North America Modular Construction Market Size, Share, Trends and Forecast by Division, Sector, Material, and Country, 2025-2033

North America Modular Construction Market Size and Share:

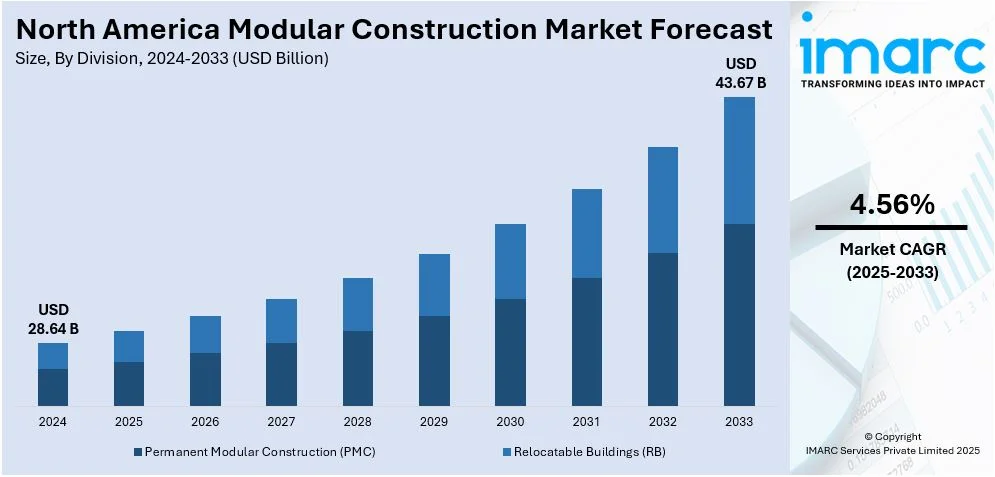

The North America modular construction market size was valued at USD 28.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.67 Billion by 2033, exhibiting a CAGR of 4.56% from 2025-2033. The market is driven by factors such as cost efficiency, reduced construction time, and increasing demand for sustainable, energy-efficient buildings. Additionally, the need for affordable housing, advancements in construction technology, and government incentives supporting green building practices are further driving market growth, positioning modular construction as a preferred solution.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 28.64 Billion |

|

Market Forecast in 2033

|

USD 43.67 Billion |

| Market Growth Rate (2025-2033) | 4.56% |

With increasing emphasis on eco-friendly building practices, modular construction is gaining traction due to its ability to incorporate sustainable materials, energy-efficient designs, and lower carbon footprints in comparison to conventional construction techniques. In addition, modular construction enables concurrent off-site fabrication and on-site setup, decreasing total construction duration. This efficiency is critical in sectors like residential housing and commercial buildings where time-to-market is crucial. Besides this, modular construction helps lower labor costs and reduces material waste due to controlled factory settings. The reduction in project timelines leads to significant savings, rendering it an appealing choice for developers. Furthermore, the rising need for cost-effective housing, especially in city regions, is making modular construction a preferred solution. It offers faster, cost-effective, and customizable options that can address the housing gap without sacrificing quality.

Apart from this, the integration of technologies like automation, 3D printing, and building information modeling (BIM) is revolutionizing modular construction. These innovations improve precision, design flexibility, and scalability, making modular units more competitive with traditional construction methods. Moreover, governing bodies across North America are mandating energy-efficient building standards. Modular construction offers an ideal way to meet these standards through its ability to integrate advanced insulation, renewable energy systems, and energy-efficient materials. Additionally, the shortage of skilled labor in traditional construction is driving the North America modular construction market demand. Modular construction relies more on factory-based assembly, where less specialized labor is required, addressing the labor gap and ensuring projects stay on track.

North America Modular Construction Market Trends:

Growing Adoption by Major Real Estate Developers

Large real estate developers are adopting modular construction for their residential and commercial projects due to its effectiveness, economical advantages, and sustainability perks. By integrating modular methods, developers can greatly shorten construction timelines, optimize budget management, and minimize waste. Additionally, this approach is highly customizable, allowing developers to meet specific design needs while maintaining cost control. As sustainability becomes a priority, modular buildings offer reduced environmental impact, with fewer materials wasted and a lower carbon footprint compared to traditional construction. This growing trend among prominent developers signals a shift towards scalable and innovative building solutions. As major players in the real estate market recognize the long-term financial and ecological advantages, the adoption of modular construction is expected to increase, encouraging further investment and expanding its role in the sector. In 2024, Greystar Real Estate Partners initiated its inaugural modular housing project in the US, Ltd. Findlay, located in Coraopolis, PA. The development included 312 apartments and highlights quicker building, savings on costs, and minimized waste. Greystar intends to grow its modular portfolio by adding additional projects in the US.

