North America Organic Baby Food Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033

North America Organic Baby Food Market Size and Share:

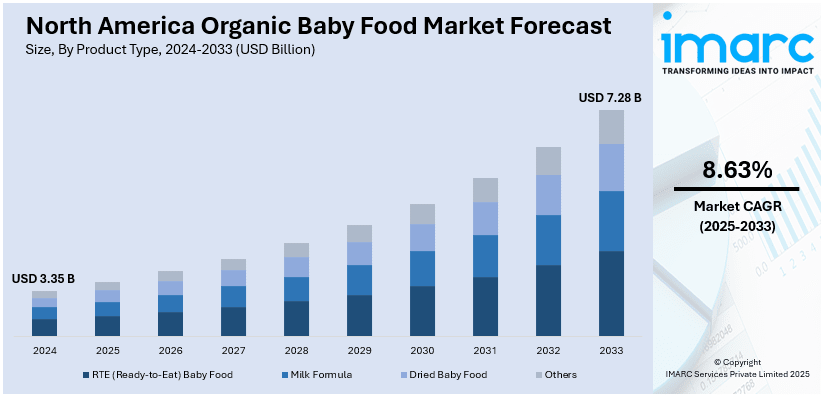

The North America organic baby food market size was valued at USD 3.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.28 Billion by 2033, exhibiting a CAGR of 8.63% from 2025-2033. Rising parental preference for chemical-free nutrition, growing awareness of organic food benefits, and increasing disposable income drive North America's organic baby food market. Stringent food safety regulations and expanding retail channels further support demand. Additionally, innovations in product variety and convenient packaging enhance consumer adoption across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.35 Billion |

|

Market Forecast in 2033

|

USD 7.28 Billion |

| Market Growth Rate (2025-2033) | 8.63% |

Rising awareness of the long-term health advantages of organic food is fueling the demand for organic baby food in North America. Parents are increasingly opting for chemical-free, non-GMO, and preservative-free options to ensure their infants receive high-quality nutrition. Concerns over pesticide residues, synthetic additives, and artificial sweeteners in conventional baby food have accelerated the shift toward organic alternatives. In addition, consumers are now constantly exposed to social media, to health experts, and to pediatricians who advise them to consume organic food. This makes the above situation even stronger as manufacturers are also responding with clean label, certified organic offers as consumers continue to become wiser about the origin of ingredients as well as transparency.

Organic baby food has increased significantly due to the growth in retail and e-commerce channels. Large chain supermarkets, special organic stores, and online shops now sell the variety of baby food products; thus, becoming more accessible for parents. Market penetration has increased further with this ease of access to online purchase, coupled with subscription-based models. Direct to Consumer (D2C) brands through digital marketing platforms reach out to eco-conscious parents and emphasize on the benefits derived from the products. In addition, the partnerships between organic food manufacturers and retail giants increase visibility, and organic baby food is available in both urban and suburban markets.

North America Organic Baby Food Market Trends:

Growing Demand for Clean-Label and Transparent Ingredients

North American consumers tend to increasingly value clarity in their food products, thereby boosting demand for organic baby food with clean labels. A report indicates that 81% of consumers consider it important to buy clean-label products. Parents are turning toward less-processed baby foods that avoid artificial additives, synthetic preservatives, and genetically modified organisms (GMOs). Growing health concerns and a demand for straightforward, recognizable ingredients offering superior nutritional value drive this trend. Responding to this need, brands provide clear ingredient sourcing details, include organic certifications, and emphasize good farming practices. In addition, the functional ingredient trend of introducing probiotics, DHA, and organic superfoods fits the bill as more parents seek a safer and nutritional benefit in their baby food.

