North America Magnet Market Size, Share, Trends and Forecast by Magnet Type, Application, and Country, 2025-2033

North America Magnet Market Size and Share:

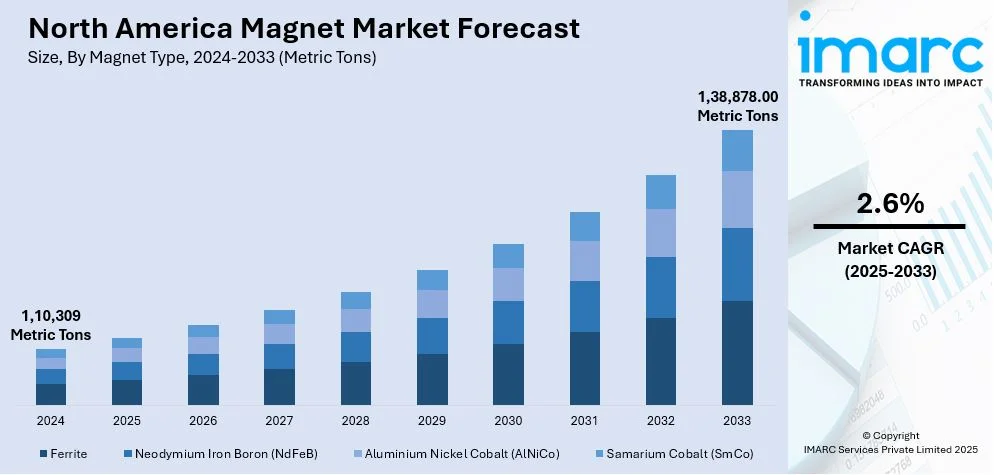

The North America magnet market size was valued at 1,10,309 Metric Tons in 2024. Looking forward, IMARC Group estimates the market to reach 1,38,878.00 Metric Tons by 2033, exhibiting a CAGR of 2.6% from 2025-2033. The market is driven by the rising demand in automotive, electronics, renewable energy (RE), and healthcare, alongside advancements in manufacturing and raw material sourcing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1,10,309 Metric Tons |

|

Market Forecast in 2033

|

1,38,878.00 Metric Tons |

| Market Growth Rate (2025-2033) | 2.6% |

The North America magnet market size is expanding due to significant growth in industries such as automotive, electronics, and RE. In addition, the increasing adoption of electric vehicles (EVs) in the United States and Canada, which rely on high-performance magnets for electric motors and batteries, is contributing to the market expansion. Moreover, the rise in wind turbine installations for clean energy production boosts the demand for powerful permanent magnets, impelling the market growth. Besides this, ongoing technological advancements in industrial automation and robotics propel the need for specialized magnets in manufacturing processes, fueling the market demand. Furthermore, the growing emphasis on energy efficiency and sustainable technologies is strengthening the North America magnet market share. Aligned with these objectives, the Biden-Harris Administration committed up to $100 million in 2024 to advance research and development (R&D) in artificial intelligence (AI) and sustainable semiconductor materials. These efforts aim to support the expansion of the clean energy and electronics industries while driving increased demand for magnets.

Concurrent with this, the North America magnet market growth is driven by the ongoing technological innovation and manufacturing capabilities of the region. The United States has a highly strong R&D industry, with continuous advancements in magnetic materials and production techniques. This significantly enhances the performance and durability of the magnet, fostering the market demand. Additionally, the demand for high-strength magnets used in medical devices, such as Magnetic Resonance Imaging (MRI) machines, is supporting the market growth. Apart from this, the government’s focus on securing critical raw materials and reducing reliance on imports is encouraging the domestic production of magnets, strengthening the supply chain, and thus propelling the market forward. Supporting these initiatives, the U.S. Department of Energy (DOE) has allocated $150 million in open funding for research projects aimed at enhancing energy efficiency and lowering carbon emissions in energy technologies and manufacturing processes.

North America Magnet Market Trends:

Shift Toward Sustainable and Green Technologies

The development of eco-friendly sustainable magnets has become increasingly popular and is influencing the North America magnet market trends. The rising interest in renewable energy sources like wind and solar power has driven increased demand for magnets used in wind turbines, electric vehicles (EVs), and energy-efficient appliances. Manufacturers develop new processes to create magnets from recycled materials and use sustainable manufacturing techniques for the reduction of environmental impacts. For instance, Jaguar Land Rover invested USD 2 Million in rare earth magnets recycling to enhance sustainability, further contributing to this trend. Besides this, the integration of magnets in clean energy applications and green technologies is rising in line with the local commitment to sustainability and carbon reduction, which is providing an impetus to the market.

