North America Laser Diode Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

North America laser diode Market Size and Share:

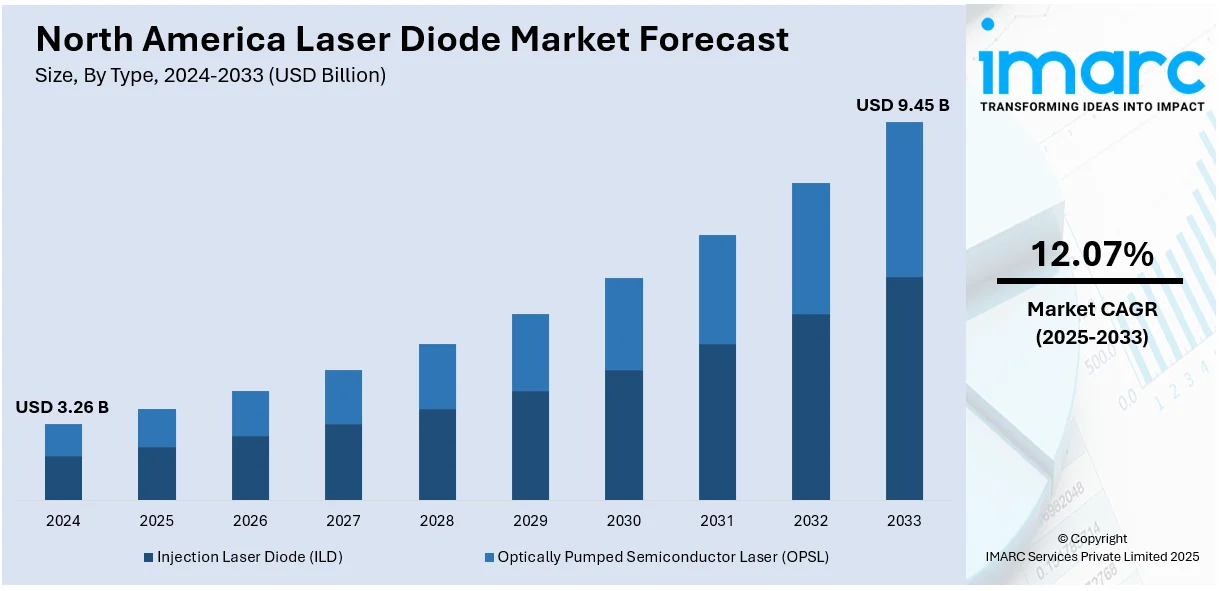

The North America laser diode market size was valued at USD 3.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.45 Billion by 2033, exhibiting a CAGR of 12.07% from 2025-2033. The market shows continuous growth because of improved telecommunications, healthcare, and developments in automotive technology and consumer electronics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.26 Billion |

|

Market Forecast in 2033

|

USD 9.45 Billion |

| Market Growth Rate (2025-2033) | 12.07% |

The North American market for laser diodes expands due to increasing medical device requirements. Laser diodes are widely utilized in treatments such as eye surgery, dental procedures, and diagnostic imaging. Their precision and ability to provide targeted energy make them ideal for minimally invasive surgeries, improving patient outcomes. For instance, in February 2024, BIOLASE unveiled the Waterlase iPlus Premier Edition, a cutting-edge all-tissue laser system, reinforcing its position as a globally recognized leader in dental laser technology. It offers comprehensive service support and remote diagnostics, providing dental professionals with innovative, customizable, and efficient solutions. The expansion of healthcare services, particularly in the field of dermatology and ophthalmology, is further fueling the adoption of laser diodes in medical technologies. Furthermore, as healthcare systems focus on improving patient care with advanced tools, the market for laser diodes continues to see significant growth.

Another significant factor includes the increasing integration of laser diodes in consumer electronics and communication systems. In particular, laser diodes are essential in optical storage devices, 3D projectors, and high-definition displays. For instance, in April 2024, Harkness Screens introduced its fifth-generation Hugo SR 2D/3D screen technology at CinemaCon 2024. Hugo SR is developed over five years and engineered to support all types of laser projection, including RGB laser diode, thereby enhancing the overall cinema experience. The rise of technologies like augmented reality (AR) and virtual reality (VR) also contributes to market growth, with laser diodes being pivotal for their display and tracking systems. Moreover, the demand for faster and more reliable data transmission in telecommunications, supported by laser diode-based components, is accelerating the adoption of these technologies in both consumer and industrial applications.

