North America Ginger Processing Market Size, Share, Trends and Forecast by Form, End-Use, Distribution Channel, and Country, 2025-2033

North America Ginger Processing Market Size and Share:

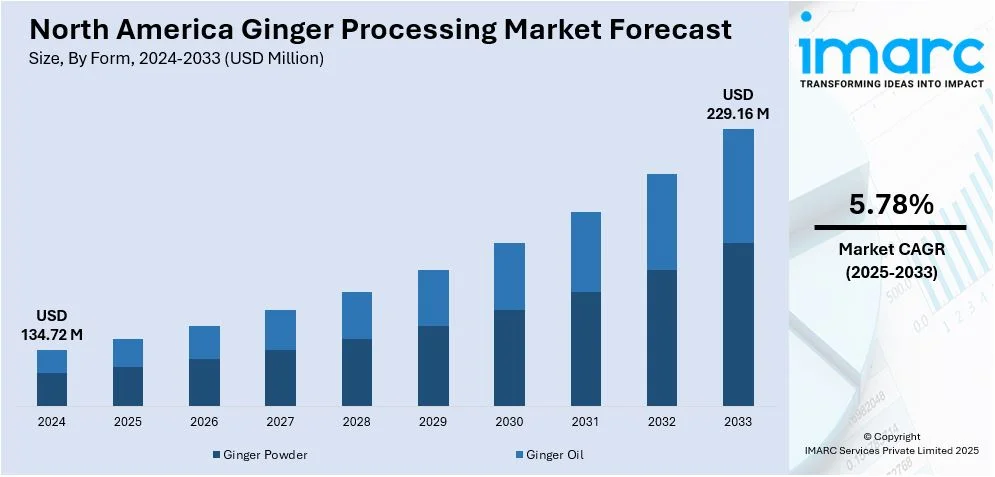

The North America ginger processing market size was valued at USD 134.72 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 229.16 Million by 2033, exhibiting a CAGR of 5.78% from 2025-2033. The North America ginger processing market share is experiencing significant growth, driven by increasing health and wellness trends, rising demand for natural and organic products, expanding functional food and beverage sectors, and growing e-commerce, with supportive government policies and an expanding cosmetic industry further boosting ginger's popularity across food, beverage, and personal care applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 134.72 Million |

| Market Forecast in 2033 | USD 229.16 Million |

| Market Growth Rate (2025-2033) | 5.78% |

Consumers in North America are becoming increasingly health-conscious, seeking natural, plant-based ingredients that offer health benefits. As per an industry data, around 70% of Americans have become conscious of their physical health after 2019 and 73% of consumers are actively planning to eat and drink more healthily. Ginger, with its known anti-inflammatory and digestive properties, is becoming a go-to choice in products such as juices, teas, supplements, and even in skin care. This surge in demand for healthier food and beverage options has significantly boosted the North America ginger processing market growth, particularly as people move away from artificial ingredients and embrace more holistic approaches to health. The rise of wellness-focused diets such as keto, vegan, and gluten-free further encourages the use of ginger in food formulations. As a result, ginger processing companies are expanding their product offerings to include ginger extracts, powders, and concentrated forms, catering to this growing health-conscious consumer base.

A growing preference for organic and clean-label products is driving the North America ginger processing market demand. It has been revealed that 56% of individuals who prioritize healthy eating consume organic foods. This is because consumers are increasingly wary of additives, preservatives, and chemicals in their food, thus favoring ingredients that are natural and sustainably sourced. Ginger, being a root with a strong historical presence in traditional medicine and cooking, fits perfectly into this shift toward cleaner, more transparent product labels. In response to this demand, more ginger processing companies are adopting organic farming methods and focusing on producing clean, non-genetically modified organism (GMO) ginger products. This trend is not only helping boost the ginger processing sector but also promoting sustainability by encouraging environmentally friendly farming practices.

North America Ginger Processing Market Trends:

Rising Popularity of Functional Foods and Beverages

A key factor driving the North America ginger processing market trends is the growing shift towards functional foods and beverages, which provide supplementary health benefits beyond essential nutrition. Consumers are seeking products that support better digestion, immune support, and overall well-being, and ginger has emerged as a key ingredient because of its proven health benefits. It is often added to energy drinks, smoothies, teas, and dietary supplements. Natural appeal for the health-conscious individuals includes the ability of ginger to reduce nausea, decrease inflammation, and aid in digestion. For this reason, more and more food and beverage companies are including ginger in their products, thereby boosting the demand for processed ginger in the form of ginger concentrates, purees, and dried ginger powder.

