North America Medium-Density Fiberboard Market Size, Share, Trends, and Forecast by Application, Sector, and Country, 2025-2033

North America Medium-Density Fiberboard Market Size and Share:

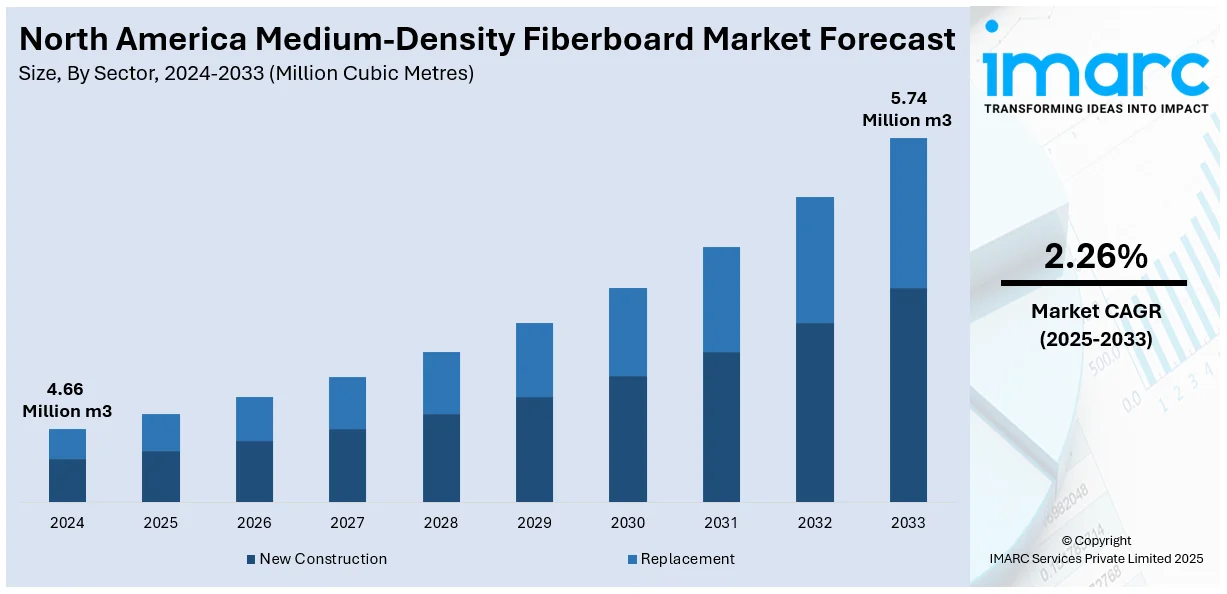

The North America medium-density fiberboard market size was valued at 4.66 Million Cubic Metres in 2024. Looking forward, IMARC Group estimates the market to reach 5.74 Million Cubic Metres by 2033, exhibiting a CAGR of 2.26% from 2025-2033. The market is expanding due to increasing demand in construction and furniture applications. Technological advancements in moisture-resistant and low-emission MDF are shaping market dynamics across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4.66 Million Cubic Metres |

|

Market Forecast in 2033

|

5.74 Million Cubic Metres |

| Market Growth Rate (2025-2033) | 2.26% |

Growth in the North America Medium-Density Fiberboard (MDF) market is driven primarily by growing demand from the furniture and interior design industries. For example, in June 2024, the Biden administration announced $85 million in housing funds to 21 local governments to enhance affordable housing development. The initiative is aimed at updating housing plans, revising land use policies, and streamlining permits. The United States government pointed out how the investment contributes to the low cost of high housing and encourages homeownership opportunities. MDF is preferred over it because of its ease in use and creation of smooth surfaces; it's more convenient for furniture manufacturers and home builders. As consumers look for inexpensive and quality material for home decoration MDF has become an important component in the production of cabinets, doors and flooring which boosts market growth.

The rising trend to be sustainable and has more ecofriendly materials in the constructions and furniture industries drives. This product is made out from recycled wood fibers hence typically has a lower environmental footprint than its equivalent of solid wood. The increase in acceptance by more companies towards green building practices, as well as demand in consumers for similar sustainable products, will ensure that the MDF market increases in adoption. In terms of the manufacturing process, innovation improves the product's strength and durability thereby driving the market of attraction.

