North America Industrial Catalyst Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Country, 2025-2033

North America Industrial Catalyst Market Size and Share:

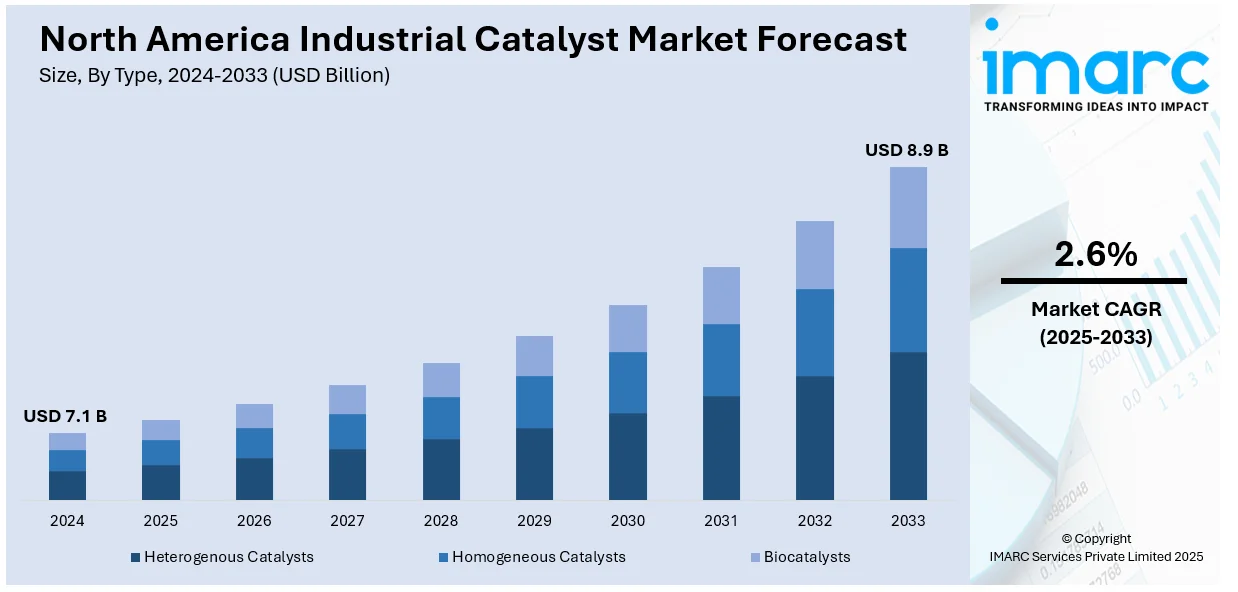

The North America industrial catalyst market size was valued at USD 7.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.9 Billion by 2033, exhibiting a CAGR of 2.6% from 2025-2033. The market is witnessing significant growth due to the rising demand for sustainable and efficient catalysis technologies and growth in the petrochemical and refining industries. Moreover, the shift toward sustainable and bio-based catalysts, high-performance catalysts for selective product yield optimization, and increasing adoption of zeolite and metal-organic framework catalysts are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.1 Billion |

|

Market Forecast in 2033

|

USD 8.9 Billion |

| Market Growth Rate 2025-2033 | 2.6% |

Many industries in North America are integrating advanced catalysts to improve the efficiency of their processes and reduce their emissions in compliance with stringent environmental requirements. The transition to cleaner production processes in petrochemicals, refining, and chemical manufacture are prompting the increased investments into catalysts that promote reaction rates, selectivity, and yield. For instance, in 2024, Brookfield will invest up to $1.1 billion in Infinium to scale ultra-low carbon eFuels, including eSAF, which reduces lifecycle greenhouse gas emissions by 90% or more compared to conventional fuels. Regulatory frameworks such as the Environmental Protection Agency (EPA) mandates and incentives for low-carbon technologies further encourage the adoption of eco-friendly catalysts, including heterogeneous and bio-based variants. The demand for catalysts in renewable fuel production, carbon capture, and sustainable chemical synthesis is also growing, supporting market expansion.

