North America Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Country, 2025-2033

North America Lithium-ion Battery Market Size and Share:

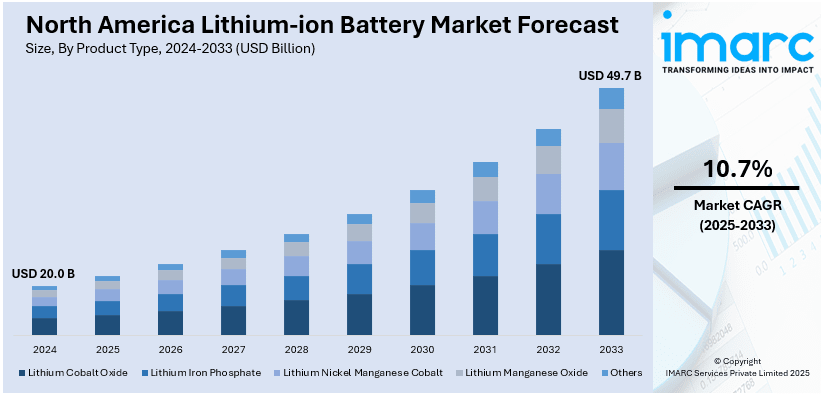

The North America lithium-ion battery market size was valued at USD 20.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 49.7 Billion by 2033, exhibiting a CAGR of 10.7% from 2025-2033. The market is witnessing significant growth due to the growing adoption of electric vehicles and expanding energy storage systems deployment. Moreover, the growth in domestic lithium-ion battery manufacturing, increasing investment in battery recycling and second-life applications, and advancements in battery technology and alternative chemistries are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.0 Billion |

|

Market Forecast in 2033

|

USD 49.7 Billion |

| Market Growth Rate (2025-2033) | 10.7% |

The major cause which is supporting the lithium-ion battery market in North America really refers to the rising acceptance of electric vehicles (EVs) in that part of the world. Also, emissions regulations by governments have prompted numerous incentives for the acquisition of such vehicles. All these factors speed up the pace of transformation towards electrification in the particular industry segment. For example, funding for charging stations within the boundaries of the domestic battery manufacturing by the Biden administration has been aimed at boosting the growth of electric vehicles. Thus, the production of electric vehicles has been ramped, particularly among leading automakers such as Tesla, General Motors, and Ford. Demand for high-performing lithium-ion batteries is enormously increasing because these companies ramp up EV production. For example, in December 2024, Volkswagen and PowerCo joined to invest $48 million in Patriot Battery Metals, with a goal to ensure a long-term North American lithium supply to manufacture batteries for EVs. Battery technology improvement towards better energy density and faster charging is also making electric cars competitive with internal combustion engine vehicles trends positively support market growth.

The growing deployment of energy storage systems (ESS) to support the integration of variable renewable energy sources is another benchmark in the progressing lithium-ion battery market. With the increasing power grid integration of solar and wind generation, utilities and businesses are investing in large-scale battery storage for enhanced grid reliability and efficiency. For instance, in November 2024, EDF Renewables secured a power purchase agreement (PPA) for 20 years with APS for the 250 MW Beehive BESS in Arizona. The construction is anticipated to initiate in 2025, with the facility focusing on storing and discharging renewable energy during peak-demand periods of the grid. This facility will encompass enclosures of lithium-ion batteries. Lithium-ion batteries are being selected in ESS applications mainly because of elevated energy density, long life cycles above 5000 cycles, and becoming cheaper. The market growth is further aided by government programs supporting energy storage deployment, together with a rising tide of investments from the private sector. The requirements for residential, commercial, and bulk storage systems are anticipated to chart an upward growth trend that will fortify the long-term growth of the market.

North America Lithium-ion Battery Market Trends:

Growth in Domestic Lithium-ion Battery Manufacturing

Currently, North America is undergoing a significant ramp-up of lithium-ion battery manufacturing, supported by numerous government initiatives and investments by the private sector within North America. With the US Inflation Reduction Act and Bipartisan Infrastructure Law providing incentives for domestic battery production and reducing foreign supply chain reliance, companies like Tesla, Panasonic, and LG Energy Solution further ramp up on battery production facilities with gigafactory building programs across the U.S. and Canada. For instance, in November 2024, a lithium-ion battery separator plant is being constructed in Ontario, Canada, by Asahi Kasei Battery Separator Corporation and Honda, which will be set to produce 700 million square meters per year by 2027. This continued activity is building that region's battery supply chain with emphasis on logistical economy as well as developmental innovation in battery chemistry technology.

Increasing Investment in Battery Recycling and Second-life Applications

Battery recycling and second-life uses are rapidly evolving into the main strategies for sustainability, with the magnifying need for lithium-ion batteries. Companies invest in the latest recycling technologies to attain valuable materials, like nickel, lithium, and cobalt, and thereby reduce the environmental burden of battery disposal. For example, in December 2024, American Battery Technology Company received a USD 144 million grant from the U.S. Department of Energy for the construction of a lithium-ion battery recycling plantin conjunction with Argonne National Laboratory. Government policies in favor of a circular economy and new business models for second-life battery applications into energy storage systems support this change. Redwood Materials and Li-Cycle are spearheading the efforts to set up large-scale recycling infrastructure in North America to create resource efficiency and supply chain resilience.