Growth of the E-commerce and Online Retail Market

As per the North America ginger processing market price analysis, the rise of e-commerce has opened up a wide range of ginger products to consumers, from fresh ginger root to ginger-based snacks, supplements, and beverages. In 2023, U.S. ecommerce accounted for 22 percent of total retail sales. Online retail platforms make it easier for consumers to purchase ginger-based products, which they may not find in local grocery stores. The convenience of online shopping combined with the surging trend for consumers to obtain specialized or niche products such as organic or fair-trade ginger leads to more processing companies in the ginger industry focusing on building strong online presences. Furthermore, the rise of health-conscious customers looking for nutritious and functional online products has improved the growth rates of the ginger processing market.

Expansion of the Food and Beverage Industry

In the food and beverage industry of North America, there is a wave of innovation; brands are finding out new ways to combine unique flavors and ingredients. Ginger's spicy and tangy flavor finds its way into an array of products in the food and beverage sector. From baked goods to frozen foods, sauces, candies, and alcoholic beverages, ginger is being used to enhance flavor and offer functional health benefits. Another driver of ginger's inclusion in products is the growth in plant-based foods and beverages, wherein its flavor can help mimic traditional meat textures and also enhance the taste profiles. It was thus reported that in the year 2023, six in ten U.S. households purchased plant-based foods. With the food and beverage industry projected to grow further, the demand for processed ginger will also increase.

North America Ginger Processing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America ginger processing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on form, end-use, and distribution channel.

Analysis by Form:

- Ginger Powder

- Ginger Oil

The largest share of North America ginger processing market by form is ginger powder, with applications in food, beverages, and dietary supplements. It is widely used in the formulation of spice mixes, ginger tea, ginger cookies, and smoothies. The convenience of ginger powder, coupled with its long shelf life, makes it a popular choice among consumers and manufacturers alike. It provides flavor and health benefits in an easily consumable concentrated form. Its growth comes from the fact that the ginger-based functional food and beverage markets are expanding, with even more demand from health-conscious markets. Demand is also observed from the natural food industry where gingers are used in products as a powder in a broad range of organic products. Additionally, it is an important ingredient in the development of plant-based food products, thus contributing to the demand in the rapidly growing vegan and gluten-free food industries.

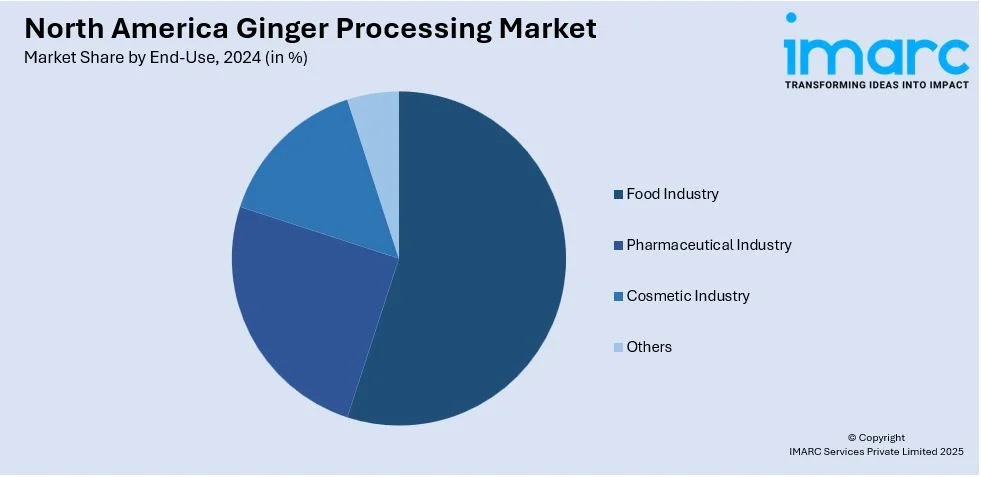

Analysis by End-Use:

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Others

The food industry is the largest segment in the North America ginger processing market share, driven by the growing popularity of ginger in various culinary applications. The major drivers behind it are the growth in popularity and demand for ginger in food applications. Its usage can be seen in most baked goods, beverages, sauces, condiments, and even snacks and ready-to-eat foods. Apart from this, its natural advantages, such as helping to enhance digestion and diminish inflammation, made it popular as an ingredient for functional foods and beverages. The increase in the demand for products made of ginger, including ginger beer, ginger tea, and health shots, has added on to the increasing market share for the food industry. Growing consumers' preferences toward natural, organic, and clean-label products fuel this market further, where ginger is also emerging as the epicenter.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

Supermarkets and hypermarkets form a huge role in North America's ginger processing market as it acts as a major distribution channel for ginger-based products. These retail chains offer a wide range of ginger products ranging from fresh ginger to ginger powder, ginger teas, and ginger snacks across a widespread customer base. Consumers for whom convenience and variety are prioritized shop at supermarkets and hypermarkets, as these are the one-stop outlets for staple and specialty food products, such as natural and organic ginger merchandise.

