North America Instant Noodles Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Country, 2025-2033

North America Instant Noodles Market Size and Share:

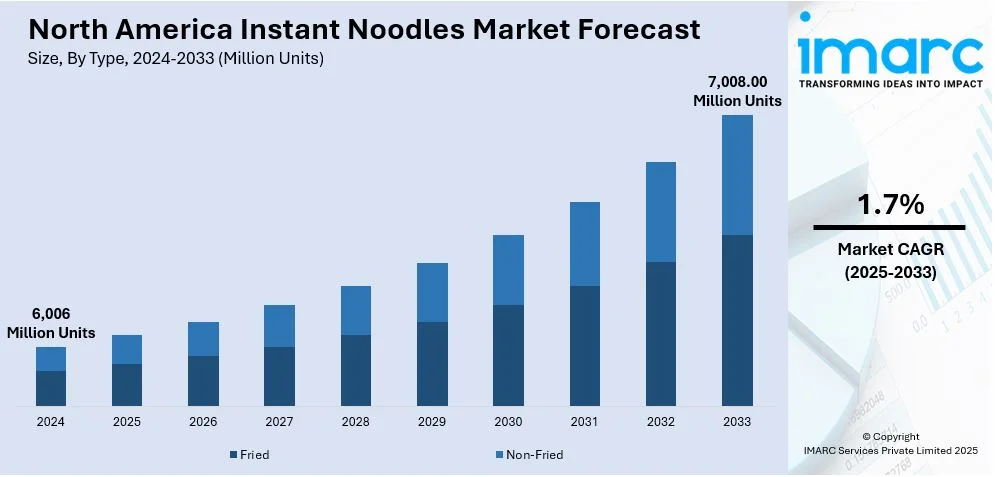

The North America instant noodles market size was valued at 6,006 Million Units in 2024. Looking forward, IMARC Group estimates the market to reach 7,008.00 Million Units by 2033, exhibiting a CAGR of 1.7% from 2025-2033. The rising interest in Asian cuisine and demand for affordable meals are key factors offering a favorable market outlook. Product innovation providing healthier options and premium flavors, alongside increased retail availability through supermarkets and e-commerce platforms, further drives the North America instant noodles market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

6,006 Million Units |

|

Market Forecast in 2033

|

7,008.00 Million Units |

| Market Growth Rate (2025-2033) | 1.7% |

As consumers in the North American region are growing bolder in their food selections, they are looking for genuine Asian tastes. The growing prominence of Japanese, Korean, and Chinese cuisines is rendering instant noodles a favored meal choice. The food culture of Asia, particularly noodle dishes, such as ramen and pho, is experiencing growing appreciation and acceptance. Restaurants, food trucks, and media outlets are showcasing Asian cuisine, leading to an increased demand for Asian-inspired products. Instant noodle manufacturers are providing items that imitate genuine regional flavors, broadening their attractiveness. Food blogs and social media showcase Asian noodle recipes, motivating consumers to try out instant noodles. The increasing presence of Asian restaurants and grocery stores in North America is catalyzing the popularity of instant noodles. Pop culture familiarizes younger generations with instant noodles, thereby enhancing market expansion.

Affordable food options are driving the North America instant noodles market demand. Instant noodles provide a budget-friendly solution for consumers looking to stretch their food budgets. As living costs increase, many individuals and families are turning to cost-effective meal alternatives like instant noodles. For college students and young professionals, instant noodles are a quick, inexpensive, and filling meal choice. Instant noodles are very affordable and can find their way into the lower-income household with a limited food budget. Lower-priced meals tend to remain the choice for consumers in economic downturn or under uncertainty. Instant noodles are usually sold in bulk to offer more value for money-thus, enhancing their appeal. They also come in single servings, targeting those who enjoy fast, economical meals without having to deal with leftovers. Some parents prefer instant noodles because they are an affordable meal to feed their children easily. In addition, there are always retail promotions in supermarkets and discount stores making instant noodles even cheaper. Even expensive instant noodles are marketed as affordable indulgences, allowing consumers to indulge in a change of flavor without overindulging.