Advancements in Battery Technology and Alternative Chemistries

The industry witnesses continuous innovations in lithium-ion battery technology with special emphasis on energy density, charging speed, and safety. Next-gen battery chemistries, such as solid-state batteries and lithium-iron-phosphate (LFP) , are now trending due to their improved thermal stability and cost-effectiveness. LFP batteries are being adopted by several automakers and energy storage companies, especially in stationary storage and entry-level EVs, while high-performance applications are seeing the development of solid-state batteries. For instance, in September 2024, BMW North America collaborated with Redwood Materials to recycle lithium-ion batteries, targeting a closed-loop system in which 95-98% of critical minerals are reintroduced into the supply chain for sustainable EV production. These innovations impact the overall efficiency of batteries with increased applicability in multiple industries

North America Lithium-ion Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America lithium-ion battery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, power capacity, and application.

Analysis by Product Type:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

High energy density and a stable performance profile make Lithium Cobalt Oxide (LCO) the preferred cathode material for consumer electronics. Such a demand, however, comes from North America concerning smartphones, laptops, and medical devices. Adoption of LCO has thus been complicated by the high costs and cobalt supply chain risks limiting large-scale application in EVs, forcing manufacturers to search for alternative cell chemistries containing little or no cobalt and higher amounts of nickel for widespread market use.

Lithium Iron Phosphate (LFP) is emerging as a new technology for North America in electric vehicles, energy storage systems, and industrial applications. In addition to having a long cycle life and thermal stability, it is cheaper than cobalt-based chemistries. For example, major car companies, including U.S.-based Tesla and Ford, are increasingly implementing LFP in affordable electric vehicle models to meet the company's sustainability goals and increase domestic battery production.

Lithium Nickel Manganese Cobalt (NMC) predominates in the EV scene of North America due to its high energy density and balanced performance. Electric vehicles uprooted longer range will make use of NMC from General Motors, Tesla, and Rivian. Battery makers also optimize the high levels of nickel in the NMC variant to lessen the cobalt dependency with greater cost efficiency while giving rise to sustainability and improved energy output for further purposes.

Lithium Manganese Oxide solves the hybrid vehicle, power tools, and medical equipment puzzle across North America. High thermal stability and safety render it an ideal choice for applications in grid storage systems and fast-charging power systems. Though LMO offers lower energy density, its cost and safety make it preferred for use in short-range electric vehicles and backup power systems.

Analysis by Power Capacity:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

0 to 3000mAh lithium-ion batteries are used for the power needs of consumer electronics, such as cell phones, wearables, and wireless accessories in North America. Such small batteries must have compact designs, energy density, and reliability properties for daily-use devices. With the improvement of fast-charging and high-cycle life, lithium-ion batteries are rapidly supporting the portable energy-efficient technology increase in variable sectors.

Batteries ranging from 3000mAh to 10000mAh are used in North America for laptop and tablet services, drones, medical gadgets, and power banks. Innovations in long-lasting, fast-charging lithium-ion batteries benefit this segment. The market continues to grow while battery safety and durability improvements enhance the performance and reliability of consumer electronics due to remote work, gaming, and digital healthcare.

10,000-60,000mAh lithium-ion batteries support electric two-wheelers, power tools, industrial tools, and energy storage systems (ESS). The growing adoption of electric mobility and backup power solutions has increased the demand in North America. These batteries, with their higher discharge rates, long lifespan, and reliability, are best suited for grid stability, off-grid power, and commercial energy storage applications.

Batteries are needed for EVs, grid storage, and heavy-duty industrial applications for North America and therefore greater than 60,000mAh. These are the batteries the automobile manufacturers, utilities, and renewable energy developers depend on for increasing EV range, peaking power demand, and integrating renewable energy. The vast capacity lithium-ion cell innovations promote the market growth and decarbonization.

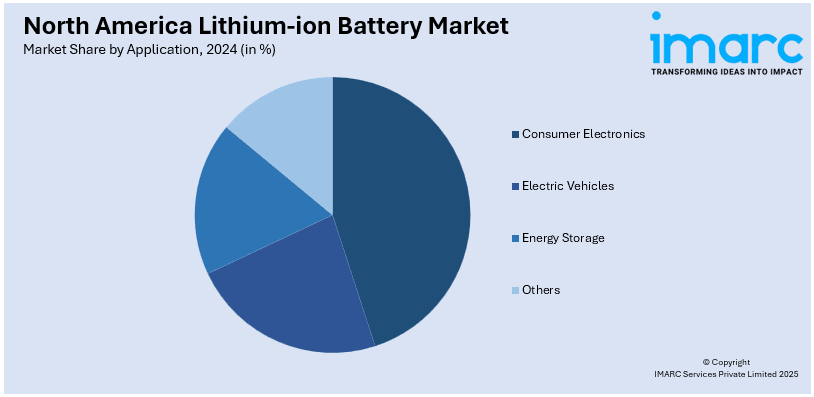

Analysis by Application:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The lithium-ion batteries are utilized in North America to power smartphones, laptops, tablets, wearables, and medical devices. This allows them to possess high energy density, fast charging, and long cycle life. As the demand for portable and connected devices rises, better batteries are required-witnessing manufacturers making advancements to help lithium-ion cells that are safer and more durable for better user experiences in support of next-generation electronics.

