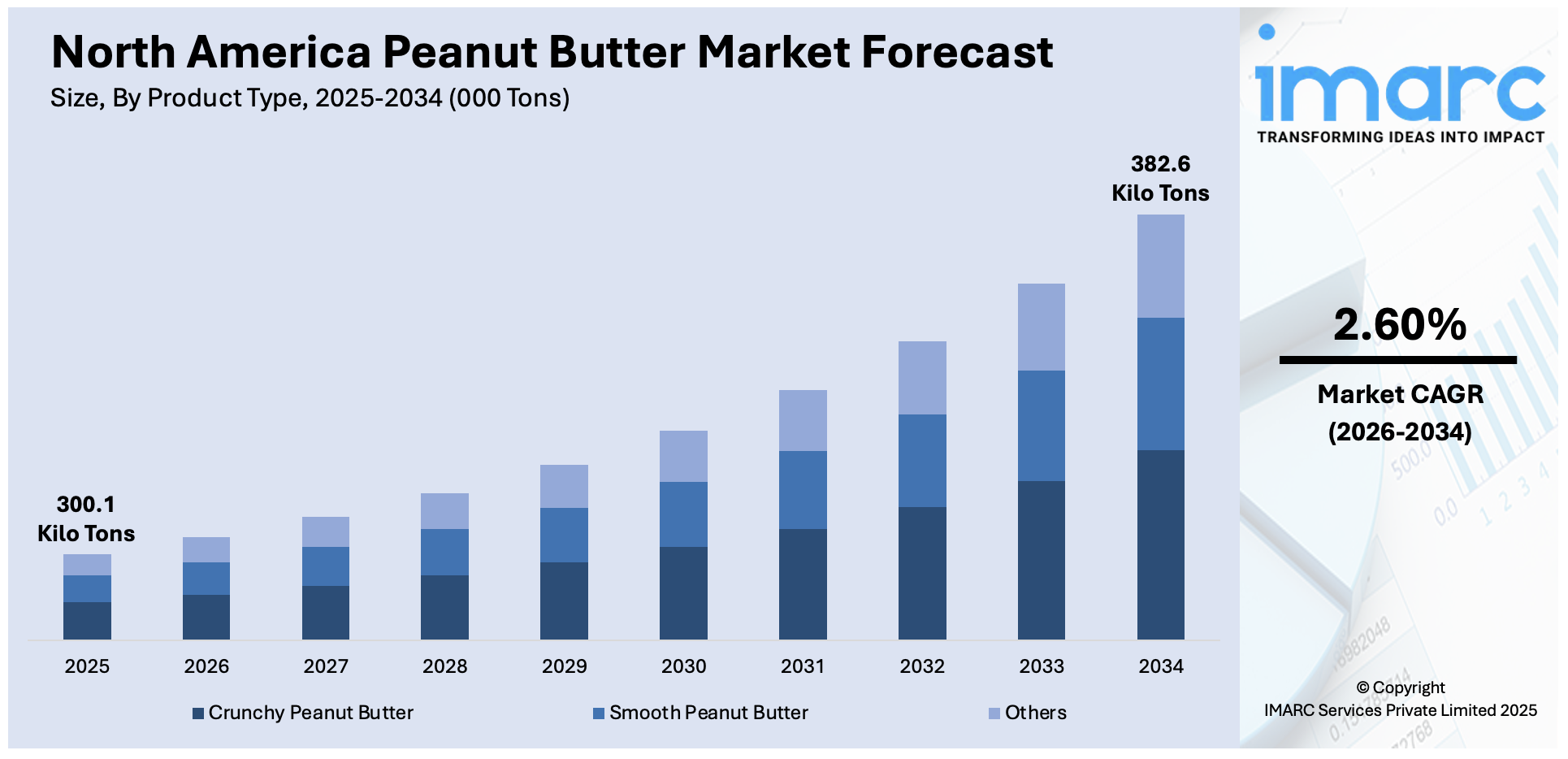

The North America peanut butter market size was valued at 300.1 Kilo Tons in 2025. Looking forward, IMARC Group estimates the market to reach 382.6 Kilo Tons by 2034, exhibiting a CAGR of 2.60% from 2026-2034. The North America peanut butter market share is driven by increasing consumer preference for protein-rich, healthy snacks, rising demand for natural and organic variants, widespread availability, and strong brand presence. Additionally, innovation in flavors and packaging enhances market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 300.1 Kilo Tons |