Labor Shortages in the Construction Industry

Labor shortages are becoming a significant challenge in the traditional construction industry, contributing to delays and increased costs. Modular construction, however, helps mitigate this issue by reducing the dependency concerning skilled workers during the on-site assembly stage. A large part of the modular construction process takes place in regulated factory settings, where automated systems, machinery, and trained workers contribute to efficient production. This method helps bypass labor shortages while still delivering high-quality, durable structures. Additionally, modular construction reduces on-site work, allowing projects to proceed more quickly and without being hindered by fluctuations in available skilled labor. As labor shortages persist, modular construction’s ability to streamline operations is making it an attractive alternative to conventional construction techniques. In 2024, Webcor, a commercial construction company based in California, declared the establishment of Webcor Ventures, LLC, and made its first investment in R2 Building, a company specializing in modular construction. The collaboration sought to tackle industry issues such as cost, efficiency, and workforce shortages by utilizing off-site manufacturing to create scalable, high-quality housing options.

Government-Funded Initiatives

Government funding initiatives are essential for fostering the development of modular construction in North America. These efforts offer financial assistance for creating innovative construction solutions, such as modular homes. Through the provision of grants, loans, and incentives, governing bodies in the region are enhancing the accessibility and appeal of modular construction for developers. Specifically, funding frequently targets tackling housing deficits and aiding infrastructure initiatives, enabling faster and more cost-effective building. Changes in regulations and affordable financing promote the use of modular construction, enabling developers to lower initial expenses and adhere to strict construction schedules. These government-supported initiatives are hastening the uptake of modular solutions, establishing them as a crucial approach to address urban housing needs while promoting efficiency and reducing costs. For example, in 2024, the Government of Canada launched two initiatives to speed up housing development. The Canada Housing Infrastructure Fund (CHIF) allocated $1 billion for necessary infrastructure, while the Regional Homebuilding Innovation Initiative (RHII) designated $50 million to encourage innovative home construction methods, including modular housing.

North America Modular Construction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America modular construction market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on division, sector, and material.

Analysis by Division:

- Permanent Modular Construction (PMC)

- Relocatable Buildings (RB)

Permanent modular construction (PMC) exhibits a clear dominance in the market, primarily due to its durability, long-term viability, and ability to meet various building codes and regulations. Unlike relocatable buildings, which are designed for temporary use, PMC units are intended for permanent installation and offer greater structural integrity, rendering them appropriate for various uses, like commercial, residential, and institutional structures. PMC’s appeal lies in its ability to be constructed off-site in a in a regulated industrial setting, ensuring consistency and higher quality while reducing construction time. These units are often highly customizable, offering flexibility in design and layout, which makes them ideal for projects requiring long-term solutions. As sustainability and energy efficiency become increasingly important in the building industry, PMC units are gaining traction due to their potential for integrating green building technologies, such as energy-efficient insulation and solar power systems, contributing to their dominance in the market.