Lithium-ion dependence in North America goes towards long-range performance, fast charging, and energy efficiency for the EV market. Automakers likeTesla, General Motors, and Ford are scaling up battery production using LFP and NMC chemistries to balance costs with sustainable practices. The combination of government incentives and the ever-growing charging infrastructure is providing the impetus for accelerated EV market adoption, giving rise to further demand for high-performance batteries.

In North America, lithium-ion battery storage systems do backup power, grid stabilization, and renewable energy integration. Utilities and enterprises in the region implement large-scale battery energy storage systems (BESS) for storing excess solar and wind power to guarantee grid reliability. Additionally, advancements in high-capacity, long-life lithium-ion batteries enable off-grid solutions, microgrids, and backup emergency systems that fuel the growth of clean energy storage.

Country Analysis:

- United States

- Canada

- Mexico

The lithium-ion battery market in North America is apparently dominated by the United States due to demand stimulated by EV manufacturing, energy storage, and consumer electronic needs. Incentives from the government demonstrated in the Inflation Reduction Act (IRA), support domestic battery manufacturing and supply chain development. Tesla, LG Energy Solution, and Panasonic have already expanded their gigafactories to take on an advantage in the EV and ESS markets.

Canada plays a major role in the lithium-ion battery industry due to critical mineral supplies such as cobalt, lithium, and nickel. Investments are being made in battery manufacturing and recycling in Canada to strengthen its supply chain for EVs and energy storage. Battery production hubs are being created by Lion Electric and BASF Canada for sustainable mobility and energy storage solutions.

Mexico is rapidly becoming a major lithium-ion battery manufacturing center due to increased automotive production as well as the USMCA. Major automakers like BMW and Ford are ramping up EV battery assembly in Mexico. With lithium deposits present in Sonora, Mexico is looking into possible domestic lithium extraction with the objective of integrating with the North American battery supply chain.

Competitive Landscape:

The North America lithium-ion battery market is represented by the presence of key players competing through technological advancements in order to expand their capacities. Companies are investing in gigafactories to localize production and also mitigate supply chain risks. Strategic partnerships between automobile manufacturers, battery manufacturers, and raw material suppliers add to the competition intensity. For example, in May 2024, Li-Cycle partnered with Daimler Truck North America to recycle lithium-ion batteries from electric vehicles to support DTNA's circular economy for extending battery life, minimizing waste, and enhancing sustainability efforts. In addition, battery recycling endeavors by new companies are fortifying the market. Government incentives for domestic production and innovative battery chemistries further define the industry's competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the North America lithium-ion battery market with detailed profiles of all major companies, including:

- A123 Systems

- Duracell Inc.

- Tesla Inc.

- Saft America

- Johnson Controls

- CANBAT Technologies Inc.

- Corvus Energy

- Prime Power

- Panasonic Corporation

Latest News and Developments:

- In December 2024, Excelsior Energy Capital partnered with LG Energy Solution Vertech in a multiyear deal for 7.5 GWh of lithium-ion energy storage, supporting U.S. domestic content requirements. Deliveries begin in April 2026, aligning with North America's ESS market growth, projected to reach 103 GWh by 2030.

- In November 2024, Evlo secured a deal to supply 300 MWh of UL 9540-certified EVLOFLEX battery storage to Dominion Energy for three large-scale projects in Virginia. The agreement enhances grid reliability and supports growing U.S. energy storage demand, with deliveries meeting Dominion’s specified safety and performance standards.

- In September 2024, Saft, a TotalEnergies subsidiary, expanded lithium-ion battery production at its Jacksonville, Florida plant to meet rising U.S. ESS demand. The investment enhances domestic supply chains, creates jobs, and supports renewable energy, microgrids, and grid stability, aligning with the U.S.'s growing ESS market, projected at 484 GWh by 2030.

North America Lithium-ion Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Countries Covered | United States, Canada, Mexico |

| Companies Covered | A123 Systems, Duracell Inc., Tesla Inc., Saft America, Johnson Controls, CANBAT Technologies Inc., Corvus Energy, Prime Power, Panasonic Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America lithium-ion battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America lithium-ion battery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lithium-ion battery market in the North America was valued at USD 20.0 Billion in 2024.

The North America lithium-ion battery market is growing due to rising EV adoption, expanding renewable energy storage, consumer electronics demand, government incentives, and advancements in battery technology. Increased domestic manufacturing, critical mineral sourcing, recycling initiatives, and sustainability goals further drive market expansion, supporting energy transition and supply chain resilience across industries.

The North America lithium-ion battery market is projected to exhibit a CAGR of 10.7% during 2025-2033, reaching a value of USD 49.7 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)