North America Instant Noodles Market Trends:

Expansion of e-commerce and retail platforms

The expansion of e-commerce and retail platforms is significantly driving the instant noodles market in North America. According to the data published by U.S Census Bureau, US retail e-commerce sales estimate for Q3 2024 reached $288.8 Billion. This has risen by 2.2% since Q2 2024. At the same point, e-commerce sales are growing by 7.5%, whereas total retail sales have risen by 2.0% as compared to Q3 2023. Online marketplaces offer consumers easy access to a wide range of instant noodle brands and flavors. Supermarkets and hypermarkets are expanding shelf space for instant noodles, thus increasing product visibility and availability. Discount retailers and convenience stores are stocking budget-friendly options, attracting price-sensitive customers seeking affordable meals. Subscription-based online grocery services are promoting instant noodles, ensuring recurring purchases and higher consumer engagement. The digital marketing strategies are targeting advertisements, influencing online sales and brand awareness for instant noodles. Social media influencers and food bloggers are recommending various brands to the target market, thus compelling younger consumers to try new flavors. The collaboration between retailers and manufacturers introduces exclusive products, generating excitement and demand in the market. International brands are entering the North American market by selling on online platforms and increase the diversity of available consumer products.

Busy lifestyles and rising convenience demand

Consumers like fast and easy meal solutions, which is why instant noodles are becoming popular among busy people. Working professionals and students consume instant noodles as a quick, filling meal when they are in a rush. According to the data released by the OECD, the employment rate kept increasing and was at 64.1% in Q1 2024, up by 1.7% from Q4 2019 in Mexico. The labor force participation of women went up from 49.3% in Q4 2019 to 51.7% in Q1 2024. More dual-income households leave little time for cooking, driving demand for ready to eat (RTE) products. Instant noodles are convenient for individuals seeking quick, RTE food products that consume less time. Microwaveable and cup noodles formats make meals convenient for any time and location. Urbanization and long commuting hours leave little time for cooking at home, and instant noodles become more of a dependency on such foods. Busy parents feed their children instant noodles because it is quick and effortless to prepare. Single-serve pack food products catered to individual consumers particularly to portion control as well as portability in the meal option. Office employees prefer instant noodles for lunch as the preparation is easy, and cleanup is minimal. Increased travel and on the go (OTG) lifestyles make instant noodles the food of choice for the regular traveling population.

Growing product innovation and premiumization

Producers are launching healthier alternatives like low-sodium, organic, and gluten-free noodles to appeal to health-aware buyers. High-quality components, including genuine vegetables, premium proteins, and natural spices, improve the nutritional quality of instant noodles. Distinct and rare tastes, such as truffle, miso, and spicy options, attract daring and upscale customers. Noodles fortified with vitamins, collagen, and probiotics appeal to those looking for nutritional advantages in their food. Companies are introducing plant-based and protein-fortified noodles to appeal to vegans, vegetarians, and health-focused consumers. Air-dried and oven-baked noodles are substituting deep-fried options, tackling worries over high oil intake. Genuine regional tastes, influenced by Japanese, Korean, and Thai dishes, are gaining popularity among international food lovers. Exclusive flavors and seasonal releases generate enthusiasm, motivating consumers to explore novel and creative offerings. For instance, in April 2024, Nissin Foods USA introduced a special edition Cup Noodles flavor, Everything Bagel with Cream Cheese. This flavorful ramen without broth combines sesame, poppy seeds, garlic, onion, and caraway in a luscious cream cheese sauce. Additionally, high-quality packaging featuring reusable containers and biodegradable substances influence brand attractiveness and promotes sustainability awareness.

North America Instant Noodles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America instant noodles market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Fried

- Non-Fried

Fried instant noodles dominate the market due to their affordability, long shelf life, and widespread availability. The frying process removes moisture, allowing noodles to cook faster, making them convenient for busy consumers. Their enhanced taste and texture appeal to consumers who prefer rich, flavorful instant noodle varieties. They absorb flavors effectively, making them a preferred choice for consumers seeking authentic taste experiences. The cost-effective production of fried noodles allows manufacturers to offer competitive pricing, increasing consumer accessibility. They require less boiling time, aligning with consumer demand for quick, hassle-free meal solutions. Fried noodles' widespread presence in supermarkets, convenience stores, and online platforms enhances their market reach. The majority of global instant noodle variants, including ramen and spicy noodles, are fried, which influences their shelf life. Compared to non-fried options, their familiar texture and taste make them the default choice for many. Although air-dried and baked noodles are gaining popularity, fried varieties continue to dominate due to preference. Their ability to retain structure and consistency even after prolonged storage further contributes to their market leadership.

