North America Limestone Market Size, Share, Trends and Forecast by Size, End-Use, Type, and Country, 2025-2033

North America Limestone Market Size and Share:

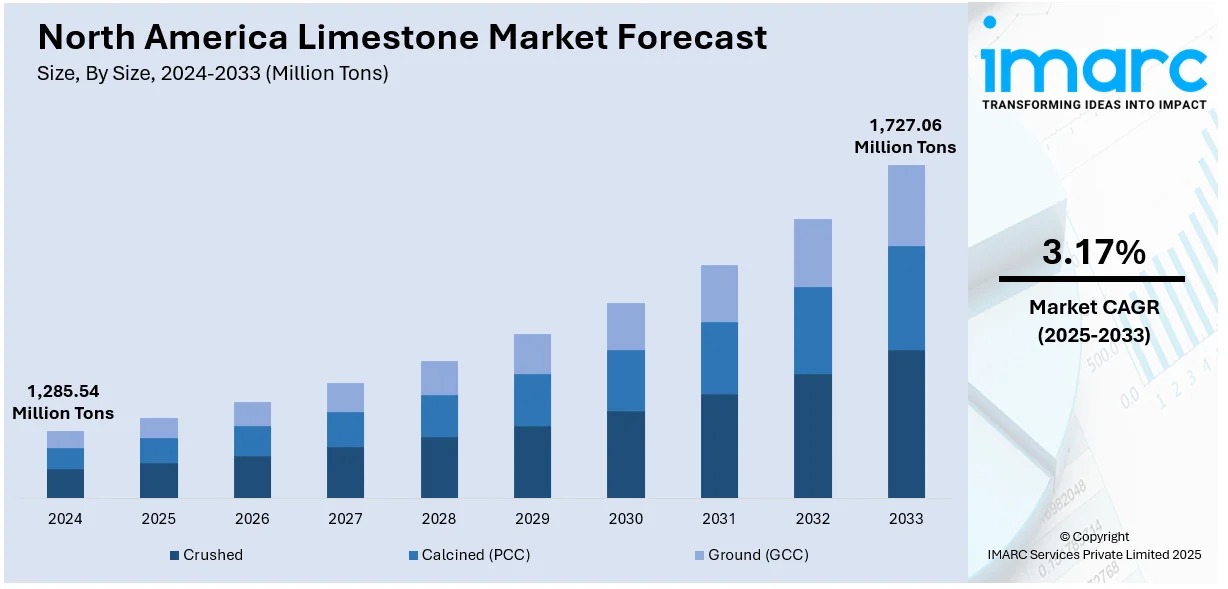

The North America limestone market size was valued at 1,285.54 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 1,727.06 Million Tons by 2033, exhibiting a CAGR of 3.17% from 2025-2033. The market share is expanding, driven by the increasing need for construction materials, rising construction projects like roads, bridges, residential units, and commercial spaces, and heightened improvements in extraction techniques, such as more efficient blasting and automated machinery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1,285.54 Million Tons |

|

Market Forecast in 2033

|

1,727.06 Million Tons |

| Market Growth Rate 2025-2033 | 3.17% |

A major factor influencing the North American limestone market is the increasing need for construction materials. Limestone serves as an essential raw material for cement production, which is crucial for building residential, commercial, and infrastructure developments. As cities in North America keep growing due to urbanization, the demand for construction projects like roads, bridges, residential units, and commercial spaces is rising. This has resulted in an increased need for limestone, utilized not only in cement but also in concrete aggregates and as crushed stone for roadway development. The shift toward reducing industrial emissions and mitigating environmental impact is significantly driving the demand for limestone products in North America, especially in industries aiming for carbon neutrality.

Advances in mining technologies and limestone processing have been crucial in determining the market landscape. Improved extraction techniques, such as more efficient blasting and automated machinery, have made limestone mining operations more productive and cost-effective. Innovations in processing technology, such as enhanced crushing and grinding equipment, have also enabled the production of finer and more specialized limestone products. These technological improvements have expanded the range of applications for limestone, including its use in high-quality chemical products, fertilizers, and even in the steel industry as a fluxing agent.

