North America Gas Meter Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

North America Gas Meter Market Size and Share:

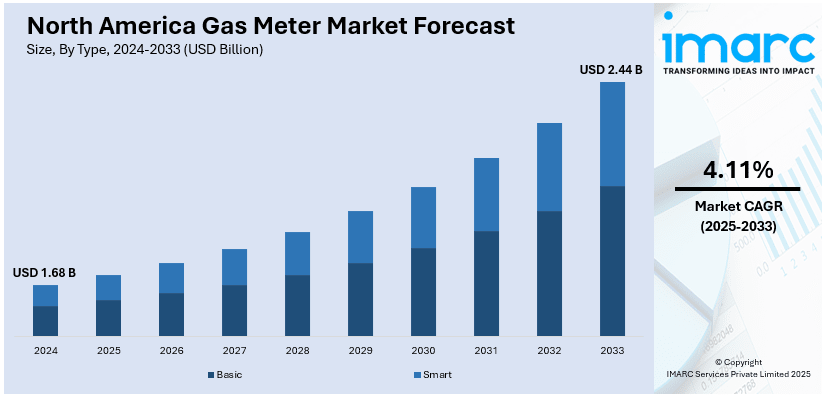

The North America gas meter market size was valued at USD 1.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.44 Billion by 2033, exhibiting a CAGR of 4.11% from 2025-2033. The market is driven by the demand for energy efficiency, ongoing advancements in smart metering technology, expanding regulatory requirements, rising sustainability initiatives, and the integration of the Internet of Things (IoT) for real-time data monitoring and increasing operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.68 Billion |

|

Market Forecast in 2033

|

USD 2.44 Billion |

| Market Growth Rate (2025-2033) | 4.11% |

The North America gas meter market demand is fueled by the growing emphasis on energy efficiency and sustainability. With rising electricity costs, both residential and commercial sectors are seeking methods to track and control their energy usage, driving the demand for advanced metering solutions. Additionally, continuous advancements in smart meter technology, enabling remote readings and real-time data collection, are further propelling market expansion. Furthermore, the growing trend towards smart homes and industrial automation is creating additional demand for integrated metering systems, providing greater control over energy usage and helping optimize efficiency, thus impelling the market growth. For instance, in 2023, the United States (U.S.) had around 130.6 million smart electricity meters have been installed, accounting for 76% of the total electricity meter market. However, this high penetration rate is expected to stabilize, signaling a more mature market for smart metering solutions.

Concurrently, the increasing government initiatives to promote energy conservation and environmental sustainability are playing a significant role in the expansion of the North America gas meters market growth. For example, North America boasts the most advanced smart electricity meters, including gas market, with nearly 77% market penetration by the end of 2023. With the global push for reducing carbon footprints, governments are encouraging the adoption of smart gas meters and other energy-efficient devices across various sectors, which is driving the market demand. These initiatives are further being supported by regulatory mandates that require accurate billing and transparent data, making the need for digital and smart meters more essential. Furthermore, the increasing demand for RE and the rise in power distribution infrastructure, particularly in developing countries, are boosting the adoption of gas meters. Apart from this, as grid modernization continues, smart grid solutions are enhancing the need for advanced metering infrastructure, thereby propelling the market forward.

North America Gas Meter Market Trends:

Adoption of Smart Gas Meters

The North America utility sector is undergoing a swift transformation toward smart gas meter adoption because of IoT technology advancements. The meters provide instant data acquisition along with distant monitoring features and self-operating capabilities which enable utility businesses to increase gas network optimization and minimize operational expenses. Smart meters help detect gas leaks more efficiently and resolve them quickly which leads to enhanced safety together with better operational efficiency. Additionally, the market expands due to this emerging trend because it provides benefits to both utility companies and their consumers through enhanced transparency reduced maintenance expenses, and better energy management. This is significantly influencing the North America gas meter market trends. In addition, in 2024, the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) introduced new energy efficiency regulations. These mandates require homes financed by these agencies to comply with the 2021 International Energy Conservation Code. These regulations are intended to reduce energy costs and lower emissions, indirectly influencing the adoption of efficient gas metering systems.