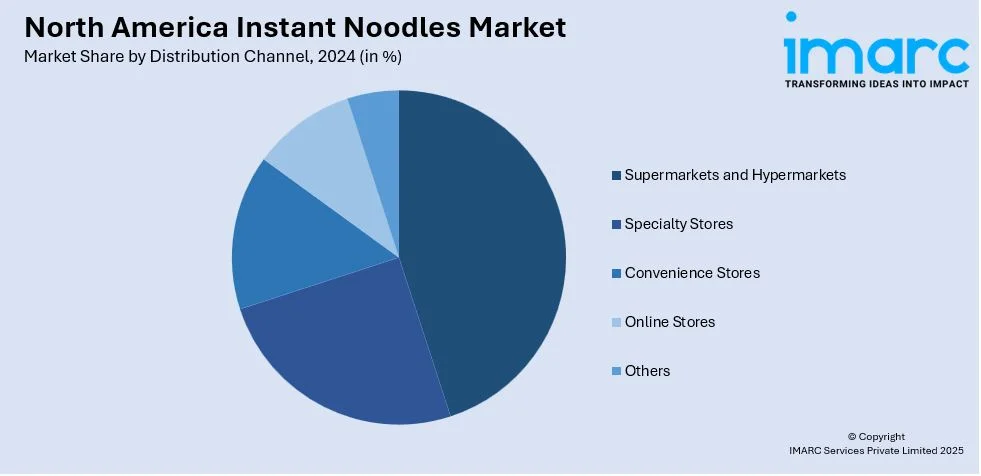

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the distribution of instant noodles due to their extensive product variety and accessibility. Consumers prefer these retail formats as they offer different brands, flavors, and packaging sizes under one roof. Bulk purchasing options in hypermarkets attract cost-conscious consumers looking for affordable meal solutions. Promotional discounts, combo deals, and in-store advertisements drive higher sales in these large retail chains. Supermarkets provide dedicated instant noodle sections, making product discovery and selection easier for shoppers. The presence of international and specialty noodle brands in hypermarkets increases exposure to diverse consumer preferences. Supermarkets' strong supply chains ensure consistent product availability, preventing shortages and maintaining consumer trust. Private-label supermarket brands also contribute to market growth by offering budget-friendly instant noodle alternatives. The ability to physically examine products before purchase makes supermarkets preferable over online shopping for some consumers. Many supermarkets now integrate online grocery delivery, further strengthening their influence in the instant noodles market. Their widespread geographic presence ensures broad consumer reach, influencing their dominant share in instant noodle distribution.

Country Analysis:

- United States

- Canada

- Mexico

The United States stands at the forefront of the instant noodles market owing to its large consumer base and diverse demographics. The increasing popularity of Asian cuisine is significantly contributing to the growing demand for instant noodles. Immigrant communities from Japan, China, and Korea drive demand for authentic noodle flavors and varieties. Leading brands, manufacture products locally, ensuring widespread availability and competitive pricing. The strong presence of supermarkets, convenience stores, and online platforms facilitates easy access to instant noodles nationwide. College students, office workers, and budget-conscious consumers favor instant noodles as an affordable and convenient meal option. The influence of social media and food bloggers promotes instant noodles as a trendy and versatile dish. The expanding e-commerce sector allows consumers to explore international noodle flavors without geographic limitations. Restaurants and food service providers incorporate instant noodles into menus, further driving market demand. Marketing campaigns targeting younger consumers through digital platforms increase brand awareness and product adoption. The rise of home cooking trends has further popularized instant noodles as a quick meal solution. For example, in November 2024, Maruchan expanded its portfolio with customizable Rice Bowls and Wonton Ramen Noodle across the US. The Rice Bowls come in Chicken and Mexican flavors, allowing for personalized toppings. The Wonton Ramen features Chicken and Hot & Spicy Chicken varieties in the brand’s largest bowls, offering a premium soup experience.