North America Limestone Market Trends:

Growing Demand from Construction Industry

The construction sector remains the primary consumer of limestone in the North American market. Limestone is essential in the production of cement, which is crucial for constructing buildings, roads, bridges, and other infrastructure projects. With ongoing urbanization across North America, particularly in the United States and Canada, the demand for residential, commercial, and industrial buildings continues to rise. Additionally, infrastructure projects funded by both public and private investments are expanding rapidly. For example, government initiatives have prioritized modernizing roads, bridges, and utilities, all of which require large quantities of limestone-based products. The need for aggregates and crushed stone for road construction and other applications further intensifies this demand. As cities grow and infrastructure needs increase, limestone will remain a key component in the construction supply chain, ensuring sustained market growth. The Alberta government declared that numerous road and bridge projects were finished in 2024. In the 2024 construction season, the government of Alberta dedicated $818 million to over 200 projects aimed at ensuring the safe and efficient transportation of people, goods, and services.

Environmental Regulations and Rise of Sustainable Practices

Environmental sustainability has become a pivotal concern in various industries, driving the North America limestone market demand. Limestone-based products, particularly lime, are widely used in pollution control applications such as flue gas desulfurization (FGD) and wastewater treatment. As stricter environmental regulations are enforced, especially regarding emissions and water quality, industries are turning to limestone for solutions to mitigate environmental impacts. For instance, lime is employed in power plants to remove sulfur dioxide (SO2) from exhaust gases, contributing to cleaner air. Similarly, limestone helps neutralize acidic soils and improves agricultural productivity, which is becoming more important as agriculture embraces sustainable practices. With increasing pressure to meet environmental standards, industries are increasingly relying on limestone to ensure compliance with pollution control regulations, promoting further growth in the market. The continued focus on reducing carbon footprints and minimizing ecological damage will bolster limestone demand across multiple sectors. Moreover, the IMARC Group predicts that the US green cement market is projected to reach USD 31,241.8 Million by 2032. This will further drive the need for limestone in the region.

Technological Advancements in Mining and Processing

Advancements in mining technologies and limestone processing have significantly improved the efficiency and profitability of limestone production. Innovations in extraction methods, such as more precise blasting techniques, automated machinery, and advanced drilling equipment, have increased production rates while reducing operational costs. The ability to meet the diverse requirements of different sectors, from construction to chemicals, has opened new markets and applications for limestone. These technological improvements are helping companies optimize resource extraction, reduce waste, and minimize environmental impacts, thereby supporting the continued growth of the limestone market in North America. As technology continues to evolve, the market will likely see increased efficiency and lower costs, further driving demand. In 2024, by employing both water testing and machine learning (ML), a study led by the U.S. Geological Survey estimated that there are between 5 and 19 million tons of lithium reserves in a geological unit referred to as the Smackover Formation. The Smackover Formation is a remnant of a prehistoric ocean that has resulted in a large, porous, and permeable limestone geological layer found beneath regions of Arkansas, Louisiana, Texas, Alabama, Mississippi, and Florida.

North America Limestone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America limestone market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on size, end-use, and type.

Analysis by Size:

- Crushed

- Calcined (PCC)

- Ground (GCC)

One of the most common forms of limestone and often used forms is crushed limestone. The application of crushed limestone can be seen in large sectors, with construction and infrastructure being the main ones. This form of limestone is obtained mechanically by breaking down bigger pieces of limestone rocks into smaller, uniform pieces. It is used as an aggregate for concrete, asphalt, road construction, and also as a base material for railroads, roads, and foundations.

Calcined limestone, also known as quicklime or calcium oxide (CaO), is produced by heating limestone to high temperatures in a kiln, causing it to break down into calcium oxide and carbon dioxide. This process, called calcination, makes PCC (Precipitated Calcium Carbonate) a valuable product in various industrial applications, particularly in the production of lime, which is used in steel manufacturing, chemical processing, water treatment, and flue gas desulfurization.

Ground limestone, or ground calcium carbonate (GCC), is produced by grinding high-purity limestone into a fine powder. It is widely used in the manufacturing of various products, including paints, coatings, plastics, rubber, and agriculture. GCC is particularly valued for its ability to provide a smooth texture and act as a filler material that enhances the performance and cost-effectiveness of end products.