Rising Demand for Energy Efficiency and Sustainability

The focus on sustainable energy management and efficiency standards is enhancing the North America gas meter market outlook. The importance of precise gas consumption monitoring along with control systems has become essential because North American consumers and businesses focus more on energy conservation. Precise gas meter readings combined with efficient resource management capabilities make modern gas meters very attractive to customers. Moreover, regulatory agencies together with government institutions are creating conditions that drive the adoption of modern gas metering systems through their focus on energy-efficient technology integration. For example, under the direction of Secretary Sean Duffy, the U.S. Department of Transportation instructed the National Highway Traffic Safety Administration (NHTSA) to update fuel economy standards. The proposed changes aim to align with a pro-oil agenda, potentially impacting energy efficiency initiatives across various sectors, including utilities. Furthermore, operational efficiencies increase, and carbon emissions decrease throughout the region because of this changing trend.

Integration with Smart Grid Infrastructure

In North America, utilities focus on linking gas meter systems to smart grid networks as a major industry development. Modern power distribution networks are linking gas meters to smart grid networks which promotes improved data transfer and energy system operations. The integration merges operations for better supply and demand equilibrium which results in enhanced grid reliability. The integration also enables dynamic pricing systems that give consumers better management of their power usage. For instance, the current U.S. administration has initiated environmental deregulation efforts, including rollbacks at the Environmental Protection Agency (EPA) targeting regulations on methane leaks and emission standards. These actions may influence the gas meter market by altering compliance requirements and operational practices. As a result, increased market growth specifically in areas that implement grid modernization programs, due to the combination of smart grid technologies with gas metering applications is strengthening the North America gas meter market share.

North America Gas Meter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America gas meter market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Basic

- Smart

Basic gas meters are a significant segment in the North America market, primarily due to their cost-effectiveness and widespread usage. Users read these mechanical devices manually in residential and smaller commercial applications. Besides this, the basic gas meters maintain their market value through their simple design while providing an affordable entry point for numerous consumers. Their durability and low maintenance requirements make them a preferred choice for many utility providers. Additionally, they do not require complex infrastructure, making them ideal for areas where smart metering adoption is limited. While digital and smart meters are gaining traction, basic gas meters remain relevant due to their reliability, ease of installation, and continued demand in cost-conscious markets.

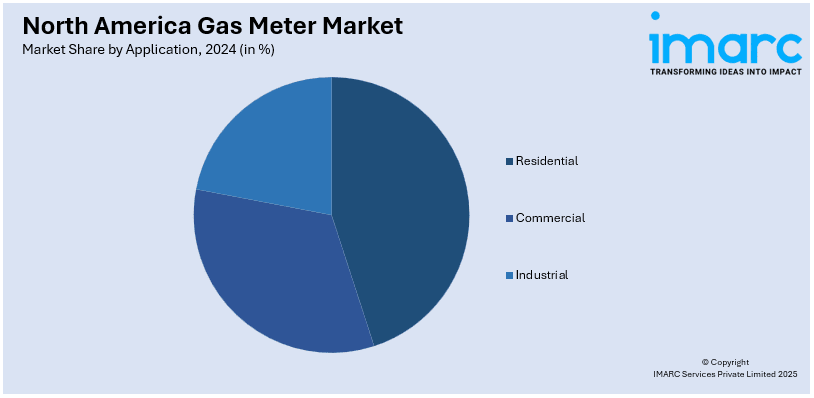

Analysis by Application:

- Residential

- Commercial

- Industrial

The North American residential market adopts gas meters at an increasing rate because homeowners require better energy usage monitoring systems. The rise of smart gas meters occurs because households need to lower utility expenses and master their energy usage. Smart gas meters also provide continuous tracking data with precise billing functions and remote monitoring capabilities that improve gas consumption management accuracy. These advanced meters help detect gas leaks, prevent wastage, and enhance safety by providing real-time alerts. Utility providers benefit from streamlined operations, reduced manual meter reading costs, and improved demand forecasting. Additionally, the integration of smart meters with IoT and home automation systems allows users to optimize energy consumption more efficiently, contributing to sustainability efforts and overall energy conservation.

