North America Mineral Wool Ceiling Tiles Market Size, Share, Trends and Forecast by Application, and Country, 2025-2033

North America Mineral Wool Ceiling Tiles Market Size and Share:

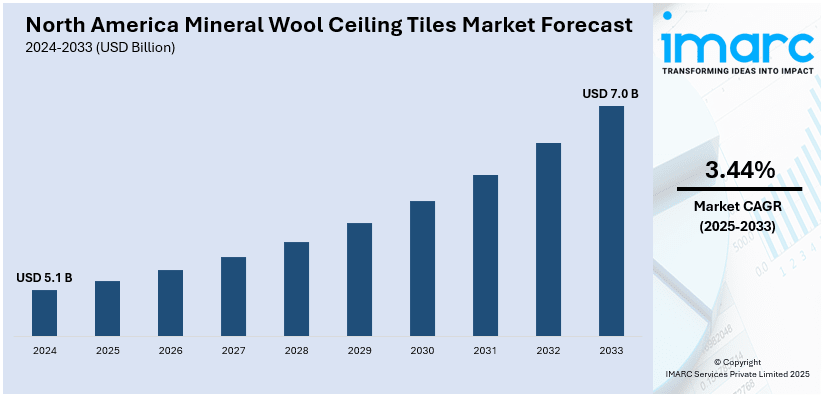

The North America mineral wool ceiling tiles market size was valued at USD 5.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.0 Billion by 2033, exhibiting a CAGR of 3.44% from 2025-2033. The market is influenced by the magnifying need for soundproof, energy-efficient, and fire-resistant materials in construction. Critical drivers encompass strict building codes, boosting both residential and commercial construction activities, and a robust focus on sustainable and environmentally safe building materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Market Growth Rate (2025-2033) | 3.44% |

The North America mineral wool ceiling tiles industry is mainly impacted by rising demand for sustainable building materials in commercial and residential construction. Mineral wool tiles offer superior acoustic insulation, fire resistance, and energy efficiency, making them highly desirable in green building projects. As environmental regulations become more stringent, architects and contractors are increasingly opting for products that meet energy standards and contribute to sustainable designs. The increasing focus on reducing carbon footprints and enhancing indoor environmental quality is further accelerating the adoption of mineral wool ceiling tiles in North America, especially in energy-efficient and LEED-certified buildings. For instance, industry report reveal that the U.S. Green Building Council is planning to introduce LEED v5 in 2025, catering building decarbonization aims with the active efforts for 2030 and 2050 net zero objectives pertaining to greenhouse gases. This development can significantly impact the market demand.

Additionally, the growth of the construction industry in North America is a crucial factor bolstering the market growth for mineral wool ceiling tiles. With ongoing urbanization and infrastructure development, there is an increasing need for cost-effective, durable, and aesthetically pleasing building materials. For instance, as per industry reports, 82.2% of the North American population dwelled in urban regions in 2024, i.e., 316,678,341 individuals. Mineral wool ceiling tiles provide a versatile solution, offering sound absorption and thermal insulation without compromising on visual appeal. Their ease of installation and low maintenance also add to their attractiveness. The growing emphasis on improving indoor air quality, noise control, and fire safety in commercial and industrial spaces further fuels the product demand across various sectors, resulting in significant expansion of North America mineral wool ceiling tiles market share.

North America Mineral Wool Ceiling Tiles Market Trends:

Growth of Commercial and Industrial Construction

The expansion of the commercial and industrial construction sectors is significantly influencing the mineral wool ceiling tiles market in North America. For instance, as per industry reports, construction industry across North America was valued USD 2,585.8 Billion in the year 2024. As the demand for modern office buildings, retail spaces, hospitals, and manufacturing facilities rise, the need for effective ceiling solutions grows accordingly. Mineral wool ceiling tiles, with their durability, ease of installation, and superior performance in fire resistance and noise reduction, are well-suited to meet the requirements of these sectors. The emphasis on creating comfortable, safe, and aesthetically pleasing environments in commercial spaces continues to drive the market's growth, with mineral wool tiles being a top choice.

Rising Demand for Fire-Resistant Materials

One of the key trends driving the North American mineral wool ceiling tiles market is the growing demand for fire-resistant building materials. Mineral wool tiles are highly regarded for their fire-resistant properties, making them an ideal choice in commercial, industrial, and residential applications where fire safety is a top priority. As building codes become more stringent and fire safety regulations are enforced, there is increasing pressure on developers and contractors to choose materials that provide enhanced fire protection. This trend is particularly evident in the construction of high-rise buildings, healthcare facilities, and schools, where the risk of fire hazards is more pronounced. For instance, as per industry reports, approximately 4800 fires occur across the United States’ construction sites on a yearly basis, resulting in 13 fire incidents daily.

Increasing Adoption of Sustainable Building Materials

In North America, the demand for eco-friendly and sustainable building materials is a significant trend driving the mineral wool ceiling tiles market. With heightened awareness of environmental impact and stricter building regulations, the construction industry is increasingly shifting towards products that meet green building standards. For instance, as per industry reports, the U.S. is actively aiming to lower total emissions of greenhouse gas by 61% to 66% by 2035. The U.S. Department of Energy's 2024 definition of a Zero Emissions Building is fostering market alignment, supply chains, and workforce development to support zero-emission construction and retrofits. This clean energy transition is expected to significantly reduce local air pollution, preventing tens of thousands of premature deaths, illnesses, and disabilities by 2035. As a result, mineral wool tiles, known for their energy efficiency, recyclability, and low environmental footprint, are gaining favor for both commercial and residential applications. As more projects aim for sustainability certifications and other sustainability credentials, mineral wool ceiling tiles are becoming an ideal option for architects and builders.