Advancements in Magnetic Materials

Continuous advancements in magnetic materials are enhancing the North America magnet market outlook. The development of next-generation materials focuses on high-performance alloys and composites that boost efficiency and performance specifically in electric motors and medical equipment. Concurrently, the creation of rare-earth-free magnets along with magnets that offer better thermal stability and energy density performance receives increased research interest. For example, in 2024, North American universities and research institutes received USD 45 Million in grants to advance research in novel magnetic materials for energy applications, including rare-earth-free and thermally stable magnets. Moreover, continuous technological breakdowns are improving the existing application performance and developing new markets for autonomous vehicles and robotics as well as advanced manufacturing systems, thus aiding in the market expansion.

Growing Use of Magnets in Healthcare Devices

Healthcare devices employing magnets have become a significant trend in North America medical facilities because they power medical imaging technologies such as MRI machines. In confluence with this, high-quality medical magnets are required in increasing numbers because advanced diagnostic tools must be used on an aging population. Furthermore, magnetic field therapy systems and dental implants represent two therapeutic devices that incorporate magnets as a key component. Manufacturers actively develop improved quality medical magnets, and this growing market strategy is driving the magnet industry demand. In parallel, the Toward Translation of Nanotechnology Cancer Interventions (TTNCI) awards are anticipated to drive progress in the translational readiness of nanotechnology-based cancer interventions, targeting key clinical objectives. Notable advancements are expected in the overall capacity to utilize these interventions as clinically viable cancer diagnostics and therapeutics. This synergy between technological innovation in healthcare devices and nanotechnology is further shaping the demand for advanced magnetic solutions in clinical applications.

North America Magnet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America magnet market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on magnet type and application.

Analysis by Magnet Type:

- Ferrite

- Neodymium Iron Boron (NdFeB)

- Aluminium Nickel Cobalt (AlNiCo)

- Samarium Cobalt (SmCo)

Ferrite magnets dominates the North America magnet market share, due to their affordability, versatility, and extensive application across various industries. These magnets are commonly used in automotive, consumer electronics, and industrial equipment, where high-performance magnets are required at a lower price point. Ferrite magnets are also non-toxic, stable, and corrosion-resistant, making them suitable for harsh environments. Their affordability compared to rare-earth magnets further drives their adoption, especially in cost-sensitive industries, solidifying ferrite's dominant position in the market for various applications, including loudspeakers, motors, and magnetic assemblies.

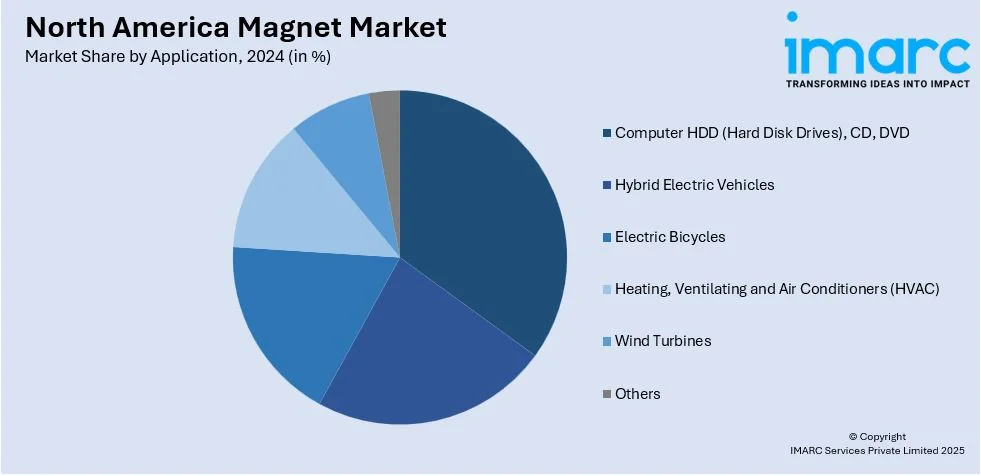

Analysis by Application:

- Computer HDD (Hard Disk Drives), CD, DVD

- Hybrid Electric Vehicles

- Electric Bicycles

- Heating, Ventilating and Air Conditioners (HVAC)

- Wind Turbines

- Others

Magnets in hard disk drivers (HDDs), compact discs (CDs), and digital video discs (DVDs) play a crucial role in data storage and retrieval. Neodymium magnets, commonly used in these applications, ensure precise, reliable operation, driving the demand for compact, high-performance magnets in consumer electronics and media storage.