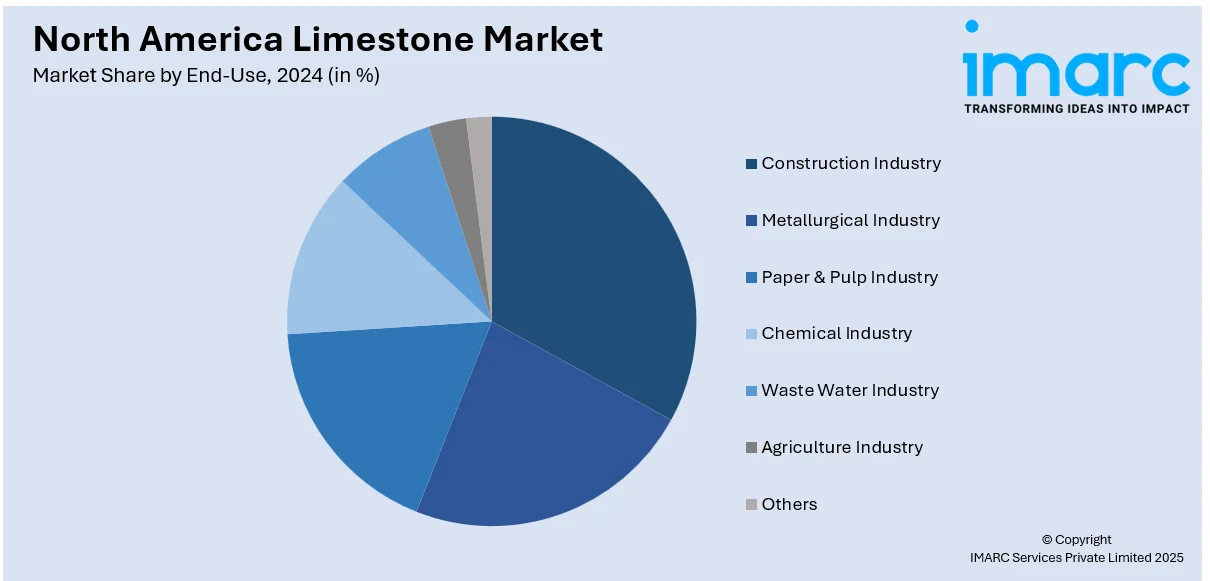

Analysis by End-Use:

- Construction Industry

- Metallurgical Industry

- Paper & Pulp Industry

- Chemical Industry

- Waste Water Industry

- Agriculture Industry

- Others

The construction industry holds the biggest market share. One of the most significant uses of limestone in construction is as a primary ingredient in cement production. Limestone is heated in a kiln to produce lime (calcium oxide), which is then mixed with other materials like clay and gypsum to create cement. Cement is the binding agent in concrete, one of the most widely used construction materials. The demand for cement, and consequently limestone, has surged with the growth of the global construction industry. Whether in residential buildings, commercial projects, or infrastructure such as highways and bridges, cement produced from limestone is integral to the stability and durability of the structures. Limestone is also commonly used as an aggregate in concrete production. Aggregates are essential for enhancing the strength and durability of concrete, and limestone’s physical properties make it a favored material in this application. It can be crushed and screened into different sizes to serve various construction needs, from coarse aggregates for heavy-duty concrete to finer aggregates for more precise construction applications.

Analysis by Type:

- High Calcium Limestone

- Magnesian Limestone

High calcium limestone represents the largest segment. High calcium limestone is a key ingredient in the production of lime (calcium oxide) when heated at high temperatures. Lime is essential in a range of industrial processes, including steel manufacturing, where it acts as a fluxing agent to remove impurities such as silica, phosphorus, and sulfur. Additionally, it is widely used in water treatment and flue gas desulfurization. The high calcium content ensures that the limestone can be efficiently converted into lime, enhancing its performance in neutralizing acidic compounds and improving industrial efficiency. In the chemical industry, high calcium limestone is also used as a raw material for producing calcium-based chemicals, which are integral to many processes.

Country Analysis:

- United States

- Canada

The United States represent the leading region in the market. The increasing use of limestone in cement production is impelling the North America limestone market growth. In addition to cement production, limestone is used in road construction as an aggregate and in the manufacturing of concrete. Crushed limestone serves as a key component in the production of asphalt and provides essential strength to the roads and highways that are crucial for transportation. The US government’s focus on modernizing infrastructure and increasing public spending on construction projects has played a crucial role in driving limestone demand, with projections indicating sustained growth in the sector. Technological innovations in mining and processing techniques have had a profound impact on the US market. Modern extraction techniques, such as advanced blasting methods and automated mining equipment, have improved efficiency and lowered the costs associated with limestone extraction. These technological advancements have enabled limestone producers to access high-quality reserves more easily, reducing production costs and ensuring consistent product quality. In 2024, Cemex revealed a partnership agreement with sand and gravel provider Couch Aggregates and marine bulk product distributor Premier Holdings. This agreement is a component of Cemex's continued plan to boost growth in the US and enhance its aggregates sector. This partnership will bolster Cemex's aggregate reserves through the production, distribution, and sale of gravel, sand, and limestone in the Mid-South, enhancing its presence and delivering improved and quicker service to this expanding area.

