North America Home Automation Systems Market Size, Share, Trends and Forecast by Application, Type, and Country, 2025-2033

North America Home Automation Systems Market Size and Share:

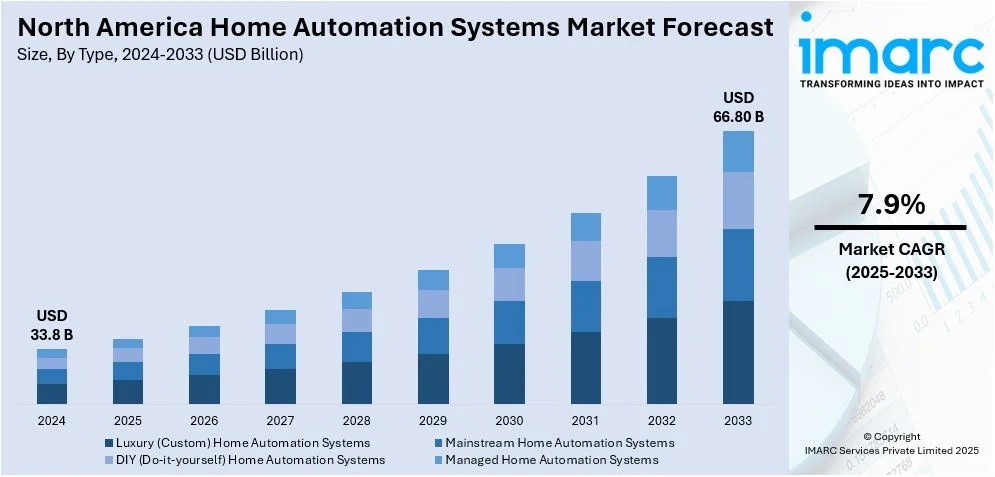

The North America home automation systems market size was valued at USD 33.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 66.80 Billion by 2033, exhibiting a CAGR of 7.9% from 2025-2033. The North America home automation systems market is driven by rising smart home adoption, increasing Intent of Things (IoT) integration, and growing demand for energy-efficient solutions. Advancements in artificial intelligence (AI)-driven home security, voice-controlled assistants, and seamless connectivity further boost adoption. Consumer preference for convenience, remote monitoring, and smart energy management also fuels North America home automation systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 33.8 Billion |

|

Market Forecast in 2033

|

USD 66.80 Billion |

| Market Growth Rate (2025-2033) | 7.9% |

The increasing penetration of smart homes across North America is a key driver of the home automation systems market. Consumers are increasingly prioritizing convenience, security, and energy efficiency, driving the widespread integration of connected devices like smart thermostats, lighting systems, and security solutions. The proliferation of IoT-enabled devices allows seamless connectivity and remote control through mobile applications and voice assistants like Amazon Alexa and Google Assistant. Additionally, smart home ecosystems are becoming more interoperable, encouraging further adoption. Growing investments in smart infrastructure, coupled with declining sensor and chipset costs, are accelerating market expansion by making automation more affordable and accessible.

Growing energy expenses and heightened environmental awareness are fueling the demand for energy-efficient home automation systems across North America. Smart thermostats, automated lighting, and energy monitoring solutions help consumers optimize energy usage while reducing electricity consumption. Government initiatives further accelerate adoption by offering financial incentives, such as the U.S. federal tax credits of up to $3,200 annually through 2032 for energy-efficient home upgrades. Moreover, the Home Efficiency Rebate program provides up to $8,000 for projects that significantly lower household energy use. The integration of renewable energy sources, such as solar panels, improves efficiency, while AI-powered energy management solutions adjust consumption based on user preferences, making home automation a key component of sustainable living.

North America Home Automation Systems Market Trends:

Expansion of AI-Driven Home Automation

Artificial intelligence (AI) is transforming home automation systems in North America through predictive analytics, voice recognition, and machine learning-driven automation. AI-driven devices, such as smart thermostats, lighting controls, and security systems, adapt to user behavior by automatically adjusting settings to maximize comfort and energy efficiency. Virtual assistants like Amazon Alexa, Google Assistant, and Apple’s Siri further enhance the experience through intuitive voice control and tailored recommendations. AI-driven security features, such as facial recognition and anomaly detection, are gaining popularity. As of 2024, 30% of U.S. households had adopted at least one smart home device, with projections reaching 50% by 2025. With AI capabilities advancing, home automation systems are becoming more intuitive, allowing homeowners to manage their spaces effortlessly with minimal manual intervention.