| Market Forecast in 2034 | 382.6 Kilo Tons |

| Market Growth Rate (2026-2034) | 2.60% |

Consumers in North America are progressively choosing for natural and organic peanut butter due to growing health knowledge and concerns about artificial additives. Traditional peanut butter products frequently contain hydrogenated oils, added sugars, and preservatives, which numerous consumers now seek to avoid. This shift has led manufacturers to introduce cleaner- marker products with minimum constituents, similar as peanuts and sea salt. Organic peanut butter, made from non-GMO and fungicide-free peanuts, is also gaining traction as consumers prioritize sustainable and healthier food choices. The expansion of e-commerce and direct- to- consumer deals channels has further eased access to premium organic peanut butter brands. This trend is anticipated to continue as consumers demand translucency, clean constituents, and health benefits from their food products.

To get more information on this market Request Sample

The North American peanut butter demand is witnessing a swell in product invention, with brands introducing new flavors and functional kinds to feed to evolving consumer preferences. Beyond traditional peanut butter, companies are launching seasoned versions similar as honey- roasted, chocolate- invested, and cinnamon- seasoned peanut butter. Also, functional peanut butter variants fortified with protein, collagen, probiotics, or superfoods like chia seeds and flaxseeds are gaining favor among health-conscious consumers and fitness enthusiasts. These inventions not only attract new customers but also allow brands to separate themselves in a competitive market. The growing trend of plant- based diets has further fueled demand for high- protein peanut butter choices, making product diversification a crucial strategy for market players.

North America Peanut Butter Market Trends:

Rising product innovation

Within North America, product innovation in peanut butters has become a significant demand driver as brands focus on introducing new flavors and functional forms to attract consumers towards them. Manufacturers are innovating with unique offerings beyond conventional peanut butter akin to honey-roasted, chocolaty, cinnamon-seasoned, and even some savory peanut butter varieties. Fortified ones with protein, fiber, probiotics, and superfoods like chia seeds and flaxseeds are becoming highly sought-after; they mainly attract health-conscious consumers. Along with these, the need for convenient and easy snack choices has spurred the growth of the single-serve peanut butter packets, protein bars, and peanut butter- flavored spreads. These innovations create differentiation in the competitive market, catering to the many different tastes of modern-day consumers. As the demand for variety and functional food products increases, peanut butter manufacturers shall keep working to expand their offerings in accordance with the ever-changing needs of consumers.

Increasing adoption of vegan diets

The rising adoption of plant-based and vegan diets in North America has significantly contributed to the increasing demand for peanut butter. As updated by World Animal Foundation in June 2024, the number of Americans who are vegan has increased by more than 3,000% in previous 15 years. As more consumers shift away from animal-based protein sources, they are turning to plant-based alternatives like peanut butter, which offers a high-protein, dairy-free, and nutrient-rich option. The expansion of flexitarian diets, where individuals seek to reduce meat consumption while incorporating more plant-based foods, has further fueled peanut butter sales. Many health-conscious consumers prefer peanut butter as a sustainable and affordable protein alternative to dairy-based spreads. Additionally, the rise in vegan and plant-based product innovations has encouraged manufacturers to develop new peanut butter formulations, including high-protein and superfood-enriched varieties. The continued shift towards plant-based nutrition is expected to sustain the strong demand for peanut butter in North America.

Rising health consciousness among the masses

The growing awareness about health and nutrition is a significant driver of the North American peanut butter market. Consumers are increasingly seeking high-protein, nutrient-dense foods that support active and healthy lifestyles. Peanut butter, being a rich source of protein, healthy fats, and essential vitamins, has become a staple in many households. It is widely consumed by fitness enthusiasts, athletes, and individuals following high-protein or plant-based diets. The rising preference for natural and organic food, free from artificial additives and hydrogenated oils, is further shaping market demand. As per IMARC Group, the United States organic food market size reached US$ 82.7 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 158.2 Billion by 2032, exhibiting a growth rate (CAGR) of 7.47% during 2024-2032. Additionally, peanut butter’s perceived health benefits, including heart health support and sustained energy release, have led to increased consumption among all age groups. As consumers continue to prioritize functional and nutritious food options, peanut butter remains a preferred choice, driving market growth across retail and foodservice sectors.