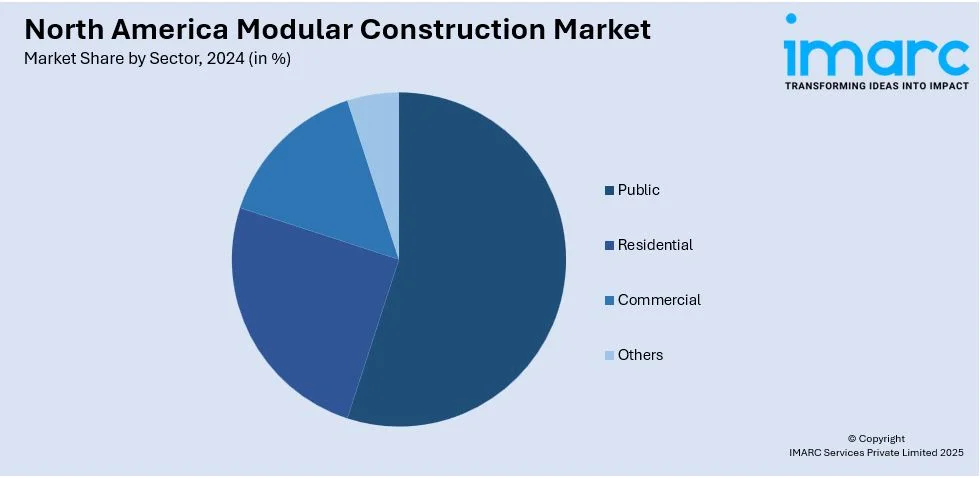

Analysis by Sector:

- Public

- Residential

- Commercial

- Others

The residential sector is the largest segment, driven by an increasing demand for budget-friendly, sustainable living options. Modular construction provides notable benefits in speed, cost-effectiveness, and energy efficiency, which are greatly desired in residential projects. As the demand grows for faster construction schedules and more eco-friendly building methods, modular homes are emerging as an effective answer to address the housing requirements of various communities. The adaptability of modular design enables customization to match different architectural styles and preferences, which enhances its appeal in the residential segment. Additionally, modular homes provide higher consistency in quality due to controlled factory environments and are increasingly being adopted for single-family homes, apartment complexes, and hybrid property designs. As the demand for energy-efficient and economical housing continues to rise, the residential sector will maintain its dominance in driving growth within the modular construction market.

Analysis by Material:

- Wood

- Concrete

- Steel

- Others

Wood holds the biggest North America modular construction market share due to its versatility, cost-effectiveness, and environmental benefits. The demand for wood-based modular units is driven by its lightweight nature, which makes it easier to transport and assemble, reducing both construction time and labor costs. Additionally, wood offers excellent insulation properties, making it a preferred material for residential and light commercial projects. Sustainability is a key factor in wood's dominance, as it is a renewable resource and can be sourced from sustainably managed forests, which aligns with the growing emphasis on eco-friendly building practices. Furthermore, wood's ability to be treated and engineered for durability ensures it meets the required structural standards for modular construction, including resistance to environmental conditions. As the market continues to demand energy-efficient and sustainable building solutions, wood’s combination of performance, cost, and environment-friendliness will continue to secure its position as the leading material in modular construction.

Analysis by Country:

- United States

- Canada

United States represents the largest segment, driven by a combination of factors. The strong demand for residential and commercial properties in the country is greatly speeding up the use of modular construction, providing a quicker and more economical alternative to conventional building techniques. Specifically, the demand for cost-effective housing and the increasing trend towards sustainable construction methods is fostering a positive modular building market perspective. Moreover, the governing body's emphasis on sustainable infrastructure and green building certifications is prompting additional initiatives that promote the acceptance of modular construction, especially in the housing sector. In 2023, Greystar launched its main modular apartment production plant in Knox, PA, through its subsidiary Modern Living Solutions. The facility sought to tackle housing shortages through quicker, cheaper, and more sustainable building methods. Apart from this, the incorporation of cutting-edge technologies such as automation, robotics, and BIM is improving the quality and efficiency of modular units, thereby increasing their attractiveness in the US market.

Competitive Landscape:

Major participants in the market are concentrating on broadening their product ranges, enhancing manufacturing effectiveness, and incorporating cutting-edge technologies like 3D printing and automation. They are emphasizing sustainability by including environment-friendly materials and energy-saving designs in their modular units. These athletes are also building strategic alliances with suppliers and contractors to improve their supply chains and lower expenses. Furthermore, numerous entities are channeling funds into research initiatives to innovate and address the increasing need for budget-friendly housing and commercial properties. To remain competitive, they are broadening their geographical presence, especially in areas with strong construction demand, while also concentrating on mergers and acquisitions (M&A). In 2023, ATCO Ltd. purchased Triple M Modular Housing, a company that produces factory-constructed modular housing located in Lethbridge, Alberta. Triple M will function as a dedicated housing sector within ATCO Structures, strengthening ATCO's status as a worldwide leader in modular building.

The report provides a comprehensive analysis of the competitive landscape in the North America modular construction market with detailed profiles of all major companies, including:

- Aries Building Systems, LLC

- ATCO Ltd.

