North America Lyocell Fiber Market Size, Share, Trends and Forecast by Product, Application, and Country, 2025-2033

North America lyocell fiber Market Size and Share:

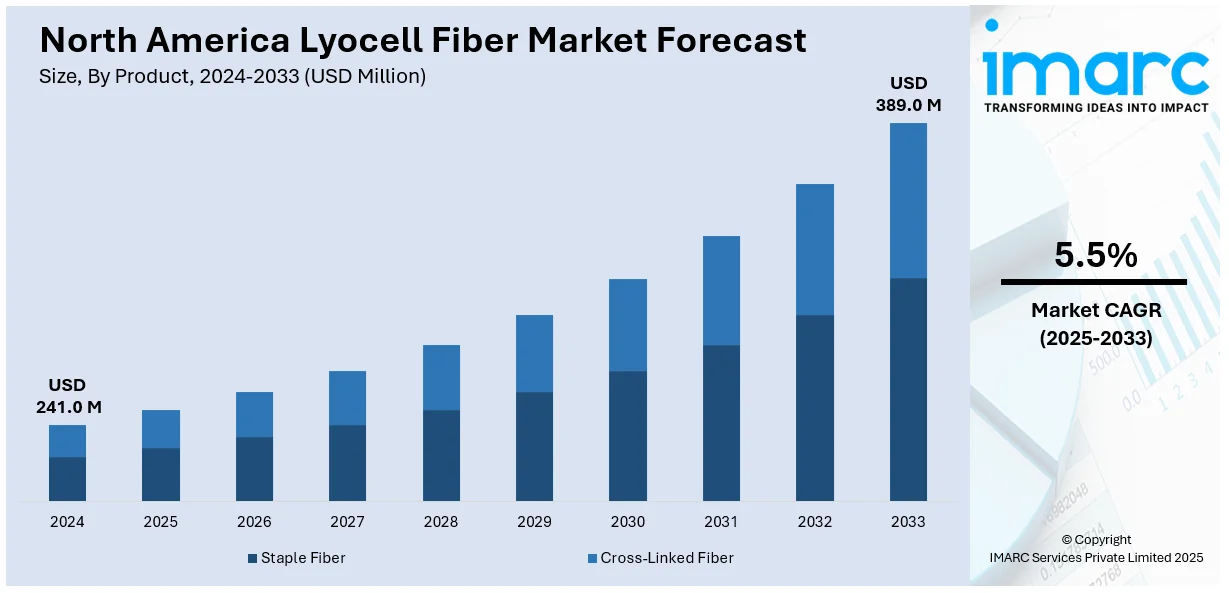

The North America lyocell fiber market size was valued at USD 241.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 389.0 Million by 2033, exhibiting a CAGR of 5.5% from 2025-2033. The market is expanding due to increasing need for sustainable textiles, technological enhancements in fiber production, and a notable inclination toward eco-friendly materials in both home and apparel textiles. Magnifying customer awareness of environmental impact and regulatory aid for sustainable practices are other crucial drivers of market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 241.0 Million |

|

Market Forecast in 2033

|

USD 389.0 Million |

| Market Growth Rate (2025-2033) | 5.5% |

The North America lyocell fiber market is mainly propelled by elevating customer requirement for both eco-friendly and sustainable textiles. As awareness of the environmental impact of synthetic fibers grows, consumers and manufacturers are shifting toward biodegradable alternatives like lyocell, which is derived from renewable wood pulp. For instance, as per industry reports, lyocell is considered to have 100% biodegradability. It is composed by a system of closed-loop that facilitates the reusing of 99.5% of the solvents for around 200 times, resulting in minimum waste generation. Additionally, advancements in lyocell production technologies have improved fiber quality and cost-effectiveness, making it a more viable option for various applications, especially in the textile and apparel industries. This shift toward sustainability is further supported by regulatory incentives promoting eco-friendly manufacturing practices, boosting North America lyocell fiber market share.

Rising demand for high-performance fabrics also contributes to the market’s expansion. Lyocell fibers are renowned for their softness, breathability, and moisture-wicking properties, which make them ideal for applications in activewear, fashion, and home textiles. Furthermore, the growing trend of eco-conscious consumers and the fashion industry’s commitment to reducing environmental footprints are driving greater adoption of lyocell in apparel. For instance, as per industry reports, to minimize the environmental impact of fashion industry across New York, Fashion Sustainability and Social Accountability Act has been introduced that also addresses the New York's climate protection act that demands the state to reduce its emissions by 40% by the year 2030. As these trends continue, the North American market is set to experience sustained growth, with lyocell becoming increasingly popular among both consumers and manufacturers.