The North American petrochemical and refining sectors remain key consumers of industrial catalysts, with increasing investments in capacity expansions and process optimizations. Rising energy demand and the continued reliance on crude oil and natural gas derivatives drive the need for high-performance catalysts in hydrocracking, fluid catalytic cracking (FCC), and reforming processes. Additionally, the shift toward shale gas-based feedstocks has led to advancements in catalyst formulations to optimize ethylene, propylene, and other petrochemical production. For instance, in 2024, Twelve secured $645 million in funding, including $400 million in project equity, $200 million in Series C financing, and $45 million in credit facilities, marking a major investment in the eFuels sector. Major industry players are investing in research and development to enhance catalyst durability, regeneration efficiency, and adaptability to alternative feedstocks, further propelling market growth.

North America Industrial Catalyst Market Trends:

Shift Toward Sustainable and Bio-Based Catalysts

The North American market for industrial catalysts undergoes a transformation intended for renewable and bio-catalyst solutions due to environmental regulations and commitments made by industries to minimize carbon footprint. Existing metal-based catalysts are now being replaced or complemented with catalysts sourced from renewables, such as biocatalysts and enzyme systems. Companies invest in catalyst innovations that will enable clean synthesis, reduced waste generation, and improvement in energy efficiency. For instance, Drax will supply more than 1 million tonnes of biomass pellets annually to Pathway Energy's $2 billion SAF plant located in Texas, capable of producing 30 million gallons of carbon-negative jet fuel yearly by 2029. At the same time, regulatory initiatives for green chemistry and sustainable manufacturing increase the pace of modernization in catalyst design for circular economy application, like the recycling of plastics and conversion of biofuel

High-Performance Catalysts for Selective Product Yield Optimization

The industrial catalyst market in North America is experiencing a transition toward high-performance catalysts that are focused on selectivity and further enhancement of valuable product yields in refinery and petrochemical processes. Refineries tend to adopt advanced FCC and hydroprocessing catalysts to improve butylene selectivity, naphtha octane, and LPG olefinicity while lowering the production of cokes and dry gas. For instance, in BASF in 2024 launched Fourtiva™, an FCC catalyst that maximizes butylene yields, improves naphtha octane, and minimizes coke formation through AIM and MFT technologies for better refinery economics and lower FCC unit emissions. Zeolite-based catalysts, with tailored pore structures and surface modifications, present refiners with opportunities to derive even greater efficiency and profitability. The rising demand for catalysts that convert feedstock while minimizing waste is heightened by the pressure from emission regulations and the need for sustainable processes.

Increasing Adoption of Zeolite and Metal-Organic Framework (MOF) Catalysts

Zeolite-based catalysts continue to see growing adoption, particularly in refining and petrochemical applications, due to their superior thermal stability, selectivity, and efficiency in hydrocarbon processing. Additionally, metal-organic frameworks (MOFs) are emerging as promising alternatives, offering tunable porosity and exceptional adsorption properties for applications in gas separation, carbon capture, and specialty chemical synthesis. For instance, in 2025, Atoco, led by Yaghi, pioneers MOFs and COFs for Atmospheric Water Harvesting, extracting water efficiently even in arid regions with humidity below 20%, overcoming limitations of traditional methods. With advancements in synthesis techniques and scalability, MOFs are expected to play an expanding role in industrial catalysis, supporting the broader industry shift toward energy-efficient and environmentally friendly processes.

North America Industrial Catalyst Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America industrial catalyst market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, raw material, and application.