Competitive Landscape:

Key players dominate the market with their wide product ranges. These companies invest heavily in product innovation to cater to changing consumer preferences for flavors and ingredients. They introduce healthier, organic, gluten-free, and low-sodium noodle options to meet growing health-conscious demand. Premium products with unique flavors and high-quality ingredients are also being launched to attract more consumers. Key players enhance their market presence through aggressive marketing campaigns, digital promotions, and influencer partnerships. They leverage online platforms and e-commerce channels to expand their reach and cater to a broader customer base. Partnerships with supermarkets, convenience stores, and restaurants further ensure product availability across North America. These companies focus on sustainability, offering eco-friendly packaging and improving manufacturing practices to appeal to environmentally conscious consumers. They also develop limited-edition flavors and seasonal offerings to generate consumer excitement and influence sales. For instance, Nissin Foods USA marked National Noodle Day with 1,006 limited-edition “Oodles of Noodles Complete Collection” boxes for $1.06 each. Featuring 41 noodle products from brands like Cup Noodles and Top Ramen, plus exclusive merchandise. Moreover, strong distribution networks and collaborations with retail chains enable key players to maintain consistent supply across various regions.

The report provides a comprehensive analysis of the competitive landscape in the North America instant noodles market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Maruchan expanded its GOLD instant ramen line to over 1,500 Walmart stores nationwide. Initially launched in Japan in 2013 and introduced to the US in 2019, Maruchan GOLD offers premium flavors like Soy Sauce and Spicy Miso. This expansion makes restaurant-quality ramen more accessible to US consumers looking for a gourmet instant meal.

- November 2024: Borealis Foods expanded its Walmart distribution with "Ramen Noodles by Chef Ramsay," crafted by Gordon Ramsay. Available in 1,300+ stores, the high-protein lineup features Black Garlic Beef and Shiitake Mushroom Chicken. This launch highlights the growing demand for gourmet, protein-rich ramen in the US market.

- August 2024: A-Sha Foods USA teamed up with First We Feast’s “Hot Ones” to launch a spicy ramen collection. It includes three heat levels: Garlic Chili, Smoky Chili, and Sweet Chili.

- July 2024: Nissin Foods USA launched a limited-edition Cup Noodles flavor, Campfire S'mores. This dessert-inspired ramen blends chocolate, marshmallow, graham cracker, and a smoky touch for a unique twist. Easy to prepare in minutes, it was sold exclusively at Walmart, offering a creative take on the classic summer treat.

- July 2023: Omsom launched its Saucy Noodles line in Whole Foods Market US. The collection includes four flavors: Coconut Lemongrass Curry, Soy Garlic, Chili Sesame, and Garlic Black Pepper. Priced at $4.99 per 4.8 oz box, these noodles feature air-dried, knife-shaved noodles paired with rich, authentic sauces, offering a quick and flavorful meal option.

North America Instant Noodles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fried, Non-Fried |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, North America instant noodles market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America instant noodles market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America instant noodles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The instant noodles market in the North America was valued at 6,006 Million Units in 2024.

The North America instant noodles market growth is driven by several factors. These include busy lifestyles demanding quick, convenient meals, rising interest in Asian cuisine, and product innovation offering healthier and premium options. The increasing demand for affordable meal solutions also contributes to market growth, as instant noodles are cost-effective. Additionally, the expansion of e-commerce and retail platforms improves accessibility, while influencer marketing and social media campaigns influencing sales.

The North America instant noodles market is projected to exhibit a CAGR of 1.7% during 2025-2033, reaching a value of 7,008.00 Million Units by 2033.

The fried instant noodles segment accounts for the largest share of the market. Fried noodles are popular due to their rich flavor, quick cooking time, and long shelf life, making them a preferred choice for busy consumers. They are commonly available in various flavors and packaging sizes, contributing to their widespread appeal. The cost-effectiveness of fried noodles makes them an attractive option for price-sensitive consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)