North America Lyocell Fiber Market Trends:

Increased Adoption of Sustainable Fabrics

The North America lyocell fiber market is witnessing a significant shift towards sustainable textiles. Growing environmental concerns have prompted both consumers and manufacturers to prioritize eco-friendly materials. For instance, as per industry reports, approximately 11.3 Million Tons of textile is dumped as waste across the United States. Lyocell, made from renewable wood pulp and biodegradable, meets these sustainability requirements. As brands in the apparel and home textile industries increasingly focus on reducing their carbon footprints, the demand for lyocell fibers has surged. This trend is expected to continue as consumers demand transparency in sourcing and production, further promoting the adoption of environmentally responsible fibers across multiple sectors.

Technological Advancements in Fiber Production

Technological advancements in lyocell fiber production are enhancing its appeal in the North American market. Innovations in manufacturing processes have led to more efficient, cost-effective production methods, improving the overall quality of lyocell fibers. These improvements include better fiber strength, softness, and moisture management properties, making it more attractive for diverse applications in apparel, home textiles, and industrial products. As production technologies evolve, manufacturers are offering lyocell fibers at more competitive prices, widening its adoption across a broader range of industries, and stimulating market growth. For instance, as per industry reports, Sateri, a major fiber producer with robust marketing and sales foothold in North America, utilizes cutting-edge closed-loop technology to produce its lyocell fibers, with a 99.7% of the recovery rate.

Expansion of Eco-Conscious Consumer Preferences

Eco-conscious consumerism is a driving force behind the growth of the North America lyocell fiber market. With increasing consciousness about the environmental effects of fast fashion and synthetic fibers, consumers are opting for textiles made from renewable, sustainable sources like lyocell. For instance, as per industry reports, around 27% of American people depict a robust commitment regarding environmental challenges, open to pay more for sustainable products. Furthermore, this shift is particularly evident in the fashion, activewear, and home goods sectors, where consumers prioritize both product quality and sustainability. As demand for ethically sourced, biodegradable materials rises, manufacturers are responding by incorporating more lyocell into their offerings, strengthening its position in the North American market.

North America Lyocell Fiber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America lyocell fiber market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Staple Fiber

- Cross-Linked Fiber

Staple fiber holds the highest market share in the lyocell fiber industry across North America as it is utilized in wide areas of industrial, textiles, and nonwovens products. Staple fibers are preferred because of their flexibility and convenience of processing, and they are excellent for spinning into yarns to be used in different types of fabrics. The elevating requirement for biodegradable as well as sustainable materials in the textile sector further strengthens the popularity of lyocell staple fibers because they provide environmental advantages, moisture management, and softness as compared to synthetic fibers. Further, staple fibers are rapidly being deployed in environmentally safe hygiene products as well as home textiles, thus broadening their market foothold. As sustainability is increasingly being used as a point of focus in manufacturing, the use of lyocell staple fiber is likely to increase. This is based on consumer preference for sustainable products and the continuous shift toward more environmentally friendly production methods.

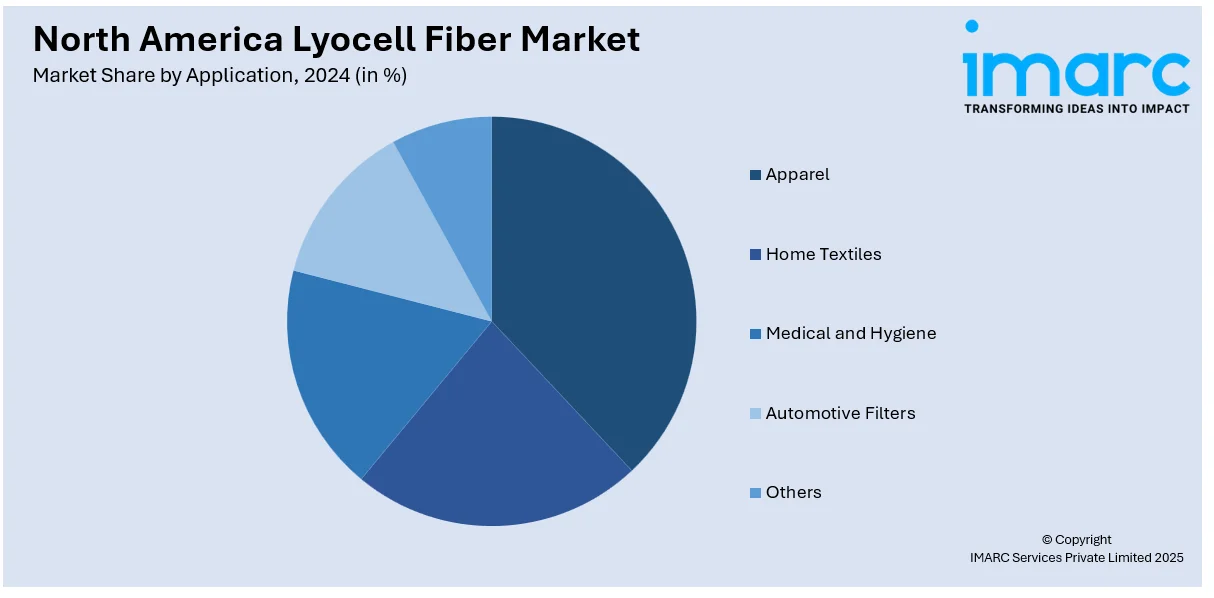

Analysis by Application:

- Apparel

- Home Textiles

- Medical and Hygiene

- Automotive Filters

- Others

North America lyocell fiber market price analysis indicate that the apparel segment leads the market in terms of application share with heightening customer need for premium-grade, sustainable, and comfortable fabrics. Lyocell fibers have gained popularity over time for being soft, breathable, and capable of moisture wicking, while being incorporated increasingly into the development of eco-friendly clothing lines from activewear and casual wear to high-end fashion. The increasing realization of environmental damage, like micro-pollutants through the release of synthetic fibers, and their demand among apparel manufacturers in recent times further enhances the consumption of lyocell. At the same time, the material's natural outlook and better properties during dyeing have increased demand for the lyocell fiber in the clothing sector. As consumers become more conscious of the demand for sustainability, apparel brands are embracing lyocell fibers to cater to the latest market trends and expectations of customers, hence reinforcing the largest application segment's position in the North American market.

Country Analysis:

- United States

- Canada

- Mexico

The United States holds the largest market share in the North America lyocell fiber market, driven by its advanced textile manufacturing infrastructure and robust consumer demand for sustainable products. For instance, as per industry reports, the textile industry of the United States generates approximately USD 64.8 Billion output per year. Furthermore, the country’s strong focus on environmental sustainability, coupled with increasing knowledge about the adverse impacts of conventional fibers, has accelerated the adoption of eco-friendly substitutes like lyocell. The U.S. is home to major textile and apparel manufacturers who are integrating lyocell into their supply chains to meet rising demand for environmentally responsible products. Additionally, the country’s regulatory framework, which supports sustainable manufacturing practices, further promotes the use of lyocell fibers.

Competitive Landscape:

The competitive landscape is highlighted by the presence of established global and regional players focusing on sustainability and innovation. Key firms are currently making investments in leading-edge production technologies to enhance manufacturing efficacy and meet elevating customer demand for environmentally friendly textiles. Strategic partnerships, acquisitions, and collaborations are intensely prevalent as companies aim to augmnet their product offerings and market reach. For instance, in October 2024, Birla Cellulose entered into a partnership with Circ, a U.S.-based recycling innovator for textiles, to boost the expansion of fiber recycling. Under the agreement, Birla will procure Circ's pulp of around 5000 tons annually. This pulp will be leveraged to produce lyocell staple fiber. Additionally, increasing emphasis on research and development enables firms to enhance fiber quality and explore new applications, maintaining competitive advantage in the rapidly evolving market.

The report provides a comprehensive analysis of the competitive landscape in the North America lyocell fiber market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Culp, a U.S.-based firm, Lenzing, a cellulosic yarn provider, and Suedwolle Group announced a tactical collaboration to produce a new product line of lyocell fibers to enhance fabric comfort of home textiles.

- In January 2025, the Lenzing Group, a global textile firm with robust foothold in North American market, announced the proliferation of its prominent product line LENZING Lyocell Fill, which will encompass a better variant with several different cut lengths, customized for filling purposes in both apparel and home textiles.

- In August 2024, Zara announced a partnership with Circ, a U.S.-based technology firm for fashion, to launch its new Women's Collection line that is composed of lyocell by Circ. The collection includes four new pieces that are composed of 100% lyocell.

- In September 2023, Calvin Klein announced a license collaboration with Revman to distribute, develop, and manufacture home collection of Calvin Klein across Mexico, the U.S., and Canada. This collection is incorporated with eco-friendly materials, including natural dyes and lyocell fibers.

North America Lyocell Fiber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Staple Fiber, Cross-Linked Fiber |

| Applications Covered | Apparel, Home Textiles, Medical and Hygiene, Automotive Filters, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America lyocell fiber market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America lyocell fiber market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America lyocell fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America lyocell fiber market was valued at USD 241.0 Million in 2024.

The market expansion is propelled by magnifying customer need for eco-friendly as well as sustainable textiles, innovations in production processes, and increase in awareness of the environmental effect of traditional fibers. In addition, the escalating utilization of lyocell in the fashion and home textile industries fuels market expansion.

IMARC estimates the North America lyocell fiber market to reach USD 389.0 Million by 2033, exhibiting a CAGR of 5.5% from 2025-2033.

Staple fiber accounted for the largest product market share.

United States currently dominates the North America lyocell fiber market, accounting for a share exceeding 39%. This dominance is fueled by its innovative manufacturing abilities, robust need for sustainable textiles, and the presence of crucial industry players bolstering innovation and production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)