North America Medium-Density Fiberboard Market Trends:

Rising Demand in Construction and Furniture Manufacturing

The demand for MDF in construction and furniture manufacturing is increasing due to its affordability, consistency and ease of customization. Unlike solid wood MDF offers a uniform surface making it ideal for cabinetry, wall paneling, flooring and decorative molding. Its smooth texture allows for seamless painting, laminating and veneering giving it a high-end appearance at a lower cost. The material’s resistance to warping and cracking makes it suitable for humid environments enhancing its use in kitchen and bathroom furniture. Demand from construction and furniture sectors significantly impacts North America Medium-Density Fiberboard Market price analysis significantly. With growing residential and commercial construction MDF is gaining preference over traditional wood due to its versatility and cost-efficiency. According to the report published by the Government of Canada, in Budget 2024, the Canadian government announced a housing plan aiming to construct nearly 4 million homes by 2031. Key to this is the Public Lands for Homes Plan, targeting 250,000 new homes on surplus public lands. A $500 million fund will be launched to acquire additional land for housing.

Increased Use in Prefabricated Housing

The growing adoption of modular and prefabricated housing is driving demand for MDF due to its affordability, uniformity and ease of fabrication. For instance, in January 2025, the governments of Canada and Quebec announced funding for 500 highly prefabricated multi-unit housing units by 2026 under the $992 million Canada–Quebec Agreement via the Housing Accelerator Fund. This initiative aims to create 8,000 social and affordable housing units in Quebec. Prefabricated homes require materials that are lightweight, durable and easy to install making MDF an ideal choice for wall paneling, cabinetry and interior partitions. Its smooth surface allows for seamless finishes, laminations and veneers enhancing aesthetic appeal. The cost-effectiveness of MDF over solid wood meets the requirements for budget friendly construction solutions. Its availability in moisture-resistant and fire-retardant variants makes it suitable for different home environments further strengthening its role in the prefabricated housing sector.

Residential Sector Expansion

Residential construction boom and increased home remodeling are driving MDF demand for interior applications. MDF is a versatile product that can be used for wall panels, moldings, trims and decorative elements. It provides a smooth surface for painting and veneering. Homeowners prefer MDF for cost-effective yet aesthetically appealing interiors while builders choose it for ease of installation and durability. Increased urbanization and housing projects are further accelerating the use of MDF in cabinetry, flooring and partition walls. MDF's ability to resemble wood at a lower cost makes it a popular choice for modern and customized home interiors. The market’s expansion is further reflected in industry consolidations aimed at enhancing product portfolios and meeting growing residential demand. For instance, in December 2024, Metrie®, North America's largest millwork manufacturer announced the acquisition of eden Inc. a pre-finished millwork producer for modular homes.

North America Medium-Density Fiberboard Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America medium-density fiberboard market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and sector.