Expansion of Plant-Based and Dairy-Free Options

Parents are now choosing dairy-free and plant-based alternatives of baby food in light of the rising popularity of plant-based diets. Allergens, lactose intolerance, and other ethical considerations due to animal products contribute to this change. The organic brands have been launching innovative new formulations of such baby food using plant-based proteins such as quinoa, lentils, and chickpeas. Baby food products made from almond, oat, and coconut milk are growing rapidly as an alternative to dairy. This is in line with the population trend, which is developing sustainable food preferences. Plant-based foods tend to cause less damage to the environment. Research and development into nutrient-dense, organic plant-based baby foods are also being developed as the target market is always changing.

Rise of E-Commerce and Subscription-Based Purchases

The digital transformation of retail has significantly impacted the organic baby food market, with e-commerce and subscription-based models becoming key growth drivers. Parents increasingly prefer online shopping for convenience, better product variety, and access to detailed nutritional information. D2C brands leverage social media and influencer marketing to build trust and highlight product benefits. Subscription services offer personalized meal plans, doorstep delivery, and cost-effective purchasing options, making organic baby food more accessible. Companies are integrating artificial intelligence (AI) to customize recommendations based on a child's age, dietary needs, and parental preferences. As digital platforms continue expanding, online sales are expected to account for a growing North America organic baby food market share.

North America Organic Baby Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America organic baby food market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, and distribution channel.

Analysis by Product Type:

- RTE (Ready-to-Eat) Baby Food:

- Milk Formula

- Dried Baby Food

- Others

Milk formula accounts for the majority of shares in the North America organic baby food market due to its essential role in infant nutrition. Organic milk formulas are increasingly preferred by parents seeking healthier, chemical-free alternatives to traditional formulas, aligning with the growing demand for organic products. The convenience, reliability, and complete nutrition provided by milk formulas make them a staple for parents who cannot or choose not to breastfeed. Additionally, advancements in formula development, such as added nutrients, probiotics, and higher-quality ingredients, have contributed to the growing preference for organic milk formulas. The presence of well-established brands, alongside new entrants offering innovative organic options, further strengthens the category’s dominance in the market. These factors combined drive continued growth in the organic milk formula segment.

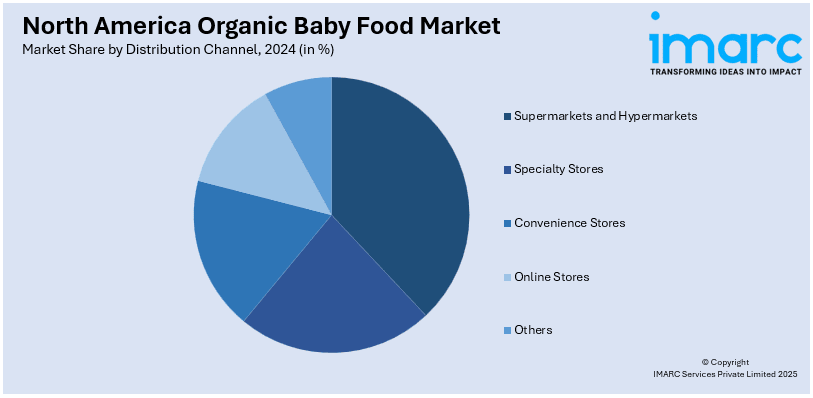

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the North America organic baby food market, thanks to their wide accessibility and consumer convenience. These retail channels provide a broad selection of organic baby food products, allowing parents to easily find various brands and choices in one place. The physical presence of large retail chains provides trust and credibility, attracting a significant number of shoppers. Additionally, supermarkets and hypermarkets often have established partnerships with organic food suppliers, ensuring consistent product availability. The growing preference for organic baby foods among consumers, combined with the availability of discounts, promotions, and loyalty programs, further boosts sales. These retail formats also provide parents the option to compare products easily, influencing purchasing decisions.