Analysis by Type:

- Heterogenous Catalysts

- Homogeneous Catalysts

- Biocatalysts

Heterogenous catalysts take the lead in the market as they provide better stability, reusability, and efficiency in key industrial applications such as petrochemical refining, chemical synthesis, and environmental catalysis. Being solid-phase, they also allow separation from reaction mixtures, thus lowering operational costs and increasing sustainability of processes. These are then applied in hydrocracking, FCC, and selective oxidation in which performance and durability are priorities for industries. They also further development of nanostructured and zeolite-based heterogeneous catalysts driving their adoption concerning the regulatory directives toward cleaner production and energy efficiency in refining, polymerization, and emission control technologies.

Analysis by Raw Material:

- Mixed Catalysts

- Oxide Catalysts

- Metallic Catalysts

- Sulphide Catalysts

- Organometallic Catalysts

Mixed catalysts lead in turning out to become most preferred as they combine the merits of both homogeneous and heterogeneous catalysts in yielding better reaction efficiencies, selective optimum yield, and stability across industrial applications. Their hybrid nature allows improvement in catalytic efficiency in refining as well as petrochemical processing and environmental applications, in which it is important to control very precisely reaction conditions. Industries now make more use of mixed catalysts to improve their processes of hydrocracking, hydrogenation, or polymerization to take advantage of the excellent activity and recyclability that mixed catalysts offer. Advances in catalyst engineering involve metal-organic frameworks (MOFs) and bifunctional catalysts, which further enhance their incorporation with regard to the industry direction toward high performance, energy efficiency, and sustainable catalytic solutions.

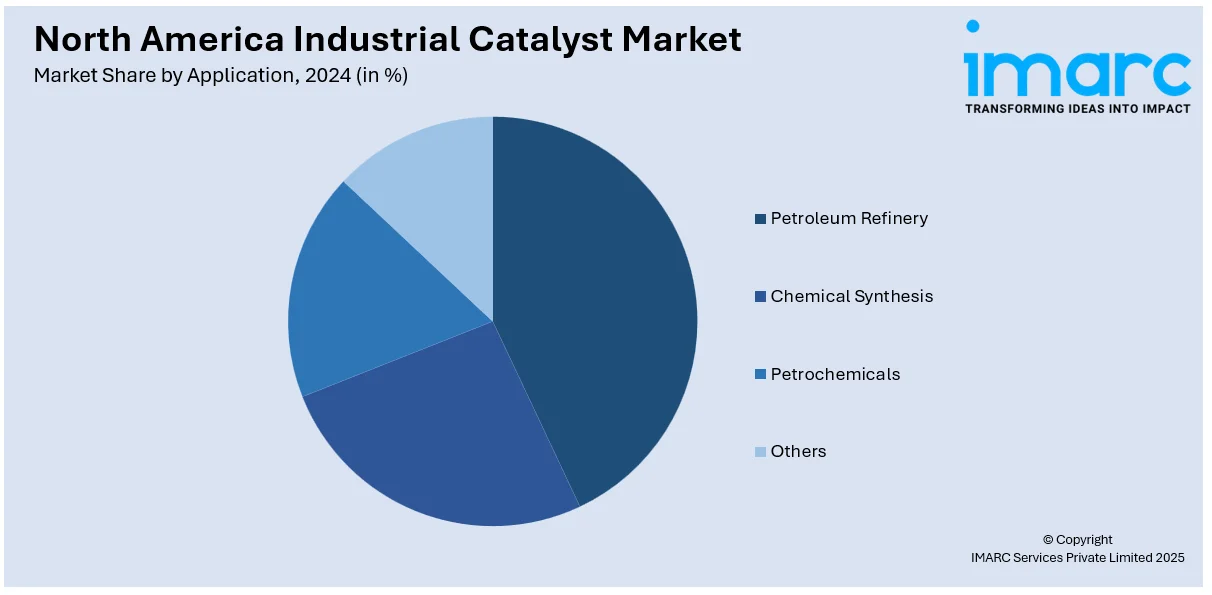

Analysis by Application:

- Petroleum Refinery

- Chemical Synthesis

- Petrochemicals

- Others

Petroleum refinery is the primary source of market demand since it is the largest consumer of industrial catalysts due to the incessant need for fuel production, process optimization, and regulatory compliance with emission standards. Catalysts enable higher efficiency in refining operations such as hydrocracking, fluid catalytic cracking (FCC), desulfurization, and reforming, thereby improving the quality of fuels, reducing adverse environmental impacts, and functioning more efficiently. Innovations in catalyst formulations enhance process selectivity, increase the life of catalysts, and reduce operating costs. Continuous investments in upgrades to the refinery and integration of feedstocks such as shale oil will keep petroleum refining as a leading outlet driving demand for industrial catalysts in North America.

Country Analysis:

- United States

- Canada

- Mexico

United States is the largest producer and consumer of these catalysts worldwide since it has developed a strong petrochemical, refining, and chemical manufacturing base. There are environment-related regulations like those of the EPA on emissions and cleaner fuel standards that hasten the advanced catalyst adoption. Beyond the presence of top catalyst manufacturers, ongoing research in nanocatalysts and sustainable solutions, and heavy investments in refinery upgrades, these factors further buttress the country’s market strength. Added to this, the growing demand for catalysts in renewable energy applications, such as biofuels and hydrogen production, further enhances the position of the United States as a powerhouse in driving innovation and expansion in the industrial catalyst market.

Competitive Landscape:

There are a lot of companies involved in the technological improvements, product innovations, and strategic partnerships in the North American industrial catalyst market, both internationally and domestically. The larger companies are mainly coming up with research and development to increase the efficiency, sustainability, and versatility in the application of catalysts. For instance, in early 2024, a $19.2 million upgrade to BASF's site in Freeport, Texas, in the Petrochemicals Division enhanced the Superabsorbent Polymer production, process optimization, and rail logistics to minimize truck traffic and carbon emissions. Market consolidation is happening through acquisitions and collaborations with end users. There is ever-growing competition in the areas of petrochemicals, refining, and environmental applications, with rising demand for customized catalysts. This coupled with stringent regulations and sustainability requirements providing differentiated products are push factors for corporations to invest in environmentally friendly and high-performance catalyst options.

The report provides a comprehensive analysis of the competitive landscape in the North America industrial catalyst market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Topsoe's TK-930 D-wax™ and TK-920 D-wax™ catalysts enhance cold flow properties in hydrotreating units, offering high isomerization selectivity with minimal diesel yield loss compared to conventional dewaxing catalysts.

- In September 2024, ASTRO America, Stifel’s North Atlantic Capital, and ASTM International will lead a panel at IMTS on funding advanced manufacturing. The discussion will explore private capital investment in defense supply chains and strategies for helping U.S. small businesses adopt manufacturing technology.

- In February 2023, Albemarle launched Ketjen, its wholly-owned subsidiary, specializing in advanced catalyst solutions for petrochemical, refining, and specialty chemicals industries, enhancing efficiency and performance in industrial processes.

North America Industrial Catalyst Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Heterogenous Catalysts, Homogeneous Catalysts, Biocatalysts |

| Raw Materials Covered | Mixed Catalysts, Oxide Catalysts, Metallic Catalysts, Sulphide Catalysts, Organometallic Catalysts |

| Applications Covered | Petroleum Refinery, Chemical Synthesis, Petrochemicals, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America industrial catalyst market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America industrial catalyst market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America industrial catalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial catalyst market in North America was valued at USD 7.1 Billion in 2024.

The growth of the North America industrial catalyst market is driven by increasing demand for efficient refining processes, stringent environmental regulations, advancements in nanocatalysts, and rising adoption of sustainable catalysts. Expanding petrochemical, chemical, and renewable energy industries further propel market expansion, alongside technological innovations enhancing catalyst performance, selectivity, and recyclability.

The North America industrial catalyst market is projected to exhibit a CAGR of 2.6% during 2025-2033, reaching a value of USD 8.9 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)