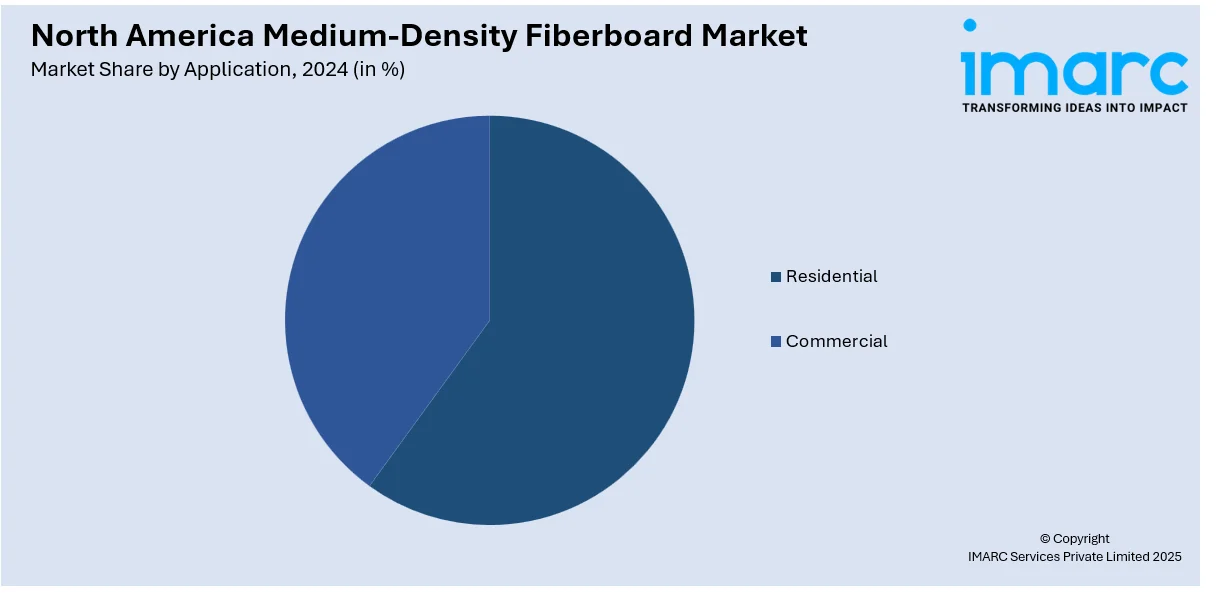

Analysis by Application:

- Residential

- Commercial

The residential sector holds the largest North American Medium-Density Fiberboard market share because of increasing demand for affordable, durable and versatile materials in home construction and renovation. MDF is widely used in interior applications such as cabinetry, wall paneling, flooring and moldings because of its smooth finish and ease of customization. Increasing homeownership, remodeling trends and urban housing developments are fueling MDF consumption. Additionally, sustainable and low-emission MDF variants are gaining traction as homeowners prioritize ecofriendly materials.

Analysis by Sector:

- New Construction

- Replacement

New construction is the leading segment in the North America Medium-Density Fiberboard (MDF) market which is driven by increasing demand for cost-effective and versatile building materials. MDF is widely used in structural and interior applications such as cabinetry, wall paneling, flooring and moldings due to its smooth surface, ease of machining and uniform composition. The rise in residential and commercial developments including changing architectural trends that align with the use of engineered wood products drives the adoption of MDF. Sustainable and moisture-resistant variants of MDF are acquiring popularity as builders seek durable and environmentally friendly solutions for modern construction projects.

Country Analysis:

- United States

- Canada

The United States dominates the North America medium-density fiberboard (MDF) market due to strong demand from residential and commercial construction. The country’s thriving housing sector coupled with rising home renovation and remodeling activities is driving MDF consumption for cabinetry, flooring, paneling and furniture. The preference for engineered wood products over solid wood due to cost-effectiveness and sustainability further strengthens MDF adoption. Strict environmental norms are driving manufacturers toward low-emission MDF versions to support green building. The development of modern plantations with a well-established supply chain and good infrastructure also sustains market growth.

Competitive Landscape:

The North America medium-density fiberboard (MDF) market is highly competitive with manufacturers focusing on production capacity expansion, technological advancements and product diversification. Companies are investing in sustainable and low-emission MDF variants to meet stringent environmental regulations and growing consumer preference for ecofriendly materials. Strategic acquisitions, mergers and partnerships are strengthening market positions enhancing supply chain efficiency and expanding product portfolios. Innovation in moisture-resistant, fire-retardant and lightweight MDF variants is driving competition. Additionally, strong distribution networks and regional manufacturing capabilities provide a competitive edge enabling faster delivery and cost-effective production to meet the rising demand from construction and furniture sectors.

The report provides a comprehensive analysis of the competitive landscape in the North America medium-density fiberboard market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Ranger Board a West Fraser Timber division announced its partnership with Sunds Fibertech for a major upgrade of its MDF plant in Blue Ridge, Alberta set for completion by summer 2025. The project includes advanced press components and a surveillance system to enhance production efficiency and reliability.

- In July 2024, Rushil Decor Ltd. announced its plans to expand into the North American market targeting substantial growth in the Laminates and MDF sectors. Coinciding with its participation at the International Woodworking Fair in Atlanta the company aims to achieve INR 2500 crores in annual revenues by FY 2029 emphasizing sustainability and innovation.

North America Medium-Density Fiberboard Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Cubic Metres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America medium-density fiberboard market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America medium-density fiberboard market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America medium-density fiberboard industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medium-density fiberboard market was valued at 4.66 Million Cubic Metres in 2024.

The market is expanding due to increasing demand in construction and furniture applications, advancements in moisture-resistant and low-emission MDF, rising prefabricated housing adoption, and growing preference for sustainable building materials.

IMARC estimates the medium-density fiberboard market to reach 5.74 Million Cubic Metres by 2033, growing at a CAGR of 2.26% during 2025-2033.

The residential segment holds the largest share due to high demand for MDF in cabinetry, flooring, wall paneling, and moldings in new home construction and remodeling projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)