Country Analysis:

- United States

- Canada

The United States gas meter market expands because residential, commercial and industrial sectors need smart meters along with energy-efficient solutions. Modern investments in infrastructure combined with sustainability initiatives have led to a change toward more sophisticated gas meter technology. Moreover, regulatory requirements for precise billing monitoring create additional support for this market. Smart gas meters backed by IoT technology enable immediate data acquisition and analytical processes that lead to superior energy management systems and leak detection methods. The U.S. gas meter market receives additional impetus from official policies and incentives that encourage energy efficiency. Furthermore, utility companies obtain operational cost reduction and better customer satisfaction because precise billing methods and improved service reliability benefit them. For instance, U.S. upstream oil and gas mergers reached $105 billion in 2024, signaling a strong market, according to Enverus. This growth reflects increasing investments in smart infrastructure and the transition to digital solutions in the energy sector. As a result, the U.S. gas meter market continues to grow rapidly because it matches worldwide trends for smarter utility infrastructure as well as energy sustainability initiatives.

Competitive Landscape:

The North American gas meter market is highly competitive, with major players emphasizing technological innovation, product diversification, and strategic collaborations. Leading companies are launching advanced smart gas meters equipped with IoT integration, real-time data analytics, and remote monitoring features to stay ahead in the market. Additionally, manufacturers are broadening their product offerings to address a wide range of applications, from residential to industrial sectors. In addition, companies are collaborating with utility providers to enhance metering infrastructure, improve operational efficiency, and meet regulatory demands. This competitive environment is driving continuous advancements in gas metering technology and transforming the North America gas meter market forecast.

The report provides a comprehensive analysis of the competitive landscape in the North America gas meter market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2024, Constellation Energy Corp. agreed to acquire Calpine, a natural gas and geothermal power company, for $26.6 billion. This merger creates a leading retail electric supplier with operations spanning the continental U.S., significantly enhancing Constellation's presence in the energy market.

- In July 2024, Seismos, an AI-driven acoustic technology provider based in Austin, Texas, received a $15 million investment from Edison Partners. This funding aims to expand Seismos's market presence into sectors such as mining, geothermal energy, and carbon capture, leveraging its innovative acoustic signal analysis combined with AI.

- In July 2024, Baker Hughes revised its projections for North American operations, anticipating a mid-single-digit decline in spending by oil producers due to reduced drilling activities. Nevertheless, the company increased its full-year revenue and profit forecasts, attributing the rise to robust international growth and higher demand for gas equipment.

- In March 2024, Itron, a prominent player in the smart gas meter market, acquired Elpis Squared, further expanding its technological capabilities and market reach.

- In May 2023, Landis+Gyr presented its G480 ultrasonic gas meter at the American Gas Association's Operations Conference. This solid-state meter features integrated cellular communications and offers advanced functionalities such as autonomous and remote shutoff capabilities, tamper detection, and rapid leak identification.

North America Gas Meter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Basic, Smart |

| Applications Covered | Residential, Commercial, Industrial |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America gas meter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America gas meter market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America gas meter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gas meter market was valued at USD 1.68 Billion in 2024.

The growth of the North America gas meter market is driven by increasing demand for energy-efficient solutions, advancements in smart metering technologies, regulatory mandates for accurate billing, rising energy costs, and the push for sustainability. Additionally, the integration with smart grid infrastructure and IoT capabilities is further fueling the market expansion.

IMARC estimates the gas meter market to exhibit a CAGR of 4.11% during 2025-2033, reaching a value of USD 2.44 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)