North America Laser Diode Market Trends:

Increasing Demand in Medical Applications

The North America laser diode market is experiencing significant growth due to the rising demand for laser diodes in medical applications. Laser diodes are widely used in medical devices for various purposes, such as in laser surgeries, diagnostics, and therapies. For instance, as per industry reports, approximately 800,000 laser vision correction surgeries are performed annually in the U.S., which is significantly increasing the laser diode demand. Their precision, compact size, and ability to provide targeted energy make them ideal for medical technologies like laser surgery equipment, dental lasers, and skin treatments. As healthcare standards evolve, especially in minimally invasive procedures, the market demand for advanced laser diodes continues to rise. Additionally, the growing adoption of laser-based imaging systems in diagnostic procedures further accelerates market growth, highlighting the importance of innovation in medical laser technology.

Growth of Consumer Electronics Industry

The North America laser diode market is benefiting from the expanding consumer electronics sector, where laser diodes play a crucial role in various devices. Laser diodes are integral components in optical drives, such as Blu-ray players, DVD players, and gaming consoles. Additionally, the use of laser diodes in advanced display technologies, including OLED and laser projectors, has been on the rise. As consumers continue to demand high-quality, compact devices with enhanced performance, the need for laser diodes in consumer electronics will continue to grow. With technological advancements in display technology, augmented reality (AR), and virtual reality (VR) devices, laser diodes are poised to maintain a strong presence in the market. For instance, in July 2024, ImmersiveTouch announced that its augmented reality platform, ImmersiveAR, has received FDA 510(k) clearance for clinical use. The platform enhances surgical planning, reducing preparation time and improving patient outcomes in various procedures. Consequently, as AR and VR technologies expand in these fields, the need for advanced components such as laser diodes grows.

Technological Advancements and Innovation in Laser Diodes

Technological advancements in laser diode technologies are playing a pivotal role in driving market growth in North America. Manufacturers are focusing on innovations such as high-power laser diodes, multi-wavelength devices, cooling technology, and improved energy efficiency to meet the growing demand across several industries. For instance, in June 2024, Sinclair North America expanded its portfolio to include the Primelase Diode Laser System to offer advanced hair removal technology. The system is recognized for its powerful performance, incorporating a dynamic cooling system that enhances patient comfort and ensures efficient results across all skin types and hair colors. Moreover, the development of blue and violet laser diodes has enabled new applications in high-density optical storage and advanced lighting systems. These innovations enhance the performance and longevity of laser diodes, further driving their adoption across industries such as telecommunications, defense, and automotive.

North America Laser Diode Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America laser diode market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Injection Laser Diode (ILD)

- Optically Pumped Semiconductor Laser (OPSL)

Injection laser diodes (ILD) are the leading type segment, propelled by their high efficiency, compact size, and versatile applications. ILDs are widely used in telecommunications, fiber optic networks, healthcare, and consumer electronics due to their ability to deliver precise, stable, and high-power light output. Their reliability and cost-effectiveness make them ideal for both commercial and industrial applications. Furthermore, ILDs are favored for their fast switching capabilities and excellent beam quality, enabling advancements in data transmission, medical diagnostics, and laser-based imaging technologies. As demand for high-performance and energy-efficient laser solutions continues to grow, ILDs are expected to maintain their dominant position in the market.