Although a relatively small market, convenience stores have experienced growth in the ginger processing market because consumers are increasingly seeking healthy and ready-to-go products. Convenience stores offer an easy and quick shopping experience that attracts busy and health-conscious consumers who are looking for ready-to-consume ginger products such as ginger drinks, ginger shots, and snack bars. This segment is expected to keep growing because of consumer health and wellness, as they provide ample room for the creation of portable and functional ginger products.

As per the North America ginger processing market forecast, specialty food stores are becoming increasingly popular within the North America ginger processing market. These types of stores tend to cater towards niche consumers, especially those that prefer high-quality organic or gourmet ginger products. Most specialty food stores focus on selling unique, artisanal, or health-conscious products, so people looking for premium ginger products, such as organic ginger powder, fresh ginger root, or specialty ginger beverages, tend to prefer these specialty food stores. This segment is further driven by the trend of gourmet cooking and the demand for more natural and plant-based ingredients.

Online stores are an emerging fast-growing segment in the ginger processing market with growing consumer reliance on e-commerce for grocery shopping and specialty products. This has enabled the option to shop from home and, on top of this, easy comparison of prices, with easy access to niche ginger products. Thus, the market for online retail is bound to expand as consumers seek convenience in shopping, including the increased demand for grocery shopping online and ginger as part of the trend for health and wellness, particularly in supplements, teas, and functional foods.

Country Analysis:

- United States

- Canada

- Mexico

As per the North America ginger processing market outlook, the largest regional share belongs to the United States because of its gigantic and diverse consumers. Growing trends in health and wellness, increase in the desire for natural ingredients, and upsurge of functional foods and beverages in the U.S. market are some significant drivers for its growth. The high market share of the country is influenced by the increased demand of ginger in different forms, such as powders, teas, snacks, and supplements. Their strong retail infrastructure further supports a lot of availability of ginger-based products in supermarkets, hypermarkets, and e-commerce platforms. In addition, organic and sustainable food product adoption in the U.S. has made organic ginger offerings more popular. As consumers still focus on their health and desire convenience, the U.S. market will keep moving forward in the upcoming years.

Competitive Landscape:

Major market players are using strategic expansions, new product innovation, and sustainability as the ways of maintaining a competitive edge in this market. Some companies invest more into organic and clean-label ginger products because of growing health-conscious natural ingredient demand. They are also adding more organic varieties to their product line as clean-label trend picks up pace. Conversely, there are also reports of companies that are adapting ginger into functional foods and drinks, like wellness teas and energy drinks, with a view towards addressing consumer appetite for immunity-building and digestive health solutions. Others are looking for niche markets like small players are focusing on gourmet products such as ginger syrups, candies, and extracts- all from sustainable ginger.

The report provides a comprehensive analysis of the competitive landscape in the North America ginger processing market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, Monterey Bay Herb Co. achieved SQF Food Safety Certification for its Watsonville, California facility, highlighting its commitment to food safety and quality in processing over 500 herbs, spices, and teas, including ginger. The certification demonstrates compliance with rigorous global standards, enhancing the company’s position in the North America market. This accomplishment will help attract new customers and better serve existing ones with safe and high-quality herbal ingredients.

- In November 2023, Fiji's Deputy Prime Minister met with “The Ginger People” in New York, securing an additional 100 Tons of Fiji-grown ginger for the US market. Kaiming Agro Processing, a Fiji-based manufacturer, will process the ginger into value-added products.

North America Ginger Processing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Ginger Powder, Ginger Oil |

| End-Uses Covered | Food Industry, Pharmaceutical Industry, Cosmetic Industry, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Countries Covered | United States, Canada, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America ginger processing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America ginger processing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America ginger processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ginger processing market in North America was valued at USD 134.72 Million in 2024.

The growth of the North America ginger processing market is driven by increasing health and wellness trends, rising demand for natural and organic products, the popularity of functional foods and beverages, expanding e-commerce, and the growing use of ginger in the food, beverage, and personal care industries.

IMARC Group estimates the North America ginger processing market to reach USD 229.16 Million by 2033, exhibiting a CAGR of 5.78% from 2025-2033.

Ginger powder accounted for the largest share of the North America ginger processing market, driven by its versatility and long shelf life. It is widely used in food products, beverages, dietary supplements, and functional foods, making it a preferred choice among consumers and manufacturers alike.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)