Country Insights:

- United States

- Canada

The United States leads the North America organic baby food market driven by several key factors. A primary reason is the increasing demand for healthier, organic food choices, as parents become more aware of the nutritional value and safety of products for their infants. This trend is further driven by concerns about pesticides, additives, and preservatives in conventional baby foods. Additionally, the U.S. has a well-established retail infrastructure, with extensive distribution networks across supermarkets, online platforms, and specialized organic stores, making organic baby food more accessible. The rise of millennial parents, who are more inclined to purchase organic and clean-label products, contributes to this dominance. Government regulations ensuring product safety and certification of organic products thus bolstering the North America organic baby food market growth.

Competitive Landscape:

North America organic baby food market is extremely competitive with major players and emerging brands. Product innovation through new formulation helps the companies differentiate their product. There are various types of products based on dietary preference, including plant-based, allergen-free, and fortified products. The competition factors for this market are based on transparency and clean-label certification. Organic sourcing and sustainable packaging help the brand to attract more eco-conscious consumers. Distribution strategies are key, with strong retail partnerships and D2C models on the rise. E-commerce expansion, subscription services, and digital marketing campaigns enhance brand visibility and customer loyalty. Competitive pricing, adherence to stringent organic regulations, and continuous product diversification remain essential for maintaining a strong presence in this evolving market.

The report provides a comprehensive analysis of the competitive landscape in the North America organic baby food market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Bobbie has launched its new grass-fed Whole Milk Infant Formula, made with whole milk from pasture-raised cows to offer superior nutrition. Featuring a 60:40 whey-to-casein ratio, it closely resembles breast milk for easy digestion. Free from palm oil, corn syrup, and maltodextrin, it meets both U.S. and EU standards, offering high DHA and carefully balanced iron levels. Bobbie continues to provide high-quality, European-style formulas for U.S. parents.

- In September 2024, Perrigo announces a new partnership between Good Start® and Dr. Brown's®, uniting two trusted infant brands to enhance formula-feeding experiences. The refreshed Good Start® | Dr. Brown's™ portfolio includes Soothe Pro™ and Gentle Pro™, designed for formula tolerance concerns. This collaboration aligns with Perrigo’s commitment to consumer-led innovation, providing parents with high-quality, trusted nutrition solutions backed by decades of expertise.

- In August 2024, Happa Foods is expanding internationally, launching its organic baby meals in Kuwait, Oman, the Maldives, Kenya, Seychelles, and the UAE. As the first Indian brand to export baby purees, it challenges the dominance of Western brands in the baby food sector. Committed to high-quality nutrition, Happa Foods showcases India’s strength in producing premium, value-added products for international markets.

- In March 2024, Else Nutrition is broadening its U.S. distribution through a partnership with a leading supermarket chain, ranked as the fifth-largest private company and the second-largest supermarket operator. With more than 420 stores, the retailer is set to offer Else’s kids and toddler product lines by Q2 2024. This San Antonio-based grocer, with $43 billion in annual sales, has topped the Dunnhumby Retailer Preference Index three times, reinforcing its industry leadership.

- In June 2023, Nature's Path Organic Foods is poised to acquire Love Child Organics, a well-regarded Canadian organic baby food brand, enhancing its position in the $499M Canadian and $8.5B U.S. baby food markets. This move aligns with Nature’s Path’s mission to expand organic food accessibility. The acquisition ensures continued availability of Love Child Organics’ products while opening opportunities for U.S. expansion and new product innovations. The deal closes around June 30, 2023.

North America Organic Baby Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | RTE (Ready-to-Eat) Baby Food, Milk Formula, Dried Baby Food, and Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, and Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America organic baby food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America organic baby food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America organic baby food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America organic baby food market was valued at USD 3.35 Billion in 2024.

The North America organic baby food market was valued at USD 7.28 Billion in 2033 exhibiting a CAGR of 8.63% during 2025-2033.

The growth of the North America organic baby food market is driven by increasing consumer demand for healthier, chemical-free options, rising awareness about the benefits of organic ingredients, and a shift towards clean-label products. Additionally, the growing trend of sustainability and eco-consciousness among parents fuels the market's expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)