Hybrid electric vehicles (HEVs) utilize permanent magnets in electric motors and battery systems, improving energy efficiency and performance. The increase in green technology adoption further drives the growth of high-quality magnet demand in HEVs since automakers focus on transitioning to more energy-efficient models.

The efficiency of electric bicycle motors depends heavily on permanent magnets because of their modern design. The demand for magnets used in e-bikes keeps increasing as environmental awareness grows while North America’s urban mobility sector actively adopts eco-friendly transportation solutions.

Magnets are integral to heating, ventilation and air conditioning (HVAC) systems, and are used in motors, compressors, and other key components. The growing need for energy-efficient solutions and smart HVAC systems in residential, commercial, and industrial settings is driving the demand for high-performance magnets, enhancing system reliability and sustainability.

Magnets serve as essential components in wind turbine generators to facilitate efficient energy transformation. The speedup of RE adoption across North America leads to elevated requirements for wind turbine magnets which is boosting the renewable power development in the region.

Country Analysis:

- United States

- Canada

- Mexico

The United States represents the leading magnet market in North America because various industries including automotive and electronics along with RE and healthcare segments create strong demand. In addition, the leadership of the country in EV production, wind energy, and technological innovations fosters a continuous need for high-performance magnets, particularly for motors, sensors, and energy-efficient systems. Apart from this, the nation hosts leading magnet producers and research organizations that help develop both magnetic materials and production technologies. Furthermore, sustainability and energy-efficient principles drive the U.S. magnet market, maintaining its position as a leader in the magnet industry. For example, MP Materials has been awarded USD 58.5 Million to enhance U.S. rare earth magnet manufacturing, supporting domestic production and reducing reliance on foreign sources for critical magnet materials. This funding supports the U.S. effort to secure a stable domestic supply of rare earth materials, crucial for advancing technology in energy, automotive, and manufacturing sectors.

Competitive Landscape:

The North America magnet market is characterized by intense competition, with manufacturers focusing on innovation and efficiency to gain market share. The market requires high-performance sustainable magnets that include rare-earth-free recyclable options to satisfy the expanding needs of automotive, RE, and electronic industries. Organizations continue to spend on developing superior manufacturing approaches together with magnet research to enhance their products' strength and durability alongside cost reductions. Furthermore, end-user sector collaboration has become a common practice for manufacturers because they want to design magnet solutions specifically for their needs while competing in an evolving market.

The report provides a comprehensive analysis of the competitive landscape in the North America magnet market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Goudsmit Magnetics introduced a heated magnetic filter to remove iron particles from liquid chocolate, improving food safety and processing efficiency in the food industry, and enhancing the North America magnet market.

- In October 2024, TDK Corporation launched the 200W-rated i1C series DC-DC converters, enhancing the magnet market in North America by providing high-efficiency power solutions for a range of industrial applications, boosting technological advancements and improving the performance of magnet-driven systems in motors and energy-efficient equipment.

- In October 2024, Goudsmit Magnetics unveiled a new range of permanent lifting magnets, boosting the North America magnet market by offering advanced solutions for efficient material handling and improving productivity across various industrial sectors.

- In August 2024, Electron Energy Corporation joined Magnetic Holdings, a parent company of Dexter Magnetic Technologies, expanding its capabilities in producing high-performance magnets and strengthening its position in the North America magnet market through enhanced innovation and strategic collaboration.

- In May 2024, Arnold Magnetic Technologies showcased its high-performance magnets at the Magnetics Show in California, highlighting its innovative products and driving growth in the North America magnet market through advanced technology and expert insights.

North America Magnet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Metric Tons |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Magnet Types Covered | Ferrite, Neodymium Iron Boron (NdFeB), Aluminium Nickel Cobalt (AlNiCo), Samarium Cobalt (SmCo) |

| Applications Covered | Computer HDD (Hard Disk Drives), CD, DVD, Hybrid Electric Vehicles, Electric Bicycles, Heating, Heating, Ventilating and Air Conditioners (HVAC), Wind Turbines, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America magnet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America magnet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America magnet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The magnet market in North America was valued at 1,10,309 Metric Tons in 2024.

The growth of the North America magnet market is driven by rising demand for electric vehicles (EVs), renewable energy (RE), consumer electronics, ongoing advancements in magnetic materials, and increasing investments in energy-efficient and green technologies.

The magnet market is projected to exhibit a CAGR of 2.6% during 2025-2033, reaching a value of 1,38,878.00 Metric Tons by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)