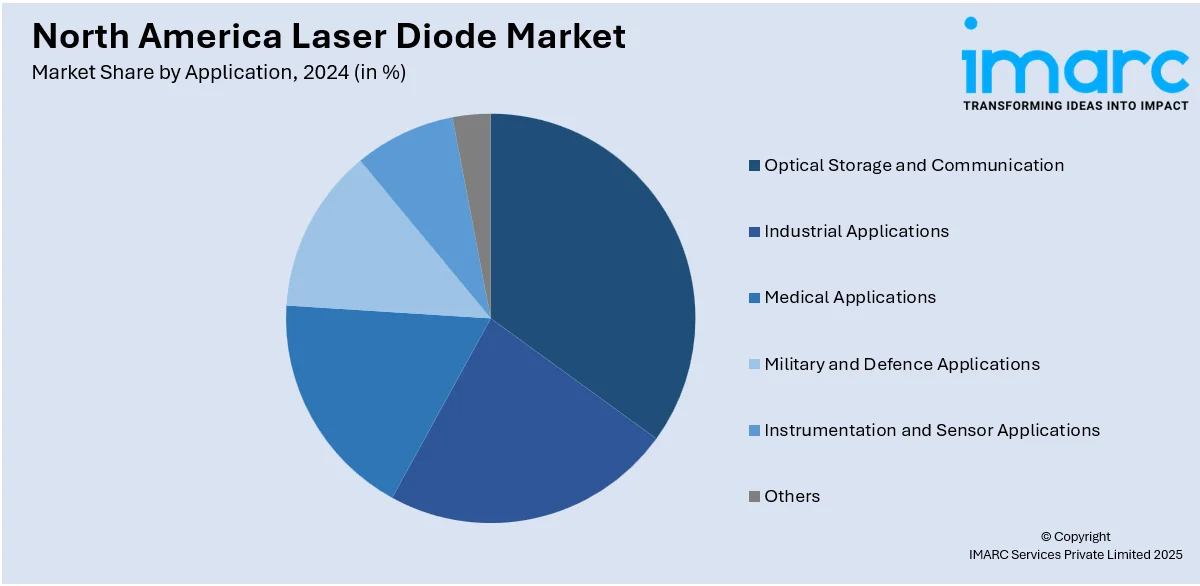

Analysis by Application:

- Optical Storage and Communication

- Industrial Applications

- Medical Applications

- Military and Defence Applications

- Instrumentation and Sensor Applications

- Others

Industrial applications are the leading segment, driven by the increasing demand for laser diodes in manufacturing, materials processing, and automation. Laser diodes are integral to precision tasks such as laser cutting, welding, marking, and engraving, offering high-speed, high-accuracy solutions. Their ability to deliver focused beams with minimal thermal distortion makes them essential for high-quality industrial applications. Additionally, the growing trend of automation in industries such as automotive, electronics, and aerospace further accelerates the adoption of laser diodes. As industries prioritize efficiency, productivity, and precision, laser diodes continue to be a vital component for enhancing operational capabilities and ensuring consistent output in various industrial processes. This growing demand is reflected in the North America laser diode market share, which continues to expand alongside these industrial advancements.

Country Analysis:

- United States

- Canada

The United States holds the leading position in the market, influenced by its advanced technology infrastructure and strong demand across key industries. The country’s substantial investments in telecommunications, healthcare, defense, and industrial applications fuel the market's growth. The U.S. is a hub for research and development, with numerous innovations in laser technologies being driven by academic institutions, private companies, and government agencies. Additionally, the widespread adoption of fiber optic networks, medical devices, and automation systems in the U.S. further accelerates the demand for laser diodes. The favorable regulatory framework and a strong manufacturing infrastructure further supports the U.S.'s dominant control in the region. Furthermore, insights from North America laser diode market price analysis reveal a steady upward trend driven by the growing need for high-performance applications in various sectors.

Competitive Landscape:

The North America laser diode market displays intense competition where established and emerging companies focus their efforts on creating innovative differentiated products. Major organizations continue developing laser diode solutions which enhance performance and power quality while expanding functionality across telecommunications, healthcare and automotive industries. Strategic partnerships together with mergers and acquisitions have become typical business practices that help companies extend their market coverage and improve their product range. Additionally, organizations dedicate funds to research and development activities to develop high-performance and cost-effective solutions because of rising market demand. For instance, in September 2024, researchers from the University of Notre Dame received a USD 550,000 National Science Foundation grant to develop a laser diode that generates a circular beam, improving fiber optic networks, materials science, and system efficiency. Furthermore, the competitive environment stems from technical advancements coupled to rising market demands for sustainable and environmentally friendly products.

The report provides a comprehensive analysis of the competitive landscape in the North America laser diode market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Laserline acquired a 70% stake in Boston-based WBC Photonics, enhancing its portfolio with blue diode lasers featuring exceptional beam quality. This acquisition strengthens Laserline’s position as a global leader in high-power, high-focus blue diode laser solutions and broaden Boston-based WBC Photonics portfolio globally.

- In October 2024, Coherent Corp. launched the ARM FL20D fiber laser, offering 20 kW power and a dual ring beam configuration. This laser enhances welding speed, quality, and efficiency, eliminating the need for filler wire in many applications, particularly in automotive and aerospace industries.

North America Laser Diode Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Injection Laser Diode (ILD), Optically Pumped Semiconductor Laser (OPSL) |

| Applications Covered | Optical Storage and Communication, Industrial Applications, Medical Applications, Military and Defence Applications, Instrumentation and Sensor Applications, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America laser diode market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America laser diode market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America laser diode industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America laser diode market was valued at USD 3.26 Billion in 2024.

The factors driving the market include growing demand for high-speed communication, advancements in medical technologies, and the increasing adoption of laser diodes in industrial applications such as material processing and automation. Additionally, magnifying demand for consumer electronics and automotive applications further supports market growth.

IMARC estimates the North America laser diode market to reach USD 9.45 Billion in 2033, exhibiting a CAGR of 12.07% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)