North America Mineral Wool Ceiling Tiles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America mineral wool ceiling tiles market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on application.

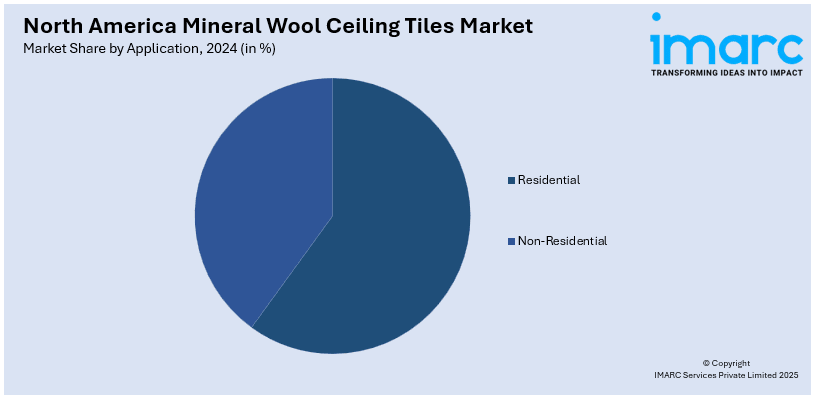

Analysis by Application:

- Residential

- Non-Residential

Non-residential is a dominant application segment. The North America mineral wool ceiling tiles industry is heavily impacted by this sector as these tiles find extensive use in commercial facilities and industrial and institutional institutions. Mineral wool tiles serve construction spaces excellently because they deliver top-notch acoustic performance, fire safety protection, along with thermal insulation, which makes them an ideal component for uses in offices as well as hospitals, schools, and retail areas. In addition, mineral wool tiles are actively gaining widespread approval for non-residential construction because they successfully certify for the necessary building regulations which emphasize fire safety standards and energy efficiency requirements. Furthermore, office and educational facilities maintain increasing pressure on the market for high-performance ceiling solutions as they are currently aiming to create productive spaces combined with comfortable work environments. Besides, mineral wool tiles maintain their status as preferred non-residential construction choice because of their environmentally friendly traits and their ability to save energy while being recyclable which helps the market sustain its development.

Country Analysis:

- United States

- Canada

The United States has emerged as the leading nation in the North American mineral wool ceiling tiles industry principally due to its flourishing construction industry together with rising requirements for energy-efficient or fire-resistant building materials. Strict building regulations and sustainability goals in the nation promote mineral wool tiles as a preferable choice for new buildings and renovation projects. The rise of high-performance ceiling solutions aligns with the rapid expansion of the United States commercial sector especially in urban districts. In addition to this, the market experiences additional growth because public buildings, including education, office compounds, and healthcare facilities, actively prioritize the development of energy-efficient, safe, and comfortable structures. The dominance is further fortified as numerous construction ventures continue throughout various sectors. For instance, industry reports indicate that as of 2024, 6 critical construction projects are ongoing across the U.S., including Southeast Connector with USD 1.6 Billion investment, Gordie Howe International Bridge with construction expenditure of USD 4.5 Billion, American Legion Bridge Replacement with estimated initial investment of USD 6 Billion, etc.

Competitive Landscape:

The competitive landscape is typically steered by a mix of established manufacturers and new entrants. Key strategies include continuous product innovation, focusing on enhanced performance features such as fire resistance, sound absorption, and thermal insulation. Companies are increasingly prioritizing sustainability, aligning their products with green building standards and energy-efficient designs. Strategic collaborations, acquisitions, and partnerships are also common as companies are actively striving to proliferate their market reach and diversify their product lines. For instance, in June 2024, CGC Inc., Canada-based arm of USG Corporation, a prominent mineral wool producer in the U.S., entered a tactical collaboration with Groupe Beauchesne to proliferate Groupe Beauchesne's product line beyond wallboard. With rising demand for high-performance and eco-friendly solutions, competition remains strong in this increasingly revolutionizing market.

The report provides a comprehensive analysis of the competitive landscape in the North America mineral wool ceiling tiles market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Rockfon, a U.S.-based company, introduced Rockcycle, its ceiling tile takeback initiative. This will aid their consumers to adhere to sustainability aims by submitting their used-up mineral wool ceiling tiles to company's production plants in West Virginia as well as Mississippi.

- In April 2024, Armstrong World Industries, an U.S.-based building products firm, introduced its news ceiling panels Ultima Low Embodied Carbon that are composed of mineral fiber with low carbon content. These are produced from 54% of the recycled content.

- In March 2024, Kingspan Insulated Panels North America, one of the leading mineral fiber insulation providers, announced the development of new production facility in the U.S. to fortify its market foothold across North America.

North America Mineral Wool Ceiling Tiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Non-Residential |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America mineral wool ceiling tiles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America mineral wool ceiling tiles market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America mineral wool ceiling tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America mineral wool ceiling tiles market was valued at USD 5.1 Billion in 2024.

The market is chiefly influenced by the magnifying need for energy-saving and fire-resistant building materials, strict building codes, and escalating construction activities. In addition, the increasing emphasis on acoustic performance and sustainability in commercial and residential buildings further accelerates market expansion.

IMARC estimates the North America mineral wool ceiling tiles market to reach USD 7.0 Billion by 2033, exhibiting a CAGR of 3.44% from 2025-2033.

United States accounted for the largest North America mineral wool ceiling tiles market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)