Increased Adoption of Interoperable Smart Home Ecosystems

Interoperability is emerging as a key trend in the North American home automation market, driven by consumer demand for seamless integration across smart home devices and platforms. Major industry players are adopting universal standards like Matter, a connectivity protocol backed by Apple, Google, and Amazon, to ensure compatibility across different brands. As of late 2022, over 750 devices had achieved Matter certification, reflecting rapid industry adoption. Projections indicate that by 2026, 50% of wireless-connected smart home devices will be Matter-compliant, underscoring the industry's commitment to interoperability. Homeowners increasingly prefer centralized control hubs that unify lighting, security, climate control, and entertainment systems. As interoperability improves, consumers can integrate new technologies without being locked into a single ecosystem, fostering a more connected smart home experience.

Rising Focus on Energy Management and Sustainability

Energy efficiency and sustainability are key drivers in the North American home automation market, with consumers adopting smart energy management solutions to reduce utility costs. Smart lighting can lower energy use by 7–27%, while intelligent HVAC systems improve efficiency by up to 10%. Smart thermostats, automated lighting, and AI-powered energy monitoring systems enhance efficiency by analyzing usage patterns and adjusting settings accordingly. The increasing integration of renewable energy sources, such as solar panels and battery storage, further promotes sustainability in smart homes. Government incentives, including tax credits for energy-efficient appliances, further bolstering the North America home automation systems market growth. As environmental concerns rise, home automation systems are evolving to support eco-friendly living, making energy conservation a central focus of modern smart home solutions.

North America Home Automation Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America home automation systems market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and type.

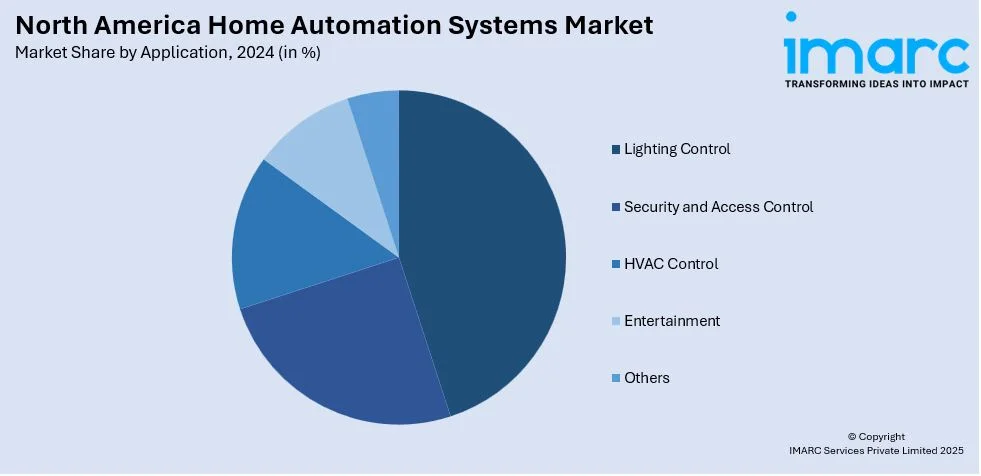

Analysis by Application

- Lighting Control

- Security and Access Control

- HVAC Control

- Entertainment

- Others

Lighting control systems manage the brightness, color, and scheduling of lights in a home. These systems enhance energy efficiency, provide convenience, and improve ambiance. They can be integrated with motion sensors, timers, and voice control for optimal management and customization.

Additionally, the security and access control systems offer surveillance, monitoring, and control over access points like doors and gates. Features include smart cameras, motion detectors, and remote locks, which help improve home security, ensure safety, and provide remote access to users for enhanced control.

However, the HVAC control systems manage heating, ventilation, and air conditioning. By automating temperature regulation, these systems optimize energy use, improve comfort, and allow remote adjustments. They can be integrated with sensors and smart thermostats to maintain ideal home conditions efficiently.

With these, smart entertainment systems control all home audio, video, and streaming devices. They allow a central control for TVs, speakers, and media players, bringing together a fluid, personalized entertainment experience. Integrating with voice assistants and mobile apps, one can easily navigate through content, volume, and settings.

Other categories also include additional home automation applications, such as smart appliances, irrigation systems, and health monitoring. They give new functionalities, making their application more convenient, efficient, and good for lifestyles, which help target specific user needs in the better management and control of home devices.

Analysis by Type

- Luxury (Custom) Home Automation Systems

- Mainstream Home Automation Systems

- DIY (Do-it-yourself) Home Automation Systems

- Managed Home Automation Systems

Luxury (Custom) home automation systems offer high-end, bespoke automation tailored to individual needs. They include advanced features like integrated security, lighting, climate control, and entertainment, typically installed by professionals. Luxury systems are designed for affluent homeowners seeking seamless integration and exclusive technologies.

However, the mainstream home automation systems provide more affordable, standardized smart home solutions for a broad market. They often include essential features such as smart thermostats, security cameras, and lighting control. Mainstream systems are generally easy to install and operate, targeting a wide range of consumers.