North America Peanut Butter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America peanut butter market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

Smooth peanut butter leads the market due to its widespread consumer preference, versatility, and ease of use. Unlike crunchy peanut butter, which contains peanut chunks, smooth peanut butter has a creamy, spreadable texture that appeals to a larger audience, including children, older adults, and those who prefer a more refined consistency. One of the primary reasons for its market leadership is the growing demand for baked goods. As per Government of Canada, the baked goods retail sales is predicted to increase at a 3.1% CAGR between 2023 and 2027, reaching US$97.7 Billion in 2026. Smooth peanut butter is a key ingredient in sandwiches, baked goods, protein shakes, and confectionery products, making it more versatile than its crunchy counterpart. Additionally, foodservice industries, including bakeries and snack manufacturers, prefer smooth peanut butter for consistent texture and easy incorporation into recipes.

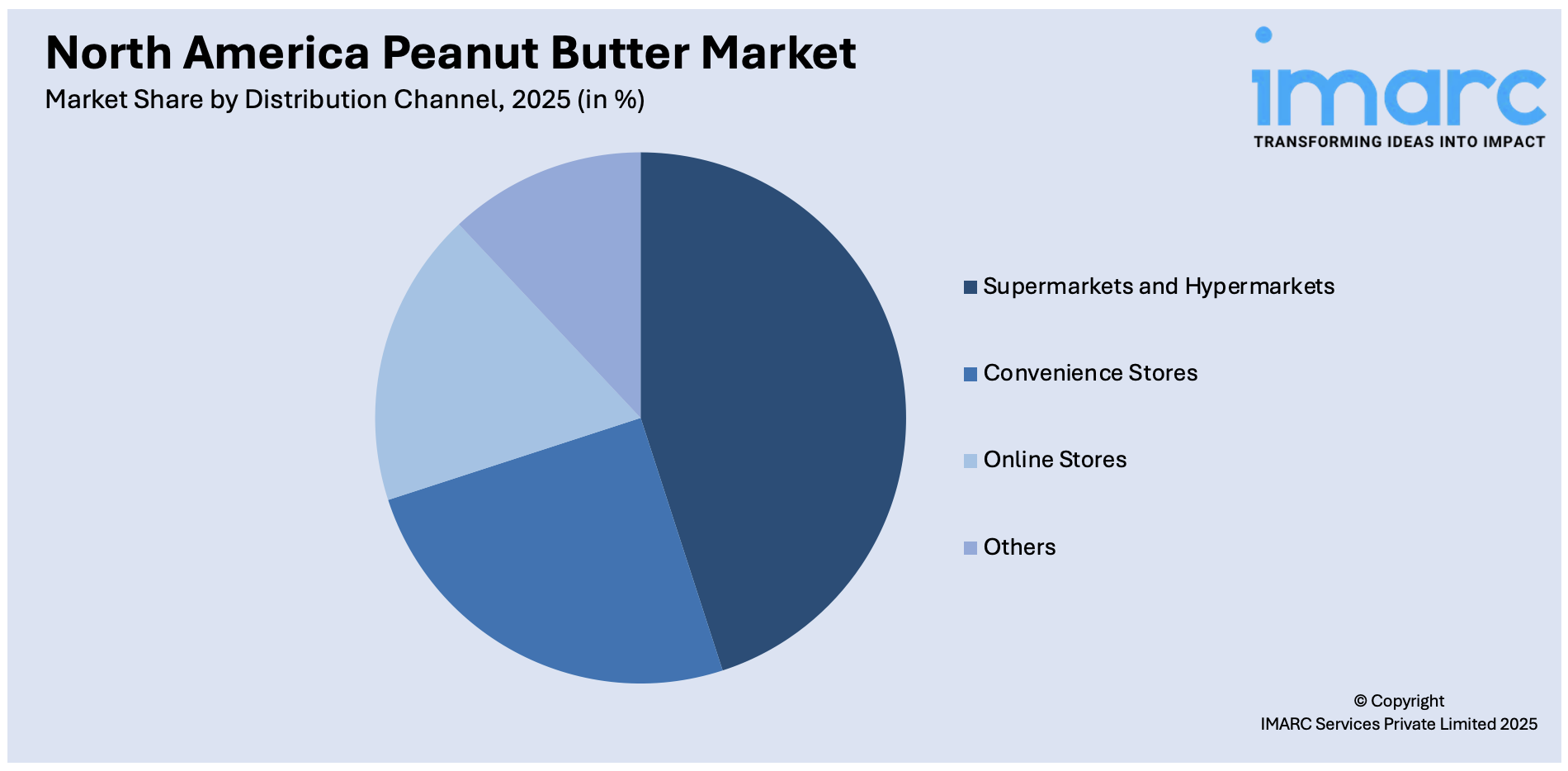

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the market due to their expansive product accessibility, strong consumer preference for in- store shopping, and capability to offer competitive pricing. These large retail chains give a vast selection of peanut butter brands, including conventional, natural, organic, and seasoned kinds, feeding to different consumer preferences. The wide shelf space allows consumers to compare brands, constituents, and prices, impacting purchasing opinions. Also, supermarkets and hypermarkets constantly offer deductions, promotional deals, and bulk purchasing options, making them an appealing choice for budget-conscious shoppers.