Competitive Landscape:

One of the primary strategies employed by leading companies in the North American limestone market is the continuous investment in technology to enhance mining, processing, and product development processes. These investments aim to increase efficiency, reduce operational costs, and improve product quality. Many companies are adopting state-of-the-art technologies to optimize the extraction and processing of limestone. Advanced mining equipment, such as automated drills, trucks, and excavation machinery, helps companies reduce labor costs while improving extraction precision. To keep pace with the rising demand for limestone products, particularly in the construction and infrastructure sectors, several leading limestone producers in North America are expanding their production capacities. This strategy helps to ensure a steady supply of limestone, even amid fluctuating demand.

The report provides a comprehensive analysis of the competitive landscape in the North America limestone market with detailed profiles of all major companies, including:

- Graymont

- Lhoist

- Carmeuse

- United States Lime and Minerals Inc.

- Iowa Limestone Company

- Mississippi Lime Company

Latest News and Developments:

- May 2023: The Canadian exploration firm Durango Resources has obtained permits from the British Columbia Ministry of Energy, Mines and Petroleum Resources to extract limestone from its Mayner’s Fortune property situated near Terrace in the province.

- August 2024: Graymont has launched a worldwide initiative to enhance its brand, showcasing the company's top-tier lime operations and highlighting its rapid growth as a global supplier of low-carbon, calcium-based solutions. Calcium is the vital mineral and the fundamental component of Graymont’s entire product range, which includes limestone and lime as well as more intricate solutions that use high-purity lime and carefully formulated mixtures of calcium compounds.

- July 2024: The Honourable Steven Guilbeault, Minister of Environment and Climate Change, along with the Honourable Elvis Loveless, Minister of Fisheries, Forestry and Agriculture, declared the establishment of a significant area for at-risk species, the Limestone Landscapes of the Great Northern Peninsula Priority Place in Newfoundland and Labrador.

- September 2024: A company located in Halifax stated that it anticipates receiving US$25.4 million for projects designed to decrease greenhouse gas emissions by blending crushed limestone into rivers in Canada and Scandinavia. The initial project from CarbonRun is underway, with lime being introduced to the West River in Pictou County at Watervale, N.S., roughly 45 kilometers east of Truro.

- October 2024: Kentucky Fertilizer launched two unique products created especially for the turf industry, comprising mini-lime pellets and mini-gypsum pellets. These novel products are developed to provide optimal soil health and enhanced turf quality.

North America Limestone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | Crushed, Calcined (PCC), Ground (GCC) |

| End-Uses Covered | Construction Industry, Metallurgical Industry, Paper & Pulp Industry, Chemical Industry, Waste Water Industry, Agriculture Industry, Others |

| Types Covered | High Calcium Limestone, Magnesian Limestone |

| Countries Covered | United States, Canada |

| Companies Covered | Graymont, Lhoist, Carmeuse, United States Lime and Minerals Inc., Iowa Limestone Company and Mississippi Lime Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, North America limestone market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America limestone market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America limestone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America limestone market was valued at 1,285.54 Million Tons in 2024.

The key drivers of market growth include the increasing demand for construction materials, rising infrastructure projects such as roads, bridges, and commercial spaces, and advancements in extraction techniques like automated machinery and improved blasting. Additionally, the push for sustainable building materials and environmental applications such as flue gas desulfurization and wastewater treatment are further fueling market expansion.

The North America limestone market is projected to exhibit a CAGR of 3.17% from 2025-2033, reaching a value of 1,727.06 Million Tons by 2033.

The construction industry holds the largest market share due to the high demand for limestone in cement production, road construction, and infrastructure projects. The growing urbanization, government investments in public works, and residential and commercial development continue to drive demand in this sector.

The high-calcium limestone segment dominates the market, driven by its extensive use in steel manufacturing, environmental applications, and cement production. High-calcium limestone is essential for lime production, which is widely used in water treatment, flue gas desulfurization, and various industrial processes.

Some of the major players in the North America limestone market include Graymont, Lhoist, Carmeuse, United States Lime and Minerals Inc., Iowa Limestone Company, and Mississippi Lime Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)