Also, the DIY (Do-it-yourself) home automation systems are designed for consumers who prefer to install and configure their own smart home devices. These systems typically include plug-and-play products like smart lights, thermostats, and sensors. They offer flexibility and cost savings but may require more technical knowledge.

Moreover, the managed home automation systems involve professional monitoring and management, often through a subscription service. Managed systems include automated features such as security, energy management, and home surveillance. They offer peace of mind with remote support and troubleshooting, making them ideal for consumers seeking convenience and security.

Country Insights:

- United States

- Canada

- Mexico

The high demand for smart devices, increased consumer awareness, and evolution of IoT technologies make the U.S. the dominant participant in the North American home automation systems market. The rising interest in 'smart homes' and substantial investments in energy-efficient solutions are other key factors driving the market ahead.

In line with this, in Canada, the adoption of home automation systems is increasingly being taken, driven by growing demand for energy-efficient solutions and the implementation of smart technologies. The market also benefits from consumer interest in security, comfort, and convenience and government incentives on sustainable energy solutions.

Besides this, Mexico's home automation market is increasing due to increasing urbanization, disposable income, and the consumer interest for energy-efficient and connected technologies. There is increasing awareness of smart homes, combined with greater availability of affordable solutions, which drives the demand for automation systems both in residential and commercial sectors.

Competitive Landscape:

The North America home automation systems market is highly competitive, driven by technological advancements and evolving consumer preferences. Key players focus on innovation, integrating AI, IoT, and cloud-based solutions to enhance automation capabilities. The market sees strong competition among providers offering smart lighting, security, HVAC, and energy management systems. Companies differentiate through user-friendly interfaces, seamless interoperability, and voice control compatibility. Strategic partnerships with homebuilders, telecom providers, and tech firms are common to expand market reach. Price competition is intense, with both premium and budget-friendly solutions available. Additionally, cybersecurity and data privacy concerns influence market positioning, as consumers demand secure, reliable smart home solutions. The growing trend of subscription-based services also adds to the evolving competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the North America home automation systems market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Sonepar inaugurated North America's first Automated Cable Cut and Automated Storage and Retrieval System (ASRS) at Lumen’s Central Distribution Centre in Laval, QC. The facility, now expanded to 565,000 sq ft, features advanced automation, enhancing efficiency and storage capacity. This project aligns with Sonepar’s goal of deploying 70 fully automated warehouses globally by 2026, reinforcing logistics and supply chain innovation.

- In August 2024, Brilliant been acquired by Almeida Strategic Investments and Cullinan Holdings, rebranding as Brilliant NextGen, Inc. The investment will drive innovation in smart home controls, switches, and plugs, enhancing home automation solutions. With strong industry ties, the company aims to expand its presence in major community developments and multifamily projects while advancing smart home technology.

- In May 2024, Honeywell partnered with Enel North America to enhance building automation and demand response solutions for commercial and industrial applications . The collaboration enables seamless integration of automated demand response programs, optimizing energy loads to prevent blackouts and stabilize power grids. By leveraging Enel’s energy portfolio, customers gain improved efficiency, cost savings, and grid reliability, addressing the growing need for flexible energy capacity during peak usage periods.

- In May 2024, Brilliant been acquired by Almeida Strategic Investments and Cullinan Holdings, creating Brilliant NextGen. This acquisition will drive innovation in smart home solutions, enhancing lifestyle, comfort, and security for homeowners. CEO Lisa Petrucci highlighted the partnership's potential to streamline and enhance smart home control, configuration, and management. With investors' experience in the building market, the company aims to accelerate adoption through collaborations with builders and multifamily projects.

- In February 2024, Gentex Corporation launched HomeLink Smart Home Solutions at the International Builders’ Show, expanding its leading car-to-home automation system into a seamless smart home and security ecosystem. The new suite of products, controlled via a single app, enhances connectivity between vehicles and homes, reinforcing Gentex’s commitment to innovation in automation and security solutions for automakers and consumers worldwide.

North America Home Automation Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Lighting Control, Security and Access Control, HVAC Control, Entertainment, and Others |

| Types Covered | Luxury (Custom) Home Automation Systems, Mainstream Home Automation Systems, DIY (Do-it-yourself) Home Automation Systems, Managed Home Automation Systems |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America home automation systems market from2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America home automation systems market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America home automation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America home automation systems market was valued at USD 33.8 Billion in 2024.

The North America home automation systems market was valued at USD 66.80 Billion in 2033 exhibiting a CAGR of 7.9% during 2025-2033.

The North America home automation systems market is driven by increasing smart home adoption, rising demand for energy efficiency, and advancements in AI and IoT integration. Growing consumer preference for convenience, security, and remote monitoring, along with government incentives for energy-saving solutions, further accelerates market growth and technological innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)