Country Analysis:

- United States

- Canada

As per North America peanut butter market analysis, United States is leading the market. The U.S. is one of the world’s largest producers of peanuts, particularly in states like Georgia, Texas, and Alabama. The USDA's National Agricultural Statistics Service (NASS) states that the US peanut production will be 5.57 Billion pounds in 2022. Georgia produced more peanuts than any state, holding more than half of total peanut output in the United States, with a 2.9 Billion-pound crop forecast for 2022. With an abundant supply of raw materials, peanut butter manufacturers benefit from stable pricing and consistent quality. This strong agricultural foundation ensures a steady supply chain, making the U.S. the largest consumer and exporter of peanut butter in North America. Peanut butter is common in American households, with high per capita consumption. It is widely used in sandwiches, snacks, and as an ingredient in desserts and protein-rich diets. The popularity of peanut butter in school lunch programs, combined with its affordability and nutritional value, has sustained long-term demand.

Competitive Landscape:

Crucial players in the North American peanut butter market are embracing various strategies to strengthen their market position, including invention, product diversification, and sustainability action. Leading brands like Jif, Skippy, and Peter Pan are fastening heavily on product invention by introducing new flavors, organic variants, and functional peanut butter enhanced with protein, fiber, or superfoods. These inventions feed health-conscious consumers and the growing demand for natural, clean-marker products. In addition, companies are investing in amending packaging to enhance convenience, similar as single-serving packets andeco-friendly stuff, meeting the requirements of on- the- go and environmentally apprehensive customers. Also, sustainability is also a crucial focus, with numerous brands prioritizing ethical sourcing practices and environmentally responsible product styles, similar as usingnon-GMO and organic peanuts. Partnerships with health and fitness influencers, along with strategic marketing campaigns, further bolster brand recognition. These efforts are creating a favorable North America peanut adulation market outlook.

The report provides a comprehensive analysis of the competitive landscape in the North America peanut butter market with detailed profiles of all major companies:

Latest News and Developments:

- In January 2025, Gelgoog successfully completed the delivery of the USA peanut butter production line project, marking the company's first delivery project milestone in the new year.

- In January 2025, in honor of the Lunar New Year, Meet Fresh presented new Peanut Butter sweets including shaved ice or a hot warm drink, there is something for everyone to enjoy.

- In January 2025, Purely Elizabeth increases cookie granola portfolio with new peanut butter cookie granola. The Peanut Butter Cookie Granola debut comes at a time when the granola category has reached approximately $1.3 billion in sales, with Purely Elizabeth leading the way with an outstanding 85% year-over-year growth rate.

- In January 2024, Reese's has introduced Direct from the Factory Peanut Butter Eggs. The name indicates that the sweets will be supplied directly from the factory. According to Hershey, the business will provide clients with a delivery window "just days after the treats were made at the Reese's factory." The candy will then be freshly wrapped and delivered to the customer's home. Prior to the advent of this product, the Direct from the Factory line only contained the classic Reese's Peanut Butter Cup.

- In May 2024, Jif, America's number one peanut butter brand, is introducing its largest flavor innovation named Jif Peanut Butter & Chocolate Flavored Spread, which combines the creamy richness of Jif Peanut Butter with the sweetness of chocolate flavor.

North America Peanut Butter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | '000 Tons, Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Crunchy Peanut Butter, Smooth Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America peanut butter market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America peanut butter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America peanut butter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America peanut butter market in the region was valued at 300.1 Kilo Tons in 2025.

The North American peanut butter market share is driven by increasing consumer preference for protein-rich, healthy snacks, rising demand for natural and organic variants, widespread availability, and strong brand presence. Additionally, innovation in flavors and packaging enhances market growth.

IMARC estimates the North America peanut butter market to exhibit a CAGR of 2.60% during 2026-2034.

United States leads the market as it is one of the world’s largest producers of peanuts, particularly in states like Georgia, Texas, and Alabama.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)