- Boxx Modular, Inc. (Black Diamond Group)

- Mobile Modular Management Corporation (McGrath RentCorp, Inc.)

- Modular Genius, Inc.

- Satellite Shelters, Inc.

- Triumph Modular Corporation

- Vanguard Modular Building Systems, LLC

- Vesta Modular

- Willscot Corporation.

Latest News and Developments:

- December 2024: Gilayo® launched its modular steel construction system, designed for builders and communities. The eco-friendly, fireproof, and expandable units are easy to assemble and transport.

- June 2024: ATCO Ltd.'s structures division signed a deal to acquire modular building maker NRB Ltd. for $40 million. This purchase was intended to broaden ATCO's manufacturing and sales reach, particularly in multi-family and affordable housing sectors.

- May 2024: Volumetric Building Companies (VBC) marked the inauguration of its Global Centre of Excellence in Monaghan, Ireland. The facility aided VBC’s modular building initiatives throughout North America, the Middle East and Europe. The center leveraged local engineering talent to drive sustainable, high-quality construction solutions.

- July 2023: Boxx Modular, Inc. (Black Diamond Group) finalized a 27,000-square-foot temporary modular structure at the University of Delaware’s Star Campus. The design, intended for scientific laboratories and classrooms, was made up of 32 modules. The project showcased BOXX Modular's expertise in delivering flexible, high-quality temporary space solutions.

- May 2023: WillScot Mobile Mini expanded its blast-resistant module fleet by acquiring Hallwood Modular Buildings and BRT Structures. This acquisition strengthened its ability to provide protective workspaces for hazardous industries like petrochemicals and defense. WillScot provided improved safety and productivity options with a wider selection of blast-resistant units throughout North America.

- February 2023: McGrath RentCorp purchased Vesta Modular for $400 million, enhancing its modular operations. The deal simultaneously involved the sale of Adler Tank Rentals to Ironclad Environmental Solutions for $265 million. Vesta's accession increased McGrath’s modular revenue mix from 66% to 80%, strengthening its position in the modular space sector.

North America Modular Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Divisions Covered | Permanent Modular Construction (PMC), Relocatable Buildings (RB) |

| Sectors Covered | Public, Residential, Commercial, Others |

| Materials Covered | Wood, Concrete, Steel, Others |

| Countries Covered | United States, Canada |

| Companies Covered | Aries Building Systems, LLC, ATCO Ltd., Boxx Modular, Inc. (Black Diamond Group), Mobile Modular Management Corporation (McGrath RentCorp, Inc.), Modular Genius, Inc., Satellite Shelters, Inc., Triumph Modular Corporation, Vanguard Modular Building Systems, LLC, Vesta Modular, and Willscot Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America modular construction market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America modular construction market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America modular construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The modular construction market in the North America was valued at USD 28.64 Billion in 2024.

The North American modular construction market is growing because of cost efficiency, faster project completion times, reduced labor shortages, and environmental sustainability. Additionally, rising need for economical housing, government incentives, technological improvements in modular design, and supply chain optimization are supporting the market growth in the region.

IMARC estimates the North America modular construction market to exhibit a CAGR of 4.56% during 2025-2033.

Permanent modular construction (PMC) leads the market in 2024, due to its enhanced durability, faster build times, cost-effectiveness, and growing demand for sustainable, energy-efficient buildings.

In 2024, residential exhibits a clear dominance in the market because of increasing housing demand, affordability concerns, faster construction timelines, and the growing preference for sustainable, energy-efficient homes, driving developers towards modular solutions.

In 2024, wood dominates the market owing to its sustainability, cost-effectiveness, ease of construction, and growing demand for eco-friendly, energy-efficient modular buildings.

Residential dominates the market in 2024, attributed to increased demand for affordable housing, faster construction timelines, and the growing preference for sustainable, energy-efficient homes.

On a regional level, the market has been classified into United States and Canada, where United States currently dominates the North America modular construction market.

Some of the major players in the North America modular construction market include Aries Building Systems, LLC, ATCO Ltd., Boxx Modular, Inc. (Black Diamond Group), Mobile Modular Management Corporation (McGrath RentCorp, Inc.), Modular Genius, Inc., Satellite Shelters, Inc., Triumph Modular Corporation, Vanguard Modular Building Systems, LLC, Vesta Modular, and Willscot Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)